As much as I would like the world to burn, it just isn’t ready to happen. The early 2016 scare, emanating from China, is over. We see that in the share prices of Macau based casinos. And we are seeing strong economic data released on a monthly basis in China.

Caterpillar just released their retail data for May vs April and it’s indicating extreme optimism and a fuckload of sales.

Caterpillar reports May 2017 retail data; total machines worldwide +8% vs +1% in April of 2017

Total Machines (May 2017 vs April 2017)

Asia Pacific +49% versus +47%

EAME: -6% vs -10%

Latin America: -15% vs -30%

North America: +2% vs -7%

World: +8% vs +1%

Total Energy & Transportation (May 2017 vs April 2017)

Power Gen -10% vs -2%

Industrial +4% vs -11%

Transportation +9% vs -3%

Oil and gas +13% vs +4%

Total +4% vs -2%

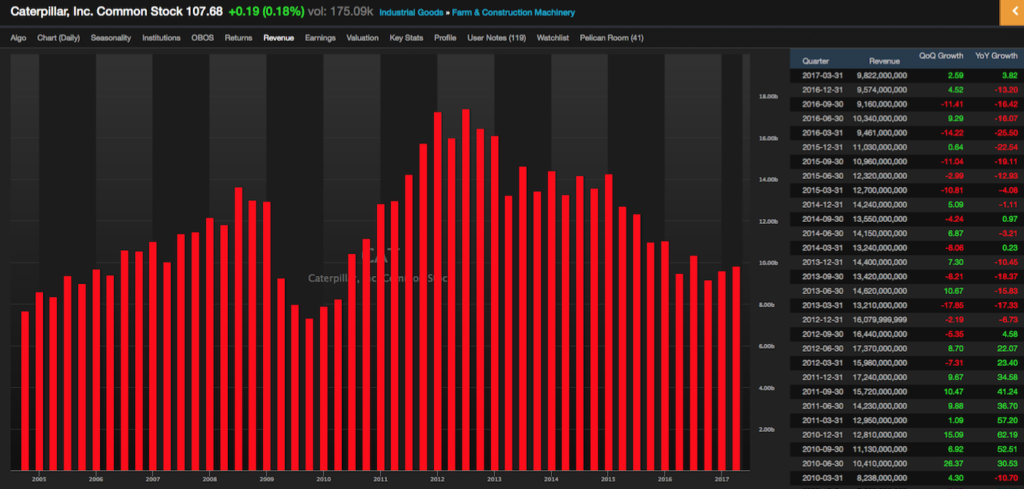

Industrials are on the rise, perhaps somewhat stymied by recent weakness in crude. Nevertheless, CAT is higher by 41% over the past year, in spite of declining revenues and earnings. But the stock was likely reflecting the turn we’re about to see now. Funny how the market knows, well in advance, when an economic tailwind is coming.

The bigger story here isn’t to shill for CAT, but instead highlight the fact that industrial activity is quickening.

If you enjoy the content at iBankCoin, please follow us on Twitter

channel stuffing, filling up the colon until it bursts

LOL. Last summer/autumn prior to market taking off and treasuries topping, Fly was short stocks to the teeth (including CAT) and long treasuries. Now he is at the opposite side.

I think Fly is the perfect contrary indicator. LOL

After having been caught evading taxes for years, CAT offers up to the Feds that they clean house, pump earnings and generous amounts of tax going forward.

then why are the basic materials/resources that CAT equipment moves around and plays with doing so poorly? One of these things is not like the other…

Hi Fly, Well you asked us Bears. IMHO One Belt, One Road of course (May was the month of the big dog and pony show, remember). China May Home Sales were flat MoM, but YoY still held up, but June (which is the slow time) has been softer in WoW data. Yet, China has this Massive Belt/Road thing going. IMHO lending Money to India and a lot of weaker EM’s to build the next Silk Road is a bit crazy cuz. What will stop them from defaulting?? Sort of like Subprime Home Loans to Countries…except China will probably be unable to collect on the collateral India, etc put up. China GDP estimates are showing weaker Estimates. Copper has not followed Caterpillar. Yes, last night for the first time china govt starting buying their own bonds…but the end of this global QE stuff and the bubble it created has to pop. Bubbles always do. Please Cue in End of the World Music for this Bear.

I think all of us know that deep down inside and the only real question is when.

History being what it is…a damn good indicator…shows us that the longer it takes to pop, the bigger the explosion when it does.

Heaterman, I really didn’t know bubbles so I decided to watch it form since China Govt started buying up copper in Feb 2009. This should be a massive explosion when it does pop cuz Swiss and Japan Govts are such large shareholders this time…and those f/x our places to hide for safety lol