Will the mean reversion magic kick in? Only time will tell. For now, I’ll leave you with the visuals and the fact that FAS flagged oversold last week in Exodus.

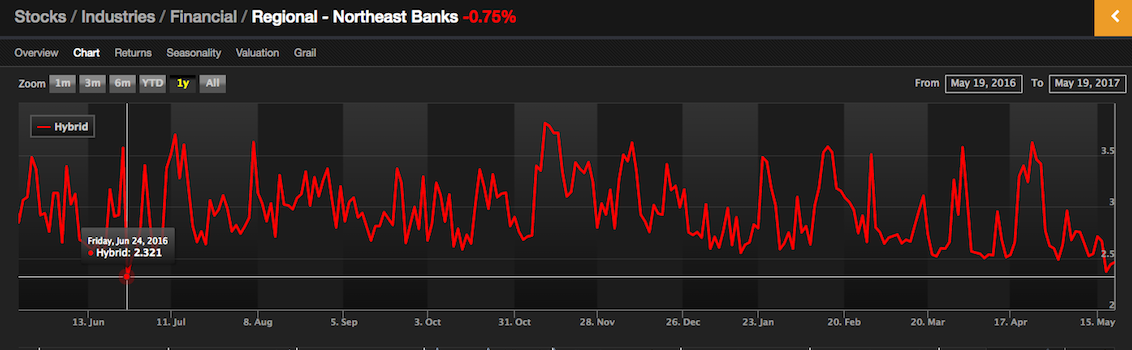

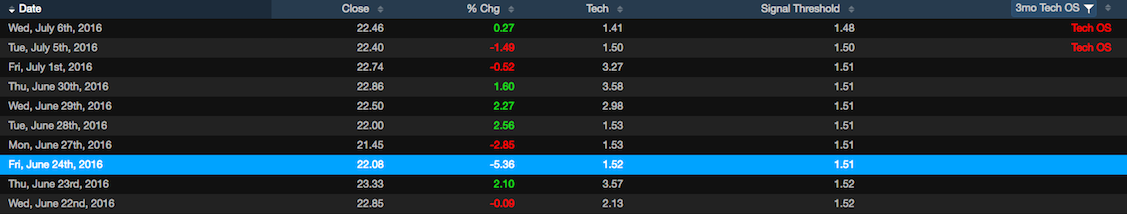

The Northeast regionals are the most oversold since June 24th of 2016.

The stats for FAS oversold are impressive, 12 up 1 down over the past 12 months.

NE regionals include STT, MTB, CFG, SBNY and others.

If you enjoy the content at iBankCoin, please follow us on Twitter

Sweet. Thanks Fly. This might offset my moronic plunge into mj stocks this week.

Great post on $BBRY, not so long ago, by the way.

Worth mention.

video:

https://www.theguardian.com/us-news/2017/may/21/trump-vows-historys-great-test-conquering-extremism-saudi-speech

Could be a defining moment.

Yep, that’s the speech.

Quite the makeover the deep state gave Trump.

XOP has been fairly trashed as of late.

More TLT you pussy. Yield curve. MUH banks

“The Fly” allocated 5% of his pussy account into gold.

Talking finance with you is like discussing Dickens with an illiterate.

Talking politics with you is like talking to a catamite rape servant

It doesn’t matter what your think. You’re a submental.

I like the smaller NE regional banks with asset sensitive balance sheets. There will be consolidation so some of the following could be bought and many pay a healthy dividend while you wait. Some to look at include FBNK, PBCT, WBS, UBNK, BHLB – they all should do well if rates start creeping up. Problem is the NE is slow growth and the commercial loan portfolios could shrink on a linked quarter basis and you get a sell off.