As you know by now, The PPT accurately called the bottom yesterday, flagging an oversold signal that led to a monumental 100 NASDAQS surge. Today’s rally changed the tone of the tape, in that the short sellers felt vulnerable to downside pin action, despite all of the seemingly negative news.

I’m gonna keep this 100 percent numerical, leaving out opinions and emotions.

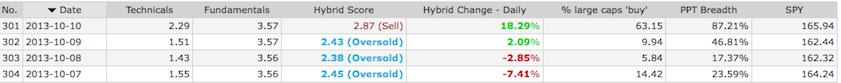

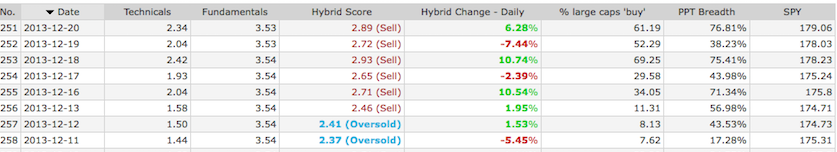

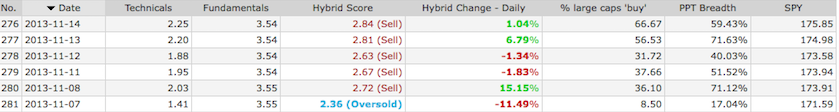

Here is the raw data of recent PPT oversold signals and how the market responded.

Yesterday’s OS

This OS came after a series of oversold signal, most of which proved to be early. The market jerked back and forth, but ultimately hit new highs.

This one nailed the bottom, to the day.

How’d it do on other occasions, you ponder?

This.

A sublime harmony of mathematical precision (SHOMP)

So why haven’t I strictly adhered to the teachings of The PPT algorithms? It’s the mystery of my life. It confounds me on a daily basis. I am not hedging myself here. The data is the data is the data. PPT wins. It gives people an edge by analyzing over 4,000 stocks, ranking them by fundamentals and technicals, taking into account price movements in commodities, treasuries and currencies. It parses out traditional correlations and makes predictions as to when the rubber band will snap back. It’s not your standard, run of the mill, mean reversion tool. It is robust, accurate, and invaluable.

It is my greatest achievement and my biggest detriment wrapped up in one. It’s so hard to remove oneself from the art of stock picking. It’s an addiction that addles me. It calls my name at night. It speaks to me in the day. I know my life would be far better off making macro-calls, using this and ETFs to accomplish my goals. But it’s hard, real hard, to just give up the pipe. I need one more hit. One more parade down the canyon of heroes, then I am done.

Until the next one comes and then I am here, writing a blog at 1:38 am about what could’ve been and what should’ve been, instead of what happened.

If you enjoy the content at iBankCoin, please follow us on Twitter

It’s such a tough market now. Grandma Yellen making decisions with 3 dissents. Lots of confusion with oil getting killed as the consumer benefits. Many deaths and victories will be seen shortly!

It tis a conundrum wrapped inside of a riddle wrapped inside of a perplexive vexxity, why le fly has not followed a nearly flawless tool of his own blood, sweat, tears & creativity.

yellen, viva la cuba and putin. time for more coffee. santa.

too early to call it a victory. possiblity of russia default not going away

Dr. Fly – this will sound like a ridiculous question, but do you subscribe to the PPT emails? I’m off ham-n-egging during the day, and my sole vehicle to the internets is my cell phone. I have the PPT wired into the Gmail that causes my Android to fire off during the day. It’s quite entertaining, and has alleviated me from a few undesirable workplace interactions, as I will feign the need to return this important communication.

Maybe if the PPT needs to be vibrating that AAPL on your hip?

If the PPT signaled Oversold several times early then it was wrong before it was right. Correct? Maybe I don’t understand the mechanics of the tool.

My very thoughts…

After all, a broken clock is right twice a day. One too fast is correct less than twice a day and one too slow is most correct of all – more than twice a day.

The way we judge it is by the initial signal during a 10 day time frame. Over the course of its history, it’s been right 78% of the time.

Has it been wrong before?

On occasion.

22% of the time it’s been wrong, statistically.

Fly, do you take back this post and with that do you now trust the Yellen?

The question is can i get another $1.5 on EEM before the close tomorrow? Actually I am not greedy, i’ll take a dollar and a slight loss on the whole event. Probably deserve it,

Despite this market surging, $EEM looks just like $CL did before it waterfalled this last month.

yes it looks like shit, i can’t wait to get out of it.

Do you really trade so one single position can take you out?

no, i never said that…current loss is about 2% of portfolio.

It probably is Christmas rally time, but a gap up and then a slam down say mid-day and a gap down and red close Friday would make for a nasty weekly and screw tons of people that loaded up today after thinking they missed the bus after yesterday.

I’m not going long just yet, but I’m not adding any shorts either. Just trying to make sure I can learn from all this.

RBC upgrades Key Energy to outperform…I might just get my appetite back.

“So why haven’t I strictly adhered to the teachings of The PPT algorithms?”

You answered yourself right here: “It’s an addiction….”

You tell yourself not really but you have a nagging echo that says maybe.

You tell yourself I did it before and I can do it again. But what if (I can’t)?

Try using some index etfs (2X if so desired)and buy when the PPT says so and then start selling as it approaches OB.

Use it in conjunction with this- http://stockcharts.com/h-sc/ui?s=%24NYMO

And stop watching the damn screen all day. Do something else during the day (go build yourself an addition to the house) and just watch the last 30 minutes or so.

And remember a bear market stays in oversold for a long time (I’m sure the PPT was back tested).

Try it and you will be happier (as will the family).

“The factory of the future will have only two employees, a man and a dog. The man will be there to feed the dog. The dog will be there to keep the man from touching the equipment.”

Exactly.

Human emotions can’t be controlled, no matter how tough one believes he is.

Jeremy needs to write a simple program and trust the computer to do the work.

Fly will miss the bottoms and the tops but I bet will come out way ahead.

love the smell of napalm in the morning smells like victory

The bears are dead, chopped their leg off and just need to lean on them, oil stocks are going to stage a violent rally over the next 4 – 6 weeks or sooner.

The inmates are running the markets the next two weeks, I am thinking of buying some heavily shorted names for a squeeze higher, $CLF , and $XONE look ripe so far. Thoughts Dr. ?