Mon Jun 4, 2012 8:11am EST

“Spanish Prime Minister Mariano Rajoy ratcheted up pressure on German Chancellor Angela Merkel to back new ideas for a resolution of the debt crisis as he urged European leaders to bolster efforts to protect banks.

With markets bracing for further deterioration in Spain’s finance sector and a possible Greek departure from the 17-member euro area, Rajoy on June 2 added his voice to calls for a more robust “banking union” in Europe, lending his support for a centralized system to re-capitalize lenders. On the same day, Merkel toughened her opposition to euro-area debt sharing, telling members of her party in Berlin that “under no circumstances” would she agree to German-backed euro bonds.”

Full article

Comments »

Mon Jun 4, 2012 8:08am EST

A little bit of good news for Spain, but i doubt anyone is celebrating.

Full article

Comments »

Mon Jun 4, 2012 8:06am EST

The Euro has remained above 2010 lows, but since Friday has had a counter trend move, not rally, despite all the negative news.

Full article

Comments »

Mon Jun 4, 2012 8:02am EST

Oil continues to fall over a slowing global economy and the future propects of what Europe’s debt crisis will do to the global economy.

Full article

Comments »

Mon Jun 4, 2012 7:59am EST

Mon Jun 4, 2012 3:59am EST

HOLY SHIT

The Tokyo market slumped to a 28-year low on Monday as Asian shares dived on fears of a nightmare scenario of euro-zone breakup, U.S. economic relapse and a sharp slowdown in China.

Investors hedged against global financial and economic crisis, heading for havens such as the benchmark 10-year Japanese government bond whose yield fell below 0.80 percent to its lowest since July 2003. Ten-year JGB futures prices jumped to a 19-month high.

Full Article

Comments »

Mon Jun 4, 2012 3:57am EST

China’s stocks fell the most in six months after the nation’s non-manufacturing industries expanded at a slower pace for a second month and fewer U.S. jobs were added than economists estimated.

PetroChina Co. (601857), the second-largest oil refiner, dropped to a record low as the Shanghai Securities News reported fuel prices may be cut and JPMorgan Chase & Co. lowered its estimate for China’s gross domestic product for the second time in a month. Sany Heavy Industry Co., China’s biggest machinery maker, declined 4.4 percent after Nomura Holdings Inc. reduced its outlook for the industry.

Full Article

Comments »

Mon Jun 4, 2012 3:56am EST

Sony Corp. (6758) dropped below 1,000 yen in Tokyo trading for the first time since 1980, when the Walkman was new, after Japan’s currency gained and the U.S. added jobs at a slower-than-estimated pace.

The shares fell 1.7 percent to close at 996 yen on the Tokyo Stock Exchange. Sony, which recorded an all-time intraday high of 16,950 yen in March 2000, last closed below 1,000 yen on Aug. 1, 1980, according to data compiled by Bloomberg.

Full Article

Comments »

Mon Jun 4, 2012 3:54am EST

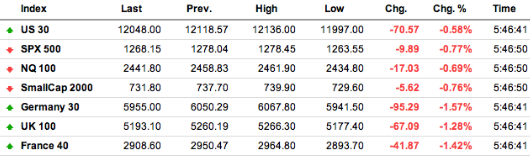

European stocks dropped on concern the euro-area debt crisis is deepening and as evidence mounted that China’s economy is slowing down. U.S. index futures and Asian shares also retreated.

Deutsche Lufthansa AG (LHA), Europe’s second-biggest airline, slipped 1.1 percent after Financial Times Deutschland reported the company may sell its catering unit. Q-Cells SE jumped 3.6 percent after a report that China’s Hanergy Solar Technology Ltd. will buy the German solar-cell and module maker’s subsidiary Solibro GmbH.

The Stoxx Europe 600 Index fell 0.7 percent to 233.53 at 8:15 a.m. in London. The benchmark measure has declined 14 percent from its 2012 high on March 16 amid growing concern that Greece will be forced to leave the euro currency union. Standard & Poor’s 500 Index futures expiring in June lost 0.6 percent. The MSCI Asia Pacific Index slid 2.3 percent.

“Sentiment has slumped after growth indicators failed to inspire markets on Friday,” Stan Shamu, a market strategist at IG Markets in Melbourne, wrote in an e-mail. “Lead indicators across the U.S., Europe and Asia are adding to fears of further economic weakness ahead in the global economy.”

Full Article

Comments »

Mon Jun 4, 2012 1:53am EST

Following last week’s resurgence and tonight’s upside reversal, it appears gold has regained safe haven status thanks to its de facto alternative currency characteristics.

Comments »

Mon Jun 4, 2012 1:50am EST

Sun Jun 3, 2012 10:41pm EST

Solar #1 on a weekly change?

Comments »

Sun Jun 3, 2012 10:20pm EST

Venus will pass in front of the sun in the early am of June 5th. The Mayans regarded this as a very special event and indeud it is on account of it being rare.

Full article

Comments »

Sun Jun 3, 2012 10:14pm EST

Splinter the party right into elections…

Full article

Comments »

Sun Jun 3, 2012 10:11pm EST

“top-down control dictated by governments”

Full article

Comments »

Sun Jun 3, 2012 10:07pm EST

Why am i not surprised ?

Full article

Comments »

Sun Jun 3, 2012 9:54pm EST

[youtube://http://www.youtube.com/watch?v=WA7rGotO-oI 450 300]

Comments »

Sun Jun 3, 2012 9:49pm EST

“According to Citigroup, US and European regulations force banks to purchase government debt; which will only lead to the debt crisis worsening.

Citigroup conducted a study that showed regulators mandate banks to buy government debt against internal capital requirements. Yet other rules facilitate the stability of the government bonds market.

In this scenario, the government issues more debt that ultimately will result in the economic destruction of governments. While they are unable to produce bond payments, this leaves banks with the unfortunate reality of billions of dollars of “toxic debt” Hans Larenzen, Citigroup strategist claims.”

Full article

Comments »

Sun Jun 3, 2012 9:47pm EST

So can we trust the source and that the so called chemtrails are not made of sugar, spice, and all that’s nice ?

I think so.

Full article

Supporting article

Comments »

Sun Jun 3, 2012 9:46pm EST

“There’s nothing stopping them. They feel like they have the right to do anything they want to anyone who gets in their way.” What they want, in this case, is to hurt her and her family. Or at least to jabber at length about maybe doing it.

Read the article here.

Comments »