Monthly Archives: July 2012

“The Impairments of Capital Formation are Now So Profound That No One and Nothing Can Be Trusted’

“News that that a swarm of termites deep inside the British banking system have been fiddling the interbank interest rates (LIBOR) for years in order to systematically vacuum a few billion pence off the exchange floors for themselves is the latest blow to the credibility of the global money system – and probably a fine overture to a looming climactic implosion of the gigantic, creaking, smoldering, reeking, duck-taped edifice of broken promises, booby-trapped hedge obligations, counterparty follies, central bank euchres, sovereign flim-flams, and countless chicanes too various, dark, and deep to smoke out.”

Comments »Stocks Pare Early Morning Gains as Materials and $AA Lead the Way Down

$JCP Get Taken to the Wood Shed As Credit Suisse Lowers Estimates

JC Penny is getting hit hard as sales are tracking less than that of Q1, which was poor to begin with, and there are reports that shelves are stocked so much that orders are being canceled.

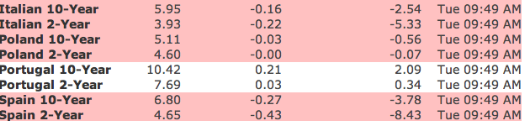

Comments »Italian and Spanish Yields are Down, And So is the Euro

Quant Funds Continue to Go With Market Neutral Portfolios

“A couple of trends have been developing in the hedge fund space that are worth noting. It seems that institutional investors (and fund of funds managers) continue to support the so-called “market neutral” strategies. Typically these funds will run a leveraged portfolio on a gross basis but try to neutralize it via long/short stocks or stock indices. They tend to use various beta weighted measurements to determine how stocks will respond to market movements in order to construct what they view as a “neutral” book.”

Comments »Who’s Next on the Biotech Chopping Block ?

RIM Comes Up With a Plan to Save Itself

OECD Warns of Long-Term Damage to Unemployed

“The rate of unemployment in developed economies will remain high for longer than previously expected, increasing the risk that a growing number of workers will find themselves permanently marginalized in the jobs market, the Organization for Economic Cooperation and Development said Tuesday.”

Comments »Merrill Tries to Shift Investor Portfolios to Safer Heaven Investments Without Creating a Panic

“This year, investors have been gobbling up US treasuries in a desperate effort to search for safety. But would they have done better to grab Australian sovereign debt or Singaporean bank bonds, as a shield against political incompetence in a fractious world?

If the wealth management arm of Merrill Lynch is to be believed, the answer could be “yes”. This month, the US broker is quietly circulating a memo which tells its affluent clients to reposition themselves — and their portfolios — for a fundamental geopolitical shift.”

Comments »Weak Sales Deflate Business Owners’ Optimism: Survey

“Small business owners’ pessimism about the U.S. economy seems to be rising with temperature. For the second month in a row, the Small Business Optimism Index declined, according to a monthly survey by the National Federation of Independent Business.

“Optimism fell off last year at the same time, but not like this,” said William Dunkelberg, chief economist for the NFIB. The index was down three points in June, after a one-tenth of a point decline in May.”

Comments »$220 Million of Customer Funds Goes Missing at PFGBest

The founder of the firm attempted suicide and a broker is missing. A mini MF Global drama for investor confidence….

Comments »What Does $AA & $AMD Earnings Have to Say About China ?

Looking into $AA earnings we get some clues about China.

$AMD is out this morning with a warning blaming China for their woes.

Comments »Gapping Up and Down This Morning

Gapping up

BMTI +11.1%, SHLM +6.8%, CWTR +5.8%, ASML +9.4%, MT +3.3%,

BCS +2.1%, TS +1.8%, LNG +1.6%, BBL +1.3%, THLD +2.5%, LUV +2.1% ,

CE +1.4%, AMZN +1%, CGV +4%,

Gapping down

PCX -44.6%, MAKO -39.3%, JRCC -12.9%, AMD -9.3%, PSMT -6.4%, BZH -6.2%,

OSUR -5.8%, DRH -5%, WDFC -4.4%, BEBE -3.7%, ARR -3.2%, ACI -2.7%,

SNH -2.1%, GEVA -1.6%, SYNC -1.1% , IR -1.2% , BPI -2.3%,

Comments »Upgrades and Downgrades This Morning

AMD, AXP, APO, BPI, COF, LNG, CQP, JCP, LTD, LNKD, MM, NWSA, NCT, NTRS, LUV, STT, AMTD, TIVO, TROW, TSN, AAPL, PCX, ANR, CNX,

Comments »In Play and On the Wires

Intel to Inject $4 Billion into ASML

“Intel Corp. (INTC), the world’s largest semiconductor maker, agreed to invest as much as $4.1 billion in Dutch chip-equipment maker ASML Holding NV (ASML) in an effort to shave two years from the time to adopt new production techniques.”

Comments »Google Said to be Near a Settlement for Data Breach

$GOOG is said to be close to a settlement of $22 million for a Trade Commission probe over a data breach.

Comments »Scranton PA Cuts All Salaries to Minimum Wage as They Try to Stave Off Cash Flow Problems

The mayor is also considering a tax hike of 29% immediately with a potential rise to 78%.

Comments »