This market is all about large cap hedge fund hotels pressing new highs, ironically fueled higher by large hedge fund managers. The numbers do not lie.

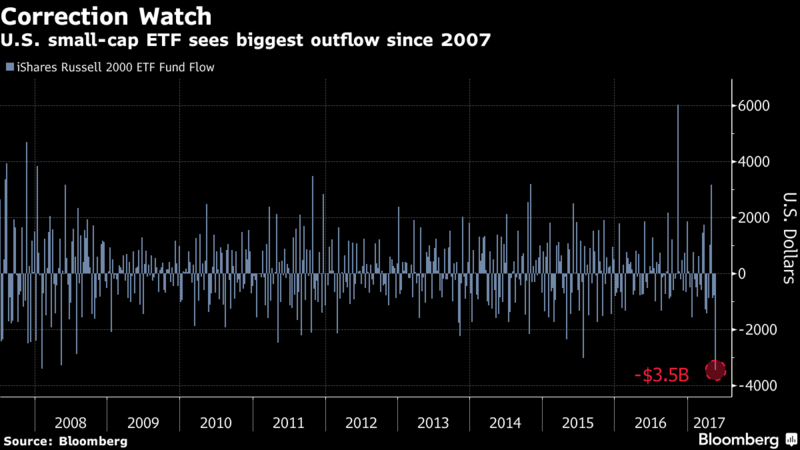

Look at the Russell 2000 outflows, the largest since 2007.

Here are some interesting numbers that illuminate the lack of diversity in this record move higher.

Stocks with market caps under $5b are down 0.89% for the past week, -0.86% for the past month, -2.74% for the past 3 months, and +0.19% for the past 6 months. Hardly impressive, more like depressive.

Stocks with market caps over $5b are up 0.12% for the past week, +1.53% for the past month, +1.65% for the past 3 months, and +10.15% for the past 6 months. Wow.

The spread between large and small caps stocks is 1,000bps over the past 6 months. The fact that no one is talking about this is equally crazy. It seems that all of Wall Street are holed up in a few stocks, such as AMZN, AAPL, MSFT and NFLX, while everything else wallows in a holding pattern.

In my experience, this sort of dichotomy tends to lead to gigantic blow outs, once the market softens. Everyone is chasing alpha now and the place to be is in larger cap stocks, which investors view as ‘safe’ and liquid. However, the safety and liquidity of these stocks have been negated by overcrowding — so buyer beware.

If you enjoy the content at iBankCoin, please follow us on Twitter

All of Wall Street, INCLUDING SWISS and other CB’s are holed up in a few stocks, such as AMZN, AAPL, MSFT and NFLX.

CB’s are the new hedge funds now that they started purchasing equity.

I’m seeing massive sell offs in the micro cap universe at really bad losses even by penny piss standards.

I was browsing iHub on my iPhone while I was taking an icrap and let’s just say people Seemingly don’t mind going shirtless.

It’s fitting that in an economy where the .01% and the crony capitalists– like the people in Trump’s cabinet– are gorging themselves at the public trough, that the stock market is carried by .01% of the stocks within it.

You truly are a fucking idiot.

Frog would have to be 100x smarter to even qualify as a fucking idiot.

Says the biggest idiot on this site.

Fly, you claim not to be a Republican. So why act like one? Republicans bash anyone who is a Democrat, for no apparent reason. Why not tell me in what way you disagree with me, instead of insulting me?

You are insulting all who carry the monicker “fucking idiot” proudly.

how did you manage to ruin this post about equities with politics? cancer of this website.

Because the tranny is a douche

Speerothedude, this trolling tadpole infects all waters of reason! Get use to it until Dr. Fly decides to purify the waters of discourse again.

Take the blue pill and profit from FANG. The rest of the market–small caps, banks, industrials, energy, miners, etc. are going to act like shit unless and until we get tax cuts and an infrastructure bill. But those things just aren’t happening with this shit-show presidency.

This “lack of diversity” claim was being made a year ago re: 2015-2016 performance too. How did that work out? How about basic materials and energy? Investing for the long term is different than short/medium term trading, and if you don’t foresee recession or significant financial dislocation in the near to medium there’s nothing to stop these trends as they are global.