“China may hold off tightening monetary policy after growth in services and manufacturing weakened, underscoring challenges for the nation’s leaders as they open the annual session of parliament tomorrow.

Expansion in industries including retailing, transportation and banking was the slowest in five months in February, an official survey of purchasing managers showed yesterday. Gauges released March 1 pointed to manufacturing growth cooling.

Premier Wen Jiabao will outline economic policies at the start of the National People’s Congress session in Beijing as the government tries to sustain a recovery from the slowest growth in 13 years without triggering consumer and asset-price inflation. While authorities have pledged to boost incomes and consumption, last week’s decision to intensify a three-year effort to tame the property market may damp the nation’s rebound.

“The recent batch of data suggest the current recovery is relatively weak compared to past ones, which means the government may delay the timing of monetary tightening to support growth,” said Zhang Zhiwei, chief China economist at Nomura Holdings Inc. in Hong Kong, who previously worked for the International Monetary Fund.

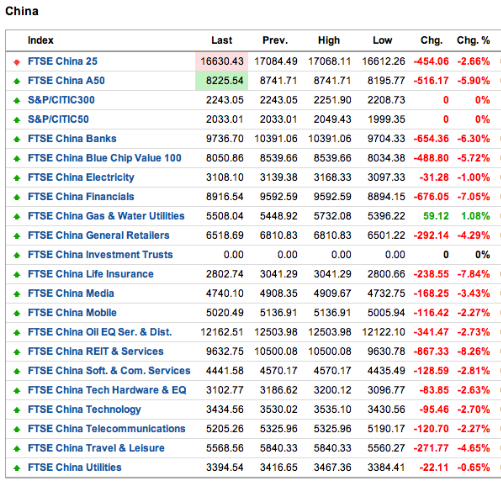

The Shanghai Stock Exchange Property Index fell 7.6 percent as of 9:41 a.m. local time, on pace for the worst decline since 2009. The benchmark Shanghai Composite Index dropped 2.2 percent.

A services industries gauge fell to 54.5 in February from 56.2 in January, the National Bureau of Statistics and China Federation of Logistics and Purchasing said yesterday.