What the fuck is a ‘shariah compliant’ note anyway. In this BBG article, they describe the debt as being compliant with the tenets of the Koran. Really, JP Morgan? I mean, what the fuck?

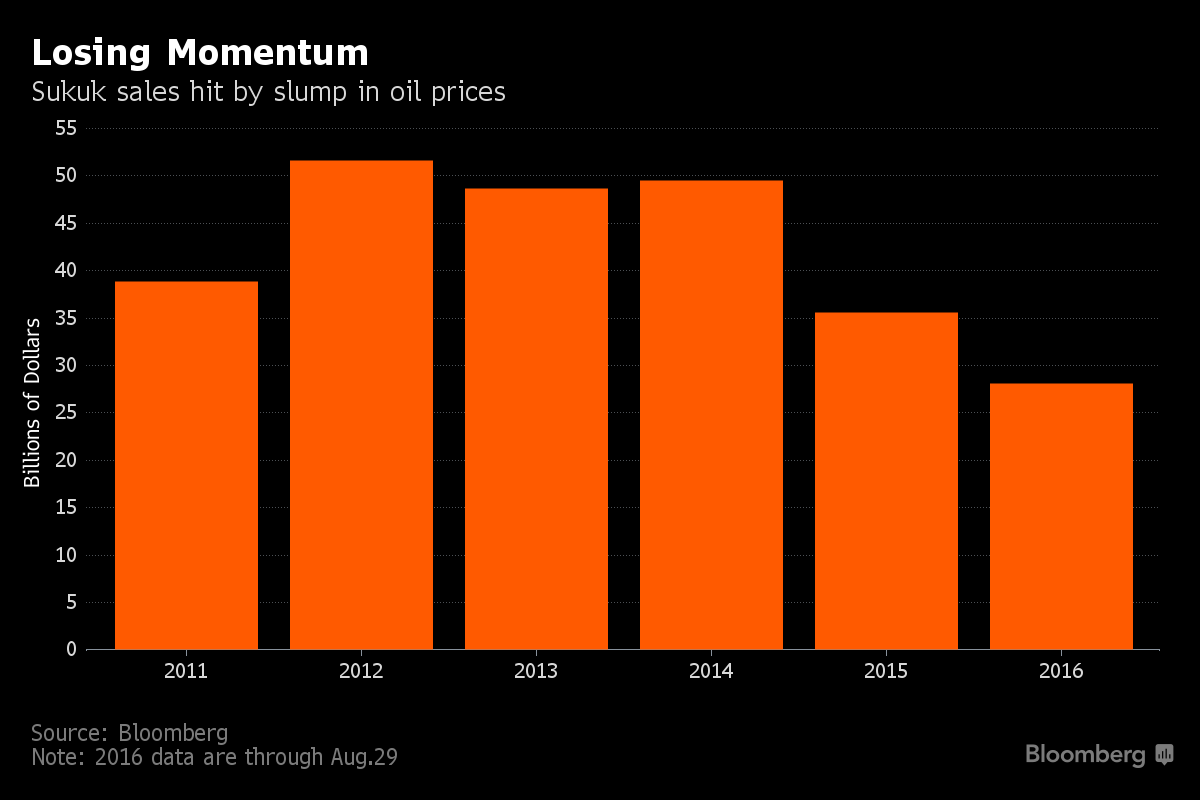

Since crude has been spiraling lower, the jackasses who issue islamic notes have been undergoing buyer disinterest.

So, like the good little lap dogs they are, JP Morgan is trying to stoke interest in this religious debt, by adding them to it indexes.

“We’ve already received several queries from clients who previously have not invested in sukuk and now want to understand the product,” said Hasif Murad, an investment manager at Kuala Lumpur-based Aberdeen Islamic Asset Management Sdn. JPMorgan’s step “will potentially lead to a wider acceptance of sukuk for investors” that don’t want to risk performance diverging too far from their benchmarks, he added.

The inclusion in JPMorgan indexes “will foster stronger market participation for sukuk,” said Angus Salim Amran, the Kuala Lumpur-based head of financial markets at RHB Investment Bank Bhd. “This is market positive. Funds that benchmark against these indices will be required to increase allocation to sukuk.”

“Sukuk will gain more attention from now on, but the market may need variety in terms of offerings to sustain the momentum,” said Sedco’s Fakrizzaki. “Issuers may now consider issuing benchmark sizes and to be rated.”

It’s not known whether JP Morgan will permit women to buy this debt. However, it is widely believed that this product will not be marketed to gays or persons of the Jewish persuasion, as that would be blasphemous and wholly against the will of allah.

According to wikipedia:

Since fixed-income, interest-bearing bonds are not permissible in Sharia or Islamic law, Sukuk securities are structured to comply by not paying interest. This is generally done by involving a tangible asset in the investment. For example, by giving partial ownership of a property built by the investment company to the bond owners who collect the profit as rent, which is allowed under Islamic law. Upon expiration of the Sukuk, the rent payments cease.

Sounds capitalistic. Where do I sign up?

If you enjoy the content at iBankCoin, please follow us on Twitter

interesting. they want more people to sukuk.

As in suk ur kok