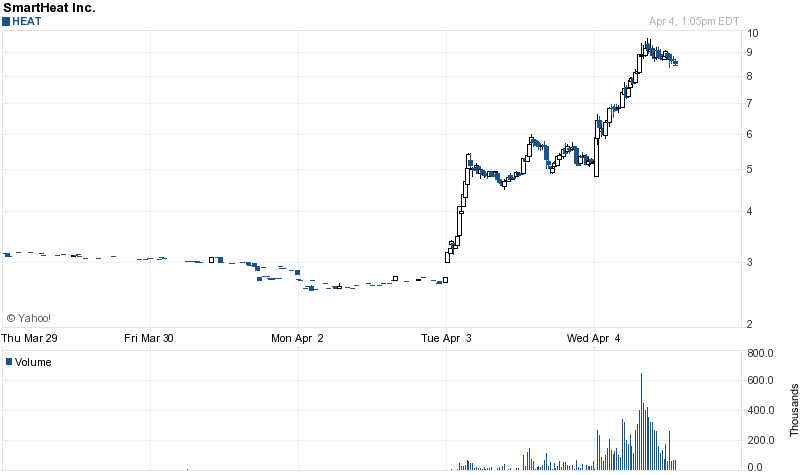

SHARES OF HEAT HAVE GONE FROM $2.50 to $9.00 This Week!

Germany’s Largest Solar Maker Goes Bankrupt

Wynn and Zynga in Talks About Online Gambling Partnership

via NYPOST.com

Eager to marry the popularity of social gaming with real-life betting, Zynga is in talks with casino company Wynn Resorts about a potential online gambling partnership, The Post has learned.

Zynga, which sees huge revenue potential in moving from pretend to real-life wagering, needs to form partnerships with casino operators in a number of states if it is to cash in on an expected boom in Internet gambling.

Neither Zynga nor Wynn Resorts responded to requests for comment.

At least 20 states are considering legalizing online gambling after the Justice Department reinterpreted a decades-old federal law in December and found it only banned sports betting and not other forms of online gambling.

Since the DOJ move, Zynga CEO Mark Pincus has been touting the company’s prospects for parlaying its popular virtual poker game into real-life betting, calling the possibilities “mind-blowing.”

While Pincus is waxing poetic about poker, experts said the odds are stacked against the social media upstart, which will need to partner with more than just Wynn to become a major player.

Among the problems: Most of the proposed state legislation would restrict online licenses to those who already are licensed to run a state gaming operation. Wynn only operates in Nevada.

New Jersey, for instance, has a bill that passed the state Senate and is now in the Assembly that would grant Internet licenses only to those with computer servers based in Atlantic City casinos.

“Our goal is to help existing casino operators. We don’t know anything about Zynga,” state Assembly Regulatory Oversight and Gaming Committee Chair Ruben Ramos Jr. told The Post.

In Connecticut, Native American tribes have reportedly said the state would be violating its agreement giving them exclusive casino gaming rights if it issued an online license to anyone else.

Likewise, Iowa in its pending bill offers online licenses only to those already authorized to operate state gambling boats and racetracks.

US Digital Gaming founder Richard “Skip” Bronson said, in a state-by-state scenario that “the existing gaming interests are most likely the ones who will be getting the licenses for Internet gambling.”

Sources said Zynga may try to move first in the UK, where online betting is already legal, though competition is stiff.

Indeed, Facebook, which does not want to host online gambling on its own site, has held conversations with UK online bookmakers William Hill and Ladbrokes about offering Facebook users access to their sites, a source said.

Reps for Facebook, William Hill and Ladbrokes did not return calls and messages seeking comment.

Stern Agee Managing Director Arvind Bhatia said if Zynga is unable to participate meaningfully in legalized online gaming here, its shares could fall as much as 10 percent because investors have baked into the share price expectations of new gaming revenue.

“I think, given that its core market is slowing, the potential gaming revenue is important.”

Read more: http://www.nypost.com/p/news/business/casino_ville_bet_DzXRAXwXYo1VOasowKIzpJ#ixzz1r5VV4wNh

Yahoo Announces 2000 Pink Slips

Burger King to Go SPAC Soon

U.S. Equity Preview: WPZ, WBMD, TIBX, SNDK, HOV, GMXR, GPS, VIAS, & DDIC

Ddi Corp. (DDIC) rose 4.9 percent to $12.86. The maker of electronic components for computer and communications companies agreed to be bought by Viasystems Group Inc. (VIAS) for $13 a share in cash.

Gap Inc. (GPS) : The largest U.S. apparel chain was raised to overweight from neutral at Piper Jaffray Cos., which cited improvement in fashion spending. An overweight rating means the shares’ return is expected to beat the median return of companies covered by the analyst in the next year.

GMX Resources Inc. (GMXR) : The oil and natural-gas producer based in Oklahoma City said it drilled and completed its fourth operated horizontal Bakken well, in North Dakota.

Hovnanian Enterprises Inc. (HOV) : The homebuilder will sell 25 million Class A shares in a secondary offering.

SanDisk Corp. (SNDK) fell 6.5 percent to $46.78. The biggest maker of flash-memory cards cut its forecast for first- quarter sales, citing weaker-than-expected pricing and demand.

Tibco Software Inc. (TIBX) : Jefferies & Co. initiated research on the business software developer with a buy rating, estimating the price will climb to $42 a share.

WebMD Health Corp. (WBMD) fell 5.6 percent to $24.26. The medical information company said it expects to buy 5.77 million shares at $26 each after a tender offer expired yesterday.

Williams Partners LP (WPZ) slipped 3.7 percent to $54.20. The U.S. pipeline operator will sell 9 million shares in a public offering. Proceeds will be used to fund a portion of the acquisition by the Tulsa, Oklahoma-based company of Caiman Eastern Midstream LLC, which was announced on March 19.

Comments »In Play and On the Wires

Chevron and Transocean Receive Another Lawsuit for $11 Billion Over Brazilian Oil Spill

“Chevron Corp. (CVX) and Transocean Ltd. (RIG) are being sued for another 20 billion reais ($11 billion) by a Brazilian federal prosecutor in a new lawsuit over a second oil spill at the Frade field off the nation’s coast.

Chevron committed “a series of errors” that led to the March spill at the project, the federal prosecutor’s office said in an e-mailed statement yesterday. Prosecutor Eduardo Santos de Oliveira is also seeking to halt operations at Frade and block Chevron from transferring profitsfrom Brazil, according to the statement.

“The oil spill at the Frade field hasn’t been contained,” Oliveira said in the statement. “The damages to the environment and to Brazil’s natural resources are incalculable at this point,” he added….”

Comments »BMW Catches Up to Mercedes in U.S. Sales

“Bayerische Motoren Werke AG (BMW)’s BMW brand, helped by a redesigned 3 Series sedan and a March sales increase of 18 percent, finished the first quarter with 36 more deliveries thanDaimler AG (DAI)’s Mercedes-Benz in the U.S.

Sales gains by both BMW and Mercedes last month indicate that the battle to be the top-selling luxury brand in the U.S. will continue through 2012 as inventories and new products arrive in dealerships. BMW took the top spot last year with a lead of just 2,715 units over its German rival….”

Comments »AT&T May See a Walk Out of 40k Wireline Employees

“AT&T Inc. T +0.05% faces the possibility of a walkout by 40,000 wireline employees Sunday morning if the union can’t reach an agreement with the telecommunications giant on a new contract.

Members of the Communications Workers of America voted over the weekend to authorize CWA President Larry Cohen to call a strike after the contract expires on April 7. CWA members staged a two-week strike against Verizon Communications Inc. in August and have yet to reach an accord with that company.

AT&T is seeking increases in workers’ health-care premiums and co-payments, pension cuts and other benefits changes, according to the union.

“Everything leads me to believe that we’re in the same position today with AT&T that we were with Verizon last year,” said Chuck Simpson, president of CWA Local 2204 in Salem, Va. “Like so many companies, they want to shift more costs to the employees.”

On its website, AT&T said employees’ medical costs rose 54% from 2004 to 2010 and 8% in 2010 alone. “AT&T seeks to reach fair agreements with our union partners that enable a competitive cost structure reflecting current market realities,” the company said on the site…”

Comments »RIM Accused of Infringing Upon 6 Patents on Blackberry Chips

“BlackBerry maker Research In Motion Ltd. (RIMM) was accused of infringing six patents owned by NXP Semiconductor NV (NXPI) for technology including ways to expand the range of data transmission.

NXP, Europe’s third-largest chipmaker, filed the complaint yesterday in U.S. federal court in Orlando, Florida. The Dutch chipmaker, based in Eindhoven, Netherlands, seeks cash compensation and a court order to block further use of its inventions.

RIM products including the BlackBerry Torch, Playbook, Curve and Bold are using the patented inventions without permission, NXP contends. The other patents cover computer bus systems, mobile phones with GPS receivers, circuit manufacturing, the polishing of the surface of wafers, and patterning of layers on the wafer.

Marisa Conway, a spokeswoman for Waterloo, Ontario-based RIM, said the company doesn’t comment on pending litigation.

RIM fell $1.16, or 8.1 percent, to $13.21 as of 12:31 p.m. in New York trading, the biggest decline in more than two months, as investors speculated that potential acquirers are losing interest.

The case is NXP BV v. Research in Motion Ltd. (RIM), 12cv498, U.S. District Court for the District in Orlando (Florida).”

Comments »Toyota Tops 200k Units

“Toyota is out with preliminary numbers for March, selling more than 200,000 units for the first time since 2008.

With automakers representing some 70 percent of U.S. sales reporting, Business Insider predicts total sales for the month may top 1.4 million, for a seasonally adjusted annual rate of sales between 15.0 and 15.4 million units.

That number is on the low end of earlier projections, but substantively above Wall Street estimates for a 14.6 million pace.

Below output from the Business Insider model, updated with results from Volkswagen and Toyota.

Eric Platt/Business Insider |

UPDATE (10:16 a.m. EST):

General Motors’ sales miss in March has endangered the auto industry’s ability to top an annualized sales pace of 15 million units, new data out of Business Insider shows.

The company reported a sales improvement of 12 percent during the month, moving 231,052 vehicles.

That number, combined with other recent reports from Ford, Nissan and Chrysler, puts total sales for the month at 754,168 already.

It’s important to note that GM has logged a steadily declining market share over the past three quarters — meaning actual market share for the four companies that have already reported could fall below 54 percent. If that’s the case, SAAR for March would come in above 15.2 million.

Below, output from the Business Insider model.

|

Eric Platt/Business Insider |

UPDATE (9:54 a.m. EST):

Over the past few minutes, automakers Ford and Nissan have released March 2012 sales results, both logging substantive improvements over year ago results.

Together with Chrysler Group, the three automakers represent more than 35 percent of the U.S. auto market.

With these results in, Business Insider is refining its original model of the seasonally adjusted annual rate of sales to between 15.4 and 15.9 million, an impressive improvement from last month’s strong results and the best reading in more than four years.

Below, output from the updated model.

|

Eric Platt/Business Insider |

One important caveat, the annualized rate is based on the median multiplier over the past 20 years, which is slightly higher than the multiplier logged in 2011.

ORIGINAL (8:50 a.m. EST):

Over the next eight hours, twenty automakers will report March auto sales in the U.S. Already, it appears the seasonally adjusted annual rate of sales will top all industry estimates, new data out of Business Insider shows.

First out the gate this month is Chrysler, with a better-than-expected sales gain of 34.2 percent, moving 163,381 units in March.

At that healthy gain, Business Insider estimates total U.S. SAAR will run between 15.2 million and 16.1 million.

This is well above current estimates of 14.6 million units, per Bloomberg.

The last time auto sales topped an annualized pace of 15.2 million was four years ago, in February 2008.

BI employed two models to make this prediction, one that tracks changes in market share tied to a second measuring impact of monthly total sales to SAAR.

Over the past year, Chrysler’s market share has fluctuated between roughly between 10 and 12 percent, touching the upper bounds recently. The BI estimated range would fall above the actual SAAR if Chrysler is able to break through the 12 percent market share mark.

Setting that rate as the predicated final rate would mean total March sales, when including automakers from General Motors to Tata Motor (Jaguar, Land Rover), would hit 1,394,305 units, with an upwards bounds of 1,476,373.

Using those two points, we constructed the average and median number with which March units were multiplied by to get the ultimate SAAR. That multiplier is 10.8761615. All together, the range above is constructed when applying both.

Below, a snapshot of the model’s output.

|

Eric Platt/Business Insider |

Business Insider will continually update this throughout the day and define a smaller range of annualized auto sales as other automakers report. “

Comments »Mercedes Benz Sees Sales Up 11%

“FRANKFURT (Reuters) – Daimler said on Tuesday that sales of its Mercedes-Benz luxury brand rose 11 percent to 131,334 vehicles in March, extending the increase in year-to-date deliveries to 313,902.

“The great customer response on the new models makes me very confident that we will achieve our goal to post a new sales record in 2012,” sales chief Joachim Schmidt said in a statement.”

Comments »Top JPM banker quits after market abuse fine

Comments »LONDON (Reuters) – One of London’s most prominent bankers was fined 450,000 pounds ($720,000) for passing on inside information in a case that will embarrass his employer J.P. Morgan Cazenove and which marks a push by British regulators to target high-profile figures.

Top “rainmaker” Ian Hannam resigned on Tuesday, to fight the fine imposed by the Financial Services Authority (FSA) in relation to 2008 emails that contained information about one of his clients, Heritage Oil.

The gruff former special forces soldier, who rose from humble beginnings, is the fifth person to be fined in relation to improper disclosure this year by the regulator, which has previously been accused of being ineffectual in its fight against financial crime. Of the five, Hannam is the most prominent.

Hannam resigned from his position as JPMorgan’s Global Chairman of Equity Capital Markets, after two decades at the firm, JPMorgan informed staff in an internal memo, which became the talk of the London financial world.

Hannam, a veteran banker in his fifties with a focus on resources and mining and whose current deals include advising miner Xstrata (XTA.L) on its merger with Glencore (GLEN.L), said he had fully cooperated with the FSA and would appeal against the decision.

FLASH: Fed Issues a Review and Penalties Against JPM for Mortgage Misconduct

GM Falls Slightly Short of Sales Estimates

U.S. Equity Preview: UEC, SZYM, SIAL, GWRE, CVI, & CAVM

Cavium Inc. (CAVM) fell 3.4 percent to $29.52. The San Jose, California-based chipmaker forecast revenue in the first quarter will fall as much as 7 percent from the prior quarter.

CVR Energy Inc. (CVI) gained 7 percent to $29.10. Billionaire investor Carl Icahn extended to April 30 the deadline for his unsolicited offer for the producer of refined products and fertilizer, after 55 percent of shares were tendered under his $30-a-share bid for the company.

Guidewire Software Inc. (GWRE) (GWRE US) fell 5 percent to $28.50. The developer of software for the property and casualty insurance industry filed plans to offer 7.5 million shares.

Pep Boys — Manny, Moe & Jack (PBY US): The Philadelphia- based automotive retailer reported a fourth-quarter loss of 8 cents a share, compared with the average analyst estimate of a 13-cent profit.

Sigma-Aldrich Corp. (SIAL) : The maker of chemicals for research laboratories acquired biomedical supplier Research Organics Inc. Terms of the deal weren’t undisclosed. The St. Louis-based company said the deal will be “neutral” to earnings in 2012.

Solazyme Inc. (SZYM) (SZYM US) rose 6.8 percent to $15.28. The maker of oil products from genetically modified algae formed a joint venture with Bunge Ltd. (BG) for a commercial-scale renewable tailored oils production facility in Brazil.

Uranium Energy Corp. (UEC) fell 6.5 percent to $3.61. The developer of a mine in Texas said it plans to sell up to 5.6 million shares at $3.60 each.

Comments »The SEC Probes Groupon After Yesterday’s Earnings Revision

Ford and Chrysler Report Strong Sales; How This May Forecast Employment

“Ford Motor had the best March for new-vehicle sales in the U.S. in five years, and AutoNation raised its forecast for sales for the whole year, in what may be a strong sign of recovery for the auto industry.

|

|

Philippe Desmazes | AFP | Getty Images

|

Ford [F 12.62 ![]() 0.145 (+1.16%)

0.145 (+1.16%) ![]() ] Americas President Mark Fileds told CNBC on Tuesday that the sales performance was due to pent-up demand, the mild weather and demand for fuel-efficient cars.

] Americas President Mark Fileds told CNBC on Tuesday that the sales performance was due to pent-up demand, the mild weather and demand for fuel-efficient cars.

AutoNation [AN 34.78 ![]() 0.47 (+1.37%)

0.47 (+1.37%) ![]() ]announced that March retail new vehicle unit sales increased 15 percent compared with the same month of last year and that sales in the first quarter increased 13 percent from the first quarter of 2011.

]announced that March retail new vehicle unit sales increased 15 percent compared with the same month of last year and that sales in the first quarter increased 13 percent from the first quarter of 2011.

The results were so good, CEO Mike Jackson told CNBC, that the dealer raised its sales forecast for the whole year.

Its shares rose 2 percent in pre-market trading.

Chrysler’s sales increased 34 percent, best monthly sales in four years.”

_________________________________________________________

Is this a sign of a good jobs report ?

Comments »