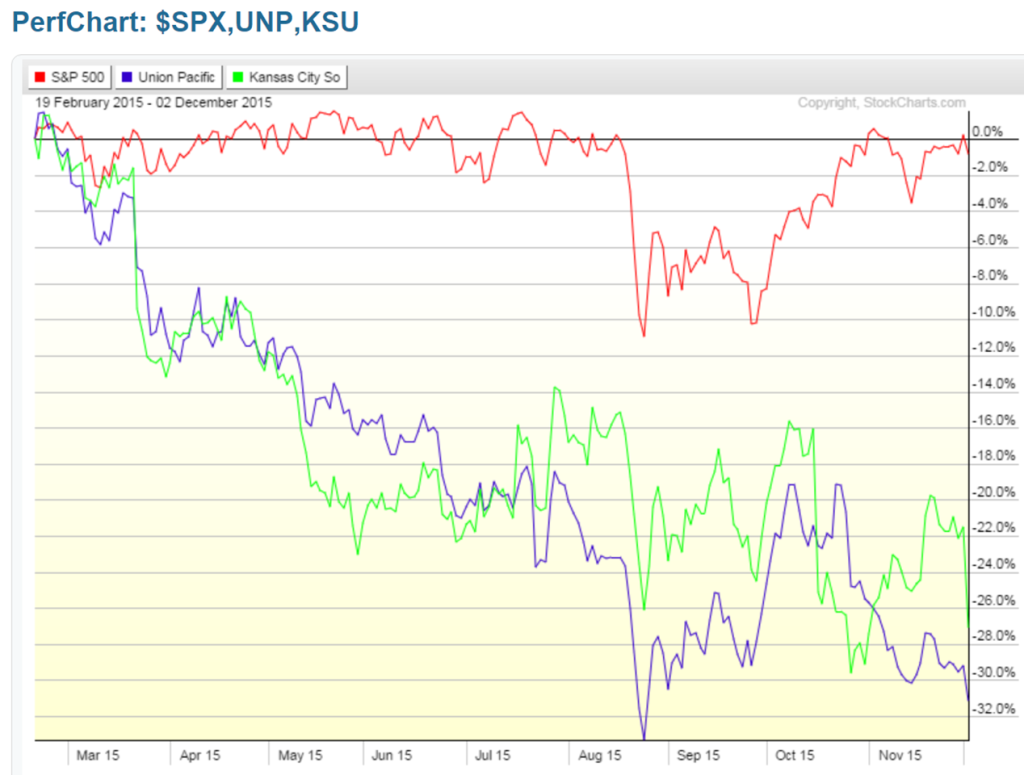

The Railroad stocks are quietly taking it like Peter Frampton in this picture. Have a quick look at their poor relative performance:

I’m not going to get into Dow Theory here, but as I’ve mentioned before (Blame the Weather), industrial production and manufacturing (along with retail sales) are often leading indicators that a recession could be approaching. The counterpoint argument is that the US economy is more of a services economy now and industrial production is a small percentage of the overall picture, something like 17%. Perhaps this explains why ISM Manufacturing data has become a poor forecasting tool, see below:

Nevertheless, if you’d like some earnings exposure – albeit to the downside – I’d like to present two companies whose earnings have peaked and are now decelerating:

- Kansas City Southern (KSU)

- Union Pacific Corp (UNP)

In addition, they have both formed decent topping patterns, technically speaking:

I don’t recommend chasing these down today however, I suggest we keep our eye on the sector. This is a long term idea; it will take most of 2016 to play out – if it plays out. Both of these setups are implying around a 25-30% payout, so there’s plenty of meat left on the bone, so to speak. Lets let patience prevail here and perhaps wait until the picture is more clear post Fed day (Dec. 16). Stay tuned.

If you enjoy the content at iBankCoin, please follow us on Twitter