The high yield credit markets are freezing up, and it’s not good news for distressed companies that are in desperate need of refinancing. In a “normal” situation, a distressed company could simply refinance their upcoming debt obligations in order to try and manage their way out of a tough situation.

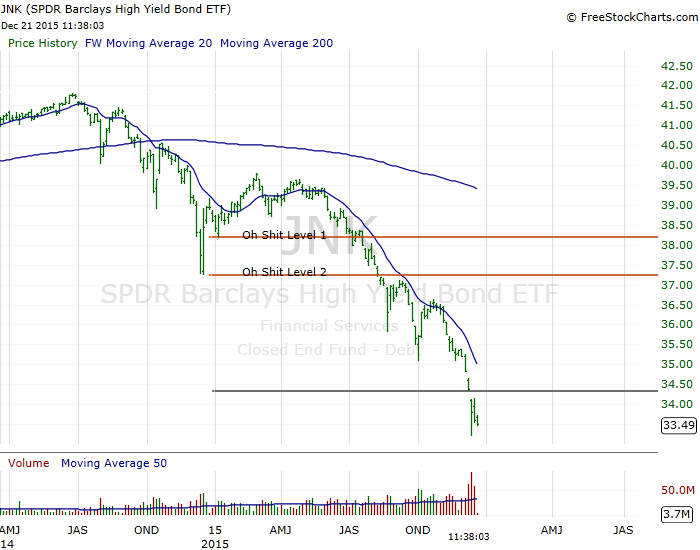

Note: I’ve had a bearish market bias since the first “Oh Shit Level” was breached, see above.

Right now assets are being practically given away in order to simply shed huge liabilities. Take Cliffs Natural Resources (CLF) for example. They are losing probably $19 per ton mined at their remaining Oak Grove and Pinnacle coal complexes (around -$3.2MM per month). In addition, they have >$330 million in outstanding liabilities owed to the United Mine Workers of America (UMWA) union (which increases by approx. $15MM per year). I’m not even sure what the environmental liabilities are, but they also exist.

Keep in mind, these coal complexes are regarded as some of the best metallurgical coal mines in the United States, but who on Earth is going to buy them!? Better yet, who could finance it?

So, CLF’s will have to basically give these assets away in order to shed the liabilities, it makes sense for them in the current environment, but I bet they wish the credit markets would give them a lifeline so they could wait out the global growth slowdown…

I bring up CLF’s simply as an example. It could of been Chesapeake Energy (CHK) which has huge exposure to the worst natural gas play (Haynesville Shale) all while nat-gas prices are at lifetime lows. Insert any frac sand producer, oil & gas producer, or miner around – access to easy credit is drying up.

Which means bankruptcies will happen sooner than anticipated.

I don’t have any particular trade for this post, more of a warning that if you are bottom fishing in commodity related equities, be very careful and do your homework as to the guidance these companies have offered in regards to their debt refinancing plans. What they were planning only 2-3 months ago may not be possible in the current environment.

Ask yourself what that could mean in regards to their solvency! And more importantly, your investing capital.

If any of you know of companies planning (hoping) to refinance soon, please comment below. We can make this a Bankruptcy Watch-list comment section. Feel free to tee off:

If you enjoy the content at iBankCoin, please follow us on Twitter

I’ll start it off with CHK.. less than 6 mo’s to live. IMO

Oh, and of course Arch Coal ACI – they are basically maxing out their credit cards now before the obvious happens.

I don’t have a particular name to put on BK watch, but I do have a long position in SJB (Short Junk Bonds). It is not a bad place to park a few greenies these days.