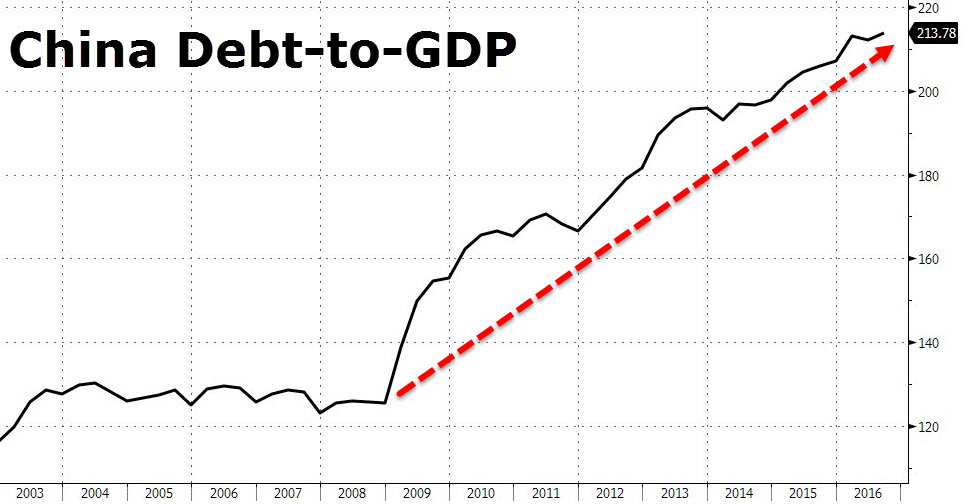

Moody’s is concerned that China will not be able to ‘rein in’ leverage, whilst growing at a fixed 7.1% rate, indefinitely. I suppose Moody’s is concerned over China’s 250% debt to GDP and how it might create tangential concerns away from the narrative of ‘global growth’ and a one world economy, coexisting in an effervescent haze of happiness.

Moody’s reduced their rating from A1 to Aa3 — citing a ‘material rise’ in economy wide debt, changing their outlook to stable from negative.

Who gives a shit, really? New highs abound. Markets work.

Total outstanding credit climbed to about 260 percent of GDP by the end of 2016, up from 160 percent in 2008, according to Bloomberg Intelligence. At the same time, China’s external debt is low by international standards, at around 12 percent of gross domestic product, according to the International Monetary Fund, meaning that a downgrade isn’t likely to be as disruptive as it would be for nations more reliant on international funding.

Overseas institutions’ holdings of onshore bonds dropped to 830 billion yuan ($121 billion) as of the end of March, from 853 billion yuan three months earlier, People’s Bank of China data show. That’s less than 1.5 percent of 63.7 trillion yuan of outstanding notes, according to Bloomberg calculations based on the central bank data.

Moody’s last cut China’s sovereign rating in 1989, when it downgraded the sovereign to Baa2 from Baa1, according to spokesperson, Manvela Yeung.

Moody’s states.

“The stable outlook reflects our assessment that, at the A1 rating level, risks are balanced. The erosion in China’s credit profile will be gradual and, we expect, eventually contained as reforms deepen. The strengths of its credit profile will allow the sovereign to remain resilient to negative shocks, with GDP growth likely to stay strong compared to other sovereigns, still considerable scope for policy to adapt to support the economy, and a largely closed capital account.”

China rejected the credit downgrade — calling it ‘inappropriate.’

If you enjoy the content at iBankCoin, please follow us on Twitter

How about Moody’s forgets China, the ~$3T creditor, and assigns “appropriate” credit rating to US $20T debt? No? Then Moody’s is not independent, objective and credible.

Why do we give 1 cent what some ratings agency says when they took payouts for ratings during the crash?

Moody’s can rate this ..|..