Monthly Archives: August 2012

No Church in the Wild

[youtube:http://www.youtube.com/watch?v=FJt7gNi3Nr4 450 300]

Comments »Harvard Study: How America Became Stupid

Fun With GM Corn

Okay so the effects are unknown, but does it not behoove us to analyze and understand further the ramifications of our behavior ?

Comments »Study: Chemotherapy Can Help Cancer to Spread, Study Moves Chemotherapy in a New Direction

An interesting study finds that chemo can help cancer to grow. This is in fact a good thing according to scientists since it allows for new methods of attack with chemotherapy.

Comments »Good news: Earnings Growth is Slowing

Hulbert’s latest article makes this fascinating statement:

The stock market historically has performed better when earnings growth is slower than when it is faster.

Read the rest of the research here.

Comments »Uninvestable Water

Jared Woodard from Condor Options breakdowns three investment themes for water then describes why the water investment well may still be dry.

Read the article here.

Comments »The Economic Impact of a Slight Increase in House Prices

Bill McBride writes, If I’m correct about house prices bottoming earlier this year – and the CoreLogic report released this morning is another indicator that prices might be increasing a little – a key question is: What will be the economic impact of slightly increasing house prices?

It is a great question, and you’ll find his answers here.

Comments »Top Wall Street Strategist: ‘We’re On The Verge Of The Next Great Bull Market’

Do stocks lead the economy or does the economy lead stocks?

After getting off to a stellar start at the beginning of the year, markets and the economy have cooled off.

In an interview with Bloomberg TV however, BMO’s Brian Belski says that despite the lack of investor confidence, stocks are set to do well.

Read the rest here.

Comments »Moody’s: Sovereign Default Remains High Even After Distressed Exchanges

New York, August 07, 2012 — Historical evidence shows that the risk of re-default tends to remain high after sovereign distressed exchanges, Moody’s Investors Service says in a new report that analyzes the modern history of sovereign bond defaults and the haircuts imposed on investors.

The new report, entitled “Sovereign Defaults Series: Investor Losses in Modern-Era Sovereign Bond Restructurings,” is available on www.moodys.com. Moody’s subscribers can access this report via the link provided at the end of this press release.

“Thirty-seven percent of the 30 sovereign debt exchanges since 1997 were followed by further default events,” explains Elena Duggar, Moody’s Group Credit Officer for Sovereign Risk and author of the report. “These high rates of re-default after a distressed exchange in the sovereign sector are similar to the experience in the global corporate sector and explain why ratings often remain low, in the Caa-C rating range, following distressed exchanges.”

Since 1997, there have been 30 distressed exchanges on sovereign bonds, by 22 sovereign issuers. Moody’s new report pinpoints four key findings:

Read here:

Comments »Can MI End Senator Debbie Stabenow’s Reign of Terror?

Knowing how many poor idiots are in this state, I’m guessing no.

Please let me be wrong…

No more than a sliver of the statewide vote is in, but former U.S. Rep. Pete Hoekstra has a lead on the competition in the race to take on U.S. Sen. Debbie Stabenow this fall – at least for now.

The Associated Press reports that with 12% of the vote in, Hoekstra, from Holland, had 55% of the vote compared to 32% for Cornerstone Schools founder Clark Durant.

Most polls showed Hoekstra with a strong chance of winning the Republican nomination going into Tuesday’s primary balloting but Durant had picked up some key endorsements. He and his supporters also were trying to strike back with ads questioning Hoekstra’s record in Congress.

The polls closed at 8 p.m. except for three counties in the western part of the Upper Peninsula, where they were set to close at 9 p.m.

Read here:

Comments »The Problem With Mandates Like Ethanol

NEW YORK (CNNMoney) — The drought that’s killing crops across the Midwest and sending corn prices to record highs has revived calls to end or ease the government’s requirement that corn-based ethanol be blended with gasoline.

Current rules stipulate that nearly 10% of the nation’s gasoline supply come from corn-based ethanol. To make that ethanol, up to 40% of the country’s annual corn production can be required.

Read here:

Comments »Gas Prices Run $0.30 Higher In 5 Weeks

NEW YORK (CNNMoney) — Gas prices continued their slow but steady march higher Tuesday, surpassing a nationwide average of $3.63 cents a gallon on the back of refinery problems in the United States and higher crude oil prices globally.

Nationwide average gasoline prices are now 30 cents higher than they were just five weeks ago. They are now at the midway mark between this year’s high price of $3.94 a gallon — hit April 5 — and the recent low of $3.33 hit just over five weeks ago, according to AAA.

Read here:

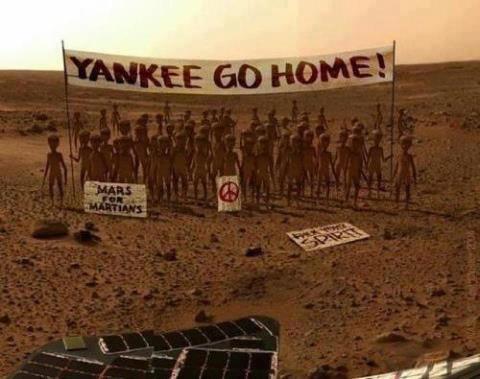

Comments »New Pictures Emerge From M-A-R-S

Papa Johns Claims ‘Obamacare’ Will Raise Pizza Prices $PZZA

via poltiico.com

Comments »Pizza chain Papa Johns told shareholders that President Obama’s health care law will cost consumers more on their pizza.

On a conference call last week, CEO and founder John Schnatter (a Mitt Romney supporter and fundraiser) said the health care law’s changes — set to go into effect in 2014 — will result in higher costs for the company — which they vowed to pass onto consumers.

“Our best estimate is that the Obamacare will cost 11 to 14 cents per pizza, or 15 to 20 cents per order from a corporate basis,” Schnatter said.

“We’re not supportive of Obamacare, like most businesses in our industry. But our business model and unit economics are about as ideal as you can get for a food company to absorb Obamacare,” he said.

Today’s Hybrid Movers

Here’s a list of today’s high volume/hybrid movers, click here for charts.

Comments »Market Update

U.S. equities have very little to complain about and as a result we have another tepid rally on our hands. Hopefully, we will not see a give back like yesterday.

Earnings, a clam put, and hope for Europe resolving their debt problems fuels the cautious rally.

Shoert have to cover as markets continue to drift higher into the heaviest shorted market in 5 years.

The S&P has poked its nose above 1400.

Europe has pared any losses seen during the trading session. Europe was able to ignore some recessionary data and the Standard Charter banking scandal.

Oil is up firmly in today’s session.

Comments »Update: What The Largest Companies are Saying About the Global Economy

“Earnings season is heading into the final quarter, as more than 85 percent of S&P 500 companies have already reported results.

Rather than dwell on company-specific performance, we wanted to see what these industry leaders were saying about the global economy.”

Comments »El-Erian: Fed Can Only Postpone the Storm

A Closer Look at This Quarters Earnings

Profits have hit a tenth straight q of upside, but that may all be about to change.

Comments »