I am reading a lot of conflicting stuff, regarding hedges at some of your favorite oil companies. My favorite story is the lack of hedges at CLR, who fully covered their hedges last month–just before the gargantuan move lower. Most of the reports I’ve read had a worst case scenario crude price of $70. As we approach, $60, it’s worth noting, the industry is in serious trouble. With over $200 billion in junk related debt, or 16% of all US junk debt, the drop in crude is bound to have a ripple effect that will be deleterious to investors.

Before I get into the hedges, just know the price of iron ore has crashed too, now at 5 yr lows. Couple that with oil, the dry bulk index, and copper, it truly paints a negative picture for China bulls.

At any rate, here is what I’ve managed to cobble together, thus far.

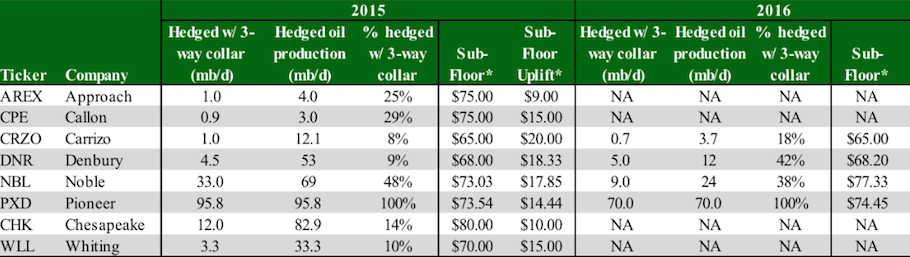

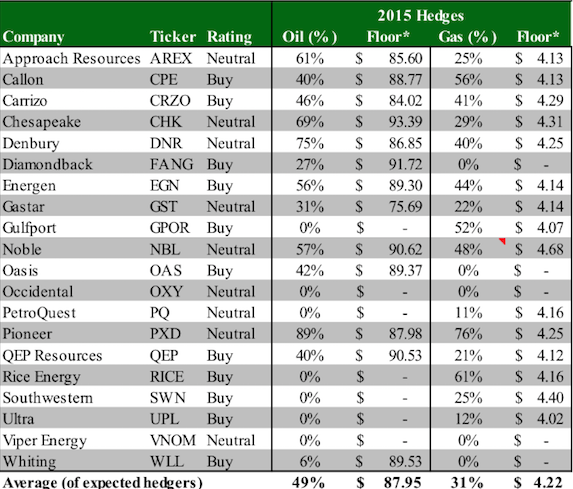

Apparently, you should beware of oil companies who have three way collars on production, as it doesn’t put a floor into the price of crude. The poster child for three way collars is PXD. Again, it’s a little murky out there, regarding who has the best hedges. But it appears PDCE did it right, hedged at $89, through 2016. It looks like HK and FANG did it right too. As the price of crude continues to slide, I am sure we’ll be hearing a lot more about this very important tidbit of information.

If you enjoy the content at iBankCoin, please follow us on Twitter

If/when crude breaks below $60, things might get pretty interesting. But could it really pierce through $60 that quickly?

instead of catching knives with the oil producers/drillers, prefer to go after the pipelines/infrastructures falling in sympathy. dipped my toe back into MLPI – earliest of the pipeline ETN/ETFs to pay the next QD (early January). 39.36.

How about MILL? EPS miss today, looks like, but they’re supposed to be well hedged out a couple years.

I read they have good hedges too. Hard to know for sure.

Thanks. Always appreciate the information contained herein and all your entertaining posts.

How about PAGP? Slight spec play with WPX?

OPEC lowered production for 2015 … I think the big players are now trying to get crude as low as possible so they can load up before they slash production & go long crude futures & score big .. take any & all bad oil-related news from here on in with a jaundiced eye/huge grain of salt

MILL is almost fully hedged at $95/b