[youtube://http://www.youtube.com/watch?v=BLWnB9FGmWE 450 300] [youtube://http://www.youtube.com/watch?v=cYIP8lGBtFQ 450 300]

Comments »Banks Salivate After AIG’S Risky Asset Portfolio

“A growing appetite for risk is prompting some Wall Street banks and investment firms to show interest in buying the most complex and troubled assets tied to the bailout of American International Group Inc.

The $47 billion face value in assets, held by the Federal Reserve Bank of New York, are the same kinds of financial instruments that were at the heart of the financial crisis and caused record losses across the financial industry. Plunging values of the securities, called collateralized debt obligations, or CDOs, caused AIG’s near collapse and a government rescue in 2008. ….”

Comments »Detroit’s last effort to avoid emergency manager

Read here:

Comments »Although Mayor Dave Bing has repeatedly said he doesn’t want to be the city’s emergency manager, he would essentially become one under a new proposed consent agreement that he and city council staffers privately are hammering out this week.

Under the 26-page draft, obtained today by the Free Press, Bing proposes taking over many of the responsibilities of a nine-member financial advisory board that Gov. Rick Snyder wanted to assume control of most of the city’s finances.

Incensed that Snyder’s proposed consent agreement strips elected officials of many of their responsibilities, Bing and the council drafted their own version following private, individual meetings between his office and the council’s staff.

The draft would grant the mayor powers of an emergency manager, except that of being able to terminate union contracts.

Under the draft proposal, Bing would be empowered to unilaterally lay off employees, close departments, end services, terminate outside contracts and appoint a chief operating officer, chief financial officer and human services director — all tasks that belonged to the financial advisory board under Snyder’s proposal.

Council, which would lose virtually all of its authority under Snyder’s proposal, would have the authority to approve the budget and would have more say in who serves on the financial advisory board.

Is Iran getting in a talking mood?

Comments »Geneva, Switzerland (CNN) — Iran says it wants more clarity from the IAEA before it allows inspectors into the Parchin military complex south of Tehran, one of Iran’s most influential officials said Wednesday.

Iran denies it conducted any nuclear experiments there, even though it is suspected of having tested explosives for a nuclear device in the early 2000s. High-level diplomats told CNN’s Christiane Amanpour it’s believed Iran abruptly stopped any work toward weaponizing its nuclear program after 2003. But weapons inspectors want to make sure.

“If the Western community is asking us for more transparency, then we should expect more cooperation,” said Mohammad Javad Larijani, a member of a powerful political clan in Iran and an adviser to the country’s supreme leader, Ayatollah Ali Khamenei.

International powers have agreed to resume nuclear talks with Tehran in the pursuit of a diplomatic solution to the tensions over Iran’s controversial nuclear program amid saber rattling in Israel about the possible need for a pre-emptive strike.

Because they have the money: Feds plan costly anti-smoking campaign

Comments »Washington (CNN) — Federal health officials on Thursday are unveiling a $54 million national media campaign to get smokers to quit and prevent anyone else, especially children, from starting.

The campaign, called “Tips From Former Smokers,” is intended to educate Americans about the dangers of smoking through the stories and graphic pictures of ex-smokers who have suffered severe health consequences of tobacco use.

The former smokers profiled have suffered ailments such as stroke-related paralysis, limb amputation, lung removal and heart attack. One breathes through a stoma, a surgically created hole in the neck through which a person who has undergone larynx or voice box surgery can breathe.

“Hundreds of thousands of lives are lost each year due to smoking, and for every person who dies, 20 more Americans live with an illness caused by smoking,” Health and Human Services Secretary Kathleen Sebelius said in a statement.

“We cannot afford to continue watching the human and economic toll from tobacco rob our communities of parents and grandparents, aunts and uncles, friends and co-workers. We are committed to doing everything we can to help smokers quit and prevent young people from starting in the first place.”

The ads are the brainchild of the Centers for Disease Control and Prevention’s Office on Smoking and Health. The agency says smoking remains the country’s leading cause of disease and preventable death, resulting in more than 443,000 fatalities annually. More than 8 million Americans live with a smoking-related illness or conditions, according to the disease agency.

Karzai continues to stab US in the back

Read here:

Comments »The United States encountered mounting challenges to its presence in Afghanistan Thursday, as Afghan President Hamid Karzai urged the U.S. to pull back to military bases and the Taliban announced they were suspending tentative peace talks.

The developments come after two incidents strained relations between the two countries — the inadvertent burning of Korans on a U.S. base, and most recently a shooting spree that left 16 Afghan civilians dead. Afghan lawmakers expressed outrage after the U.S. soldier suspected in that massacre was flown out of the country to Kuwait.

By Thursday, both Karzai and the Taliban were lashing out at American negotiators, all while Defense Secretary Leon Panetta was visiting the country.

Karzai, in a meeting with Panetta, asked the U.S. to withdraw from Afghan villages and stay on bases, saying, “Afghan security forces have the ability to keep the security in rural areas and in villages on their own.”

He also urged the U.S. to let Afghan forces take the lead for countrywide security in 2013, a year ahead of schedule.

Shortly afterward, the Taliban announced they were breaking away from talks with the U.S. because the U.S. “turned back on its promises.” One concession the Taliban were looking to extract out of peace talks was the release of prisoners from Guantanamo Bay.

The statement said the Taliban would suspend talks “until the Americans clarify their stance on the issues concerned and until they show willingness in carrying out their promises instead of wasting time.”

ROVE: Obama Campaign Having Trouble Fund-Raising

via wsj.com

By KARL ROVE

Last July, President Obama’s campaign announced that it had raised an average of $29 million in each of the previous three months for itself and the Democratic National Committee (DNC). I was only mildly impressed. After all, that was well below the $50 million a month needed to reach the campaign’s goal of a $1 billion war chest for the 2012 race.

Seven months later, I’m even less impressed. Through January, the president has raised an average of $24 million a month for his campaign and the DNC. Next week, the Obama campaign will release its February numbers, but the president is on track to be hundreds of millions of dollars shy of his original goal.

It’s not for lack of trying. Mr. Obama has already attended 103 fund-raisers, roughly one every three days since he kicked off his campaign last April (twice his predecessor’s pace).

The president faces other fund-raising challenges. For one, there are only so many times any candidate can go to New York or Hollywood or San Francisco for a $1 million fund-raiser. Team Obama is running through its easy money venues quickly.

For another, many of Mr. Obama’s 2008 donors are reluctant to give again. The Obama campaign itself reported that fewer than 7% of 2008 donors renewed their support in the first quarter of his re-election campaign. That’s about one-quarter to one-third of a typical renewal rate: In the first quarter of the Bush re-election campaign, for example, about 20% of the donors renewed their support.

There are other troubling signs. Team Obama’s email appeals don’t ask for $10, $15, $25 or $50 donations as they did in 2008, but generally for $3. Nor are the appeals mostly about issues; many are lotteries. Give three bucks and your name will be put in a drawing for a private dinner with the president and first lady.

This is clever marketing, but it suggests the campaign has found that only a low price point with a big benefit can overcome donor resistance among people who contributed via mail or the Internet in 2008. It also points to higher-than-expected solicitation costs and lower-than-expected fund-raising returns.

AFP/Getty ImagesPresident Obama at a Democratic fundraiser at ABC Kitchen in New York on March 1.

The final financial challenge facing Mr. Obama’s campaign is how fast it is burning through the cash it is raising. Compare the 2012 Obama re-election campaign with the 2004 Bush re-election campaign. Mr. Obama’s campaign spent 25% of what it raised in the second quarter of 2011, while Mr. Bush’s campaign spent only 9% in the second quarter of 2003. In the third quarter it was 46% for Obama versus 26% for Bush; for the fourth quarter it was 57% versus 40%. In January 2012 the Obama campaign spent 158% of what it raised, while the Bush campaign spent 60% in January 2004.

At the end of January, Team Obama had $91.7 million in cash in its coffers and those of the DNC. At the same point in 2004, the Bush campaign and Republican National Committee had $122 million in cash combined.

The Obama campaign’s high burn rate doesn’t come from large television buys, phone banks or mail programs that could be immediately stopped. It appears to result instead from huge fixed costs for a big staff and higher-than-expected fund-raising outlays. These are much tougher to unwind or delay. Left unaltered, they generally lead to even more frantic efforts to both raise money and stop other spending.

This perhaps explains why the White House told congressional Democrats last week not to expect a single dime for their campaign efforts from the Democratic National Committee this year. All the DNC’s funds will be needed for the president’s re-election.

His campaign’s financial situation also may explain why Mr. Obama has embraced Super PACs after decrying them as a “threat to democracy” in the midterm elections. The president was quick to criticize Rush Limbaugh’s crude comments about contraception advocate Sandra Fluke. But he refused to condemn his Super PAC’s acceptance of a million-dollar donation from Bill Maher, who routinely attacks Republican women such as Sarah Palin and Michele Bachmann in vulgar and sexually charged terms.

That virtually all Republicans and many independents consider Mr. Obama a failure is obvious. But many Democrats are disappointed with him, too. The president’s difficulty in raising campaign cash is evidence of this. He is working a lot harder than he thought he would to raise a lot less than he had hoped.

Mr. Rove, the former senior adviser and deputy chief of staff to President George W. Bush, is the author of “Courage and Consequence” (Threshold Editions, 2010)

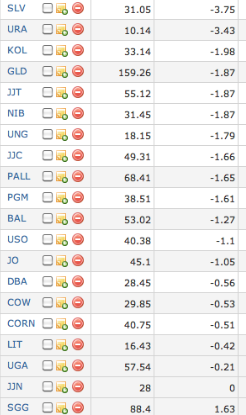

Comments »Raw Commodities Are Lower, Sans Sugar

HBO Stops Production of “Luck” After Third Horse Death

Day 1 Recap of NFL Free Agency

Free Agency Day 1: The Insightful and the Incoherent

By Bill Barnwell on

On Tuesday morning, word around the NFL was that the Bears were basically formalities away from locking up Vincent Jackson and Mario Williams. By 5 p.m., the Bears had acquired Brandon Marshall, but the Bills were now going to host Robert Meachem and Mario Williams and sign them both before their fans woke up the following morning. As the clock struck midnight on the East Coast, Meachem was on the Chargers, Williams was a free man, and we vowed to stop listening to the rumor mill. And then on Wednesday at 12:05 am on the East Coast, we started refreshing Twitter every five seconds while jonesing for our fix. We’re only human.

By the end of a busy first day of free agency, the league had raided the wide receiver and cornerback aisles and left them barren, with 10 notable signings between the two positions alone. About half of those moves made a lick of sense, as logic took a backseat to getting (or spending) cash now. It is our duty to cover both the insightful and the incoherent, and so we start our look at Day 1 of free agency in Washington, where the Redskins defied the odds to pull off their best Redskins impersonation.

The More I Get, The More I Want

With their draft picks tied up in the RG3 trade and their spending money repossessed by the NFL, you would have forgiven the Redskins for taking a rare opening day of free agency off. And then they would have said, “Thanks for forgiving us! Now, please get out of our way so we can get back to spending money we may or may not have. There are second-tier free agents just roaming around out there! For free! Without contracts!”

And so the Redskins found it in their hearts to give Pierre Garcon a five-year, $42.5 million contract with $21.5 million in guaranteed money. This is the same Pierre Garcon who has caught just over 53 percent of the passes thrown to him over the past three seasons despite having Peyton Manning at quarterback for two of those three years. The other Colts wide receivers caught just under 64 percent of the passes thrown to them over that time frame. And while a low catch rate is fine if you’re a deep threat or a demon after the catch, Garcon’s averaged 13.6 yards per catch over that span, which is almost exactly league average. Jabar Gaffney has averaged more yards per catch over the past three years than Pierre Garcon. Is he a downfield threat?

Garcon fits one of the archetypes we identified last year when we described the free agents you meet in hell, a second or third wideout from an effective passing offense. These sorts of players look good against single coverage with great quarterbacks around them, but when you move them into the no. 1 slot on a team with an inferior quarterback, they fail to meet expectations. Last year, Garcon’s raw numbers showed some improvement because he took more snaps and made it through all 16 games for the first time in his career, but his catch rate without Manning fell from 56 percent to 52 percent, and that came while Garcon enjoyed the splendor of garbage-time yardage for the first time in his career. He had three receptions for more than 40 yards all year, and two of them came in one game against the dismal Buccaneers. What about this guy says, “We need to give him $21.5 million as soon as possible?”

While the Redskins were seemingly down to Santana Moss and flotsam at wideout, they already had a useful receiver sitting in Mike Shanahan’s ample doghouse. Anthony Armstrong spent most of 2011 on the bench because Shanahan thought he couldn’t get off press coverage at the line of scrimmage, but Armstrong’s production as a starter in 2010 was arguably better than Garcon’s, despite the fact that the former swapped out Peyton Manning for Donovan McNabb and Rex Grossman:

Garcon might be the better player, but it’s not a clear case. At the very least, the difference between the two of them over the next two seasons certainly isn’t $21.5 million in guaranteed cash. As bad signings go, this isn’t bringing in Albert Haynesworth, since Haynesworth was at least at the top of his game in the two seasons before the Redskins paid too much for him. This is more like the signings of DeAngelo Hall or Brandon Lloyd, when the Redskins acquired (or retained) a B-list player by giving him A-list money. You can make the case that Washington needed to upgrade at wide receiver and give RG3 options, but you don’t accomplish that by throwing $21.5 million at league-average receivers.

On the other hand, the Redskins made a perfectly rational, reasonable decision to buy low on Josh Morgan, who broke his leg after five games and missed most of San Francisco’s 2011 season. Morgan’s statistics aren’t all that impressive, and he’s not regarded as a burner, but he’s spent the past three years playing with Alex Smith in a conservative offense. It’s also worth noting that he’s averaged 13.0 yards per catch over those three seasons, virtually identical to Garcon’s figure. The Redskins only paid $7.5 million in guaranteed money for Morgan on a five-year, $12 million contract that will void after two years (for cap purposes, the Skins will spread the signing bonus hit over five years, but it’s essentially a two-year deal). Washington may find that Morgan’s actually the better player of the two.

Big Receiver-a-Go-Go

We were right to assume that there were two oversize wideouts on the market who would move fast during free agency, but we had the wrong receivers. After the Saints locked up Marques Colston early Tuesday morning, the Bears abandoned their chase of Vincent Jackson and shockingly acquired Brandon Marshall from the Dolphins for a pair of third-round picks.

The Marshall trade didn’t obviously stink the way that the Santonio Holmes trade did — when the Jets acquired a Pro Bowl-caliber receiver for a fifth-rounder — but the sudden availability and acquisition of Marshall suggested that there was more to the move than meets the eye. It was no surprise hours later, then, when Adam Schefter reported that Marshall was being investigated by the league for yet another off-field incident. It later came to light that Marshall had allegedly “slugged” a woman in the face at a New York City club on Sunday, a move that might have inspired Miami’s desire to give up on Marshall.

The only logical perspective from which this makes sense for the Dolphins is the disciplinarian angle, where a new head coach simply wanted to move on from a frustrating player. That makes for wonderful quotes, but Marshall was the team’s best offensive weapon by a wide margin, and there’s nobody left on the market to replace him. They gave up two second-round picks for Marshall and then paid him $19 million for two years of above-average production before shipping him away for two third-round picks.

Obviously, what Marshall offers on the field is worth more than two third-round picks. Over the past five years, only four players have more receiving yards than Marshall, and his three 100-catch seasons all came in Denver with Jay Cutler at the helm. Cutler, of course, will be Marshall’s starting quarterback again in Chicago. Marshall’s arrival will take the heat off Devin Hester as a no. 1 wideout and keep Earl Bennett in the slot, moves that will make everyone in the offense better. In addition, the Bears won’t be responsible for paying Marshall’s signing bonus and should only owe Marshall his base salary (a little over $9 million) in each of the next three years. If Marshall becomes too much to handle, they can cut him without incurring any cap penalty.

We had a whole paragraph written here about how the Dolphins now needed to sign Reggie Wayne — even if it meant throwing him a few extra bucks — because it would fill their biggest need while giving Peyton Manning extra ammunition to choose Miami over Denver in his quest for a new organization. After being linked with Manning for the past week as a combo deal, Wayne stunningly returned to the one place Manning isn’t heading to, Indianapolis. The Colts gave him a three-year deal worth $17.5 million with $7.5 million guaranteed. It’s shocking that the a receiver-needy team like the Dolphins wouldn’t have offered Wayne more in guaranteed money, but perhaps the veteran wanted to finish his career in Indianapolis after all. The Colts don’t exactly need a 33-year-old wideout these days, but at that price, Wayne can be a viable target for the beginning of Andrew Luck’s career without costing the organization very much. It’s a win-win-oh-my-god-the-Dolphins-lose deal.

And as for Jackson, he finally got the long-term deal he’s sought for years by inking a five-year, $55,555,555 contract with the Buccaneers to serve as Josh Freeman’s top wideout. The deal guarantees Jackson $26 million. To put that in context, consider that Jackson has more receiving yards over the past three years than Garcon despite being thrown 97 fewer passes (344 for Garcon, 247 for Jackson), while his catch rate is at a far-superior 58 percent despite being the target of so many Philip Rivers prayers downfield. We’ll stop picking on Garcon now. Jackson has his own history of off-field issues and has spent his entire career playing in an effective passing offense with a great quarterback, so he could qualify as a free agent from hell (especially if you consider Antonio Gates to be the team’s top target), but his sheer size and athleticism should play well in a division with small corners like Brent Grimes and Jabari Greer. The Bucs should be a little concerned that they have two wideouts of markedly similar styles in Jackson and Mike Williams, though, and they might want to stay in the market to add a slot receiver who can do some damage underneath. That player could be Early Doucet, who the Cardinals can’t afford to retain.

The Chargers found their replacement for Jackson in Robert Meachem, giving the former Saints wideout a four-year deal with $14 million in guaranteed money after he failed to come to terms with the Bills. As a third or fourth option in the Saints’ passing attack over the past few years, Meachem’s been remarkably consistent. Over the past three seasons, he’s started either seven or eight games, caught between 40 and 45 passes, and averaged between 14.5 and 16.0 yards per catch. Those numbers have some value, but at 28, it’s worth wondering whether Meachem is ever going to become anything more than that. If the Chargers continue to use Meachem as a third target, they should find that he’s up to the task. If they expect Meachem to be their no. 1 receiver, though, San Diego might be disappointed by what they find.

Finnegan’s Wake of Money

Last August, Cortland Finnegan disappeared from Titans training camp and attributed the absence to a personal matter. The personal matter was that he wasn’t happy with his contract and wanted the Titans to give him a new one. As you might suspect, the Titans were not desperate to re-sign Finnegan this offseason and let him go to St. Louis, which released a bevy of veterans to sign Finnegan to a five-year, $50 million deal with $26.5 million in guaranteed money. Much like the Redskins, the Rams desperately needed help at cornerback. Their top three corners all went down with season-ending injuries last year, and since previous ace Ron Bartell’s injury was a fractured neck, it’s easy to understand why the Rams would go out and target a top corner.

Is Finnegan a top cornerback, though? Pro Bowl voting is far from exact, but Finnegan’s only made one Pro Bowl in his career, and that was in 2008. More importantly, is Finnegan going to be a Pro Bowler with the Rams? St. Louis is paying him like one, and there are reasons to be concerned about his future viability. Finnegan, who just turned 28 in February, is generously listed at 5-foot-9. The recent history of short cornerbacks making it into their thirties as starters is not very long, as only five players listed at 5-foot-9 or less have started 12 or more games in a season after they turned 31 since 2002. That includes a few embarrassingly bad seasons, too, for guys like Fred Thomas, Dre’ Bly, and Tyrone Poole. The only short corner to really keep up his performance at a high level into his early thirties is Antoine Winfield, while dozens of taller corners have lasted into and beyond that age range over the same time frame. The Rams might get a year or two of solid performance out of Finnegan, but this contract is likely to end very messily.

Compare the Finnegan signing to that of Carlos Rogers, who re-signed with the Niners on Tuesday on a four-year deal for about $30 million. There’s no word yet on the guaranteed money, but Giants cornerback Terrell Thomas re-signed with his team on a similar deal with about $11 million guaranteed, and it’s hard to imagine that Rogers would get more than $15 million or so of his deal locked up in guaranteed cash. Rogers was better than Finnegan last year, when he made his first Pro Bowl, and he’s arguably been better over the whole of the past three years. And for that, Rogers is getting about as much total money over the length of his contract as Finnegan’s getting in guaranteed cash. That’s a victory for the San Francisco front office, which now returns all 11 starters from last year’s dominant unit.

Block the Doors With Beef on Weck

Don’t let him leave the facility. It’s the rule that every team follows when a big-time free agent heads to their city for a visit. If you get a player to hop on your private plane and head to your town for hours of meetings and interviews, your best way to sign that player is to lock him in your offices until he puts pen to paper. If that means ordering in the fanciest dinner in town, turning on the stadium’s lights, and dining on the 50-yard line, you do it. If it means adding a few million dollars to the contract figure you had in mind, you do it. If it literally means locking the doors and stalling the player in question from getting in a limo to take him back to the airport, you do it. The moment that player leaves your facility and heads out of town, though, your odds of signing him decrease dramatically. The Bills had their shot at Mario Williams last night. They weren’t able to keep him in the facility.

Although we suggested that the Bills should only enter the market to make a Godfather offer to Williams, we were pleasantly surprised to see that they actually went ahead and convinced Williams to start his free agent tour in Buffalo. They presumably got Williams to head there by telling his agent that the organization would give Williams the prescribed $40 million in guaranteed money that would help make him the highest-paid defensive player in NFL history.

It’s here where the NFL’s business model shines through. Because the league’s television contract is entirely national and split evenly between the league’s 32 teams, every team has enough money to make a legitimate top-dollar offer to the best free agent on the marketplace. Meanwhile, baseball teams who were already struggling with an income gap between the haves and have-nots are facing cavernous differences in their local television deals. The Pirates would not have been able to credibly offer Albert Pujols $300 million this offseason. The Bills — in a tiny market with a 40-year-old stadium — can outbid the rest of the league for an elite player if they want to.

Unfortunately for the Bills, it takes two to tango, and it doesn’t appear that Williams wants to dance. In all likelihood, Williams chose to start his national tour in Buffalo to send a message to his other suitors. Baseball’s rumor mill is famous for introducing the Mystery Team, an unknown suitor who agents would perpetually report as lurking in the shadows to sign their free agent for an exorbitant sum. Williams has basically started free agency by going to visit the Mystery Team. He can now go visit any other team in the league and tell them that Buffalo’s made him the biggest offer any defensive free agent has ever seen, and unless they’re willing to come close to that offer, he’ll go back to Buffalo and take their money. The Bills don’t have the leverage to take their deal off the table, since there’s nobody else in the market who would be worth that sort of contract. Even if Williams has no intention of ever signing with the Bills, it makes total sense for him to start his search there and strike fear into the penurious hearts of owners around the league.

Of course, Williams could still end up sticking around in Buffalo and signing with the Bills. Maybe they sweeten the pot and make it $45 million, or Williams simply changes his mind after a long night’s sleep and decides to stay. Nobody even whispered Williams’s name in reference to the Bills before free agency began, so there’s little reason to trust the rumor mill surrounding him now. We know one thing for sure, though: You can’t sign a contract with one team when you’re locked inside another team’s facility. Once the Bills got Mario Williams inside of Ralph Wilson Stadium, he shouldn’t have left without a contract.

Comments »5 Charged With Insider Trading After Alcoholics Anonymous Confession

WASHINGTON (AP) — The Securities and Exchange Commission says it is charging two financial advisors and three others connected to them with insider trading for more than $1.8 million in illegal profit gained from confidential information gleaned through an Alcoholics Anonymous relationship.

Read the rest here.

Comments »Citigroup, SunTrust Banks Capital Plans Fail Fed Stress Tests

Citigroup Inc. (C), the lender that took the most government aid during the financial crisis, will resubmit its capital plan to regulators after failing to meet some minimum standards in Federal Reserve stress tests.

SunTrust Banks Inc. (STI), Ally Financial Inc. and MetLife Inc. also fell short by at least one measure under the central bank’s most dire economic scenario, according to results released by the Fed today. Ally also intends to resubmit its plan, the company said in a statement.

Read the rest here.

Comments »Quitting While They’re Behind: Some Hedge Funds are Throwing in the Towel

THE past few years have been “as miserable as I can remember”, says Johnny Boyer of Boyer Allen Investment Management, a British hedge fund focused on Asia. The fund, which looked after $1.9 billion at its peak, faced the prospect of spending the next few years trying to claw its way back to pre-crisis asset levels. Instead the founders decided to shut the fund and give investors their money back.

Others have also had enough. “I’ve been doing this for 15 years and I’ve never seen as many people give up as in the last three months,” says Luke Ellis of Man Group, a large listed fund. This trend is distinct from the round of closures in 2008. Then, managers were hit by investors’ redemptions and had no choice but to close; today many are electing to walk away.

For some managers, the markets have become too stressful. Running a hedge fund today is “three times as much work for a third of the fun,” says one. But many are motivated by economics. Hedge funds typically get paid a 2% management fee on assets to cover expenses and a 20% performance fee on the returns they achieve for investors. Most funds do not earn performance fees unless they outperform their peak level or “high-water mark”. At the end of 2011, 67% of hedge funds were below their high-water marks, according to Credit Suisse, and 13% have not earned a performance fee since 2007 or earlier.

Funds can survive off a management fee for a couple of years, but four is a long time to go hungry. Most managers were banking on a recovery in 2011 but the average hedge fund slid by 5.2%—much worse than the S&P 500, which returned 2%. Poor performance is causing changes in the way the industry markets itself (see article). It also means many funds will have to wait even longer to earn a performance fee again. According to Morgan Stanley, 18% of hedge funds are more than 20% below their high-water marks.

Smaller funds have been more likely to close than their larger peers. That’s partly because it used to be possible to run a hedge fund with $75m under management. Today funds need at least double that amount because administrative and compliance costs are higher than ever. Larger funds also depend less on performance fees because their management fees bring in so much cash. John Paulson, a hedge-fund giant whose flagship fund was clobbered last year, has pledged to make up investors’ losses but his fund is so large that he can easily afford to carry on. That risks distorting the original point of hedge funds—that they are small, limber operations which come and go often (see chart).

For investors, it is generally a good thing if underperforming managers are returning cash and not milking them for fees. But others worry that high-water marks could skew funds’ investing decisions. Managers who have not earned a performance fee in years could take bolder bets to get back into the black. Leverage levels have been creeping up. Some may prefer to go out with a bang, not a whimper.

The 10 Best Quotes About Rising Gas Prices

vía Politico.com

1. “They [OPEC] want to go in and raise the price of oil because we have nobody in Washington that sits back and says you’re not going to raise that f—-ing price, you understand me?” — Donald Trump (April 2011)

2. “I figured out Karl Rove’s political strategy – make gas so expensive, no Democrats can afford to go to the polls.” — Sen. John Kerry (May 2004)

3. “President Obama must announce today in his Nashua address that he is firing Secretary Chu and replacing him with a pro-American-energy appointment. If he doesn’t, then the American people will know the president is still committed to his radical ideology, which wants to artificially raise the cost of energy.” — Newt Gingrich (March, 2012)

4. “You’ve got Donald Trump saying don’t pay OPEC $100 for the oil. Just tell them you’ll give them $50. Really? I go into Trump’s hotel, it’s $1,000 for a suite and I say I’m not going to give you that, I’ll give you $200. I’m on the street looking for another place to sleep. You can’t tell them I’ll give you $50 when the world market is $100. It just doesn’t work that way.” – T. Boone Pickens (Feb. 2012)

5. “We went into a recession in 2008 because of gasoline prices.” – Rick Santorum (Feb. 2012)

6. “I can get you a gallon of gasoline for a dime. … You can buy a gallon of gasoline today for a silver dime. A silver dime is worth $3.50, it’s all about inflation and too many regulations.” – Ron Paul (Sept. 2011)

7. “Since the president has been president, the cost of gasoline has doubled. Not exactly what he might have hoped for. … He’s said it’s not my fault. By the way, we’ve gone from ‘Yes, we can’ to ‘It’s not my fault.’ Well, this is in fact his fault.” – Mitt Romney (March 2012)

8. “Somehow, we have to figure out how to boost the price of gasoline to the levels in Europe.” – Energy Secretary Steven Chu (Sept. 2008)

9. “The next time you hear some politician trotting out some three-point plan for $2 gas, you let them know, we know better. Tell them we’re tired of hearing phony, election year promises that never come about.” — President Barack Obama (March, 2012)

10. Honorary mention: Dan Aykroyd, playing President Jimmy Carter in a Saturday Night Live skit in the 1970s, had some fun with Carter’s famous suggestion that Americans put on sweaters and turn down the heat:

Read more: http://www.politico.com/news/stories/0312/73891.html#ixzz1ovXMQif3

Eric Holder Messes with Texas: Justice Department Opposes Texas Voter ID Law

WASHINGTON (AP) — The Justice Department’s civil rights division on Monday objected to a new photo ID requirement for voters in Texas because many Hispanic voters lack state-issued identification.

Texas follows South Carolina as the second state in recent months to become embroiled in a court battle with the Justice Department over new photo ID requirements for voters.

Photo ID laws have become a point of contention in the 2012 elections. Liberal groups have said the requirements are the product of Republican-controlled state governments and are aimed at disenfranchising people who tend to vote Democratic — African-Americans, Hispanics, people of low-income and college students.

Proponents of such legislation say the measures are aimed at combating voter fraud. But advocacy groups for minorities and the poor dispute that and argue there is no evidence of significant voter fraud.

In regard to Texas, “I cannot conclude that the state has sustained its burden” of showing that the newly enacted law has neither a discriminatory purpose nor effect, Thomas E. Perez, the head of the Justice Department’s civil rights division, said in a letter to the Texas secretary of state.

Texas Attorney General Greg Abbot has said the Obama administration is hostile to laws like the one passed last year in Texas.

The National Conference of State Legislatures called the voter ID issue “the hottest topic of legislation in the field of elections in 2011,” with legislation introduced in 34 states.

The department had been reviewing the Texas law since last year and discussing the matter with state officials. In January, Texas officials sued U.S. Attorney General Eric Holder, seeking a court judgment that the state’s recently enacted voter ID law was not discriminatory in purpose or effect.

As a state with a history of voter discrimination, Texas is required under section 5 of the Voting Rights Act to get advance approval of voting changes from either the Justice Department or the U.S. District Court in Washington, D.C.

In a letter to Texas officials that was also filed in the court case in Washington, the Justice Department said Hispanic voters in Texas are more than twice as likely than non-Hispanic voters to lack a driver’s license or personal state-issued photo ID. The department said that even the lowest estimates showed about half of Hispanic registered voters lack such identification.

The range was so broad because the state provided two sets of registered voter data.

In December, the Justice Department rejected South Carolina’s voter ID law on grounds it makes it harder for minorities to cast ballots. It was the first voter ID law to be rejected by the department in nearly 20 years.

In response, South Carolina sued Holder; the state argued that enforcement of its new law will not disenfranchise any voters.

Other states have moved toward photo ID requirements in the past year.

Alabama has a photo ID law, but it does not go in effect until 2014. Mississippi voters approved a photo ID law, but the state legislature has not yet adopted enabling legislation. The Justice Department has not yet reviewed the initiatives in either state.

The Justice Department has said it is reviewing voter ID laws in other states, but has not identified which ones.

Comments »WATCH: Biggest Wave Ever Surfed in a Kayak

Alex Jones: Kony is All Bullshit; Jolie is the True Monster

Iran Tells West to Fuck Off

“You say to Iran all options are on the table. Leave them there until they rot. The time of arrogance and colonialism has passed, and the era of your unreasonableness passes too.”

Comments »

DON’T MESS WITH ISRAEL’S “IRON DOME”

Israel’s Iron Dome

The Iron Dome system intercepted about 90 percent of the rockets fired at Be’er Sheva, Ashdod and Ashkelon, including three on Sunday morning.

Despite the rocket barrage, Israel kept open the Erez Crossing for passengers and employees of international organizations operating in Gaza. Kerem Shalom was open for the delivery of 200 truckloads to Gaza residents.

Its deployment this past weekend appears to have defeated Hamas, at least for the time being. The terrorist organization has been talking with the new regime in Egypt for another ceasefire after failing to inflict mass casualties or property damage on Israel.

The problem with the Iron Dome is its cost and the lack of enough systems to defend all of Israel. The United States is providing funds to Israel to buy more of the made-in-Israel systems, each one of which costs more than $100 million.

The Iron Dome has been able to defend Israel’s three most populous southern cities, but if Hamas unleashes longer-range missiles that can reach Rehovot, Kiryat Gat and Kiryat Malachi, closer to metropolitan Tel Aviv, the IDF would lack enough systems to cover everyone. Defense Minister Ehud Barak said Sunday morning that expanding the system should be a national emergency project.

In addition to the defensive action of deploying the Iron Dome, the IDF also has taken the offensive against terrorists.

It targeted two members of the Popular Resistance Committee terror organization on Friday. The squad was responsible for planning a combined terror attack that was to take place via the Sinai Peninsula and the Israel-Egypt border.

In response to the ensuing rocket and missile bombardment from Gaza, the Israel Air Force targeted several weapons manufacturing facilitates and terrorist cells preparing to launch missiles.

Comments »PREPARE FOR WINE INFLATION

(via) H/t @StockJockey

Is California Facing a Grape Shortage?

Grape prices are going up, but consumers have grown accustomed to bargains

California’s grapegrowers finally have something to cheer about—grape prices are going up. But does that mean higher prices for consumers? Winery owners are trying to cut costs so they can keep prices low at a time when drinkers still want value.

After nearly three years of sluggish sales and an oversupply of wine, vintners have cleared their cellars of older vintages and are looking to increase their grape purchases. But two small harvests and an absence of new plantings mean they are competing for a smaller amount of fruit. That demand is pushing up grape prices and bulk wine prices. “If you are buying wine on the bulk market, or you’re a négociant, your costs are going to go up,” said Adam Lee of Siduri and Novy Family wines. Larger producers like E. & J. Gallo are actively signing long-term contracts with vineyard owners to guarantee grape supplies at a set price.

Grape costs can vary depending on the vineyard, its location and the size of the harvest. On average, the price of all California grape types rose in 2011. The average cost of red grapes increased 12 percent per ton while white grapes jumped by 8 percent compared to 2010, according to a preliminary report on the 2011 grape crush by the U.S. Department of Agriculture (USDA).

At the height of the recession, California’s wine industry faced an excess of wine. Sales of bottles priced at $20 and above slumped as consumers traded down to cheaper brands. Winery cellars backed up with unsold wines as restaurants and retailers tried to move existing inventory. Many winemakers had to change their tactics to stay afloat. To stimulate sales, producers and négociants turned to bulk wines and created second labels to meet consumers’ taste for values. Many looked to the state’s Central Valley for inexpensive grapes and processed juice.

Vintners attributed the surplus of wine during the recession to slow sales, not an excess of grapes. “The reasons for these oversupplies have been primarily economic, not due to particularly bountiful harvests,” said Cameron Hughes, founder of the eponymous négociant, which purchases surplus juice from wineries and bottles it under its own labels.

Wineries are now selling off that inventory. Over the past year Americans consumed more wine and reached for more expensive bottles. Wine Spectator sister publication Impact Databank reported that sales increased in volume by 1.7 percent in 2011. With cellars now empty, wineries are scrambling to buy grapes. “For the first time in three years most varietals across California are in demand,” said Brian Clements, vice president of California wine brokerage firm Turrentine.

“Some growers are already saying they are sold out [of their 2011 harvest] when a few years ago they were begging to sell fruit,” said Bill Brosseau, winemaker at Testarossa Winery in the Central Coast. Like many small and medium-size wineries, Testarossa relies on growers for most of its grapes.

Some of California’s largest producers are flexing their financial muscle to secure access to fruit. Winery giant E. & J. Gallo has signed long-term contracts with grape growers for 90,000 acres and announced that it plans to add 10,000 more, mainly in the Central Valley, over the next year. “With our forecasts for projected growth in the wine business, we are and will continue to make major long-term financial commitments to the California wine industry,” said Joe Gallo, E. & J. Gallo’s president and CEO.

A pair of challenging vintages is adding to the pressure to find good grapes at good prices. Data in the USDA’s 2011 grape crush report show that the grape harvest was down 3 percent in 2010 and nearly 10 percent last year compared to the 2009 harvest. “Yields have been down pretty dramatically and for all varieties as well,” said Siduri’s Lee. The 2011 vintage brought cold and wet weather throughout the growing season and a late frost in the Central Coast.

Another issue facing wineries is that the number of new vineyards being planted has slowed since 2006. “No one is planting right now,” said Ed Sbragia of Sbragia Family Vineyards. “So as demand for these wines grows, grape prices are going to go up; as a winery owner you’re going to have to pay more.”

But some argue that the shortage is not as severe as has been reported. “California wine shipments have grown steadily throughout the last decade but that growth is not outpacing supply,” said Hughes. He argues that shipments to wholesalers have outpaced wine sales, emptying cellars and creating an illusion of a shortage. And even though 2010 and 2011 were smaller harvests than 2009, they were still some of the largest in California history. Hughes worries any price increases would be very bad for sales right now.

If the shortage is real, wineries may have to raise their prices or change how they operate to offset the rising costs. While the economy is recovering, most customers are still price conscious—and many got used to discounts during the tough times.

Vintners are looking for ways to save money in their wineries so they don’t scare off customers. Brosseau said Testarossa is focusing on direct-to-consumer sales instead of going through distributors or wholesalers, who buy wine at reduced cost. “We’ve gone direct to restaurants and retail and are stimulating more sales in the tasting room, to offset higher grape prices.”

How wine drinkers will respond to potentially higher prices remains to be seen. And with analysts predicting that California’s shortages could last for several years, wineries will have to consider their options carefully. Grape prices could stay high because of demand even if the state sees a large harvest in 2012. “If we had a bumper crop this year it would be absorbed no problem,” said Clements. “Across the board there are more buyers than sellers.”

Comments »