David Einhorn is a legitimately good person, in spite of his immense wealth. His long term track record is one to be envious of and his grasp of financial matters is second to none. So how the fuck is his fund down 26% YTD?

We’ve all been there, haven’t we? But Greenlight’s struggles have been ongoing for years, resulting in redemptions and all sorts of fucked up articles like this one. But this isn’t meant to poke fun at David. Plus anyway, he’s winning the game of life in numerous ways, much greater than me, so who the fuck am I to critique him? With this particular tape, during this very moment, Greenlight Capital hasn’t a clue what they’re doing.

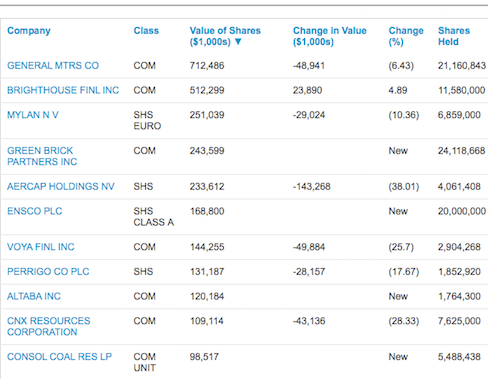

According to the most recent filings, these are Einhorn’s positions.

Why?

I get value investors need to droll on in boring ass stocks in a flaccid attempt to extract returns, but that right there is ridiculous. GM, really? The stock is down 18% for the year and showing no signs of a turn. Brighthouse Financial, ticker BHF, is down by 24% this year. MYL is also a bowser, off by 13%. In addition to his wrong longs, he reportedly has a ‘Bubble Basket’ of high value names that he’s short. I recall this revelation in 2014 and I attempted to mirror it based upon his criteria.

My Bubble Basket inside Exodus is +93% for the year.

In other words, Greenlight is short the best stocks, flying higher in the face of unreal and surreal valuations, whilst his value longs get beat down to a pulp. The entire value space has been disjointed and flayed during 2018. Have a look at some of these fucking stocks — spearheaded by the pavement apes at GE.

Is there a teachable moment here?

YES.

You aren’t smarter than the market. As much shit as I talk about being the best trader to have ever lived and not on the verge of suicide, I place 75% of my account in a Quant, designed by me, to track the market and become a slave to trends. If Greenlight wants to turn things around, they need to dump those fucking stocks and start fresh, long the names that are working — because during a bull market like this, one that defies all logic and tenets of value investing, you must conform or you will be eliminated.

Like all things in life, Darwinism applies here, filtering out those who’ve gotten weak and stubborn, rewarding those who are malleable and energetic.

If you enjoy the content at iBankCoin, please follow us on Twitter

He can’t dump now fly. Major top coming in just months or maybe a year. Seems like he’s trying to get ahead of the recession

Cognitive Dissonance.

Especially if one has been very successful in the markets.

Being in the Way, that is,

Alignment with what is actually happening, as opposed to what one thinks is happening

Means simply not to

Be in the way.

You are It Is Showtime

Nice catch. No one could be that retarted.

INDEUD – good stuff

Cue the “trends works until they don’t” fags

Man, I don’t care who you are…listening to that sends you to a different realm. Thanks fly

He got there by golng long “value” stocks like $GM, -18% YTD and shorting stocks like $AMZN +70% and $NFLX +95% YTD. But don’t worry. “Value” investing is just out of style at the moment. It is only a matter of time until it is back in vogue.