The King of passive investing, Vanguard, is out with commentary warning that a correction is just around the bend. I’ve been reading these notes for two years, especially from Goldman, and nothing evert happens. Perhaps Joe Davis, Chief Economist at Vanguard, is right this time around.

He’s predicting returns of 4-6% over the next five-fucking-years.

“It’s about having reasonable expectations,” Davis said. “Having a 10 percent negative return in the U.S. market in a calendar year has happened 40 percent of the time since 1960. That goes with the territory of being a stock investor.” He added, “It’s unreasonable to expect rates of returns, which exceeded our own bullish forecast from 2010, to continue.

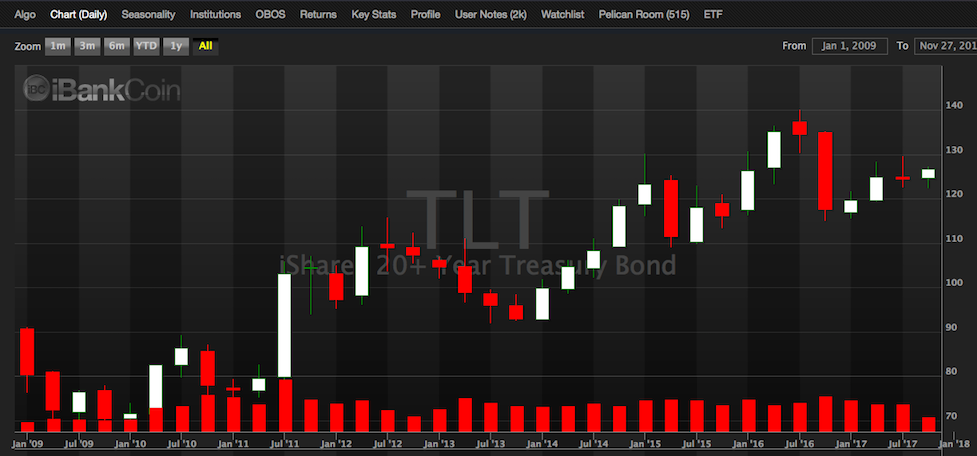

The risk premium, whether corporate bond spreads or the shape of yield curve, or earnings yields for stocks, have continued to compress,” Davis said. “We’re starting to see, for first time … some measures of expected risk premiums compressed below areas where we think it can be associated with fair value.”

David adds, “don’t become overly aggressive. The next five years will be challenging, and investors need to have their eyes wide open.”

HAHAHAHA. These people are GIGANTIC FAGGOTS, making wild eyed predictions that stretch over half a decade.

He concludes:

“It’s important to separate what is expected of the global economy from the price being paid for it. In the United States, stock prices have already been bid up based on future business expansion. As markets rise and valuation on the Shiller has risen … [it] doesn’t mean we’re in bubble territory, but we have deviated from where values should be,” Davis said. Historically, low interest rates on bonds help explain why stock valuations have overshot corporate fundamental growth, but still can’t justify the valuation levels.

I suppose we’re all gonna end up on the ark, one way or another.

If you enjoy the content at iBankCoin, please follow us on Twitter

Prepping the boomers for any corrections. Hey you should only be expecting 5% a year at best, so if we correct 10% don’t sell our funds.

GIGANTIC FAGGOTS

stretch over half a decade

Extra Cackle Hillary

Yeah at the endstages of an overstretched bull cycle

It depends if the power elite need market chaos to avoid Alcatraz

Joe wears a pussy hat and supports Hillary for President and crosses his legs like a woman. After the election his live webcast was a solemn occasion. I told him he sounded like a funeral director.

But McNabb is in charge.

VGT +38% YTD + .42 Div.

Granny making money, floating down, littering the yard. Day traders committing suicide.

It wasn’t always that way. As a matter of fact, it rarely is. Don’t be a GIGANTIC FAGGOT who believes MCD will continue to do what it’s doing.Then again, me asking that of you is like asking a private to run a war. Go back to whence you came.

Granny will slap you into next week boy. Your returns are smaller than a spec of atomic dust.

No hes wrong sp500 4000 by 2022. 20 percent gains all time highs every year for the rest of our lives. Super fucking awesome.