Full disclosure, CAT is a distinguished member of my FIST OF DEATH — which are 5 short sales of mine designed to bring forth the end of the world.

In my opinion, there isn’t a higher conviction short out there than CAT. The company is wholly dependent on a robust Chinese economy and mining industry, both of which are struggling in a big way. The company just came out with earnings and sales sucked.

Reports Q3 (Sep) earnings of $0.85 per share, excluding non-recurring items, $0.09 better than the Capital IQ Consensus of $0.76; revenues fell 16.4% year/year to $9.16 bln vs the $9.88 bln Capital IQ Consensus

The decrease in revenue was primarily due to lower sales volume, resulting from lower end-user demand attributable to continued weak commodity prices globally and economic weakness in many developing countries

While sales for both new equipment and aftermarket parts declined in all segments, most of the decrease was for new equipment. The unfavorable impact of price realization also contributed to the decline

Sales declined in all regions

Operating profit for the third quarter of 2016 was $481 million, compared with $925 million in the third quarter of 2015. The decrease of $444 million was primarily due to lower sales volume, resulting from lower end-user demand attributable to continued weak commodity prices globally and economic weakness in many developing countries.

In addition, restructuring costs and price realization were unfavorable.

Co lowers FY16 guidance, sees EPS of $3.25, excluding non-recurring items, vs. $3.53 Capital IQ Consensus Estimate, from $3.55; sees FY16 revs of $39.0 bln vs. $40.13 bln Capital IQ Consensus Estimate, from $40.0-40.5 bln

Caterpillar preliminary outlook for 2017 is that sales and revenues will not be significantly different than 2016 (consensus EPS slightly higher and rev slightly lower)

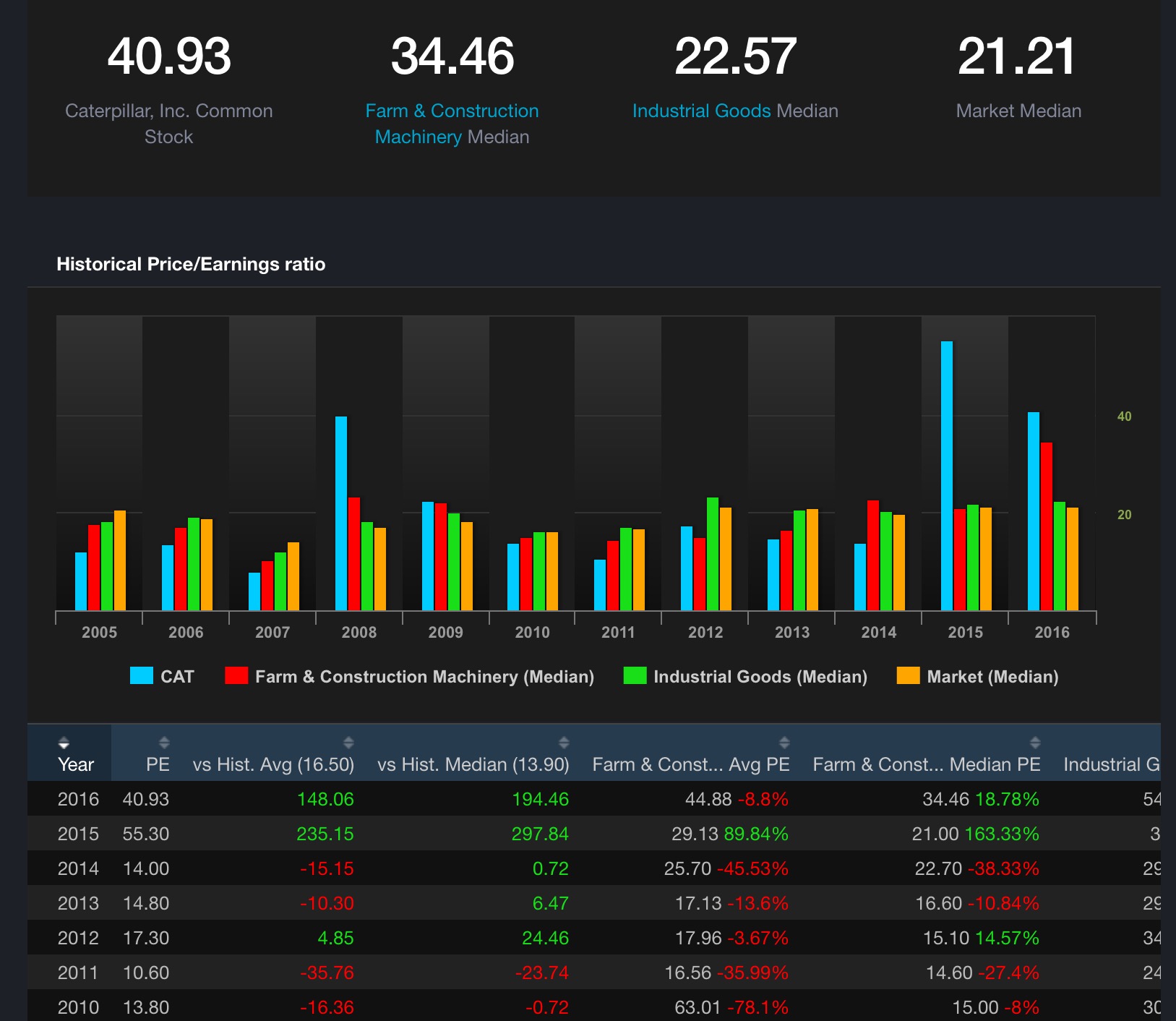

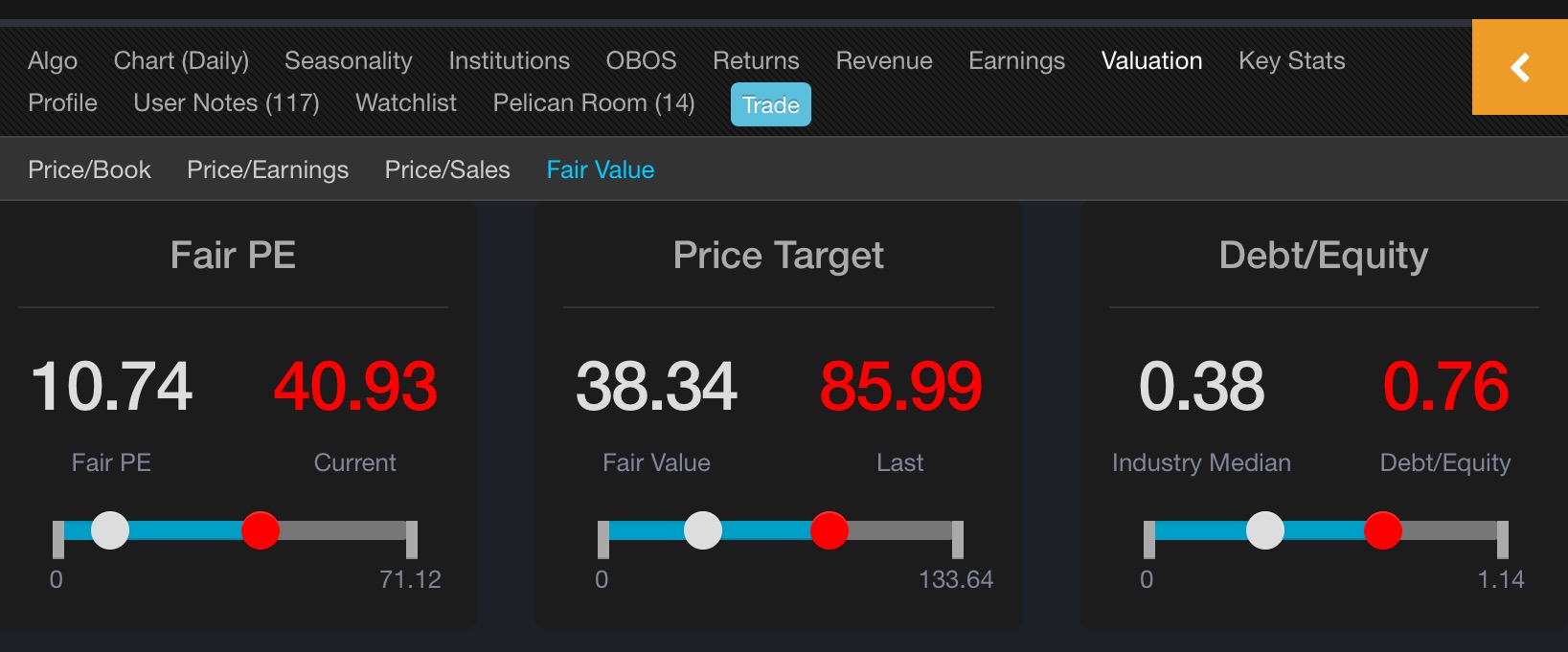

From a valuation standpoint, this company is woefully overvalued, trading at 40x revenues. Based upon the valuation algos in Exodus, whereby a PE is affixed to a company and growth rates extrapolate a fair value, the stock can get cut in half from present values.

This is a no brainer short, in my opinion.