Since the recovery and ZIRP, investors have piled into consumer goods stocks, due to predictable earnings trends, global outreach, and because they paid dividends.

Inside of my laboratory (Exodus), I’ve affixed tons of visuals to accompany the hard data. Humans are a visual species.

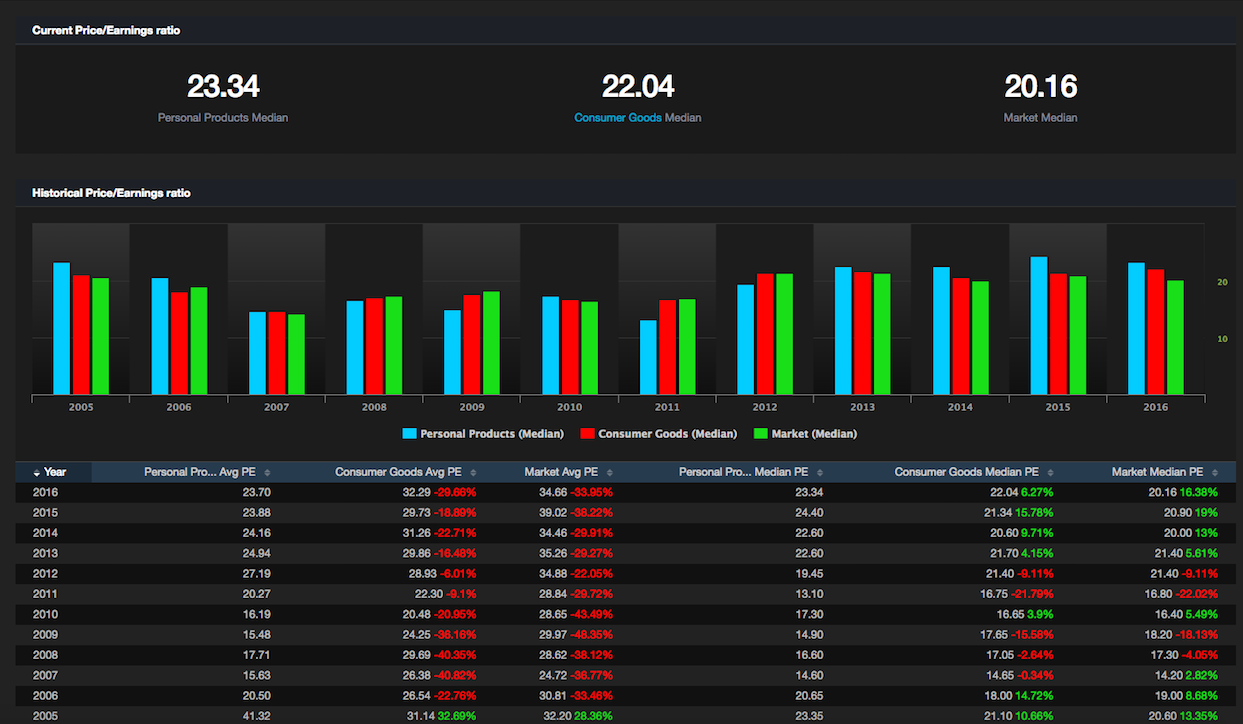

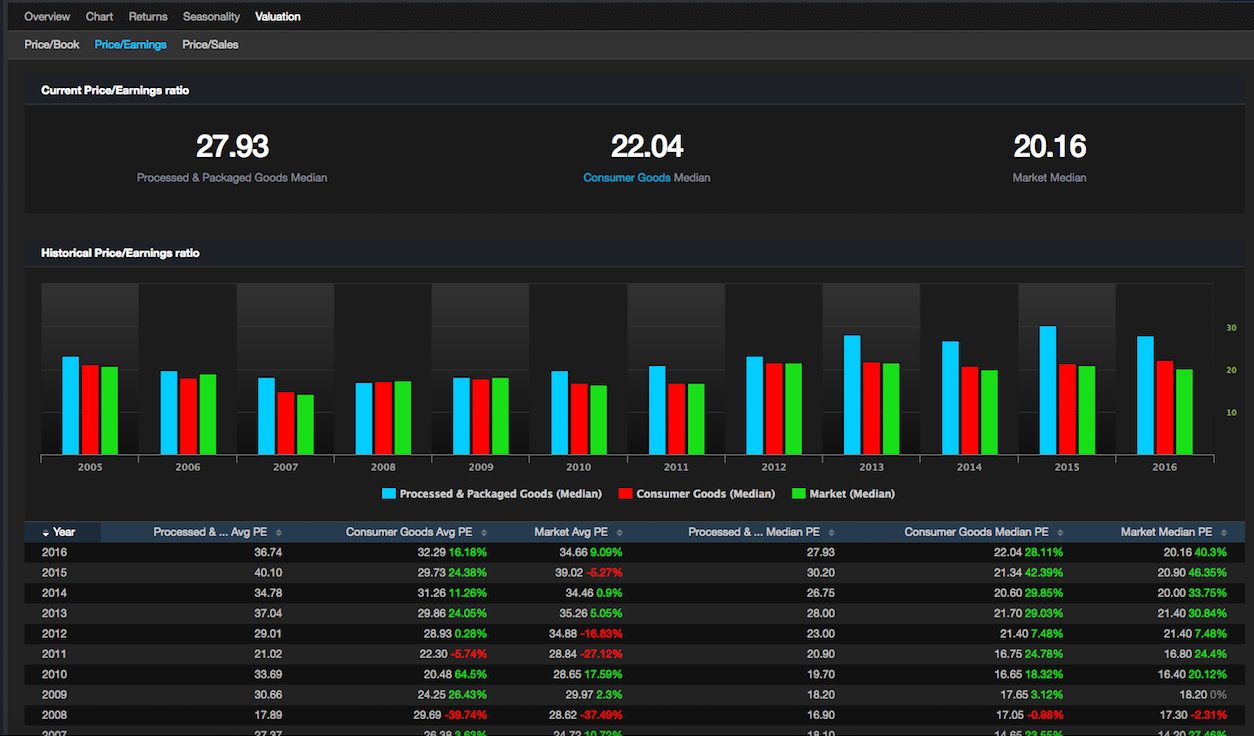

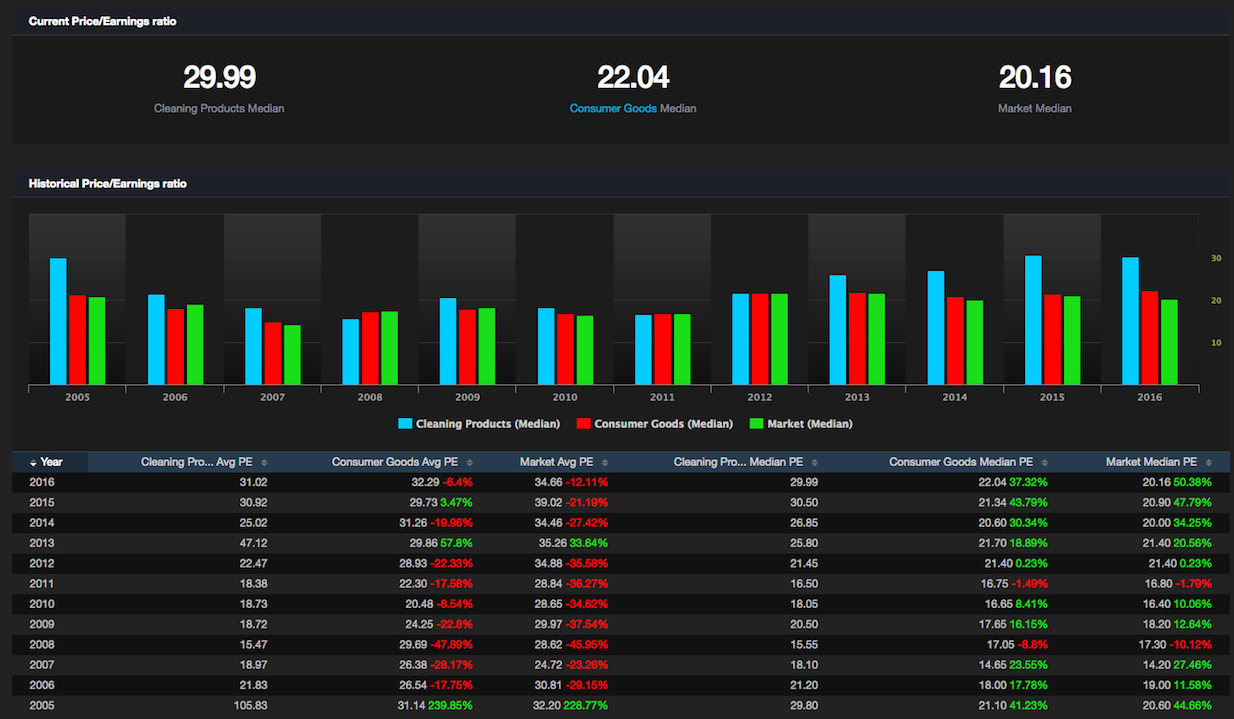

Let’s revive three core industries of the consumer goods sector: personal products, cleaning products and processed and packaged goods.

Best represented by PG, CL and KMB

Best represented by PEP, MDLZ and GIS

Best represented by CLX, CHD and ECL

The consumer goods industry is trading at a 50% premium to the median PE of the overall market. Ten years ago, it was trading at just a 11% premium.

The processed & packaged goods industry is trading at a 40% premium to the median PE of the overall market. Ten years ago, it was trading at just a 3% premium.

The personal products industry is trading at a 16% premium to the median PE of the overall market. Ten years ago, it was trading at just a 8% premium.

We run data for over 200 industries, and in my experience, have been able to foretell plenty of corrections. For example, during live demos we ran last year with customers, the biotech industry was something that was highlighted as being historically expensive. One year, whereunto, the industry has been racked with losses in excess of 30%.

If you enjoy the content at iBankCoin, please follow us on Twitter

I caught some of Mr. Cramer’s show and he was doing the chart thingy stuff on pet based stocks.

XLU VNQ had a bad day too

Credit default time. The third world is in total chaos second world is looking tippy and muni’s are starting to fail. California income tax receipts are way under exp.

We need a reset like trump has been saying. He just want It to happen before he gets in so he can be savior like obama. But obama blew his chance by trading in the power to breakup the banks for obama care so he could be hero to his dead grandmother. Do gooder gone bad. And credit is going bad as a result.

I bought the dip today.

Ha ha, bulltrap. Also poor taste posting trade after the fact. Do it as a set up prior or in realtime.

I am not here to stop you from trading. I am here to stop you from destroying your net worth.

I think it’s OK to call out any position you have as long as it is still open (and at risk)

I followed Buffett and bought AAPL. I could care less. My timeline is 10-20 years. But, my gut feeling says that it will prove to be a very profitable trade within the next couple of months. Indeud.

*I couldn’t care less.

I miss your anime avatar, Trumpmeister. Some other people didn’t like it, but they might have gotten used to it. Anime avatars are pretty common on other boards, I notice. You were just the forerunner here.

Did not realize that your a fortune teller. My mistake.

Who are you people?

I won’t ban you, Roundwego. Feel free to flail in the wind if you want to. Call out the fact that the site has a business model by which it is maintained, independent of venture capital funding. We’ve amassed close to 70 million page views since inception have provided good incomes for many working for the site.

I am a megaphone for truth and clarity. If you don’t like it, you’re welcomed to travel elsewhere.

Also, you may want to look at utilities for the same reason: people chasing dividends and ignoring capital presevation.

Some think a stock paying a 4% dividend = bond paying 4% dividend