This is what you call “3-D intergalactic speed tennis chess.”

Via CNBC:

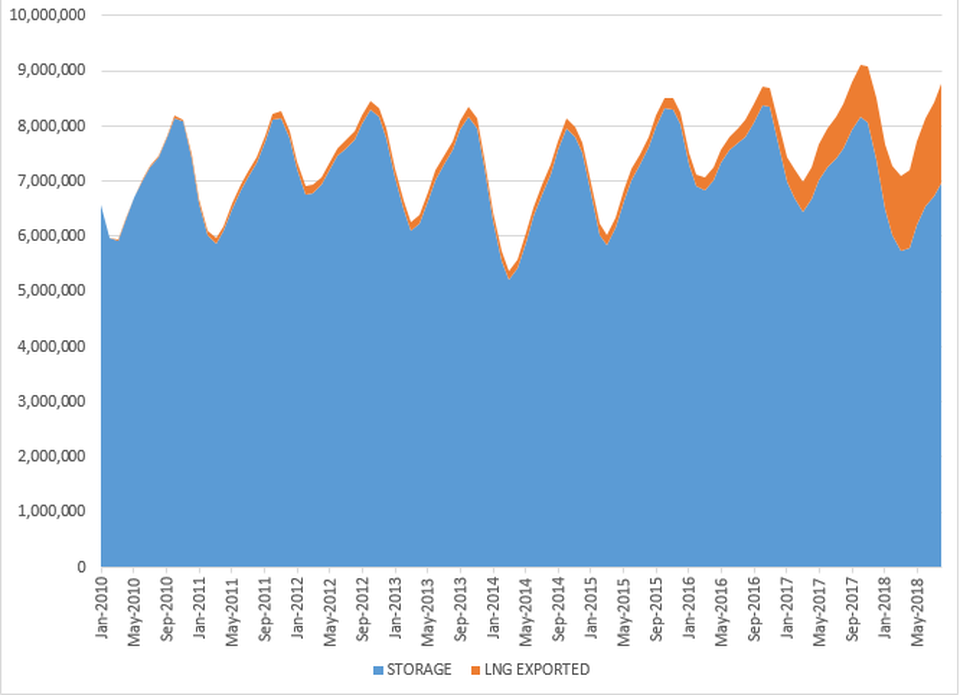

“They got sort of tricked here,” said John Kilduff, founding partner at energy hedge fund Again Capital. “The Russians and the Saudis in particular ramped up production, ramped up exports ahead of what was supposed to be severe sanctions on Iran, and when the administration gave the eight waivers to Iran’s largest buyers, it undercut that whole equation.”

“So now we’ve tripped into an oversupply situation almost overnight because of the severe reaction by Russia and the Saudis to cover for Iran losses, which never materialized.”

To be sure, the sanctions have shrunk Iran’s exports by about 1 million barrels per day. Few thought the Trump administration would actually achieve its stated goal of cutting its rival’s shipments to zero.

But the sanctions, backed by the administration’s hawkish rhetoric, cut Iran’s exports more quickly than many anticipated. The market also expected another big drop after the Nov. 4 deadline passed. That fear fueled a rally that sent oil prices to four-year highs.

Over the last six weeks, that rally has unwound in spectacular fashion, with oil prices tumbling into a bear market. The pullback has several causes, including a weaker demand outlook for oil and a wider market sell-off, but analysts say OPEC’s output hike earlier this year and the sanctions waivers play a major part in the oil price plunge.

“In early October there was this expectation that a lot of Iran’s barrels were going to come off the market, and so essentially Saudi Arabia was duped into increasing production,” said Matt Smith, head of commodities research at tanker-tracking firm ClipperData.

Smith says it’s uncertain the situation has unfolded exactly as the Trump administration intended, but it has ultimately worked out in the president’s favor — though potentially at a cost to U.S.-Saudi relations.

“They’ve really done a good job of decreasing that oil price, but it has been at the expense of some of those relations there, because surely the Saudis have got to be pretty unhappy with the way things have played out here.”

Saudi Energy Minister Khalid al Falih acknowledged this week that Iran’s exports didn’t fall as much as expected.

He also announced that Saudi Arabia will ship 500,000 fewer bpd in December and said OPEC and its allies may cut production by 1 million bpd next year. That decision could come in a few weeks when OPEC, Russia and other producers meet to review their current policy of easing output curbs that have been in place since last year.

Trump took to Twitter a few hours later, tweeting, “Hopefully, Saudi Arabia and OPEC will not be cutting oil production. Oil prices should be much lower based on supply!”

The president has previously used Twitter to blame OPEC for high oil prices and demand the group take action to cut costs. At the UN General Assembly this year, he told world leaders that OPEC is ripping them off.

Analysts say Falih’s comments this week might have pushed oil prices higher, if not for Trump’s tweet.

“I think the market is ignoring [the Saudis] because of Trump,” said Helima Croft, global head of commodity strategy at RBC Capital Markets. “I think if you didn’t have the Trump tweet, there would not be this skepticism. Right now, there’s a view that the Saudis will reverse course because of Trump. There’s a sense that Trump really has them over a barrel at this point.”

The kingdom is in a precarious position after a Saudi prosecutor acknowledged that government agents killed journalist and U.S. resident Jamal Khashoggi in a Turkish consulate last month, following earlier denials by the state.

Gary Ross, CEO at Black Gold Investors, believes the cartel will ultimately agree to cut output when it meets with Russia and other producers next month. However, in his view it may be too little too late.

“They’re pretty much snookered by Trump,” Ross said. “I mean, Trump led them to believe that the Iranian exports would be zero. It turned out they’re going to be 1.2 to 1.5 million barrels a day, way higher than people thought.”

“Broadly speaking, it’s an oversupply story, and I think they will cut back, but they’re not likely to cut back enough to drive prices back up to anything like $80 Brent,” he told CNBC. “I think we’re going to be in a $60 to $70 Brent market for some time.”

The White House did not immediately return a request for comment.

What a time to be alive.

Comments »