Really…”manipulative schemes”…

Comments »Yearly Archives: 2013

$VZ Says They Will Not Pay Up for $VOD

“LONDON (Reuters) – Verizon Communications would like to buy out Vodafone from their Wirelessjoint venture but will not do so at any cost, its chief executive has told JP Morgan analysts,

In a note to clients, analyst Philip Cusick said Verizon boss Lowell McAdam had said he did not believe a premium would be required to buy Vodafone’s 45 percent stake in the highly successfulVerizon Wireless business, because Verizon already had control through its 55 percent holding.

Shares in both groups are up over 20 percent this year on speculation Britain’s Vodafone could finally exit the leading wireless business in the United States, a partnership the two firms’ formed in 2000.

Verizon management have stepped up the rhetoric in recent months, saying they want to do a deal and two people familiar with the situation have told Reuters that Verizon is working on a possible $100 billion bid to take full control of the asset.

In response, Vodafone has said it has an “open mind” on whether to stay in the business, which makes up around 75 percent of its market value….”

Comments »Weak Power Demand Has $DUK Posting Lower Than Expected Profits

“(Reuters) – Duke Energy Corp , the largest power provider in the United States, reported a lower-than-expected quarterly profit on Friday, citing weak electricity demand and higher costs at two key units.

The company, which uses coal, natural gas and nuclear plants to generate electricity, has had weak power sales since the 2008 recession as the housing market struggles to recover and consumers remain reluctant to increase their spending.

Demand from commercial customers was especially weak in the first quarter, Duke said, but it still expects to earn $4.20 to $4.45 per share this year. The midpoint of that forecast roughly matches analysts’ average estimate of $4.33.

Low rainfall in Brazil boosted generation costs at a key hydroelectric power station, the company said. Duke operates an international power supply business, primarily in South America, but the United States is its largest market…”

Comments »Non Farm Payroll Data Melts Up Futures and European Markets

The Dollar Halts it Largest Advance Against the Euro

“The dollar snapped its biggest advance against the euro in two weeks before the U.S. releases April jobs data after the previous report disappointed with employers adding the fewest positions in nine months.

The euro yesterday dropped versus 15 of its 16 major peers after European Central Bank President Mario Draghi said policy makers may take the unprecedented step of charging banks to hold excess reserves. Australia’s dollar was set for its longest weekly losing streak versus the New Zealand currency in 12 years as traders raised bets the bigger nation’s Reserve Bankwill cut borrowing costs next week.

“The data has softened recently and that could show up in non-farm payrolls,” said Richard Grace, the Sydney-based chief currency strategist and head of international economics atCommonwealth Bank of Australia. “If the number is weak, theU.S. dollar will go down a little as will long bond yields.”

The dollar traded little changed at $1.3067 per euro as of 7:11 a.m. in London after rising 0.9 percent yesterday, paring this week’s decline to 0.3 percent.

The U.S. currency fetched 98.10 yen from 97.94 yesterday and 98.05 on April 26. The 17-nation euro was at 128.16 yen from 127.95, heading for a 0.3 percent climb on the week.

Japanese markets are closed today and on May 6 for holidays.

Payrolls increased by 140,000 workers after an 88,000 gain in March, according to the median forecast of economists surveyed by Bloomberg News before a Labor Department report. Theunemployment rate may have stayed at 7.6 percent, matching March’s reading as the lowest since December 2008.

Fed, ECB…”

Comments »India Cuts Interest Rates to Spur Growth

“India cut interest rates for a third straight meeting to revive growth, extending the only reduction in borrowing costs among major emerging nations this year.

Governor Duvvuri Subbarao lowered the repurchase rate to 7.25 percent from 7.50 percent, theReserve Bank of India said in Mumbai today, as 33 of 40 analysts in a Bloomberg News survey predicted. One forecast 7 percent and the rest no change after quarter-point reductions in both January and March….”

Comments »Non Farm Payrolls: Prior 88k, Market Expects 155k, Actual 165k

Unemployment rate drops to 7.5%

Comments »The EU Lowers Growth Estimates

“The euro-area economy will shrink more than previously estimated in 2013 as part of a two-year slump that has pushed up unemployment to a record, according to the European Commission.

Gross domestic product in the 17-nation currency bloc will fall 0.4 percent this year, compared with a February prediction of 0.3 percent, the commission said in a report issued in Brussels today. This follows a 0.6 percent contraction in 2012 and shows the region headed for its first ever back-to-back years of falling output….”

Comments »Copper Leads Metals Higher

“Copper led metals higher before a U.S. report that may show employment climbed in the world’s largest economy, while the yield on Spain’s 10-year bonds fell below 4 percent for the first time since 2010. European stocks and U.S. index futures were little changed.

Copper jumped 4.2 percent and zinc increased 2.1 percent at 7:56 a.m. in New York. The Spanish 10-year yield dropped eight basis points to 3.97 percent, and the Italian 10-year yield fell to the lowest since February 2006. The euro strengthened against the dollar and the yen. The Stoxx Europe 600 Index advanced 0.1 percent, while futures on the Standard & Poor’s 500 Index retreated 0.1 percent….”

Comments »Aisia Trades Mixed at Best, Europe is Flat Like a Pancake, and U.S. Future Wait on Non Farm Payrolls

Yields for Italy, Spain, France, and Germany …

Comments »The Rising U.S. Dollar Myth

“Year-to-date, the U.S. dollar is up; does that mean we are in a rising dollar environment? Or is it an opportunity to diversify out of the greenback?

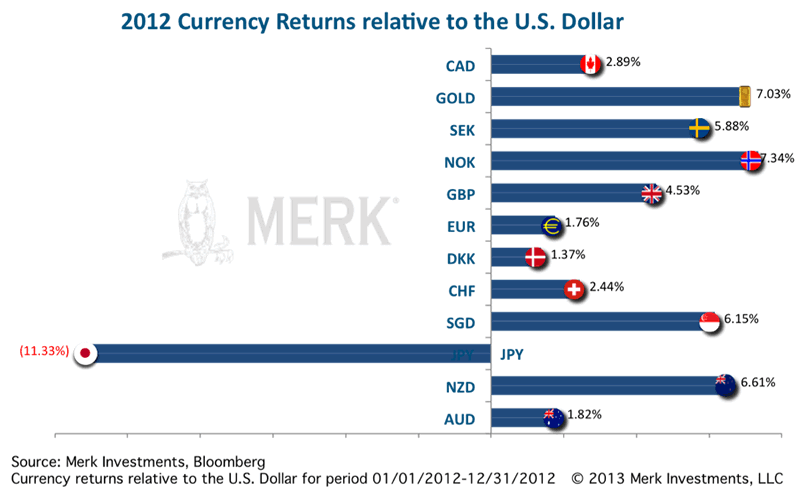

Last year, with all the turmoil in the Eurozone, the euro was up 1.79% versus the dollar; that appeared to be the best the U.S. dollar could do in times of turmoil. Of the major currencies only the Japanese yen was down versus the U.S. dollar:

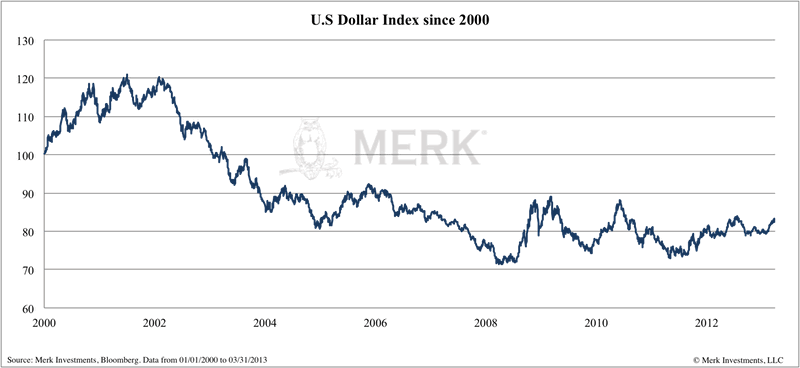

Year-to-date, the dollar index, a trade weighted index comparing the U.S. dollar to a basket of six major currencies, is up 2.95% as of April 29, 2013. What many are not aware is that this index has not really been updated since it was first created in the early 1970s, giving the euro a 57.6% exposure. The dollar’s downward trend has been slowed in recent years in large part by the turmoil in the Eurozone. Additionally, the New Zealand dollar for example, which is not in the index, is up 3.37% year-to-date.

To ascertain what may happen to the dollar, let’s look at the greenback from a couple of different angles:

Myth: U.S. dollar’s safe haven status

In recent years, when there has been talk about a “flight to quality” benefiting the U.S. dollar, we had a couple of observations:

•Flight to quality may be a misnomer: our analysis suggests the dollar tends to be in demand in times of turmoil because of liquidity, not quality considerations;

•Since the onset of the financial crisis, each time the pendulum swings in favor of the U.S. dollar, it may be swinging there less so;

•The balance sheet of the U.S. appears to be deteriorating at a faster pace than the balance sheets of much of the rest of the world;

•Wherever there is a crisis, it is being “patched up”, suggesting that when the pendulum once again favors risky assets, more money might flow towards those assets; and when the pendulum swings once again in favor of the U.S. dollar, it may be less and less of a beneficiary.

In other words, the safe haven status of the U.S. dollar may slowly be eroding.

Myth: a rising rate environment favors the U.S. dollar…”

Comments »Retail Investors are Slowly Coming Back to the Equity Table

“The latest AAII asset allocation survey showed that individual investors increased their equity holdings by 2.2%, increased fixed income exposure by 2% and reduced cash by 4.3%. That’s a meaningful swing in cash levels and shows how desperate small investors are to put some money to work. The current equity levels show that individual investors are still not completely sold on the rally as the historical average equity allocation is 60% while the latest reading brings us up to 61.7%.

Here’s more via AAII…”

Comments »

$GOOG Invests $125 Million in Lending Club

“Peer-to-peer lending platform Lending Club is announcing a huge new investor today: Google. Google and existing investor Foundation Capital have put $125 million in Lending Club, which was valued at $1.55 billion in the round. As part of this investment Google will take an observer seat on the Lending Club Board alongside existing Board members including Kleiner Perkins’ Mary Meeker, ex-chairman and CEO of Morgan Stanley John Mack and former U.S. Treasury Secretary Larry Summers.

The investment by Google came as part of a secondary transaction whereby new and existing investors acquired shares from existing investors. Last year, Lending Club raised $17.5 million from Kleiner Perkins, bringing its total outside investment to just under $100 million. Because this is a secondary round, there is no new money being raised, as Google and Foundation are buying out existing early investors.

Lending Club, which brings together lenders and borrowers who want to cut out banks in the process of investing among peers, has facilitated a total of $1.65 billion in loans. In the last quarter, Lending Club saw $350 million in loans made through the platform, and has generated 22 consecutive quarters of positive returns. Lending Club expects to issue $2 billion in loans this year alone.

The company’s wholly-owned subsidiary LC Advisors, an SEC Registered Investment Advisor, has launched several funds in the last 2 years and now has more than $450 million in assets under management….”

Comments »Hopefully Slowing Worker Productivity Will Inspire More Hiring

“WASHINGTONU.S. worker productivity barely grew from January through March after shrinking in the final three months of 2012. Weak productivity growth could prompt employers to hire more if consumers and businesses continue to increase spending.

The Labor Department says productivity rose at a seasonally adjusted annual rate of 0.7 percent in the first quarter, after shrinking 1.7 percent in the previous quarter.

Labor costs increased at a seasonally adjusted annual rate of 0.5 percent, below the fourth quarter’s 4.4 percent gain….”

Comments »So What are Hedge Funds Buying These Days ?

“Several weeks after the end of each fiscal quarter, the SEC requires hedge funds and many other major investors to file 13Fs which disclose many of their long-equity positions in U.S. stocks as of the end of that quarter. These filings come shortly after an investor buys 5% of a company’s outstanding shares, and can therefore provide initial ideas from these investment managers for further research. Here are five stocks which hedge funds have bought recently:

Billionaire George Soros reported a position of over 17 million shares in J.C. Penney JCP +2.99% , the troubled retailer backed by Bill Ackman’s Pershing Square. Revenue fell 25% in J.C. Penney’s most recent fiscal year compared to the previous one, with resulting operating losses of about $1 billion; the CEO recently left the company following what has been a failed turnaround.

Wall Street analysts are forecasting continued net losses this year and next year, though the consensus is that the company will improve over that time frame. Soros’s involvement is interesting, but we still wouldn’t consider J.C. Penney a buy right now.

Blue Mountain Capital Management, which is managed by Andrew Feldstein and Stephen Siderow, had not owned any shares on Lexmark LXK +0.03% at the beginning of 2013, but has since purchased 3.6 million shares, giving it 5.6% of the company.

Lexmark rose after its first-quarter results beat expectations, even though revenue was down 11% vs. a year earlier and earnings-per-share (EPS) fell by 36%. The sell-side is bullish, with the stock trading at eight times forward-earnings estimates, though we would be skeptical of their optimism. We would note that Lexmark pays a dividend yield of 4.7% at current prices and dividend levels.

Billionaire Ken Griffin’s Citadel Investment Group has bought additional shares of Halcon Resources HK -11.20%, giving the fund a total of over 18 million shares in its portfolio. Halcon is a $2.5 billion market cap oil-and-gas-exploration-and-production company; despite the fact that its production mix is about 70% oil (which currently has a more favorable market environment than natural gas), it experienced an operating loss in 2012 due to higher costs. The forward-earnings multiple is only nine, but we think that we would prefer to look at other shale E&P companies such as Continental CLR -0.74% and KodiakKOG -1.89% …..”

Comments »Pimco’s Gross: Recession Unlikely in the US

“The U.S. economy doesn’t look headed for recession in the next 12 months, but it’s no sure thing, says Bill Gross, co-chief investment officer at Pimco.

“That importantly depends on the global environment — Euroland, and how quickly they come out [of their recession,] and China, that vast mystery of growth that supposedly grows forever at 7.5-8 percent,” he told CNBC.

“I would watch those two areas to see whether or not the U.S. will be ultimately affected,” he added,

As for financial markets, “we’re not looking at Armageddon, but we’re looking at an increasingly risky environment.”

And why is that? “Because real growth has not been produced by these quantitative easing measures, and some day there will be consequences,” Gross explained.

Asked whether the stock market’s rise to record highs stems more from the Federal Reserve’s easing or improving corporate fundamentals, Gross said it’s both.

“Stock prices have been artificially elevated by the Fed’s check buying, no doubt,” Gross noted. …”

Comments »$GILD Pops 5% on News a Phase 2 Trial Has Eliminated Hep C

“May 2 (Reuters) – Gilead Sciences Inc on Thursday said almost all patients taking a fixed-dose combination of two of its experimental hepatitis C drugs appeared to have eliminated the liver virus after either 8 weeks or 12 weeks of treatment in a small mid-stage study.

The data could help Gilead, whose shares rose 4 percent, remain in the lead among drugmakers racing to develop better medicines for the potentially dangerous condition that also require far shorter durations of treatment…”

Comments »Roubini: Fed Risking Sequel to 2008 Financial Crisis

“The Federal Reserve’s commitment to loose monetary policy is likely to lead to asset and equity bubbles in the next two years which could be worse than the previous crisis, renowned economist Nouriel Roubini said in an opinion piece for Project Syndicate.

Roubini, co-founder and chairman of Roubini Global Economics famously dubbed Dr Doom for his accurate prediction of the 2008 financial crisis, wrote earlier this week that “the problem is that the Fed’s liquidity injections are not creating credit for the real economy, but rather boosting leverage and risk-taking in financial markets.”

“The issuance of risky junk bonds under loose covenants and with excessively low interest rates is increasing; the stock market is reaching new highs, despite the growth slowdown; and money is flowing to high-yielding emerging markets,” he added.

According to Roubini, a slow exit from the Fed’s quantitative easing (QE) policy would be similar to 2004, when the central bank began to slowly raise rates. Between June 2004 and December 2007, the Fed raised rates in 25 basis point increments. The gradual rate hikes were blamed for keeping monetary policy accommodative for too long and worsening the housing bubble….”

Comments »Easy Money Helps Investors While Hurting Real Home Buyers

“Michael Marchillo, a plumber, has been trying and failing for months to buy a bigger home for his family here in Sin City. He was pre-qualified by a bank for a $130,000 mortgage, which a year ago would have landed a typical three-bedroom home in the area. No more. Now, the 36-year-old says, it’s hard to compete with “greedy investors” who come to the table flush with cash for quick deals.

Marchillo is on to something. The once-beleaguered Las Vegas housing market has been on fire since investment firms led by Blackstone Group, Colony Capital, and American Homes 4 Rent began buying homes here some eight months ago, backed by $8 billion in investor cash to spend nationally.

These big investors and a handful of others have bought at least 55,000 single-family homes across the U.S. in the past year. In the Vegas area alone, they have accounted for at least 10 percent of the homes sold since January 2012, according to a Reuters analysis of housing transactions.

(Read More: US Pending Home Sales Tick Upward in March)

That added firepower helps explain why home prices in this metropolitan area of 2 million people are up 30 percent over a year ago, far more than the national average of 10 percent. Permits for new home construction are up 50 percent, twice the national average.

Local real-estate broker Fafie Moore says private-equity firms and hedge funds have largely “crowded out” local buyers like Marchillo. That’s because the investment firms have broadened beyond their initial focus —buying homes at foreclosure auctions. Now, they are also bidding for homes listed by private owners and banks.

In a sign of how freely the money is flowing, Moore notes around 60 percent of all sales are in cash these days.

Fellow broker Trish Nash said she has seen cases where a home gets listed and quickly draws a dozen bids, many in cash. Realtors are talking about a mini-bubble forming here.

“There is an artificial appreciation in our market,” says Nash. “I know (the big investors) say they aren’t going to be flippers, but for them it is all about the bottom line.” …”

Draghi Pledges Easy Monetary Policy for as Long as Needed

“The European Central Bank on Thursday cut its main refinancing rate by 25 basis points to 0.5 percent, the first rate cut since July 2012 in a move aimed at boosting the ailing euro zone economy.

But it failed to announce any new measures to help the economy directly.

“Our monetary policy stance will remain accommodative for as long as is needed,” Mario Draghi, the President of the European Central Bank said at a press conference after the decision.

The bank also said it would keep its main refinancing operations until at least July 2014. Those operations, known as “fixed rate full allotment” allow banks under stress to access unlimited ECB liquidity at a fixed rate in return for collateral.

“The fixed rate full allotment will basically represent liquidity insurance for the banking system, so frankly, there can’t be fears of lack of funding for not lending,” Draghi said. “In other words, this is a kind of measure that benefits all banks.”

The 25 basis point rate cut was widely expected after data this week showed record high unemployment for the euro zone and lower-than-expected inflation.

Calls for the ECB to announce a funding scheme for the real economy have grown stronger in recent weeks amid evidence that the ECB’s cheap loans to banks have not trickled down to small- and medium-sized enterprises….”

Comments »