As the chilly winds of January have swept through my fair city (on the heels of a 70 degree day yesterday), I sit slowly puffing on my pipe whilst the fire crackles nearby. My thoughts wandered to a comment that I received earlier on my blog:

Excellent question…if it were December.

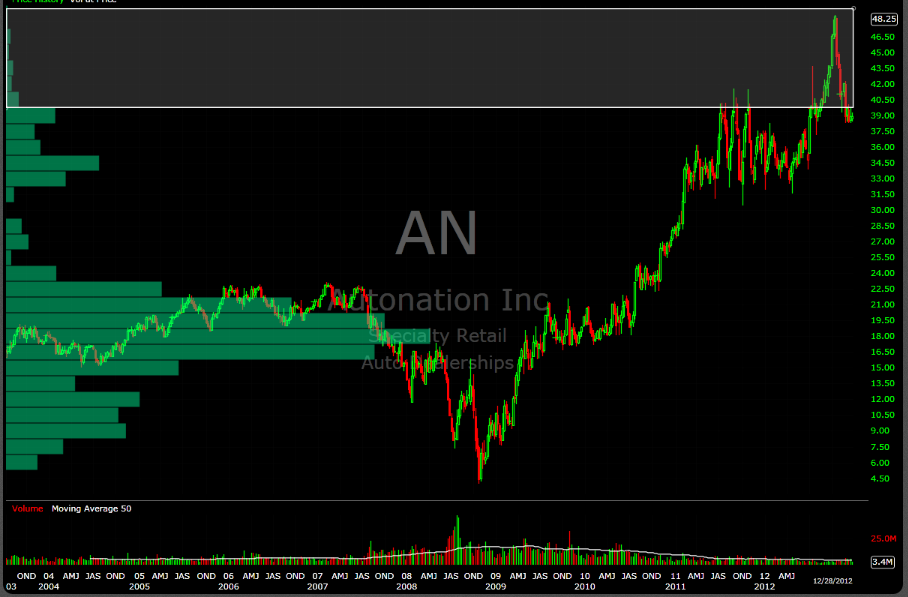

The second chart:

was from the time when I went long the stock in the last week of December.

My thought was: “if this stock can gain momentum, there is virtually no historical record of people buying or selling shares in this region. Therefore, what incentive is there for people to sell? Almost everyone owns the stock at lower prices, so there is going to be a basic supply and demand problem, no? If the vast majority of current shareholders are sitting on a profit, there won’t be an incentive to sell. Now, of course everyone has their price, but one could assume that it would be much easier to bid up the price of a stock in a region where there is a limited supply and a surplus of demand.”

Comments/thoughts are encouraged.

-EM

3 Responses to “A Query by Hearth’s Edge”

Cascadian

AAPL was recently up in that area where everyone had a profit and supposedly no one had an incentive to sell…

elizamae

That is a good point.

I guess my question is: at what point does it get to be “too much”?

Keep in mind that I’m not suggesting that this is a holy grail or anything, merely that it gives you an edge. Combining this with your favorite technical analysis/chart chomping strategy is my suggestion with risk management still employed as the top priority.

Thanks for reading.

OldDix

Thanks you for giving us your thought process.