Theese will not be margin calls, but Fed calls–meaning they’re due immediately. I suspect many brokers and individual investors will take hits on this. If the broker or client can’t cover the deficit to get back to zero, ultimately, the firm takes the hit.

Making the rounds is one trader asking for donations to cover his hit. Last night, I went over a scenario that I thought might play out today, and it happened. Take a look.

I feel for this guy.

I do recall a situation that I was in, circa 2000, when the dot coms collapsed. My partner and I had a client who went balls to the wall long, just before the crash. His account was heavily margined and his stocks fell so hard, so fast, it went to zero, AND MORE. I was very young and appalled by the sheer ferocity of the market. My partner executed one of the best sales calls I’ve ever heard, convincing the client to send in $250k, just to get back to zero. Otherwise, as dictated by the rules of the game, the hit would be ours to absorb. I had enough fucking problems of my own, than have to deal with that.

As for the unfortunate trader featured above: don’t beat yourself up over this. It was the Black Swan event to end all Black Swans. But know, these things happen from time to time.

Learn from the experience. Pick yourself up; and hopefully, get back in the game a smarter trader.

If you want to donate a few bucks, here is the fund me page.

If you enjoy the content at iBankCoin, please follow us on Twitter

i just blogged about this as well. fuck

i RT’d it

that’s just not right. It really highlights the dangers of the business. What an absolute nightmare.

I read that guys tweets and read his story, and for the life of me I can’t bring myself to feel bad for this gentleman’s situation. He shorted stocks. He has limited upside and as proven, soul crippling downside. Instead, I keep returning to this sage observation, presented humbly and with large, comedic jowls for your viewing pleasure… http://youtu.be/Pn0WdJx-Wkw

so this marty kid is looking to be a player.

who the hell goes all-in short on a sub $5 stock after it’s already had a ridiculous drop?

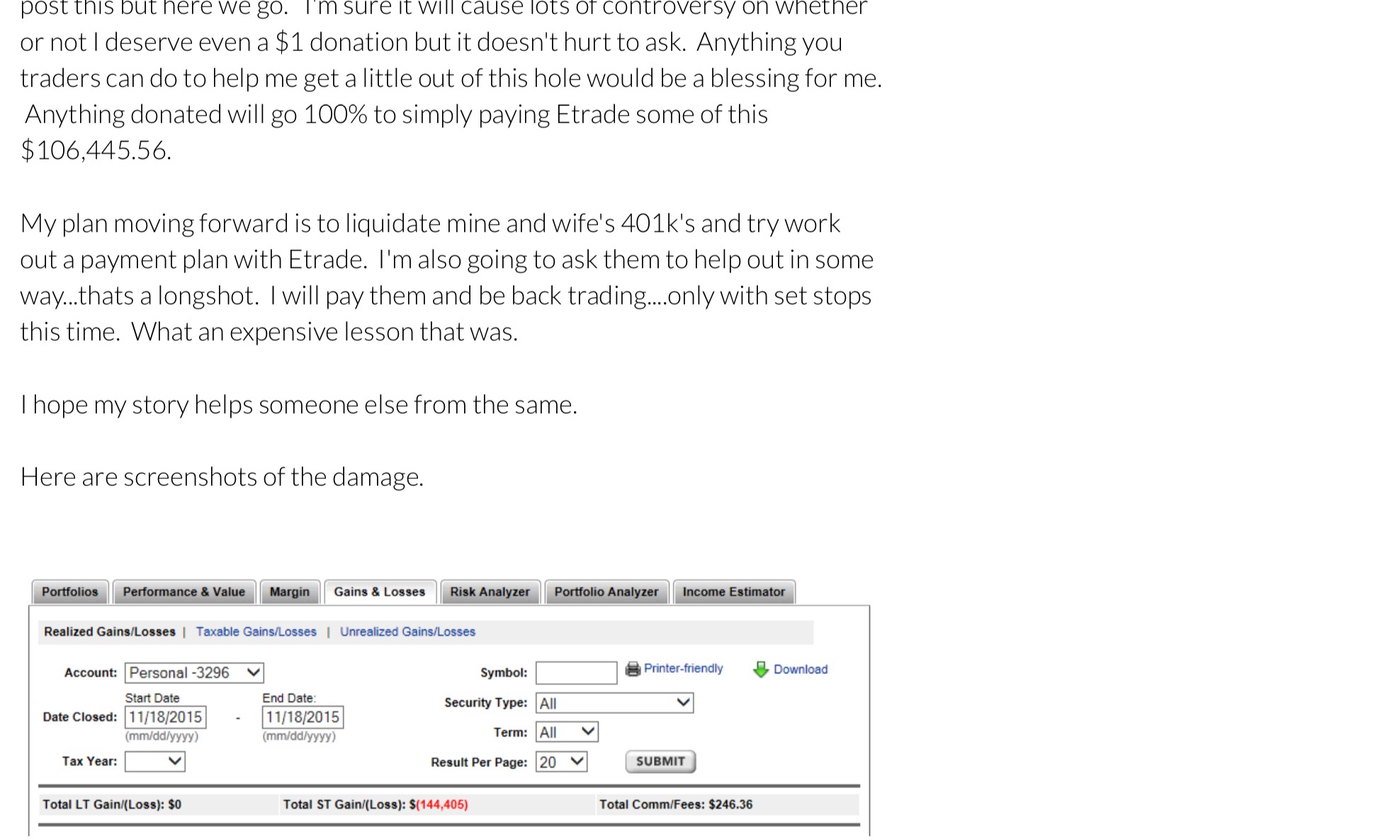

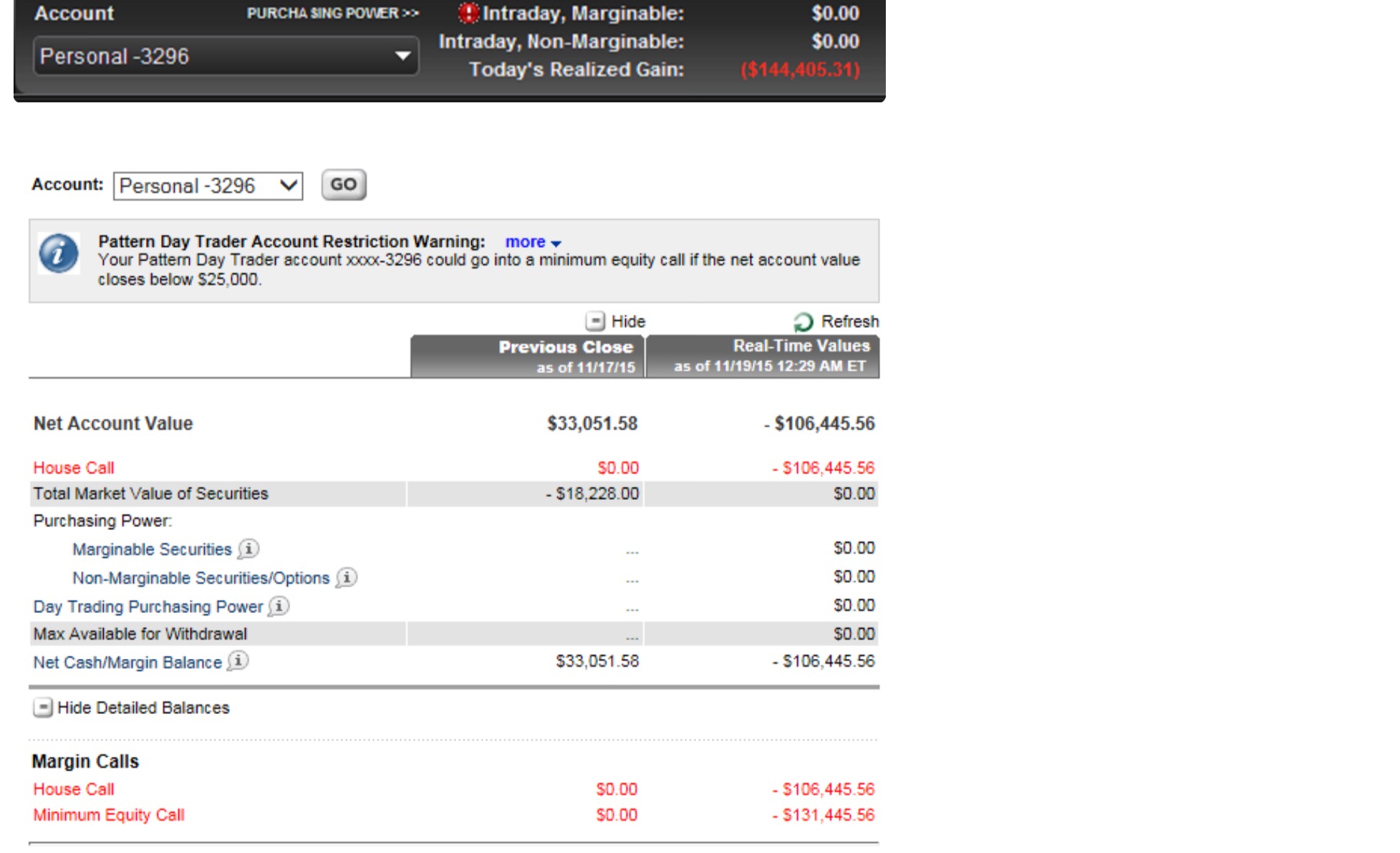

looks like he might’ve been short 8,000 shares, or half his acct

$16k turned into -140k

Not sure how I feel about people being eviscerated by these events. On one hand, we all know how rare they are. On the other, he reminds of the guy from Grizzly Man.

it is his responsibility to know the rules of the game but still it just seems like to harsh of a lesson. That’s a life changer for most people.

What a fucking idiot

you people are harsh, and this is coming from a guy who kicks old people in wheeled chairs down sewer pipes.

any time you short stocks the odds are stacked so heavily against you with this being the ultimate price to pay. Where else can you put down your stake and then walk away owing around 800% on top…it’s a crazy game.

The lack of education is the problem, if you’re going to trade on your own you better know what the hell you’re doing.

I’d love to help out but I’M recovering from being “date-raped” by Independence BCBS. The fuckery with the ACA premium credit and my stupidity allowing IBC to tap my checking for the monthly premium have left me feeling violated.

It’s only $4,500 that they snatched from my account in one withdrawal;

premium that I was never charged for until the October invoice for November. Never mind that I would not have agreed to a $750 dollar a monthly premium for 2015 had I been lead to believe that this would be my premium; had I been sent invoices every month for $750 as opposed to the invoices I received for $311.

It’s not the end of the world for me. I have to admit, this trader’s situation sounds more sympathetic as far as loss.

Fuckery is in the stars. Be careful out there!

Fly – a few of my buddies were shorting this after hours. Were FULLY aware of the risks. They took losses like real men, without bitching. This fucking guy… Why would you put half of your account in some bullshit play and not have a stop??? No sympathy for stupiditt

Fuck this weasel faced Shrekeli clown. If this happened to me I would toss another 10k into having him killed.

So far he has raised $466 on the GoFundMe page.

It looks like everything will be OK after all.

How long will $466 last in Mexico? Honduras? How far do the E*Trade tentacles reach?

LOL!

the E*trade baby is coming for him.

KBIO opened this morning in the $13-$14 range. Poindexter here paid $18.50 for it last night.

At 8,000 shares, that’s $40K+ vaporized just for the timing. $13.49 as I post this.

Is this deflationary? LOL

New trader (since March) decides takes an outsized short in a Biotech stock? Seems to me this was bound to happen – if not this trade, sometime in he future. I also wonder how much this fella has removed from his account since March? Might put this position into some perspective. Otherwise sounds like casino mentality to me.

A stupid trade like this (leveredged long NTRI) bounced me out of the game late 2007. I still had enuff cash to to survive and get a job, but lesson learned.

That lesson kept me from imploding on CLF in 2012.

The solution is simple – don’t pay them.

11.00 now. I feel so bad for this guy. Covered at 18.50. Ouch.

E-Trade baby loses everything…a cautionary tale.

https://www.youtube.com/watch?v=AYrpROr9Gmk

I play a lot of craps and am that rare thing, a lifetime winner. Compared to this market, the game has zero fuckery.

Curious to hear a legal perspective.

First there’s the language in his Etrade user agreement. What’s he really on the hook for?

Second, what kind of indemnification insurance does Etrade have for this sort of thing? How does that work?

Third, what legal rights does Etrade really have to go after him? Do principles like state recourse and non-recourse laws apply?

Much like subprime and no-doc mortgage lenders during the 2002-2006 boom, Etrade took the risk of taking this guy on as a client and allowed him to put on a leveraged position. Some might want to argue the morality of breaking a contract, but strictly from the business perspective, walking away is a business decision, and should always be considered in the full list of options. In other words, this tab might not all be on him, ala

“jingle mail”.

If he is on the hook but chooses to let it go to court, one outcome might also be a reduced settlement.

The point is this guy shouldn’t be in a hurry to do anything right now. At the very least, wait until the shock wears off. And get some legal counsel, particularly before he starts liquidating 401k accounts. Cold as it sounds, I’d hesitate before making any online donations to his cause.