I know other bloggers have discussed the important matter of “traffic magic.”

Let me explain. When people from the internet (you) scurry around, panicked, over the markets, the Godly folks at iBC enjoy “big dicked” traffic. Well, my traffic has increased for 2 straight years, but that’s neither here nor there.

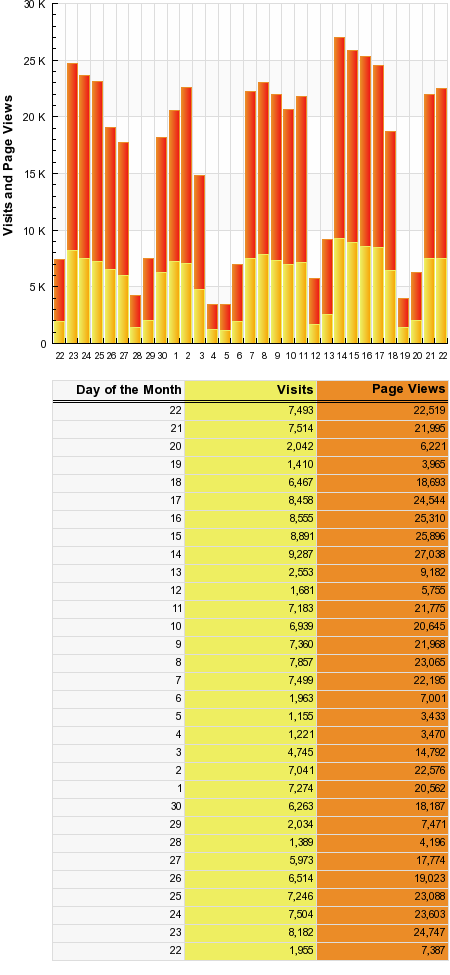

If you look at the recent spike in traffic, demonstrated in the pic below, that was the bottom. As a matter of fact, every time the market “bottomed,” our traffic spiked to new daily highs.

I conclude, as always: when the fear factor is at its peak, morons who surf the web come check out my site in droves. This, more than anything else, is the #1 factor in determining market bottoms, apparently so.

If you enjoy the content at iBankCoin, please follow us on Twitter

Fly – who the phuck is Howard? You keep calling me Howard, like you know me or something. I’m just a simple farmer who lives in DumbPhuck Iowa. I grow corn and pigs. I trade stocks. I pick the pockets of dumbassed city slickers who don’t know a cow pie from a pie hole. So stop with this Howard shit.

I control this program.

They (internet fuckwads) come here because I allow it.

I posted the below on July 15th the day the market bottomed out. It was clear to me that easy money on the short side had been made and that it was a way overcrowded trade (especialy with the popularity of these inverse ETF’s), and considering the market has been essentially flat for the past 10 years. Moron J. Gint’s response follows…do I win the car???

Me-

Hey shorts…ever heard of a crowded trade? Everything is crap and expect many more financials to go under, but guess what- the market has basically been down every day for the past month and a half. How many others will be selling over the coming days. Keep selling short and learn about the wall of worry.

Moron Gint response…

The Wall of Worry, eh?

Anonymous Douchebag, the problem is that you goatfuckers aren’t worried enough!

But hey, thanks for playing. We’ll be sure to enter the above quote in the “Ten Cent Bravado” contest for you.

First prize, a 1997 Oldsmobile Bravado!!

Same thing regarding web hits happens over at Barry ritholtz’s blog. He’s commented on it several times.

Fly – I believe Tim Knight reports the same phenom, except in reverse. When his traffic plummets, the bottom is in.

Unrelated:

I came home from vacation to find my (new!) HVAC unit down, bad compressor, my home hotter than a fresh biscuit (90 degrees) a hot water leak in the bath resulting in black mold covering every surface in the bathroom.

Sounds like a Fly home repair story, no?

Anonymous Douchebag — fuck off.

You will die soon. “Bank” on it.

Or not.

Either way, you are stuck, a consumate douchebag for life.

_______

Fly — what the flue with the “Steven Segal” type magician on the FP?

What happened to my boy Merlin?

___

“Poof!” The Merovingian has been reduced to a gay Pac-Man graphic.

So sorry.

____

Fly —

Yeah, you spiked on the 14th through 16th, but do you think you were that much (statistically significant) higher than you were on the 23rd through 25th of the prior month?

I’d look for a much bigger “panic factor” than that slight increase to call a bottom, if that’s what you’re doing here. Not sure a couple of thousand extra page views are going to “make the case,” especially given that GW is your Peanut of the Month this month, and that dude’s prolific (ie, more pages to view).

___

__

An entertaining accent and a nice bear argument?

How could I resist?

Who was that old Billy Crystal character? “Fernando?”

You look maaahvelous dahling!

__

uh…let’s try this again

http://valleywag.com/5028030/steve-jobs-had-another-surgery-to-fix-cancer+treatment-complications

@Jake: It’s tough to see on that graph, but the # of visitors also spiked last week, from the usual 7-8k, to 8-9k. That’s an increase of 12-15%, which could be ‘statistically significant’, no?

Still, most impressive was that 1-day spike for the iBC elections.

Is this the best game plan you can come up with?

Traffic stats.

What is this, some sort of 3rd tier blog?

you know, its funny…

we all knew this bear market rally was coming, myself included. yet when it happens, we all (again, myself included) shake our heads in disbelief that the market (and financials in particular) sprints higher.

i agree 100% with someones (sorry, dont remember who) observation that this rally is being led the the shittiest issues out there. with toxic balance sheets, the level 3 hidee-ho, massive dilution and the loss of leverage (the only way they made money in the first damned place), the banks deserve to be where they are right now. the fact that they lead the rally is a big “tell”.

further, the fact that the market (financials) are rallying here, esp with AXP/WM/C Q’s, means the market is back in denial mode. fly is right, when DSL/NCC/WM go ass up, it wont even be noticed. at this point, its a screaming freight train – get on, or get out of the way.

fly has cajones grande, to be sure. i fully understand why he does what he does, but there is no way in hell i could sleep at night owning the banks…..cause you ~know~ its only a matter of time till the grim reaper comes-a-knockin.

last comment: aris, those ‘shops were very funny. nice work.

jake, you are the worst kind of investor. At least the fly is able to take a step back and look at the other side of a situation. You are a barron’s discipline bearshitter who will suffer enormous losses because u are too stupid to understand what a crowded trade is. Finally, u not myself will die soon. Moron

Btw jake u keep looking for that capitulation moment. Webpage views isnt the answer moron- folks were lining up at their banks trying to withdrawal money not surfing the net. Let me know if

u need any more lessens- moron

Corn futures still getting holed.

My traffic spikes at market bottoms as well… but that’s only because it makes people feel good to see someone worse off than they are.

-DT

Anonymous Douchebag-

Try reading for comprehension, prehensile tool user.

It was Fly who brought up “web page views” as a “tell” as to capitulation, not me. Again, good luck with those difficult upcoming GED exams.

As for your “knowing” what a “crowded trade” is, further congratulations are in order.

If you look into the glove compartment of your “new to you” 1997 Bravada, you will find a “Junior AlphaTrader” (Jim Cramer in profile) merit badge, suitable for Mommy to sew upon your Webelo sash.

Don’t forget to ask her nicely this time, Douchebag!

__

Fuck who is correct on the market. Where is the money!!!!

Hey Dickweed let’s say you average 20,000 hits a day okay?

Well, on any given day 15,000 of those would be Jakegint with his excessive/compulsive clicking of the mouse okay?

Throw in another 3800 from Donny and DSB (mr mortgage) and the real numbers reveal themselves.

Not too impressive, capiche?

Odd, no?

1997 Bravadas are prettty sweet. I’m thinking about “trading up” from my 1994 Volvo 850.

Good times.

Thank you, O’ big dicked one for calling me a MORON.

I always enjoy my superiors telling me what i am.

Holy Shit ! SKF below $120 . I had to buy a little more down here. I have buy orders on SKF all the way down to $100. It could go that low or even lower. To think it was as high as $211 a week back.

XHB, KBH, C, QQQQ… Wow!!!

Bought more SKF under $115. Crazy stuff. Just take a look at the chart of the $ BKX http://stockcharts.com/charts/gallery.html?$BKX. Fuckin Incredible .

Market gapping significantly higher again here intraday.

SKF = PAIN.

Amazing. I must have missed the memo that the financial crisis is over.

yesterday bot 90 aapl aug 165 calls @ 2.34, sold @ 2.40, now 8.20 or so

What the fuck is going on?

i mean this in the nicest way possible, but….

why on gods green earth would you be buying SKF with bush reversing his position and paulsons “bail out the world” bill being passed.

i agree that the banks are fucked, but IMO it will be a while before the next leg down in that story.

i am thinking SKF @ 90 ish (christ, i just did some mental calcs, and at this rate, that might happen early next week)

Melt up in progress. Shorts are going to be ripped a new asshole. In a bull market, the day starts weak and finishes strong. We’re in a bull. 17 K by labor day. Oil to $60 – $70 range.

I’m not in…just watching from the sidelines right now.

Quite a fall from last week….completely unjustified.

I’m 90% cash right now….I don’t have a good handle on the reality of the economy v. the mentality of the market.

Denninger on Fah-yah today:

http://market-ticker.denninger.net/archives/525-RED-ALERT-RAPE-BY-CONGRESS-IMMINENT.html

The future of the country is at stake!!!

Go long FNM & FRE.

SPY hit exactly 38.2% retracement.

http://garyscommonsense.blogspot.com/

Despite yesterdays weak rally I do think oil has topped. Every single time oil has spiked more than 100% with in a year it has led to a recession. I think it’s safe to say that this time has been no different. Oil actually rose almost 200% trough to peak.

Now let me say that every recession has crushed demand and eventually brought prices back down. It will be no different this time. This time we have a global recession and it’s going to be severe. To think that somehow demand is going to increase or even stay the same in a severe worldwide recession is simply absurd.

Often after a long intermediate move the first counter day after at least 4 days in a row in the direction of the trend will signal a trend change. (The four day corollary).

Also after a long intermediate move four days in a row counter to the trend will often confirm the trend change (The four day rule).

You will notice that we have both on the oil chart. Oil is short term oversold so a bounce could be expected but the odds are now in favor of oil trending down.

Looking at the weekly chart it becomes apparent just how far the parabolic rally went and how overbought it became. I really don’t think this is going to be corrected by four down days. I fully expect oil to correct back to the consolidation zone of the T1 pattern (the technical rules are at listed on the lower right side of the home page). That should take oil back to the $85-$100 level before this correction is over.

Investors looking to hide from the bear in the energy sector are going to be disappointed I’m afraid

no recession, just depression boys.

Long gold, guns, and women.

Pharm,

Please get your head examined. We are going no where by Labor Day. This, too, shall pass and we will resume the downward trend. Also, we have dropped 3,000 points in the past year so your term “Bull Market” appears to contradict the facts. We are in a bear market that is temporarily trending higher. Nothing more.

Anyone else buy SKF?

Massive reversal shaping up…….

I am going to be the CNBC of iBankCoin and call a top right here.

I will have on several guests who will reinforce my view, even if I have to “encourage” them first with cattle prods. Anyone with a contrarian view will be criticized, mocked and not be asked back, other than for comedic relief. I will have several bimbos with credentials including beauty pageant wins be my “news” anchors, and I will never forget that my job is to make the business news, not report it. I will give each of my “reporters” cool nicknames like “Hot Breeze” or “The Besto.” If, on the off chance, I am early, I will have selective amnesia and call a top at a higher level at the appropriate time.

Let the cratering begin.

rational analysis doesn’t matter. they want to run the banks up, because so many institutions are sick of losing money.

meanwhile, COST quietly misses numbers…

although, at least COST is willing to buy their own stock…