She made through security to board the plane. So much for security….

Comments »Monthly Archives: January 2012

Bill Clinton De-Balls Newt Gingrich

Bill Clinton, the original “comeback kid” doesn’t see much hope for a resurgence by Republican presidential candidate Newt Gingrich, dissing him in a new interview as a Romney clone because of issues the former speaker has flip-flopped on.

Clinton, who is on the cover of the upcoming issue of Esquire, puts down the speaker who has bragged on the campaign trail of how he worked with Clinton to reform welfare and balance the budget.[Check out the latest political cartoons.]

Clinton doesn’t giving any love back. In an excerpt provided to Whispers, the former president says, “As a private citizen he was for certain important health-care reforms and believed in climate change and believed there had to be a strong reaction to it. And now he’s just like Romney. Neither one of them can say what they believe to be true and get nominated. Romney’s still trying to figure out what he did as governor of Massachusetts and still appeal to this driving vituperative energy.”

Bubba also takes a shot at the GOP culture, charging that the Republican side of aisle has given up any pretence of moderation and bipartisanship. His key example is how Jon Huntsman was run out of the Republican primaries because voters saw him as a moderate and didn’t respond well to his work as PresidentObama’s ambassador to China.

“Huntsman’s economic record — and his positions on the abortion issue and other things — is every bit as conservative and considerably more consistent than the two front-runners. But he also doesn’t make any bones about being willing to work with people and thinking you ought to put your country first. When the president asks you to serve — to go to China, and you speak Mandarin Chinese and you think you can help American business and America’s national strategic interest by doing it — you do it.”

“But all of a sudden that’s disqualifying. So I think that it shows you, we’re, you know, we’re living in a time when the Republicans have only pushed harder and harder to the right. And every time the president adopts a plan that they once advocated, they abandon it and push farther to the right. But the voters can push them back.”

Comments »Depressed Harvard Business School Grads with Zuckerberg Envy are Negative on America, and Life in General

The United States is becoming less economically competitive versus other nations, with political gridlock and a weak primary education system seen as the main drag, according to a survey released on Wednesday.

In particular, the nation is falling behind emerging market rivals and just keeping pace with other advanced economies, according to a Harvard Business School survey of 9,750 of its alumni in the United States and 121 other countries.

Seventy-one percent of respondents expected the U.S. to become less competitive, less able to compete in the global economy with U.S. firms less able to pay high wages and benefits, the study found.

The findings come at a time when high unemployment is a major concern for Americans, with 23.7 million out-of-work and underemployed, and the economy the top issue ahead of November’s presidential election.

“The U.S. is losing out on business location decisions at an alarming rate” said Michael Porter, a Harvard Business School professor who was a co-author of the study.

U.S. companies, which slashed headcount sharply during the 2007-2009 recession, have been slow to rehire since the downturn’s official end and some have continued to cut. This month, Archer Daniels Midland Co (ADM.N), Kraft Foods Inc (KFT.N) and Novartis AG NOVN.XV all said they would be cutting U.S. jobs this year.

Survey respondents said they remained more likely to move operations out of the United States than back in. Of 1,005 who considered offshoring facilities in the past year, 51 percent decided to move versus just 10 percent who opted to keep their facilities in the country, with the balance not yet decided.

Respondents, graduates of the prestigious business school who were polled from October 4 through November 4, were particularly concerned about how the United States was shaping up versus emerging nations such as China, Brazil and India, with 66 percent saying the United States was falling behind.

WEAK POINTS

Among respondents who had decided to move operations out of the United States over the past year, 70 percent cited lower wages as the reason they chose a new location, pointing to what is widely seen as emerging markets’ main advantage.

While the United States held up better compared to other advanced economies, with about 70 percent saying it was keeping pace competitively, 21 percent said the U.S. was also falling behind other wealthy countries, such as those in Western Europe and Japan.

The United States’ main disadvantages compared with other advanced economies were the complexity of its tax code, the ineffectiveness of its political system and the weakness of its educational system from kindergarten through high school.

Higher education fared better, with respondents citing high-quality universities as the nation’s top competitive advantage.

Asked what the U.S. government could do to improve its competitive position, respondents top recommendations were to simplify the tax code, reform immigration policies and reduce the corporate tax rate.

Comments »Marky Mark is a Douchey Douche

Mark Wahlberg claims he could have done what hundreds of other doomed passengers couldn’t … fought off the multiple 9/11 hijackers and saved Flight 93.

Wahlberg just gave an interview with Men’s Journal … in which he states, “If I was on that plane with my kids, it wouldn’t have went down like it did. There would have been a lot of blood in that first-class cabin and then me saying, ‘OK, we’re going to land somewhere safely, don’t worry.'”

So the question … is Wahlberg’s braggadocio insulting to the dead passengers and their families?

Comments »FLASH: STATE DEPARTMENT EXPECTED TO REJECT KEYSTONE PIPELINE

FLASH: Einhorn Goes Long a Dinosaur

CNBC reports David Einhorn re-establishes long position in XRX, opens new long in DELL, & closes short position in DMND & FSLR

Comments »Fed’s Tarullo on Volcker Rule: Implementing a pain

Read the whole remark here:

Comments »My remarks today will focus on some of the issues faced in developing the interagency proposal. As I have previously noted in Congressional testimony, the goal of the Federal Reserve with respect to this and all other provisions of the Dodd-Frank Act, is to implement the statute in a manner that is faithful to the language of the statute and that maximizes financial stability and other social benefits at the least cost to credit availability and economic growth.

The Federal Reserve, the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the Securities and Exchange Commission (SEC) (collectively, the “agencies”) in November sought public comment on a proposal to implement the Volcker Rule. The Commodities Futures Trading Commission (CFTC) recently issued its substantially similar proposal for comment. Because of the importance and complexity of the issues raised by the statutory provisions that make up the Volcker Rule, the agencies initially provided the public a 90-day opportunity to submit comments. We recently extended the comment period for an additional 30 days, until February 13, 2012. The Federal Reserve welcomes comments on Volcker Rule implementation and has had numerous meetings with members of the public on this subject. We continue to post on our website all the comments that we receive and a summary of all the meetings that the Federal Reserve has had with members of the public about the Volcker Rule and all other provisions of the Dodd-Frank Act.

Summary of statute and proposal

The statutory provisions that make up the Volcker Rule generally prohibit banking entities from engaging in two types of activities: 1) proprietary trading and 2) acquiring an ownership interest in, sponsoring, or having certain relationships with a hedge fund or private equity fund (each a covered fund). These statutory provisions apply, in general, to insured depository institutions; companies that control an insured depository institution; and foreign banks with a branch, agency, or subsidiary bank in the United States, as well as to an affiliate of one of these entities.Under the statute, proprietary trading is defined as taking a position as principal in any security, derivative, option, or contract for sale of a commodity for future delivery for the purpose of selling that position in the near term or otherwise with the intent to resell to profit from short-term price movements. The statute applies only to positions taken by a banking entity as principal for the purpose of making short-term profits; it does not apply to positions taken for long-term or investment purposes. Moreover, the statute contains a number of exemptions, including for underwriting, market making-related activities, and risk-mitigating hedging activities. The implementing rule proposed by the agencies incorporates all of these statutory definitions and exemptions. The statute also authorizes the relevant regulatory agencies to permit additional activities if they would promote and protect safety and soundness of the banking entity and the financial stability of the United States.

The second major prohibition in the statute forbids any banking entity from acquiring or retaining an ownership interest in, or having certain relationships with, a covered fund. Again, the statute contains a number of exceptions, including for organizing and offering a covered fund, making limited investments in a covered fund, sponsoring and investing in loan securitizations, and risk-mitigating hedging activities. The statutory definition of a fund covered under the Volcker Rule is quite broad. The statute also quite broadly prohibits any banking entity that serves as the investment manager, adviser, or sponsor to a covered fund, or that organizes and offers a covered fund, from engaging in certain transactions with the fund, including lending to, or purchasing assets from, the fund.

The statute also prohibits otherwise permissible trading and investment activities when there is a material conflict of interest with customers, clients, or counterparties, or when the activity results in an exposure to high-risk assets or trading strategies. These are significant provisions and the agencies have specifically solicited comment on disclosure requirements and other approaches to implementing these parts of the statute.

Differentiating proprietary trading from market making

One of the more difficult tasks in implementing the statutory prohibitions is distinguishing between prohibited proprietary trading activities and permissible market-making activities. This distinction is important because of the key role that market makers play in facilitating liquid markets in securities, derivatives, and other assets.At the ends of the spectrum, the distinction between pure proprietary trading and market making is straightforward. At one end, for instance, trading activities that are organized within a discrete business unit, and that are conducted solely for the purpose of executing trading strategies that are expected to produce short-term profits without any connection to customer facilitation or intermediation, are not difficult to identify. These “internal hedge fund” operations existed at many bank affiliates for quite some time before the Volcker Rule was enacted. Firms that either are or were engaged in these non-client-oriented, purely proprietary trading businesses can readily identify and wind down these activities. Indeed, some have already done so for a number of reasons, including anticipatory compliance with the Volcker Rule.

At the other end of the spectrum, a textbook example would be a pure agency-based market maker that acts as an intermediary, instantaneously matching a large pool of buyers and sellers of an underlying asset without ever having to take a position in the asset itself. Profits are earned either solely by charging buyers a higher price than is paid to sellers of the asset, or in some cases by charging a commission. Buyers and sellers willingly pay this “spread” fee or commission because the market maker is able to more quickly and efficiently match buyers with sellers than if they were left to find each other on their own.

I refer to this as a textbook example because instances of such riskless market making in our trading markets are rare. In actual markets, buyers and sellers arrive at different times, in staggered numbers and often have demands for similar but not identical assets. Market makers hold inventory and manage exposures to the assets in which they make markets to ensure that they can continuously serve the needs of their customers.

Accordingly, in the broad middle that exists between these two clear examples, the distinction between prohibited proprietary trading and permissible market making can be difficult to draw, because these activities share several important characteristics. In both activities, the banking entity generally acts as principal in trading the underlying position, holds that position for only a relatively short period of time, and enjoys profits (and suffers losses) from any price variation in the position over the period the position is held. Thus, the purchase or sale of a specific block of securities is not obviously permissible or forbidden based solely on the features of the transaction itself. The statute instead distinguishes between these activities by looking to the purpose of the trade and the intent of the trader. These subjective characteristics can be difficult to discern in practice, particularly in the context of complex global trading markets in which a firm may engage in thousands or more transactions per day. A similar challenge attaches to efforts to distinguish a hedging trade from a proprietary trade.

Implementation framework

The agencies have proposed a framework for implementation of the Volcker Rule that combines: 1) an explanation of the factors the agencies expect to use to differentiate prohibited activities from permitted activities, 2) a requirement that banking entities with significant trading activities implement a program to monitor their activities to ensure compliance with the statute, and 3) data collection and reporting requirements, to facilitate both compliance monitoring and the development of more specific guidance over time. In addition, the agencies will use their supervisory and examination processes to monitor compliance with the statute.The third element of the interagency proposal bears some additional comment. In order to help differentiate between permitted market-making activities and prohibited proprietary trading activities, the agencies have proposed to collect data from trading firms on a number of quantitative measurements. These metrics are designed to assist both the agencies and banking entities in identifying the risks and characteristics of prohibited proprietary trading and exempt activities. The proposal makes clear that metrics would be used as a tool, but not as a dispositive factor for defining permissible activities. The agencies instead propose to use metrics to identify activity that merits special scrutiny by banking entities and examiners in their evaluation of the activities of firms. The proposed rule does not include specific thresholds to trigger further scrutiny for individual metrics, but requests comment on whether thresholds would be useful, and notes that the agencies expect to propose them in the future. The proposal also makes clear that the agencies expect to take a heuristic approach to metrics, revising and refining them over time as greater experience is gained in reviewing, analyzing, and applying these measurements for purposes of identifying prohibited proprietary trading.

Additionally, since some banking entities engage in few or no activities covered by the statute, the proposal also includes a number of elements intended to reduce the burden of the proposed rule on smaller, less-complex banking entities. In particular, the agencies have proposed very limited compliance programs and have reduced or eliminated the data collection requirements for these banking entities.

Yang’s departure boon to Yahoo?

Readh here:

Comments »In the after market shares of Yahoo! (NASDAQ: YHOO – News) landed on the trader radar after word hit the Street that former CEO Jerry Yang resigned, suddenly, from his position on the Yahoo! board of directors.

Yang is the controversial figure who spurned a $33 offer from Microsoft in 2008, saying the offer was insufficient. At the time the stock was trading around $14.

Microsoft subsequently walked away from the negotiations and Yahoo! has been in a state of flux, ever since. Although the company later hired Carol Bartz to turn around its fortunes, she was removed from her position this past September, via phone call.

What should you make of these developments?

“Yang’s out – that’s very bullish,” says top trader Guy Adami.

More insider trading arrests

Comments »NEW YORK (Reuters) – At least two senior hedge fund employees were being arrested as part of the government’s sweeping probe into insider trading, people familiar with the matter said on Wednesday.

The arrests reflect a widening of the government’s long-running probe into the alleged sharing of confidential information on publicly traded corporations with hedge fund managers and analysts. In the biggest case so far, onetime billionaire Raj Rajaratnam was convicted of insider trading and is now serving an 11-year prison term.

Anthony Chiasson, who co-founded the Level Global Investors hedge fund, is among those expected to face charges, and is turning himself in to authorities, one of the people said.

Todd Newman, who headed technology trading for Diamondback Capital Management from Boston, has also been arrested, another person said.

Newman had been placed on leave of absence in 2010 and subsequently was let go by that firm. Reuters in November reported the government’s interest in Newman.

Overall, charges against at least four people are expected to be unveiled on Wednesday, the people said. The charges are expected to be filed in U.S. District Court in Manhattan.

Jon Horvath, who is currently employed at Sigma Capital Management, a unit of Steven A. Cohen’s $14 billion hedge fund SAC Capital, was also arrested, one of the people said. A spokesman for SAC Capital could not immediately be reached for a comment. The identity of the fourth person could not immediately be confirmed.

The Twilight of Goldman Sachs

Read the rest here:

Comments »Goldman Sachs was once legendary for its trading prowess.

The traders were so admired and envied on Wall Street that people were convinced they had some kind of edge over their counterparts at other firms.

The theories varied, depending on who you asked. They were front-running hedge fund clients, manipulating markets, or using government connections to game policy. Other folks just thought the Goldman traders were smarter than every one else. People said that Goldman was a hedge fund disguised as an investment bank.

That all changed after the financial crisis.

Lawmakers passed rules to clamp down on proprietary trading by regulated banks. Goldman (NYSE: GS – News) reorganized itself to be, or appear to be, more client oriented, shutting down some internal hedge funds and eliminating proprietary trading desks. Trading at Goldman was no longer supposed to be about Goldman betting its own money, but about Goldman servicing client orders.

Whatever it was that once made Goldman the envy of Wall Street traders seems to have taken flight.

Homebuilders see small signs of life

Comments »WASHINGTON (AP) — Increased interest by potential buyers left U.S. homebuilders less pessimistic about the housing market for the fourth straight month in January. But tighter lending standards are still keeping many of those buyers from purchasing new homes.

The National Association of Home Builders/Wells Fargo builder sentiment index rose four points to 25 in January. That’s the highest level since June 2007. It’s just the third time the index has been at 20 or above in two years.

Still, any reading below 50 indicates negative sentiment about the housing market. The index hasn’t reached 50 since April 2006, the peak of the housing boom.

Last year, the number of people who bought new homes fell to its lowest level on records going back nearly a half-century. The figure for 2011 will likely be below that level.

Builders are struggling to compete with foreclosures, which have forced down prices of previously occupied homes. And many buyers are finding it hard to qualify for loans or meet higher required down payments.

SOPA and PIPA protests in full swing

Read here:

Comments »With a Web-wide protest on Wednesday that includes a 24-hour shutdown of the English-language Wikipedia, the legislative battle over two Internet piracy bills has reached an extraordinary moment — a political coming of age for a relatively young and disorganized industry that has largely steered clear of lobbying and other political games in Washington.

The bills, the Stop Online Piracy Act in the House and the Protect IP Act in the Senate, are backed by major media companies and are mostly intended to curtail the illegal downloading and streaming of TV shows and movies online. But the tech industry fears that, among other things, they will give media companies too much power to shut down sites that they say are abusing copyrights.

The legislation has jolted technology leaders, venture capitalists and entrepreneurs, who are not accustomed to having their free-wheeling online world come under attack.

One response is Wednesday’s protest, which will direct anyone visiting Google and many other Web sites to pages detailing the tech industry’s opposition to the bills. Wikipedia, run by a nonprofit organization, is going further than most sites by actually taking material offline — no doubt causing panic among countless students who have a paper due.

Morning Market Update

(via Fox Business)

The markets turned higher as traders paid close attention to headlines from Europe, and mulled a slew of economic data and quarterly earnings reports.

Today’s Markets

As of 10:40 a.m. ET, the Dow Jones Industrial Average gained 57.9 points, or 0.46%, to 12539, the S&P 500 rose 7.1 points, or 0.55%, to 1301 and the Nasdaq Composite rose 22 points, or 0.81%, to 2750.

Wall Street has been off to a strong start so far this year, with the Dow presently sitting at its highest level since July.

Traders have been keeping a close eye on developments from Europe, where the debt crisis is still posing a serious threat to many world economies. The International Monetary Fund said Wednesday it needs to raise its firepower by roughly $1 trillion in coming years, and plans to raise its lending capacity by $500 billion. However, the IMF said it is “exploring options on funding and will have no further comment until the necessary consultations with the Fund’s membership have been completed.”

Also on the European front, the Greek government is still struggling to hash out a deal with creditors on the size of private-sector losses on its debt. The talks, which are resuming on Wednesday, fell through last week. If a deal can’t be struck, it may lead to a Greek debt default when the country’s next major payment comes due in March, analysts have said.

The euro rose 0.49% to $1.2799, while the U.S. dollar slipped 0.32% against six world currencies.

Goldman Sachs (GS: 103.02, +5.34, +5.47%) posted a fourth-quarter profit of $1.84 a share on $6.1 billion in revenue. Analysts expected the investment banking giant to earn $1.24 on sales of $6.5 billion. Shares were up 2.3% in pre-market trading following the report.

Market participants also got a fresh read on wholesale inflation and industrial production on the day.

The Producer Price Index fell 0.1% in December from November, compared with expectations of a 0.1% gain. Excluding the more volatile food and energy components, core prices were up 0.3% on the month, a bigger increase than the 0.1% economists forecast. Inflation at the producer level has jumped 4.8% from the year prior, or 3% on the core level.

The more closely-watched report on consumer prices is on tap for Thursday. Meanwhile, industrial production was up 0.4% in December from the month prior, slightly weaker than the 0.5% gain economists were looking for.

Commodities were mixed. The benchmark crude oil contract traded in New York rose 38 cents, or 0.41%, to $101.12 a barrel. Wholesale RBOB gasoline jumped 2.2% to $2.831 a gallon.

In metals, gold was unchanged at $1,655.

Foreign Markets

European blue chips fell 0.06%, the English FTSE 100 dipped 0.06% to 5,690 and the German DAX rose 0.18% to 6,344.

In Asia, the Japanese Nikkei rallied 0.99% to 8,551 and the Chinese Hang Seng climbed 0.3% to 19,687.

Read more: http://trade.cc/aaflixzz1jpFZqeTc

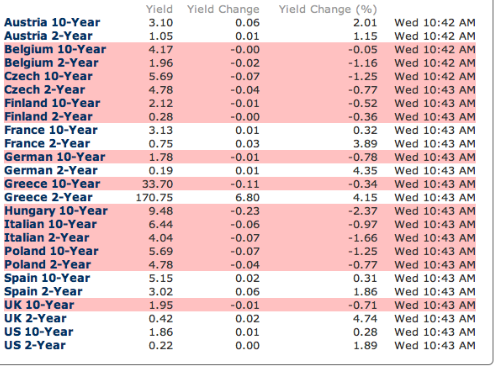

Comments »European Sovereign Bond Yields Fall Again

$GS Sets Aside $12.2 Billion for Pay

Goldman Sachs set aside $12.2bn (£8bn) to pay its staff in 2011 – an average of $367,000 each – sparking criticism that the Wall Street firm was living in a “parallel universe”.

The size of the payouts sparked a backlash from unions, who regard them as evidence that David Cameron’s government should take steps to ensure top pay is better linked to performance. Campaigners for a “Robin Hood tax” on transactions said it backed their case for new levies on banks.

“When even in a bad year each Goldman employee pockets an average of $367,000 – nearly ten times the average UK salary – it’s proof that banks live in a parallel universe to the rest of us,” a spokesman for the Robin Hood Tax campaign, said.

Goldman used a greater proportion of its revenue (42%) to pay its 33,000 staff in 2011 compared with 39% a year ago. The firm axed 7% – 2,400 – of its staff during the year and those who remain will begin to learn the size of their annual bonuses in the coming days.

The highest profile firm on Wall Street reported better than expected full year revenue of $28.8bn – down 26% – while earnings almost halved to $4.4bn prompting Lloyd Blankfein, chairman and chief executive of Goldman, to blame “global macro-economic concerns” for the fall..

The total payout per staff of $367,000 – a figure which includes salaries, bonuses, equity awards and benefits – was down 15% on the $430,000 the previous year. The actual amount set side to pay staff at $12.2bn was down 21%.

David Viniar, Goldman’s finance director, insisted that “discretionary” bonuses were down “considerably more than revenues” during the year and said the firm had embarked on a strategy to cut $1.4bn of costs.

But TUC general secretary Brendan Barber said: “Goldman Sachs are brazenly defying their own sliding profits by dishing out pay and top bonuses worth £240k a head. This latest example of excessive rewards for mediocrity should give the government the green light to get tough on top pay. Ministers should start by putting workers on remuneration committees and making pay and bonuses exceeding £260,000 liable for corporation tax.”

The firm has recently provided more disclosure than in the past about its pay deals in the UK as a result of rules set out by the Financial Services Authority requiring firms to publish pay for “code staff” – those taking or managing risk. Regulatory filings for Goldman Sachs Group Holdings (UK) show that it had 95 code staff in 2010 who had an average pay deal of $6.2m (£4m) in 2010 – and had a further $595m awarded in a one-off mid-year award of shares in 2010.

“This past year was dominated by global macroeconomic concerns which significantly affected our clients’ risk tolerance and willingness to transact,” Blankfein said.

“As economies and markets improve – and we see encouraging signs of this – Goldman Sachs is very well positioned to perform for our clients and our shareholders,” he added. The turmoil in the eurozone held back many of its business areas. Revenues in investment banking were down 9% while its business that underwrites share offerings was down 14%. Its fixed income, currency and commodities operations suffered a 34% fall in revenue. “Although activity levels in 2011 were generally consistent with 2010 levels, and results were solid during the first quarter of 2011, the environment during the remainder of 2011 was characterised by broad market concerns and uncertainty, resulting in volatile trading and significantly wider credit spreads, which contributed to difficult market-making conditions and led to reductions in risk by the firm and its clients,” the firm said.

Comments »Money Flows, Heat Map, & A/D Line

Money Flows

ISSUE GAINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

Apple AAPL NASD 427.16 +46.1 1.17

Citigroup C NYSE 28.44 +15.4 1.22

SPDR S&P Homebuilders XHB ARCA 18.57 +14.7 10.99

Chevron CVX NYSE 105.79 +13.7 1.65

Amazoncom AMZN NASD 184.00 +12.4 1.37

Lowe's Cos LOW NYSE 27.10 +12.2 3.03

AT&T T NYSE 30.28 +12.0 2.63

Procter & Gamble PG NYSE 65.96 +11.3 2.15

Wells Fargo WFC NYSE 29.88 +10.7 1.77

Texas Instruments TXN NASD 32.74 +9.7 1.58

Gilead Sciences GILD NASD 46.44 +9.2 2.05

Yahoo! YHOO NASD 15.84 +8.7 1.75

Disney DIS NYSE 38.88 +7.6 2.88

VISA (Cl A) V NYSE 103.27 +7.4 1.61

Home Depot HD NYSE 44.23 +6.5 2.38

Kraft Foods KFT NYSE 38.43 +6.4 1.86

Coca-Cola KO NYSE 67.55 +6.1 1.99

Bristol-Myers BMY NYSE 33.90 +6.0 3.01

Deere & Co DE NYSE 85.12 +5.8 1.99

CVS Caremark CVS NYSE 42.59 +5.5 2.73

ISSUE DECLINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

Microsoft MSFT NASD 28.20 -114.9 0.16

Cisco Systems CSCO NASD 19.45 -72.2 0.16

Google GOOG NASD 625.44 -49.4 0.60

Abbott Labs ABT NYSE 55.71 -31.4 0.14

General Electric GE NYSE 18.88 -21.1 0.41

iShrs Tr S&P 500 IVV ARCA 130.34 -16.0 0.33

Intel INTC NASD 25.11 -15.3 0.62

Johnson & Johnson JNJ NYSE 65.32 -12.1 0.40

Merck MRK NYSE 38.90 -11.2 0.28

Comcast A Sp CMCSK NASD 24.93 -10.3 0.17

Philip Morris Intl PM NYSE 74.50 -9.7 0.67

Safeway Inc SWY NYSE 21.20 -9.6 0.32

LKQ LKQX NASD 31.90 -8.9 0.09

IBM IBM NYSE 180.81 -8.8 0.75

Oracle ORCL NASD 27.81 -8.0 0.50

PwrShrs QQQ Tr Series 1 QQQ NASD 58.97 -7.6 0.74

Schlumberger SLB NYSE 68.20 -7.3 0.70

Caterpillar CAT NYSE 103.77 -7.0 0.78

Novartis ADS NVS NYSE 57.09 -6.5 0.26

Broadcom BRCM NASD 33.51 -6.3 0.66

Comments »

52 Week Highs and Lows

NYSE

New Highs 45 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ BlackRockMuni Tr BYM 15.15 48,953 BlkRk MuniYld PA Quality MPA 16.35 4,016 Blackrock Strategic Muni BSD 13.97 4,838 Canadian Pacific Railway CP 70.18 159,719 Cedar Fair LP FUN 23.76 26,796 Centene CNC 44.88 106,453 China Pete & Chemical SNP 117.75 9,610 Ecopetrol EC 49.88 86,425 HBFuller FUL 25.98 27,580 Genie Energy GNE 10.14 46,595 John Hancock Pfd Inc III HPS 17.81 18,923 Health Net HNT 35.85 151,580 Home Depot HD 44.23 1,223,156 InlandReallEst8.125% IRCpA 25.45 400 Invesco InsCa ICS 14.95 2,269 Invesco IMInc IIM 17.39 17,243 Invesco Insured Mun Secs IMS 14.92 4,591 Invesco Insured Mun Tr IMT 15.89 10,556 LEH 6.25% CorTS Boeing JZL 26.87 1,800 Lennar Corp B LEN/B 17.93 4,980 McDonald's MCD 101.86 901,944 Michael Kors Holdings KORS 28.85 183,831 Nike Inc NKE 99.50 278,193 Nuveen CA Investment NQC 14.99 8,394 Nuveen Muni High Income NMD 11.78 1,912 Nuveen NY Div Fnd NAN 14.64 1,366 Nuveen NY Investment Qual NQN 15.69 11,964 Nuveen Pa Premium Inc 2 NPY 14.23 7,381 NuvPremMuniOpp NIF 16.53 23,084 NuvPremIncmMuniOpp NPX 13.85 8,573 Nuveen VA Premium Income NPV 16.25 2,929 Philippine Long Distance PHI 65.00 17,593 Pimco Muni Inc II PML 11.87 21,701 PIMCO NY Fd PNF 11.89 2,013 Plains All Amer Pipeline PAA 74.65 45,726 RSC Hldgs RRR 19.81 155,791 Rayonier REIT RYN 46.52 65,604 Rentech Nitrogen Ptrs LP. RNF 21.17 70,440 JM Smucker SJM 80.43 51,060 Taubman Ctrs TCO 63.86 21,680 Ultrapar Participaco UGP 20.04 46,119 UnitedHealth Group UNH 54.08 861,613 Vornado Rlty Tr 6.75% H VNOpH 25.29 1,556 Wstrn Asset Muni Ptnrs Fd MNP 15.77 8,240 Williams Cos WMB 28.93 918,530 New Lows 14 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ Artio Global Invs Inc ART 4.22 36,926 CPI Corp CPY 1.25 127,961 Chesapeake Energy CHK 20.61 1,961,491 ChinaTele CHA 51.41 25,152 EXCO Resources XCO 7.93 390,230 GMX Resources GMXR 1.13 286,804 GenOn Energy GEN 2.18 3,460,247 Hugoton Royalty Tr Un HGT 14.44 108,561 Inergy LP NRGY 22.38 154,187 NRG Energy NRG 17.12 228,706 Portugal Telecom PT 5.30 67,007 Pulse Electronics PULS 2.40 12,714 Quicksilver Resources KWK 5.20 607,422 San Juan Basin Royalty Tr SJT 20.05 47,235

NASDAQ

New Highs 32 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ ATMI ATMI 23.14 35,343 Alexion Pharm ALXN 77.35 103,969 American Dental Ptnrs ADPI 18.94 1,952 Amgen AMGN 68.50 497,549 Apple AAPL 428.08 2,403,435 Automatic Data ADP 55.98 214,623 Broadvision Inc BVSN 23.67 114,844 CVB Fincl CVBF 10.96 60,605 Cogent Comm Group CCOI 18.93 54,118 Convio CNVO 15.98 405,438 Datawatch Corp DWCH 6.01 8,160 FARO Techs FARO 55.74 33,030 Gilead Sciences GILD 46.60 1,511,101 HMS Hldgs HMSY 34.01 155,220 Halozyme Therapeutics HALO 10.45 87,477 InfoSpace INSP 12.26 49,362 magicJack VocalTec CALL 15.21 28,050 Monster Beverage MNST 101.67 65,594 NewsCorp A NWSA 19.18 2,309,965 NewsCorp B NWS 19.46 188,103 Novellus Systems NVLS 45.44 1,161,283 O'Reilly Automotive ORLY 82.86 38,378 OSI Systems OSIS 53.46 26,922 PETsMART PETM 53.49 44,378 RAM Energy Res RAM 3.93 581,917 SLM 6.398% CPI-Lnkd 2018 ISM 21.52 900 SLM CPI-Lnkd Md Trm Nts A OSM 22.48 15,168 Starbucks SBUX 48.10 490,382 Tessco Techs TESS 17.14 39,048 VOXX International VOXX 12.25 34,007 ViroPharma VPHM 29.63 138,195 Whole Foods Market WFM 77.37 268,221 New Lows 6 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ Central European Media CETV 5.89 9,070 RR Donnelley RRD 11.96 1,111,957 Hutchinson Tech HTCH 1.32 79,027 IMRIS IMRS 2.26 1,613 Motricity MOTR 0.76 122,911 ProShr Ul Sh QQQ SQQQ 16.63 323,965Comments »

Most Active Options Trades

CALLS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE BAC 2/18/12 6.0000 3489 0.7800 up 0.0900 VLO 1/21/12 21.0000 2463 1.9600 up 0.9100 AAPL 1/21/12 425.0000 2011 3.8000 up 0.9100 VLO 1/21/12 22.5000 1854 0.5500 up 0.4000 NVDA 1/19/13 15.0000 1665 2.0800 up 0.0400 AAPL 1/21/12 430.0000 1534 1.4600 up 0.3400 YHOO 2/18/12 16.0000 1353 0.5400 up 0.1400 ORCL 1/21/12 28.0000 1305 0.2000 up 0.0600 LVS 1/21/12 47.0000 1257 0.3700 dn 0.0100 BAC 1/18/14 10.0000 1202 0.8900 dn 0.0500 -PUTS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE PM 2/18/12 65.0000 20011 0.2600 up 0.1000 PM 2/18/12 72.5000 10130 1.0400 up 0.3300 STX 2/18/12 19.0000 4738 0.9700 dn 0.0500 SWN 6/16/12 25.0000 2165 1.5200 dn 0.0800 VALE 1/21/12 24.0000 2004 0.3000 dn 0.1400 BAC 2/18/12 6.0000 1870 0.1700 dn 0.0500 GS 1/21/12 95.0000 1396 0.1600 dn 1.0800 INTC 1/21/12 25.0000 1384 0.3600 dn 0.0500 BMY 2/18/12 33.0000 1230 0.4000 dn 0.0700 EQT 6/16/12 40.0000 1000 1.7000 up 0.0000 -VOLUME- CALLS PUTS TOTAL 357363 562436 919799

-CALLS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE BRCM 1/21/12 32.0000 760 1.6000 up 0.9300 AAPL 1/21/12 440.0000 212 0.2200 up 0.0200 AAPL 1/21/12 430.0000 203 1.4500 up 0.3800 DELL 2/18/12 16.0000 200 0.6300 up 0.0900 AAPL 1/21/12 425.0000 146 3.7500 up 0.8500 ANR 1/21/12 20.0000 142 0.4900 up 0.1700 LVS 1/21/12 46.0000 137 1.1300 up 0.2300 C 1/21/12 30.0000 131 0.0300 dn 0.0500 NFLX 1/21/12 95.0000 128 2.4200 dn 0.1500 WFR 2/18/12 5.0000 110 0.2200 dn 0.0200 -PUTS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE RIMM 1/21/12 16.0000 195 0.0500 dn 0.0200 BAC 1/21/12 6.0000 189 0.0400 dn 0.0100 RIMM 2/18/12 16.0000 139 0.9300 up 0.0400 AAPL 1/21/12 425.0000 113 1.8500 dn 1.4500 CREE 2/18/12 22.0000 100 0.7700 dn 0.3300 BAC 2/18/12 7.0000 95 0.6500 dn 0.0800 RIMM 1/21/12 17.5000 80 0.9300 up 0.3900 GLD 1/21/12 159.0000 71 0.6300 up 0.0000 CREE 1/21/12 22.5000 67 0.2400 dn 0.5500 RIMM 2/18/12 18.0000 66 2.0900 up 0.2600 -VOLUME- CALLS PUTS TOTAL 11133 10590 21723Comments »