The results for January are in:

I am disappointed (but not discouraged) for two reasons. 1) I did not reach my +2% goal for the month, and 2) even more frustrating, I am significantly lagging behind the benchmark (S&P 500 finished January +5%…).

After some brief analysis, my underperformance can be attributed to the following: a) being ‘underinvested’, I never had less than a 30% cash position and spent most of the month in the 40-50% range. b) the majority of capital that I did have invested (30%) was placed into a laggard ETF (EEM), which dragged on my performance during the month.

Hindsight being 20/20, had I placed the same assets into IWM instead, I would have finished the month +2.8%. C’est la vie.

On that note, I did liquidate my EEM position for a small loss this afternoon, selling at 44.22 (from 44.33, for a loss of -0.2%) and in turn purchased a similar amount of MDY (the new top performing ETF) at 199.01. So, now we ride with MDY until my signal flips from green to red or 21 days pass and I determine if I need to reinvest in another ETF.

More portfolio notes:

- It has been well documented on my blog, but AN (and their dubious CEO) went nuts following the release of earnings in the early morning hours of January 31st, 2013, finishing the day up over 8% , a mere 6 cents from all-time highs. I’m going to hold this small position for now and wait to see what happens in this 48-49 region and think about adding to my position again should the opportunity present itself.

- I added to CBI early in the day, more than tripling my position, buying based on the harmony of mathematical precision provided by The PPT (covered in the 1/30 update). My stop is in the mid 48’s, so I’m going to give this one a chance to prove itself.

- ESV gave back all of the previous gains and more. In buying breakouts, I’m have to be willing to watch these things “fail” and then consolidate to determine their fate before casting them aside (because, in my experience that’s what breakouts seem to do).

- I like how PCL filled the rather large gap from Tuesday and then settled into a nice small-bodied candle. I was too anxious to add to this position the other day, as this looks like a more appropriate place to be adding shares.

- WGO continues to meander between 18.5 and 20…this has formed what looks like another promising pullback, but the repeated failure of the stock to break through 20 does leave me in a place where I hesitate to add.

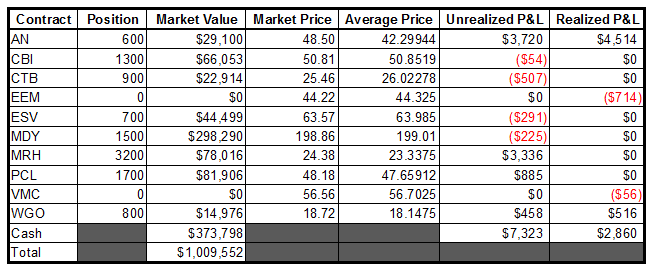

In the words of my good internet friend “The Rhino”, here is “my book”:

Keep in mind that the sum of the “Realized P&L” column is cumulative and includes transactions from the past that are not included in the above table.

-EM