We had a correlations between the 2s and 10s yield curve today, which widened to 70bps and the market, with the fag heavy Nasdaq regaining more than 50 points from the lows. The Dow was off by 205 and barely closed down 100.

Men seated in wheeled chairs were out and about talking extremely greasy, elated by the decadence of it all.

Anything showing down more than 100 is quote stuffing fake news!

— Ramp Capital?? (@RampCapitalLLC) November 9, 2017

NVDA just posted earnings and as expected, they were spectacular.

NVIDIA sees Q4 revs $2597-2.703 mln vs $2.44 bln Capital IQ Consensus Estimate

NVIDIA prelim Q3 $1.33 vs $1.07 Capital IQ Consensus Estimate; revs $2.640 bln vs $2.36 bln Capital IQ Consensus Estimate

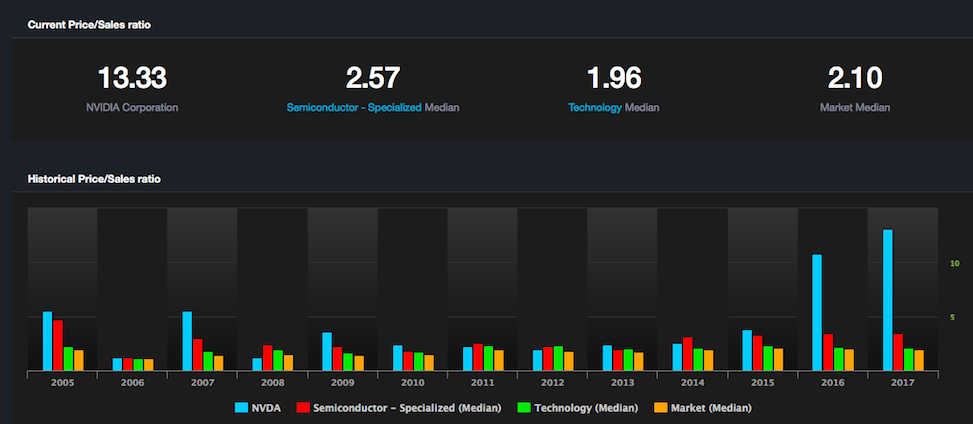

However, the basis for being short NVDA has little to do with earnings, but more to do with the price of the stock.

At 55x earnings and more than 13x sales, the stock is already priced for perfection — higher by 92% for the year.

Any upside action in the after-hours will be faded tomorrow. You can take that to the bank.

If you enjoy the content at iBankCoin, please follow us on Twitter

There are yield curve flatteners and yield curve steepeners (trade types). Credit widens or tightens. Parallel shift higher in rates most likely with slight flattening as Fed funds rate is increased. Credit can not tighten much more and central bank accommodation is unwound (ECB 1st in line), then Fed, lastly BoJ.

And why is JNK getting killed?

I’m with Jeffrey Gundlach

Follow him on twitter folks.

Both HYG (just under 20bln AUM) and JNK (13bln AUM) are trading down on heavy volumes. HYG 23.8mm shares vs 11mm avg. JNK 6x “normal”, incl. 3 block trades mid-day for 394mm, as in million. Bid up by passive allocations and selling on GOP tax plan delays. Below 50/100/200 day moving averages. Perilous, indeed.

You want Ramp Capital? Check out the close on $URA.

Yellowcake to the moon!

Man killin these calls

So predictable. FED always BTFD.

https://tinyurl.com/y8s2az8t

Thank you for your great works good sir.

Just coming off the Nvda call, long term investor, I humbly advise you to cover your short before market open.

He’s not worried because it’s going to sell off tomorrow because it is just “up too much” and therefore it is a “sell”

Just remember this Wall Street adage: “The Fly is winning even when he appears to be losing.”

Fly man, not to be a whiner cause I love this site, but it has too many pop-up ads and shit. I typically access it via my mobile and it drives me nuts with the frequent pop-ups.

Agreed

Get the mobile app.

Let me guess: Millenial, right?

Sorry, but fuck off. How’s that for reader sympathy? Do you like it?

So my complaint was forwarded to the complaint department (trash bin)?

Is it “EnVidia” or “NaVidia”? I don’t care, I’m just winning today as certain short sellers get squeezed.

The NVDA is exhibiting similar behavior around earnings as the last report in August. But this time the pattern is much stronger, as it is hitting a 52-week / all-time high today. Being that it’s up 5.5% today and volume is 550% more in the first hour of trading than normal, I guess the institutions are voting against the bears today.

Hey el Fly. Did you get out of NVDA in time or are you swatted flat against some truck windshield?

Not being sarcastic. damn stock was ruthless today.