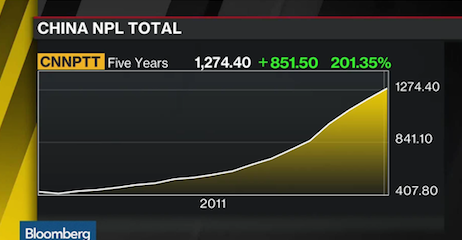

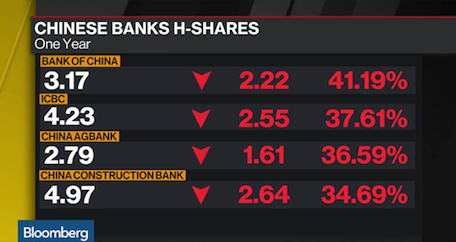

This is fucking madness. China has a massive NPL (non-performing loans) problem, which amounts to $195 billion. The government has a mandatory 150% coverage ratio for these bad loans, which is extremely important to ensure the economy doesn’t blow up into ten thousand pieces of fortune cookie. Being that NPLs have soared by nearly 50% since last year, nothing could be more important to the health of the Chinese economy than to make sure its banks are well capitalized.

WRONG.

The banks have lobbyists over there too. They’ve managed to convince party bosses that lowering the coverage ratio to 120% is the best solution, aka a bailout.

Just remember, China has bottomed, Europe is picking up steam, Oil has bottomed.

If you enjoy the content at iBankCoin, please follow us on Twitter

No different than the FASB rule change when they went to mark to model instead of market on this side to help out the bank portfolios.

China had the same problem with the way the accounted for pollution and “bad days”. Just raise the bar and now its ok to breathe the air.

Good points. China sin’t really doing anything that different than the US, except that they do it more directly (more transparently).

Fly, sorry for my ignorance. What movie is this?

http://ibankcoin.com/flyblog/files/2013/07/wendover.jpg