How many times do we need to endure this? If you take a step back from the bullshit that is today, however, you’d note that the shenanigans at the Fed have resulted in markets ripping to all-time highs. In order to accomplish the steady and persistent squeezing of shorts, they’ve been good at creating monsters — in this specific case they themselves are the monsters.

If they permitted markets to run, unabated, it might overheat and then collapse once people figured out it was all bullshit. By checking advances, through menacing markets with nonsensical rate hikes, they’re controlling markets to the downside. This is what you get when you accept a rigged market. It’s rigged both ways — both up and down.

Some might say it’s conspiratorial to believe the Fed is walking down stocks. But if history is of any use, how do you explain the year long parade of Fed heads telling markets hikes are just around the bend — when inflation and growth targets aren’t even close to stated goals?

They’re betting on being able to arrest any decline that approaches 10%. As market plebs, we’re merely piss in the wind — as Yellen and her band of zealots blow.

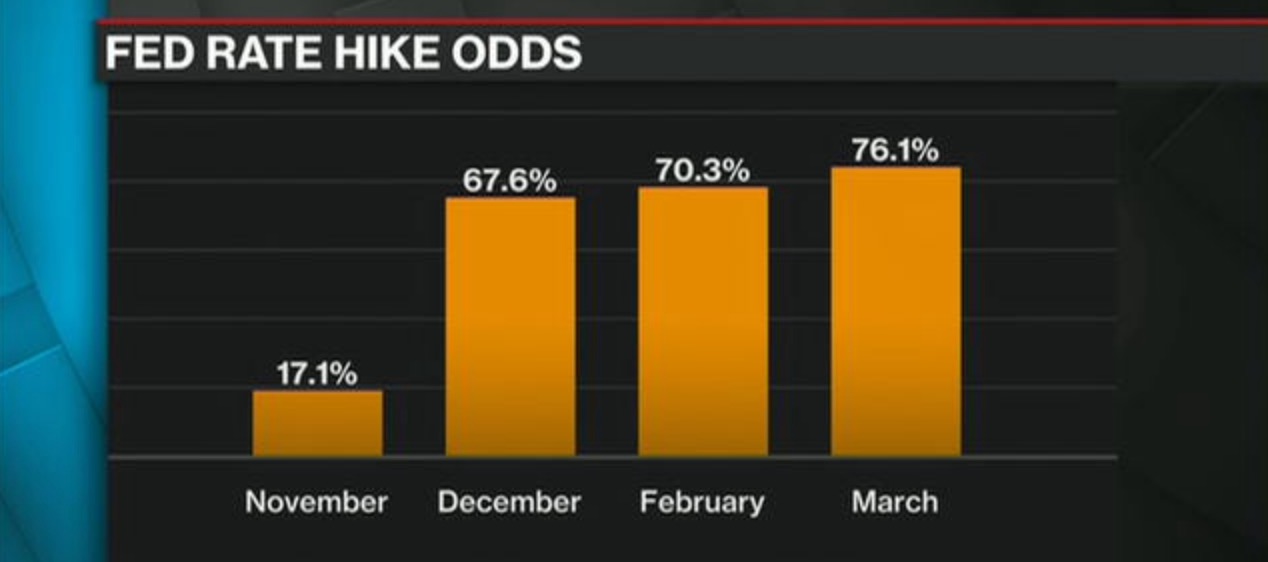

Expectations for a December hikes are through the roof — in spite of the fact that none of the soon to be worse than expected retails sales have been revealed. This is just poor betting.

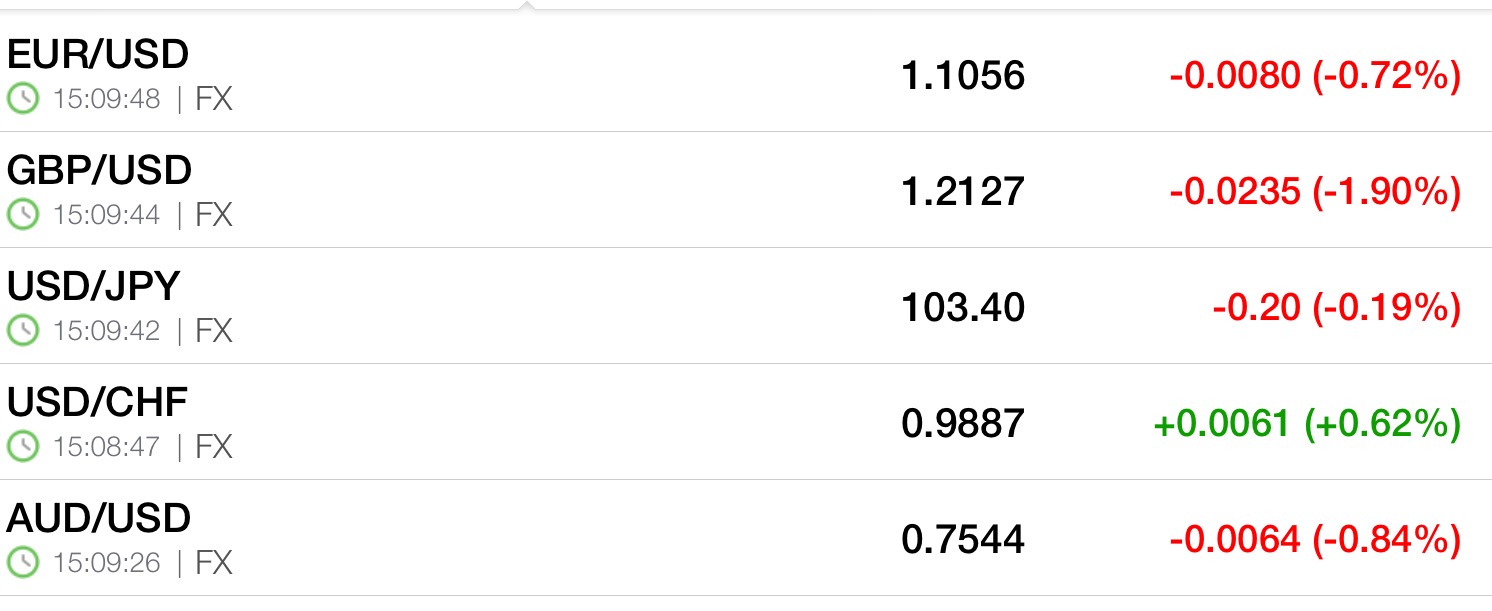

Fed rate hike fears are causing disruptions in Forex markets. Enjoy.

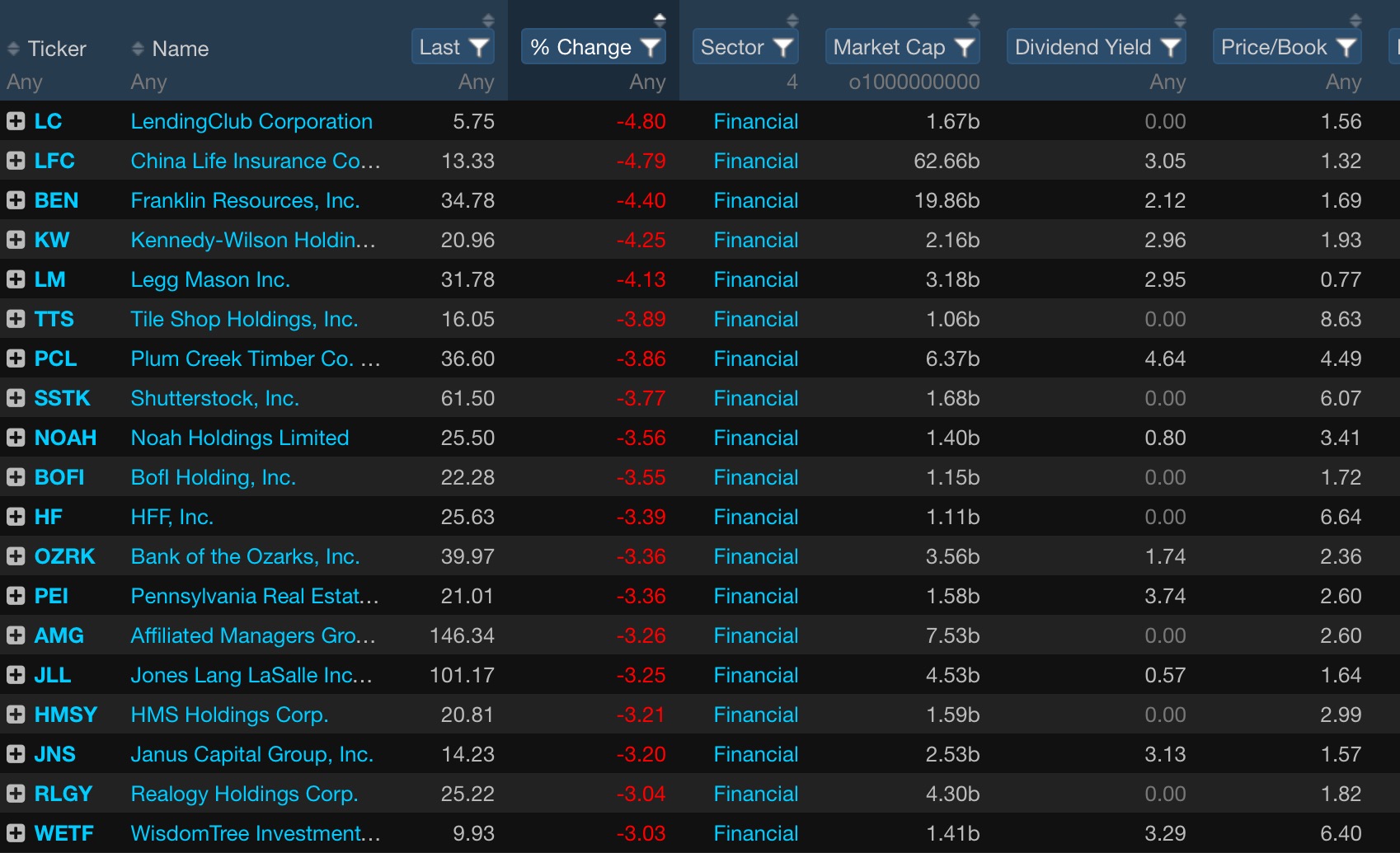

Bank stocks are getting bludgeoned — led lower by China Life — which is screaming ‘FX dislocation’. Keep a close eye on Asian trade tonight. Asian markets might get lit up — if China’s largest insurance company plunging by nearly 5% can be trusted as a forward looking indicator.

Top picks: TLT, gold, short FCX.

If you enjoy the content at iBankCoin, please follow us on Twitter

Doesn’t the FED have to hike rates in December? Obviously not before the election but they are boxed in at this point? A mere 25 BPS would make a hike but be meaningless. They’ve only committed to 2 in 2017 making it hardly even a blip. Seems like they have to do something at this point no?

A rate hike is nearly meaningless, except for the fact they have labeled their inflation target and we are not close to it, it is downward revised on a monthly basis. Additionally, if a 25bps move higher is meaningless, why is the market having such difficulty processing it?

My current hypothesis is that money is sloshing around looking for yield and growth, but the fundamentals are not there to support the higher prices that institutions are generating by their accumulation.

With potentially a 4th quarter of lower earnings, no inflation or embedded wage growth, a surplus of base materials, and tepid consumer demand, how can anyone possibly justify higher asset and security prices?

They’re systemically targeting shorts, what could easily be interpreted as trying to eliminate them. [Observed significantly since 15/14] Suggests the conniving intent…

Killary the blabber mouth.

https://youtu.be/u-k-UQ95wWc

Phsyco Killer qu’est-ce que c’est