Busy times at werk this morning, so I am limited to giving thoughts on my current holdings.

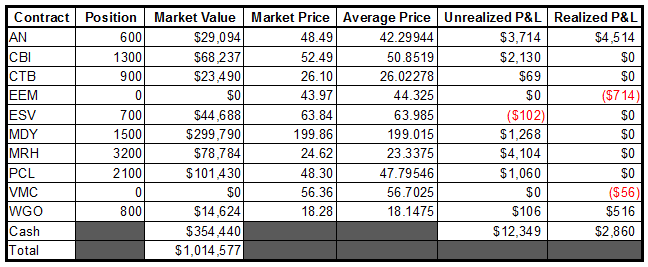

- AN is back, doing what it does…ready to plow ahead to new all-time highs. The violent nature of the post earnings price swings have prevented me from adding shares here, but I see nothing to suggest that this stock will stop going higher.

- I have highlighted CBI several times now, and this stock is behaving exactly as I hoped it would. The PPT nailed the buy point to the day yet again in this run up since late November. I spoke about this last week prior to tripling my position. Yesterday I mentioned how I thought this stock would really benefit from a tailwind from the broad market. Truth be told, from a price swing/volatility standpoint, this is a rather boring stock, but it rallied almost 2.5% yesterday. My target is still on the all-time highs at 63.5.

- Just when I’m ready to kick this stupid stock CTB to the curb, it rallies to close above my cost basis. If I had a ton of good looking buys flashing in front of my eyes, I would most certainly liquidate this stock to put that money to better use. My thoughts are that this stock breaks higher and is then sold off. I’m still unsure of what I plan on doing.

- ESV is screaming “BUY ME” right here. I may oblige today if the environment looks favorable.

- So far I am considerably more enthused with my holdings in MDY versus my experience in January with EEM. Hopefully that will continue.

- MRH is another rather ho-hum stock that continues to slowly churn higher. Earnings are after the close on Thursday (2/7), I will lighten up prior.

- Early in yesterday’s session I added to PCL. This position now comprises over 10% of my assets…and I don’t feel at all uncomfortable with it. I like how calmly the stock has behaved since that big move higher on January 29. I think that this will see new 52 week highs shortly.

- WGO has the look of a stock that is turning to garbage. I’m not a fan of stocks that sell off in the face of market rallies. At this point I probably should just cut this one free and salvage what I can as I can almost guarantee that I will regret holding to see this selloff through.

-EM

Comments are closed.