It’s all about the money. New message to children: crime is good if you can pay your way out of trouble.

Comments »Monthly Archives: September 2012

For Every $1 Added to the Economy, Obama Added More Than $3 in Debt

Since Obama has taken office ….

[through Q2 2012 for comparative purposes]

–> For every $1 added to the economy, we’ve added more than $3 in debt

–> added $5.23 trillion in debt vs. $1.68 trillion to the economy

–> 50% increase in debt vs. 12% increase in economic output

Total Public Debt:

$10,626T [Jan 20, 2009] $15,856T [Jun 30, 2012]

–> $5.23 trillion increase in debt

[source: Treasury Dept]

……

GDP

$13,923T [Q1 2009] $15,606T [Q2 2012]

–> $1.68 trillion increase in GDP

[source: BEA]

Comments »

White House Demands Military Prisons for Americans Under NDAA

Analysts See 20% Upside in Old Man Buffet’s Outfit

“Berkshire Hathaway Inc. (NYSE: BRK-B) rarely gets analyst research calls from Wall St. research and independent research shops. When it does, many investors tend to pick apart the data hoping to find one more tidbit of data that they did not know about Warren Buffett and one of the greatest growth stories of the 20th century. The call is right on the heels of Warren Buffett telling the board that he has finished his prostate cancer treatment…”

Comments »Risk Indicators Hit a 2 Year Low

Aswath Damodaran: The Fed’s Latest Plan To Save The Economy Looks Like A Step Toward Insanity

“I am sure that I am missing some significant piece of the puzzle, but as I watch the news coverage and market reaction, I am reminded of one of my favorite movies, ‘Groundhog Day,’ he writes in a new blog post.

“I was a skeptic on the efficacy of QE2 and Operation Twist and I remain unpersuaded on QE3. If the definition of insanity is that you keep trying to do the same thing over and over, expecting a different outcome, then we seem to be fast approaching that point with the Fed.”

Damodaran runs through some of the risks and implications of the the Fed’s latest plan. Read about it at the his blog, Musings on Markets.”

Comments »Morgan Stanley’s Adam Parker is Still Calling for 1167 S&P or Bust on Global Slowdown and Weak Earnings

“In a massive presentation on his year-end predictions, Parker explains why:

- Earnings growth is very poor.

- Earnings are volatile, and that’s also ominous.

- Historically, extreme rates (both high and low) are bearish. Our current sub-zero interest rates are bad.

- Historic price-to-earnings ratios at this time of year suggest a downturn. “Investors are overpaying for cyclical earnings!” he exclaims, adding, “most industry groups appear to be over-earning right now.”

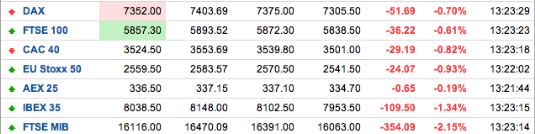

European Markets Are Doing Awesome and Amazing

Dow 17,000 by Next Year? Why Not, says Wharton’s Siegel

“The Dow Jones Industrial Average could conceivably hit 17,000 next year, said Wharton School finance professor Jeremy Siegel.

Siegel in February said the popular stock-market measure could hit 15,000 by 2013, as despite gains over the past few years, historical valuations show stock prices have room to rise.

The index closed Monday at 13553.10.

“Going to the 15,000 level, which a few months ago people were very skeptical of that, we’re talking about the end of 2013. We only need to go up 10 percent from current levels. I’m not saying it’s a slam-dunk. Nothing’s a slam-dunk in the market. Odds are 3-to-2-to-1 on that,” Siegel told CNBC.

“The 17,000, when I first gave the prediction late last March, I said it was a 50-50 proposition. But I think that that’s a goal that is very, very attainable given the market circumstances,” Siegel added.

“That’s what the statistics show, that there was almost a 50 percent chance on past historical valuations and periods that the market would reach that 17,000 by the end of next year.”

Comments »Currency Expert Ed Moya: QE3 Will Devalue Dollar, Do Little Else

“The Federal Reserve’s decision to unleash a third round of bond purchases from banks to stimulate the U.S. economy will likely weaken the dollar and do little else, said Ed Moya, chief currency strategist for Trading Advantage, a leading trading education firm.

The Fed recently announced plans to buy $40 billion in mortgage-backed securities held by banks every month until the economy and labor market improve, a monetary policy tool known as quantitative easing (QE).

The announcement marks the third time the Fed has rolled out QE measures to jolt the economy since the 2008 financial crisis, with the first round seeing the Fed snap up $1.7 trillion in mortgage securities and the second round seeing the Fed buy $600 billion in Treasury securities held by banks.

QE aims to stimulate the economy by injecting the financial system full of liquidity via bond purchases that push down interest rates to encourage investing, job demand and stock market gains.

Fed Chairman Ben Bernanke claimed in a recent speech that past rounds of QE helped contribute to the creation of 2 million jobs; however, such tools carry diminishing returns and this latest round will likely do little to put jobless Americans back to work, Moya said.

“We’re ultimately going to see that it’s not going to be as effective as the first two and, ultimately, it’s just going to devalue the dollar,” Moya told Newsmax.TV in an exclusive interview.

Watch our exclusive video. Story continues below…”

Comments »$MOT Releases the Razor i Powered by $INTC

“Intel’s mobile chipsets have popped up in a handfulof devices over the past few months, but Motorola — arguably the biggest of Intel’s smartphone partners — has been content to keep quiet about the fruits of its efforts longer than others.

Well, that wait is finally over. Motorola officially revealed the Intel-powered RAZR i at a (relatively brief) press event in London today, and as early rumors foretold it looks nearly identical to the recently-released RAZR M.

Seriously, not even Motorola could tell them apart — the two phones look so similar that Motorola Europe erroneously used an image of the Verizon phone in its announcement photo on Facebook. Way to go, guys.”

Comments »Twitter Announces a New Design

“Today, Twitter’s CEO Dick Costolo announced anew design with a focus on profile pages and an iPad update on the TODAY Show, live. The show teased “big changes” coming to Twitter, and drew it out pretty well giving a company tour.

The company announced that there are over 140 million users, with 340 million tweets per day, currently. Twitter also has an $8B valuation, which is just massive, not to mention a whopping 900 employees in San Francisco alone.

At times, this felt like a commercial for Twitter, discussing the free snacks they get.

“Twitter brings you closer to the action and your heroes” said Costolo.”

Comments »Lenovo Acquires U.S. Software Firm Stoneware

“BEIJING—Lenovo Group Ltd. 0992.HK +0.47% continued its buying streak Tuesday as it announced plans to acquire U.S.-based software company Stoneware Inc. for an undisclosed sum in a bid to expand services allowing customers to link devices directly over the Internet.

The acquisition won’t add significantly to earnings, but it will help the company add new technologies, Lenovo said in a statement.”

Comments »IMF: ‘Serious Challenges’ in Designing Bailouts for Euro Zone

“The International Monetary Fund (IMF) acknowledged on Monday it faced “serious challenges” in designing bailout programs for troubled euro zone countries mainly because it was restricted by the rules of the 17-member currency zone.

Analysts and some IMF member countries have expressed concern that the Fund has compromised on tough conditions in its bailouts in Europe where it has been part of a “troika” of international lenders in Greece, Ireland and Portugal.

But the IMF preliminary assessment found that the Fund actually had to impose extensive structural conditions on euro zone countries—where deep labor and market reforms were needed—compared to programs elsewhere.

“While it is difficult to judge whether all the conditions were critical, the increase in the number and depth of (Euro Area) conditions warrants scrutiny,” according to the review, which analyzed conditions attached to 159 IMF programs in the decade to September 2011.”

Comments »Gone Viral: The Controversial Mitt Romney Video

Here is a transcript and video that everyone is squawking about this morning…

Comments »Gapping Up and Down This Morning

Gapping up

OXGN +40.3%, DOLE +9.5%, NBS +3.6%, DEO +1.6%, BRCM +0.3% ,

VOD +1.4%, TYC +1.1%, OCZ +2.0%, LNG +7.2%, AZN +0.6%, SNY +0.4%,

SHF +3.8%,

Gapping down

OCZ -8.7%, AMD -6.5%, CLWR -5.2%, BCS -3.8%, DB -3.2%, CLF -2.9%,

FTE -2.8%, CNDO -0.8%, LL -1.3% , BBBY -0.8%, HNT -1.8%, MOH -2.8%,

WMS -3.1%,

Comments »Upgrades and Downgrades This Morning

ABT, AA, AB, MDRX, ADI, AVB, BBBY, BRCM, ESS, INTC, JIVE, LAMR, NOV, NWSA, NVDA, SLB, TASR, TXN, DK, PSX, MPC, WNR,

Comments »In Play and On the Wires

MORGAN STANLEY: The World Economy Is Stuck In The ‘Twilight Zone’

“Sept. 18 (Bloomberg) — The world economy is sliding into a “twilight zone,” trapped between outright expansion and renewed recession.

“It could go either way,” said Joachim Fels, chief economist at Morgan Stanley in London, who coined the description in an Aug. 15 report. “It doesn’t take much to tip us into a global recession.”

The quandary is forcing central banks back to the fore, with the Federal Reserve last week embarking upon a third round of quantitative easing and the European Central Bank standing ready to buy bonds. While the moves were enough to propel the Standard & Poor’s 500 Index to its highest since 2007, the test is whether they can lift the global economy from its so-called stall speed.”

Comments »Bob Janjuah is Close to Getting Stopped Out on His Bearish Call

“Everyone agrees that the Federal Reserve’s unlimited QE and the ECB’s OMT plans are historic. Both plans involve buying tremendous amounts of debt on the markets in efforts to suppress borrowing costs and ultimately stimulate economies.

Nomura contributing strategist Bob Janjuah, however, thinks that history won’t remember these actions very kindly. From his latest note to clients:

“We can now clearly see that the only solutions that are offered by the Fed and the ECB are the extension of the same failed policies that got us into our financial and economic despair in the first place. Namely MORE debt, MORE bubbles and MORE monetary debasement. When future historians look back for the day that the West lost its status as global economic superpower, and for the day that the West lost its aspirational leadership in terms of sound economic and prudent financial system management, I feel that September 2012 may be seen as a significant pivot point.”

This criticism is not unexpected by those who follow Janjuah.

However, his note also revisits his big call of the year: that stocks would rise into the fall, and then plummet by 20% to 25%.

In short, Janjuah had said if the S&P 500 rallied to 1,450, his call was off.

From his note today:”

Comments »