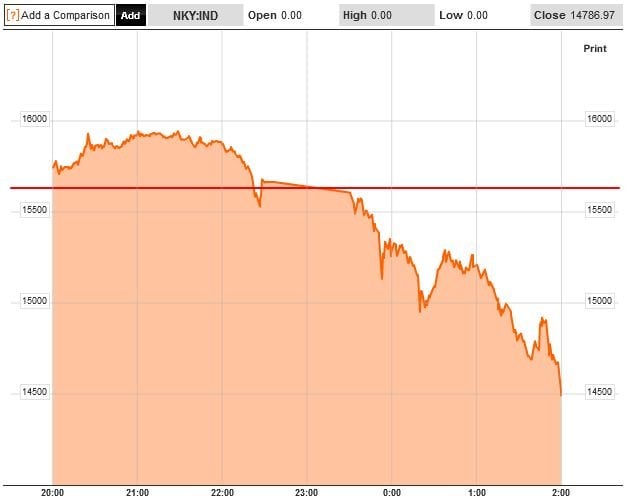

“As the global equity and bond markets grind ever higher, abundant signs exist that we are once again living through an asset bubble – or rather a whole series of bubbles in a variety of markets. This makes this period quite interesting, but also quite dangerous.

With equity and bond markets at or near all-time record highs, with all financial assets consistently shrugging off bad – or worse – news as the riskiest of assets continue to find consistent upward bids, we find ourselves in familiar and bubbly territory.

I can summarize my thoughts in one sentence: How could this be happening again so soon?

In times past, it took one or more generations between bubbles for people to financially recover and forget the painful lessons before they would consider doing it all again. Yet here we are, working our way through our third set of bubbles in less than two decades, which must be some sort of world record.

I will confess to my biases right up front: I have always been deeply skeptical of both the practice of running up debts at a faster pace than income (the common practice of the entire developed world over the past several decades) and the idea that the solution to too much debt is more debt, enabled by cheaper money courtesy of thin-air money printing.

In short, instead of seeing central banks as sophisticated stewards of intricate monetary policies, I view them as serial bubble-blowers and reckless debt-enablers whose only response, when confronted with the inevitable consequences of their actions, is to serve up more thin-air money at an even cheaper rate. And when that doesn’t work, then they simply try even more of the same, but in larger quantities.

While I think central banks are populated by earnest people with impressive credentials who have rationalized their actions as being necessary and in service of the greater good, I also think that the biggest ones hold an entrenched set of institutional views that are dogmatic, fail to incorporate the idea of economic and resource limits, and are seemingly immune to healthy introspection.

Somewhere along the way, I would have hoped they might have noted that each new crisis is larger than the one before….”

Full article

Comments »