Germany does not want to back the whole bag; especially if they can not impose harsh medicine to get countries to bend to their ways.

Comments »Monthly Archives: June 2012

Netflix Plays With Fire by Entering CDN Market

$NFLX’s announcement of entering into the CDN market has not been received well. This reminds me of Corning moving into fiber optics. Where does $NFLX get the coin to make a capital intensive move ?

Comments »The Top 5 Most Heavily Shorted Stocks on the S&P

FLASH: Another One Bites the Dust

Top al Qaeda leader Abu Yahya al Libi is dead via @NewYorkPost

Comments »Recent US LBO’s Have Not Destroyed Recoverable Value Of Companies

New York, June 05, 2012 — Creditor recoveries when US leveraged buyouts default are nearly equal to recoveries in non-LBO defaults, Moody’s Investors Service says in a new special comment, “Lessons from 200 LBO Defaults.”

Of the more than 1,000 US defaults in Moody’s Ultimate Recovery Database, 200 involved companies that had undergone leveraged buyouts since 1988. The average family recovery in those LBO defaults was 54%, compared with 55% in the more than 800 defaults at companies that had not experienced LBOs.

“The high leverage of LBOs has not translated into lower creditor recoveries in defaults of companies with private equity owners or other financial sponsors,” says David Keisman, a Moody’s Senior Vice President and author of the report. “While the LBO sponsors could not spare these companies from defaulting — and may have prompted defaults through high leverage — the average family-level recovery rate in these situations was nearly the same as the rate at the non-LBO companies.”

One of the main reasons LBO recoveries have been in line with non-LBOs is the high proportion of distressed exchanges and prepackaged bankruptcies among defaulted LBOs. These types of defaults typically yield higher family-level investor recoveries than regular bankruptcies. Less than half of LBO defaults occurred through regular bankruptcies (not prepackaged), compared with nearly two thirds of non-LBO defaults, Moody’s said.

The average recovery for the bank debt at the top of a company’s capital structure was less in LBO defaults (75%) than in non-LBOs (83%) because the wide use of bank debt in LBOs left a smaller cushion of subordinated debt tranches to takes losses first.

Read more here:

Comments »Early Lunch Break: Scary But Safe…Like the Stock Market

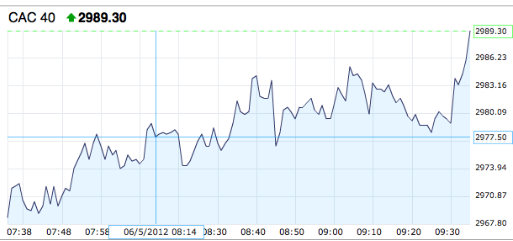

Europe Heads Into the Close High on Hopium

European markets are managing to have faith in the hopium of the G-7 conference call.

Comments »Barry Ritholtz Joins the Gary Shilling Band Wagon; S&P to 850 Over a Multi Year Period

Ritholtz says were in a secular bear market and that recession could take 30% of current S&P levels by 2015.

Comments »Bloomberg Research Suggests $JPM Q2 Loss Will Be Roughly $4.2 Billion

Preliminary research suggests a pretax loss of $0.65 cents per share; far above Dimon’s initial estimates of $0.25 per share.

Comments »How $FB Can Avoid the Yahoo Debacle

“Which new media platform has rocketed to hundreds of millions of unique visitors, provides both utility and entertainment for the masses, and has become the destination of choice for its generation? If this were 1999, Yahoo! would be your answer. Today, that torch has been handed to Facebook. And with good reason, since they have embedded their ubiquitous social network of nearly 1 billion members into a large part of people’s lives and the digital ecosystem.”

Comments »$HERO Offers A Nice Discount to a Recent Insider Purchase

“There’s an old saying on Wall Street about insider buying: there are many possible reasons to sell a stock, but only one reason to buy. Back on May 31, Hercules Offshore Inc’s Director, Thomas R. Bates Jr., invested $137,000.00 into 40,000 shares of HERO, for a cost per share of $3.42. Bargain hunters tend to pay particular attention to insider buys like this one, because presumably the only reason an insider would take their hard-earned cash and use it to buy stock of their company in the open market, is that they expect to make money.”

Comments »Berkshire Partners Sees Party Times Ahead

Get Your Bailed Out Bank Stocks ‘Ova Herea’ (sic)

The treasury is selling positions in seven bailed out banks. Gots (sic) to get rid of TARP holdings b4 Europe falls.

Comments »Citi Presents Notes on the Global Consumer

Oracle Buys Data Miner Collective Intellect

“(Reuters) – Oracle Corp will buy Collective Intellect, which helps businesses to get information about consumers from Facebook and Twitter pages.

The terms of the deal were not disclosed.

The deal comes a day after Oracle’s rival Salesforce.com Inc agreed to buy Buddy Media, a social media marketing company.”

Comments »Global Natural Gas Demand to Rise Sharply

“Over the next five years, global demand for natural gas will rise at an average annual growth rate of 2.7% according to a report from the International Energy Agency (IEA) entitled Medium-Term Gas Market Report 2012. The projected growth rate is more than 10% higher than the projected average annual growth of 2.4% in last year’s report.

The IEA predicts that Chinese demand for natural gas will double in the next five years…”