I must admit, I did not think the Fed would be able to get away with hiking rates without there being adverse consequences. Let’s all acknowledge some plain facts. The Fed did in 2017 what many believed to be impossible. They got rates off the ground of zero to 1.25-1.5% without a ripple in stocks. In the past, the idea of even thinking about hiking rates would cause a market hysteria. Do you remember those days?

Now the Fed is in a position to both unwind their balance sheet and hike rates, all the while the economy is chugging along at a 3% rate.

Dare I say, best case scenario is at hand?

From their statement today.

“This change highlights that the committee expects the labor market to remain strong, with sustained job creation, ample opportunities for workers and rising wages,” Chair Janet Yellen told reporters Wednesday in Washington following the decision. In her final scheduled press conference before before stepping down on Feb. 3, Yellen also said she would do her utmost to ensure a smooth transition to her nominated successor, Jerome Powell.

Forget about Obama and Trump. Global markets have been guided by the steady hand of Fed Chairs Bernanke and Yellen since 2008 and I think it’s only fair and right that someone gave them their due.

If you enjoy the content at iBankCoin, please follow us on Twitter

Yes indeed. They should get the ‘Phew, Not On My Watch’ award.

I’m not surprised that, with the real rates they set still being negative, the party has persisted. I am surprised that they’ve gotten away with it for so long.

“Give them their due”? …history will give them their due.

Back to short the dollar via UUP June puts.

USD will go sky high as peripheral currencies implode and everybody piles into USD for safety (I am vomiting while typing that). USD will be the last man standing, destroying the US economy in the process, before hyperinflating. NWO one currency already waiting in the wings. The long term trend is up, not down. The process already started with the first interest hike. It’s by design.

Might could be. The dollar needs to go lower for any hope of the Republitard tax redistribution to accrue to the benefit of Americans. Do the manipulators give a shit …I dunno.

Anyway, there is a potential topping formation/failure of a bottoming formation. That’s what I’m playing today. If it takes out yesterday’s high, I’ll likely cover.

The FED is a political beast. They know Trump needs low int rates to succeed. And that’s why he will be denied. The marxist FED is the epitome of communism – centrally planned everything. They want Trump out. The FED is financing the deep state through the back door via black budgets, the very deep state that wants Trump out. All those Pentagram unaccounted trillions are not part of the national debt. Where did all those trillions come from? The FED is financing the deep state’s agenda.

No so sure that they want our distraction machine of a president to be gone.

Oh …and if you’re worried about Bernanke not getting enough accolades, there is a whole book (self-written) about his genius and his “Courage to Act”.

https://www.amazon.com/Courage-Act-Memoir-Crisis-Aftermath/dp/039324721X

BANNED

yes, triggered

In the old days when valuation mattered Marty Zweig would accurately call market turns.

Now it’s just buy until it crashes and then buy again.

https://cmtassociation.org/kb/zweigs-fed-indicator/

You’ve been shitting on Yellen her entire term as Chairwoman. Horrible screeds about her.

None of that is true. Provide us all with some quotes and links that show me taking greasy about her.

Everyone here knows I’ve always been an ardent supporter of Yellen. Quit lying.

These selections date back to 2015. on the whole, you disparage her and beg for a bull market. She helped produce and maintain your bull market, will remarkable stability.

From 2/11/16: I’ll make another call for you here. Janet Yellen will go down as the single worst Fed Chair in history.

Etc:

While markets have done swell under Yellen, we both know she was merely riding the long coattails of a certain Dr. Benjamin Bernanke — the hero who saved western finance from sinking into the deepest depression the world has ever known.

Her rat like visage will not be missed.

Fed’s Yellen just got finished with an interview, where she jabbered on a long while without saying anything. Reporters are trying to paint this as some sort of revealing interview, when it’s just nonsense.

She’s an animal, not of the human species. Yes, she acknowledged that inflation is non-existent and that her fucking dot plot failed by all measures — but she’s still going ahead with the December rate hike — fuckers — and there’s nothing you can do about it.

THIS IS THE LEADER OF THE GLOBAL BANKING SYSTEM, a mechanized drifter who is seemingly unaware of how to properly keep her house in order. The fact that Fed’s Brainard might be actively seeking employment from a Clinton administration, while serving as a voting member of the Fed, is beyond reproach. The institution of the Fed is supposed to be above partisan politics and should never tolerate this sort of shit.

The Great Bearded Clam, Dr. Benjamin Bernanke, would’ve dropped that bitch off a rooftop for even looking at a Hillary Clinton commercial, let alone interview for a fucking job while on the Fed board.

I don’t understand why so many in the media defend the actions of Janet Yellen. She is purposely being belligerent and is making things much worse. These people who support Yellen are either short stocks or have zero irons in the fire. They’re just talking heads with asshole opinions.

This woman is all wrong. If you heard her testimony, you know she’s delusional. She’s still talking rate hikes. I know the market thinks she’s fucking around, but she’s not.

She is dead serious when she says that the Fed has to raise rates now in order to avoid RAPID FIRE rate increases to fend off outrageous inflation caused by runaway economic growth. She even said the drop in crude might give the economy an unexpected jolt. No mention, however, of how many oil and gas jobs will be lost in the process and how all of that oil debt will get hashed out.

Look at this woman. She’s completely out of her league.

This imbecile will give her semi annual speech today, describing why she prefers Werthers butterscotch candies over Andies mints. Also, she might need to cut the speech short today, as it is rumored she has a podiatrist appointment that needs to be attended.

Yellen inherited a strong, alpha bank, and made it beardless. Her lack of leadership has turned the world’s leading central bank into a mockery, one that is chided and derided at dinner tables worldwide.

“Hello father, may you please pass the mashed potatoes. They rather remind me Janet Yellen’s head.”

“Good one son. Don’t forget to sprinkle some extra pepper on your Yellen mashed potatoes to give her a Bernanke beard. Aye me laddie, I somewhat miss that old bearded bastard.”

My position, as I’ve stated here on numerous occasions, is that the Fed should not hike rates. Deflationary forces are clearly the greater risk. Aside from my abhorrently high grocery bill, which has more to do with my aversion to GMOs than the availability of cheap produce and meats, prices have been dropping–across the board.

This is a significant speech and part in Federal Reserve history. Yellen is effectively on record saying that our central bank is beholden to foreign markets–because of the fact that so many of our corporations have picked up and left American lands, abandoned and scuttled factories, in favor for slave labor abroad. The slaves shall toil, working feverishly to produce products to be sold in Walmart and Target. Americans will buy those wares, at exceedingly cheap prices. But the funnel is narrowing. The availability of respectable paying jobs is lessening.

Now we need Yellen is grow a fucking beard and step up her Fed chief game. Ever since she’s been chief, markets have been miserable. I vividly remember saying stocks should be sold when Bernanke left his post at the Fed. That call ended up being right.

I’ll make another call for you here. Janet Yellen will go down as the single worst Fed Chair in history.

1/2016

Again, you’re assuming Janet Yellen is not insane. This is a woman who sent out her Fed heads to discuss her fucking ‘dot plot’ of 16 scheduled rate hikes from now until 2018, as the markets were cratering. It’s like she doesn’t own a television or read newspapers. She’s living in a vacuum, where submentals feed her Kansas Fed news only–always hawkish.

Judging her recent behavior and the actions of her board, I think she’s being punitive to Wall Street by design. I think she’s trying to decouple the Fed from the mood of Wall Street, hell bent on seeing rates “normalize”, despite the concerns of nearly everyone about the rate of change tightening aspects of going from 0% to 3% in a world wrought with nothing but deflation.

For my money, TLT is still my top pick.

*Since Jan/2016, TLT, or the ARK is virtually unch. Spy up 35%

Yellen is a Born Loser

She just doesn’t have the swag that the good Dr. Bernanke had. Perhaps it’s her lack of beard. She could’ve done anything yesterday and the market would still spit in her face today.

BURN IN HELL YELLEN!

Good day sir.

TL;DR

I’m guessing those were one off events. Turd. Perhaps you can provide us with a little more insight into how I truly felt about Yellen. Why, everyone here knows that I’ve been her biggest fan.

Show me something recent.

You felt really shitty about her. All the more recent evidence of how you really feel is in the shitty performance of your discretionary trading.

Butterscotch candies, Indeed!

Lord Fly has talked trash about Yellen whenever there was a hint that they were considering normalizing.

There was an experiment done with mice where the mice could depress one of two levers. One lever caused nutritious food to be dispensed, the other delivered cocaine. The mice hit the cocaine lever until their little hearts exploded. Sapiens have much in common with mice.

It takes time for interest rates to work themselves into the term structure. Let’s not forget there is tons of liquidity sloshing around the markets. The US markets are going up because foreigners consider US markets as the least smelly shitty toilet paper and are piling in. And let’s not forget hedge funds such as SNB investing in US stawks. The higher interest rates are attracting foreign capital, causing the US market to go up in spite of higher interest rates. Look around, everything else elsewhere is swirling around the turlet. Slomo train wreck.

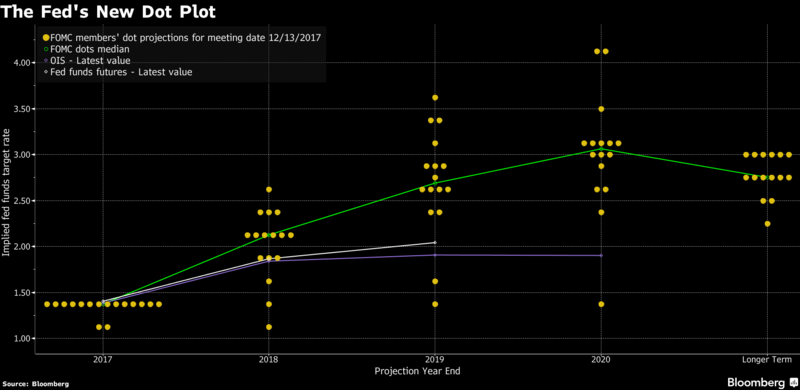

So we had 15 dots in 2017 – hell fucking yeah, we love dots. 3 for 2018 and a measly 1.6 fucking dots for 2019? Damn Jerome

You’re giving the wrong Central Bank the credit.

The third round of QE was officially halted in 2014 in the USA. However, the world’s other main central banks acted in rotation — passing the baton of QE, like in a relay race — so that when the US slacked off, Japan, Britain, the European Central Bank, and the Bank of China, took over money-printing duties. And because money flies easily around the world via digital banking, a lot of that foreign money ended up in “sure-thing” US capital markets.

It’s really a lot simpler than that. Most countries (including the USA) realize that their survival depends on stock markets maintaining certain high levels. If retirement/pension funds cratered, there would be hell to pay (think soup lines).

It’s not hard to keep the market up (creating the illusion of prosperity) by printing digital money out of thin air and buying ETFs with that money (extra Japan), thus keeping the stocked market high and retirement/pension funds on life-support . In that way, retirement/pension accounts don’t crater and the people don’t revolt.

The alternative simply isn’t acceptable. True price discovery??? Not acceptable. It would create instant poverty for most countries and most people. It’s not going to happen until the bond market sees through this charade and implodes.

Then, gold and hard assets will be the only safe place. The charade will end… it’s a mathematical certainty. It will happen when the music stops and there are not enough chairs. It the meanwhile, all governments will keep the plates spinning… until they can’t. Then, gold (not BTC) will hit astronomical levels that can’t be imagined at this point in time.

That will be little solace for the misery and pain that will be experienced world over.

This is a concept the millennial snowflakes are incapable of comprehending. They think the grid is a fixture that will never go down. Most geniuses here do not comprehend that there are no assets anymore, just debt. When debt implodes, and it will, the majority of companies that keep the grid humming will go bankrupt as well. Lights out. The process was already started by hiking interest rates. The debt bubble will collapse on itself in domino effect and the only thing that will be left at the bottom of Exeter pyramid is yellow.

Look, you can’t create “wealth” from trees or digital 0’s and 1’s. You can temporarily create the illusion of wealth in these ways but it’s still just an illusion and it’s still just temporary.

Wealth is “stuff” you can see, hold, hide and hoard. Everything else is a proxy for that… a proxy that vaporizes as easily and quickly as it is created.

By the way, that includes gold… it’s just a more stable and reliable proxy than its paper or digital alternatives.

That is why God says, you can own the whole world and you still own nothing that lasts.

It was not just about pensions and retirement. There were other, far less systemic ways to mitigate those disruptions. They did not NEED to control such a fundamental input – – the price of money.

But other methods would have involved wealth distribution to the average guy – – e.g., Ben’s helicopter approach. The QE course they choose instead involved wealth redistribution to those who already were asset rich …or as Fly has described them the ‘superior asset allocators’ ..you know, like the owners of gaudy, gold-plated, golf resorts and such …like our bottle blonde in chief.

3 or 4% in 2020? Hmm, I guess they think the asset bubble will be “contained”.