Tomorrow (well, today) marks day 21 (in market time) in this grande experiment that I have been fortunate enough to embark upon here in the hallowed halls of iBC. My sincere hope that you are either being educated or entertained by my articles. If this blog serves as a source of both entertainment and learning, well…that makes the effort I have been putting forth even more worthwhile.

I appreciate all of your readership. If you enjoy what you read here, feel free to direct friends, family, colleagues, pets, whatever to my blog and the other contributors of iBC. Now that vulgarity has organically disappeared (for the most part), this is a site for any sort of gentleman willing to don a topped hat, white bowed tie and tuxedo. Being a part of the collection of talent here is a tremendous honor.

February will bring more fun and exploration as we continue to delve deeper into the “Volume Void” rabbit hole.

Now for some notes as related to my portfolio:

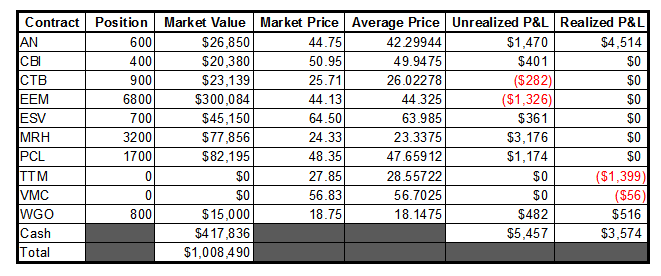

- I sold out of 75% of my AN position prior to 2:15 in preparation for earnings tomorrow. I was sitting on a nice gain and didn’t want to get taken by surprise while doing “real” work…so I locked it in at 44.67 (from 42.30) +5.6%

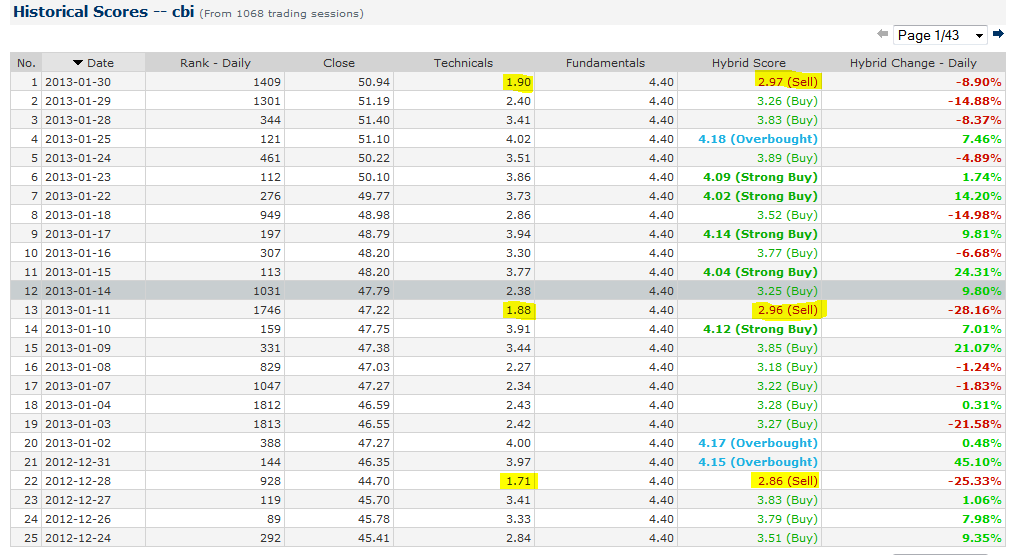

- I tip my topped hat to reader “Tpain” who suggested using individual stock PPT OVERSOLD scores for adding to his VMC position. Keeping with that theme, looking at the historical scores in The PPT, CBI may be in a good place to add here, look (this same sort of thing continues back through mid November when this rally started):

- CTB continues to bore me to tears. I’m looking for a headfake here as the Bollinger Bands have pinched down pretty tight as of late. If it spikes higher I will likely sell at least a portion of my position…if it goes lower…I’ll likely liquidate.

- Since tomorrow is day 21 (e.g., one month), and since EEM is far from the top scoring ETF in the “keep pace with the market” (KPWTM) portion of my portfolio, I will be rolling over the sale amount (give or take) into (as of this evening) MDY.

- ESV showed some nice resiliency in the face of a sub 30% breadth day. I would consider that a good start…but this could be a “Costanza” moment…who the hell knows anymore.

- MRH bounced off of 24 again. If this stock looks like it is going to close under that level, I will liquidate some of my position. Basically, I don’t like to argue with a level that has served as support and is then violated. For what it’s worth this was also part of the 28.98% of stocks that finished positive for the day. Earnings are on 2/7.

- I expected and received volatility today in PCL…this was my biggest loser ($wise).

- Right before the close I sold out of VMC at 56.56 (from 56.70) for a miniscule loss. Several times during the day I commented about how happy I was that I didn’t add to this position on Tuesday (which I was seriously considering).

- My leash on WGO keeps getting shorter and shorter…will I wait around to see if/when it finds support? Probably…but that is subject to change at any moment.

Note: I’m keeping stocks in which I have 0 shares in the above table for one (1) week after they are liquidated (though the “Realized P&L” total will remain cumulative).

-EM

4 Responses to “Portfolio 01/30/13; 21 Days Later”

Arctic Gambino

You’re a good man EM. I watch your posts daily, though my pea-brain forgets to comment often.

Just know you have at least 1 loyal reader. Probably the most handsome and charismatic one too.

elizamae

Thanks.

Though I’m sure it is an oversight…you still are not following me on the Twitter.

Tpain

Thanks for the mention EM. Hopefully we see some success with the PPT triggers. I am learning a lot from your studies and they have really drawn me closer to the technicals of the market as I try to also grasp this volume void concept. As Arctic Gambino has said, you are a good man.

elizamae

Thanks again for .

One item of note, I do believe that you will need to exchange your purple topped hat for one of a more appropriate colour (sic)…namely, black. Good day to you sir.