The ETN racket is coming to an end. Companies like Direxion are inherently evil and have created tools to destroy the portfolios of millions, which have ruined marriages and caused countless children to grow up without a cohesive family. As sure as I’m sitting here, medical bills have likely resulted from the stress they’ve applied to people and some have died because of it.

ETN’s kill people, literally.

Over the past 5 years, FINRA has made ETNs enemy number one and regularly skins brokers alive for buying them. As such, Credit Suisse is closing down their super popular 3x upside and downside crude ETNs — because they probably don’t want to kill people anymore.

Over the last decade 89 out of 300 issued ETNs have closed down. What’s important to note is that when they do close down, and if you’re still holding them, you’re entirely fucked.

In the case of UWTI and DWTI, you could be fucked until 2032.

Source: Reuters

Investors are rushing to get out of a top exchange-traded note before it stops trading publicly, and those who fail to find a buyer may be stuck for years in a widely misunderstood product.Credit Suisse’s $1.1 billion VelocityShares 3x Long Crude Oil ETN (UWTI) is poised on Thursday to become the largest-ever note to be delisted from U.S. exchanges.

Investors hold $22 billion of U.S. ETNs which, like debt, constitute a pledge by an issuer. Payouts are based on the performance of the underlying asset, but the notes do not “hold” those assets, unlike ETFs to which they are often compared.

It is rare for a delisting to come without a new redemption option for investors who retain the product. Credit Suisse’s move may make investors wary of ETNs.

Upon delisting, ETF holders are typically paid out in cash while ETN holders are at the mercy of the issuer.

After that, investors looking to sell would be forced to find a buyer “over-the-counter,” where investors are not guaranteed anything close to what the notes are worth.

Several traders and analysts expect Credit Suisse to announce plans to effectively redeem the remaining notes for cash, but the bank has not said whether it would do so..

Investors pulled nearly $675 million from UWTI in the two weeks through last Wednesday, according to fund researcher Thomson Reuters Lipper. The march toward their delisting has occurred despite a massive run-up in oil prices which has boosted the ETN’s price.

Credit Suisse said in a Nov. 16 statement it would delist the ETN to better align “its product suite with its broader strategic growth plans.”

Investors hold UWTI for six days, on average, according to Deutsche Bank Securities Inc. Those who do not sell UWTI this week could be forced to hold the notes for years since they do not officially expire until February 2032.

A smaller related ETN, the $222 million VelocityShares 3x Inverse Crude Oil ETN, is also delisting Thursday. The notes actually attracted $60.2 million in the latest week, Lipper said.

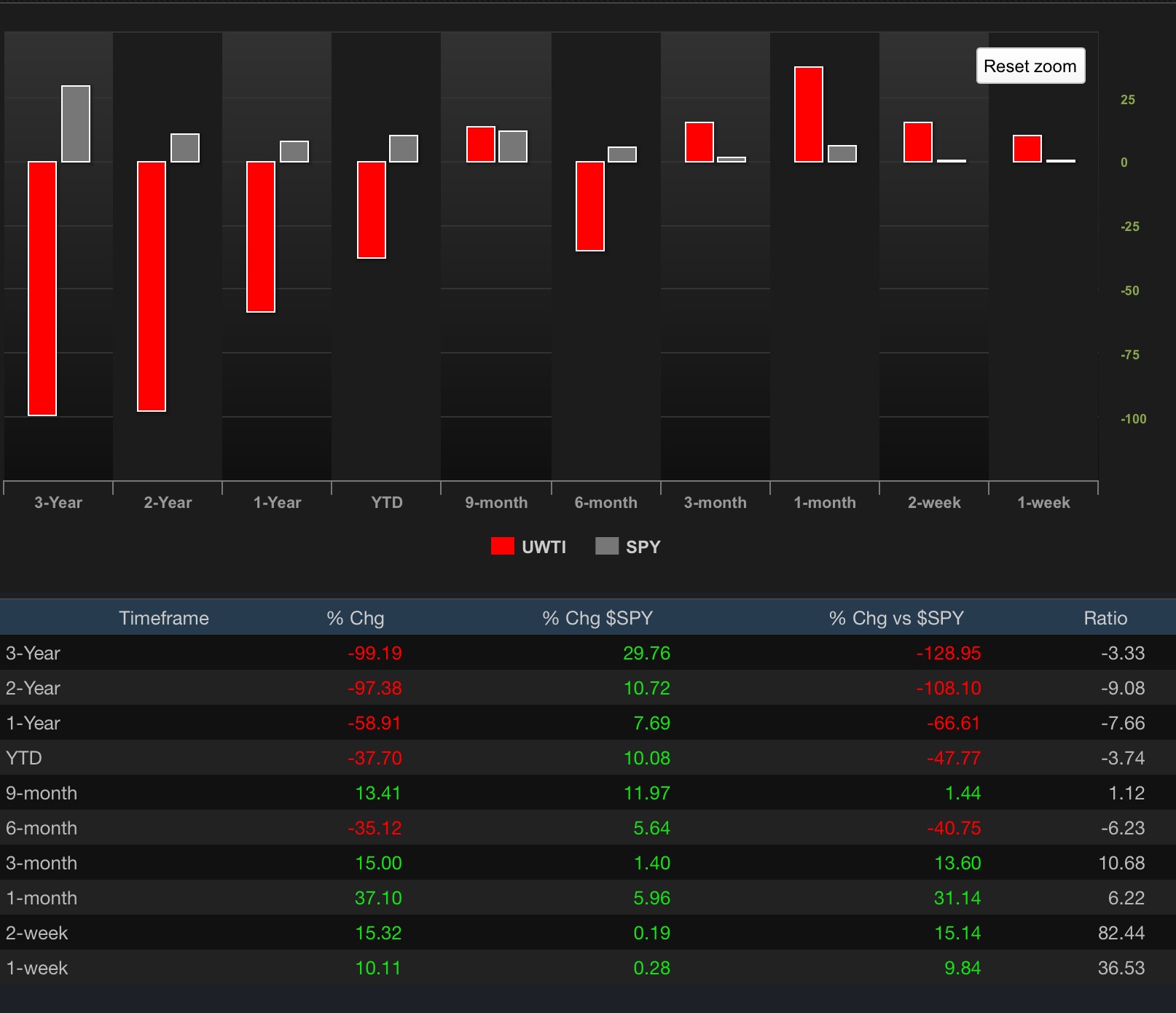

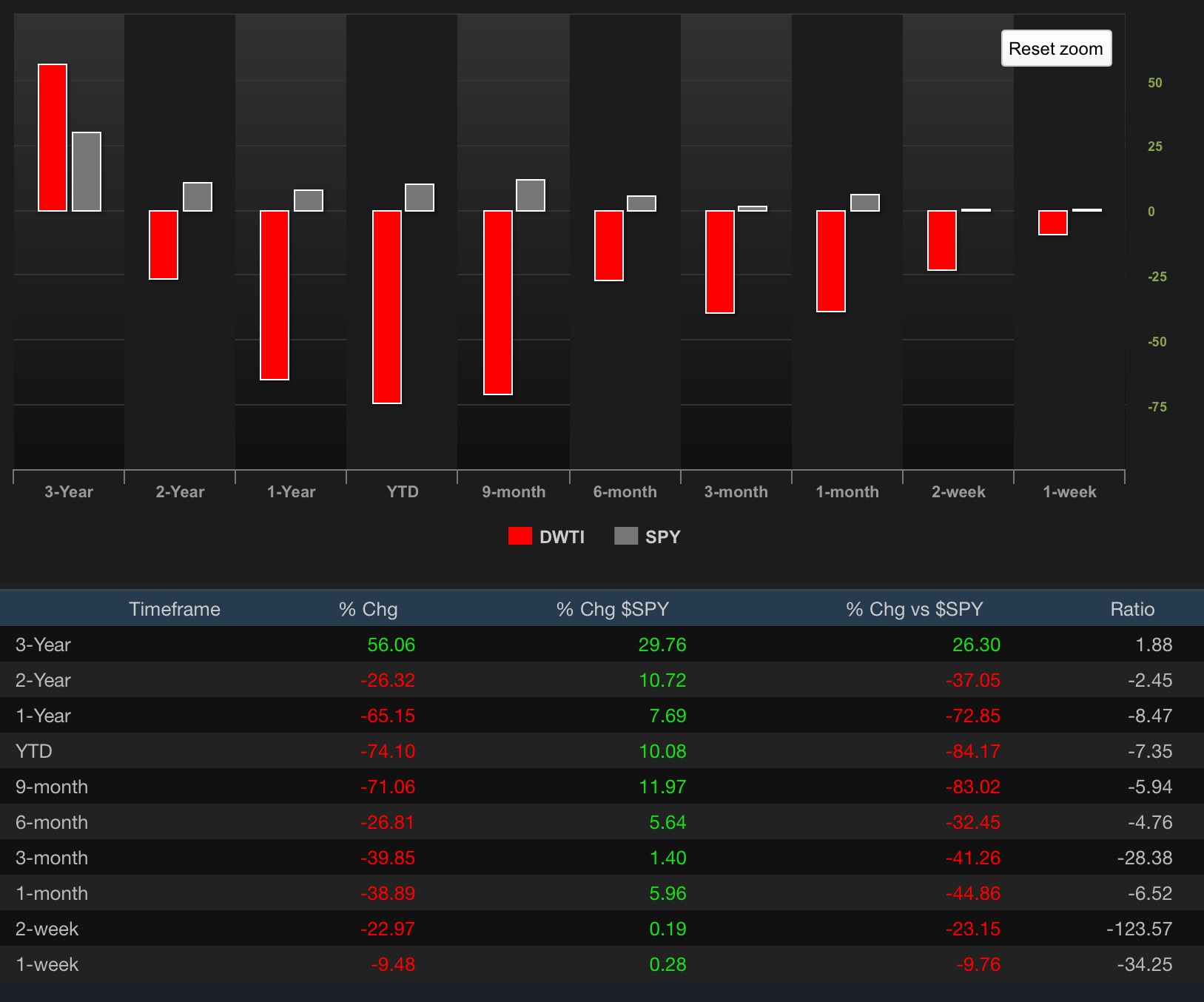

Over the past 5 years, UWTI has returned -99.1% and DWTI is down 71% in 2016. These are diabolical weapons of mass poverty, designed to destroy the America family and reduce the population.

If you enjoy the content at iBankCoin, please follow us on Twitter

I owned UWTI earlier in the year with good results. I like these 2x, 3x, ETN tools, gives the little guy a chance to use smart leverage.

The people have a right to bear arms and a right to use leveraged products.

They can scrap 95% of ETNs but I hope they never get rid of VXX. Too easy to make money betting against it forever. And playing the long side of XIV and others.

Never again.

https://youtu.be/g4ChTL-3c3o

What if you are holding an option in an ETN? Do they all expire immediately worthless? Would the net gain be erased? the net loss? How can they just dissapear in an option trade?

Let’s sell them to China.