Interesting chart and commentary

Comments »Monthly Archives: October 2011

Germany Pushes For Maximum Pain Upon Bond Holders

The Nikkei Gaps Up 2.2%….Asian Markets Follow

DRAMA QUEENS: Euro Leaders Postpone Crisis Summit

European leaders pushed back a debt- crisis summit amid opposition to German Chancellor Angela Merkel’s drive for deeper-than-planned writedowns of Greek bonds.

The Oct. 18 meeting was postponed to Oct. 23 as Europe gropes toward a master plan for dealing with Greece’s oversized debt, insulating the Spanish and Italian markets, and shielding banks from the fallout.

Europe needs a strategy for shoring up banks before unstitching a July accord to cut Greek bond values by an average of 21 percent, Belgian Prime Minister Yves Leterme said.

“It is a very sensitive item,” Leterme said in a Bloomberg Television interview at his Brussels residence yesterday. “You can’t at every European Council change the percentages and bring supplementary problems to banks.”

Germany and France, Europe’s dominant tandem, this week pledged a crisis-management breakthrough in time for a Nov. 3 meeting of Group of 20 leaders, the informal steering committee for the world economy.

Opposition to bigger Greek debt writedowns is coming from theEuropean Central Bank, which is against any backsliding from the July 21 accord on a second Greek bailout, a central bank official said yesterday. An appeal to “fully implement all aspects” of the July roadmap was inserted into last week’s monthly policy statement as a warning to Germany, the official said under condition of anonymity.

Economic-Review Mission

For Greece, the endgame drew nearer with an announcement that European Union, International Monetary Fund and ECB experts are likely to complete their economic-review mission today. Some “technical issues” remain to be sorted, Greek Finance Minister Evangelos Venizelos said in a statement yesterday.

“It is looking as if the July 21 agreement just isn’t sufficient and that’s been increasingly recognized in Greece and the rest of Europe,” Julian Callow, chief European economist atBarclays Capital in London, said yesterday on Bloomberg Television’s On the Move with Francine Lacqua.

Merkel and French President Nicolas Sarkozy put bank recapitalization at the top of the priority list in an Oct. 9 declaration in Berlin that triggered a flurry of consultations in European capitals.

The German and French leaders each called for a “lasting” solution to the 19-month crisis, echoing language the EU used in March when it unwrapped what it labeled a “comprehensive” package to restore economic order.

Upgraded Strategy

The upgraded strategy hinges on finding a way to get more out of the 440 billion-euro ($602 billion) rescue fund.

“Further elements are needed to address the situation in Greece, the bank recapitalization and the enhanced efficiency of stabilization tools,” EU President Herman Van Rompuy said in setting the new summit date yesterday.

The summit, now slated for a Sunday when the U.S. and European markets are closed, will be preceded by a meeting of finance ministers on a date to be determined. Europe has traditionally chosen weekends for market-sensitive crisis management, as when the euro area created the rescue fund in May 2010.

A planned reinforcement of the fund, known as the European Financial Stability Facility, faces its sternest test today with a vote in Slovakia’s parliament. One party in the governing coalition is holding out against approval.

Political jousting in Slovakia, a euro user since 2009, showed how Europe’s unanimous decision-making principle makes the emergency response hostage to local politics.

EFSF Ratification

Slovak Prime Minister Iveta Radicova’s party is seeking to pressure rebel lawmakers by tying the EFSF ratification to a no- confidence motion, two government officials said under condition of anonymity yesterday.

Belgium’s Leterme said a veto shouldn’t derail the fund. He called on the remaining 16 euro governments “to take over the burden and we’ll have to defend the euro” in case Slovakia balks at ratification.

The strengthened fund will gain the power to buy bonds in the primary and secondary markets, offer IMF-style precautionary credit lines and enable the bolstering of bank capital.

Officials are working out how to scale up the EFSF’s firepower without requiring another round of parliamentary approvals or dipping into the balance sheet of the ECB. The central bank has ruled out granting the EFSF a banking license.

Under a workaround floated yesterday, the governments could use the EFSF to insure a portion of new bonds sold by debt- strapped nations, automatically extending the fund’s coverage.

EFSF resources “should be dedicated to enhance sovereign debt new issuance of securities, thus multiplying their effect,” ECB Vice President Vitor Constancio said in Milan yesterday.

Comments »FLASH: JOE THE PLUMBER IS RUNNING FOR CONGRESS

John Paulson Had a Splendid Day

No. Ticker Institutional Holder % Change

1 MNI PAULSON & COMPANY, INC. 12.15

2 SHO PAULSON & COMPANY, INC. 10.36

3 ANR PAULSON & COMPANY, INC. 8.92

4 LNG PAULSON & COMPANY, INC. 8.91

5 AHT PAULSON & COMPANY, INC. 8.59

6 HHC PAULSON & COMPANY, INC. 8.44

7 BEE PAULSON & COMPANY, INC. 8.00

8 C PAULSON & COMPANY, INC. 7.59

9 PMI PAULSON & COMPANY, INC. 6.67

10 MGM PAULSON & COMPANY, INC. 6.44

11 RLJ PAULSON & COMPANY, INC. 6.21

12 RF PAULSON & COMPANY, INC. 6.18

13 BAC PAULSON & COMPANY, INC. 6.10

14 FCH PAULSON & COMPANY, INC. 6.05

15 RKT PAULSON & COMPANY, INC. 5.87

16 WY PAULSON & COMPANY, INC. 5.74

17 RIG PAULSON & COMPANY, INC. 5.70

18 BZ PAULSON & COMPANY, INC. 5.41

19 COF PAULSON & COMPANY, INC. 5.22

20 NG PAULSON & COMPANY, INC. 5.05

21 BLK PAULSON & COMPANY, INC. 5.02

22 CBG PAULSON & COMPANY, INC. 4.81

23 HIG PAULSON & COMPANY, INC. 4.78

24 IP PAULSON & COMPANY, INC. 4.47

25 XL PAULSON & COMPANY, INC. 4.37

26 GGP PAULSON & COMPANY, INC. 4.14

27 FHN PAULSON & COMPANY, INC. 4.11

28 WHR PAULSON & COMPANY, INC. 3.92

29 LEA PAULSON & COMPANY, INC. 3.88

30 SLXP PAULSON & COMPANY, INC. 3.82

31 STI PAULSON & COMPANY, INC. 3.80

32 APC PAULSON & COMPANY, INC. 3.73

33 MTN PAULSON & COMPANY, INC. 3.56

34 BYD PAULSON & COMPANY, INC. 3.55

35 GFI PAULSON & COMPANY, INC. 3.45

36 BZH PAULSON & COMPANY, INC. 3.40

37 MYL PAULSON & COMPANY, INC. 3.29

38 ACAS PAULSON & COMPANY, INC. 3.23

39 NVS PAULSON & COMPANY, INC. 2.96

40 BPOP PAULSON & COMPANY, INC. 2.74

41 ARG PAULSON & COMPANY, INC. 2.65

42 DEXO PAULSON & COMPANY, INC. 2.63

43 BAX PAULSON & COMPANY, INC. 2.50

44 AON PAULSON & COMPANY, INC. 2.49

45 CNO PAULSON & COMPANY, INC. 2.39

46 FDO PAULSON & COMPANY, INC. 2.20

47 AU PAULSON & COMPANY, INC. 1.98

48 VECO PAULSON & COMPANY, INC. 1.78

49 SNI PAULSON & COMPANY, INC. 1.61

50 BSX PAULSON & COMPANY, INC. 1.60

FLASH: FORECLOSURE LAWSUIT SETTLEMENT IMMINENT

Sources at Citigroup and Bank of America tell FOX Business that bank officials worked through the weekend and were in close talks with state attorneys general and the Department of Justice to try to wrap up a potential $20 billion settlement that could come as early as this week or next over improper mortgage practices and robosigning.

The would-be settlement involves foreclosure papers that were rubberstamped, allegedly pushing many out of their homes. JPMorgan Chase, Ally Financial and Wells Fargo are also involved in the talks, sources say.

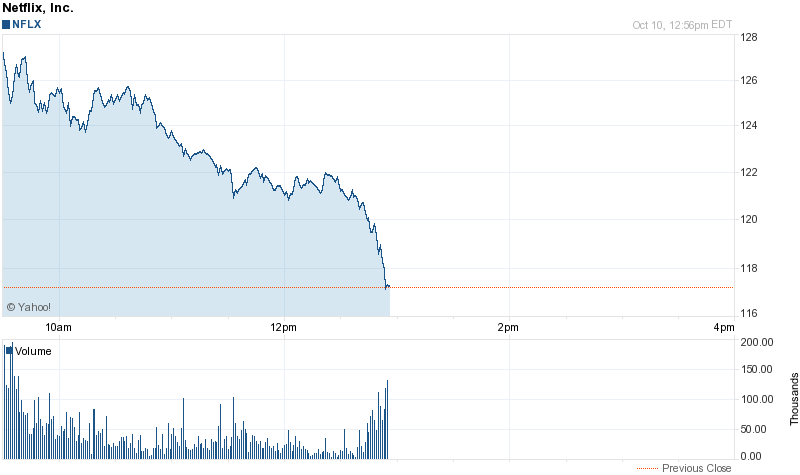

Comments »FLASH: Shares of NFLX Just Went From Bad to Much Worse

+10 early, then gave it all back. Now it is outright plunging, down $7 or 6%.

Comments »Sprint shares getting crushed on capital needs

Comments »(Reuters) – Sprint Nextel shares (NYSE:S – News) fell 8 percent on Monday as analysts slashed their forecasts for the No. 3 U.S. mobile operator, which said last week that would have to raise new capital.

Sprint shares fell 20 cents to $2.21 after analysts cut their price targets for the stock and forecast free cash flow losses. S&P gave Sprint debt a “watch negative” rating.

The company discussed a costly network upgrade plan at a conference on Friday, telling investors that it would need to tap capital markets, even before accounting for big additional costs it expects from subsidizing sales of the new Apple Inc (NasdaqGS:AAPL – News) iPhone. (ID:nN1E7960J0)

UBS analyst John Hodulik estimated that Sprint would incur a free cash flow loss of $2.5 billion over the next two years and worried how it would pay for upcoming debts.

Congress takes up China trade bill

Comments »WASHINGTON (AP) — Congress is attacking the jobs front this week, with votes on China currency, free trade and President Barack Obama’s jobs bill.

The Senate on Tuesday evening should pass legislation imposing economic sanctions on China if it continues to keep its exports cheap by undervaluing its currency. The bill, however, faces opposition in the House and may function mainly as a strong message of frustration with China’s economic policies.

It will also be difficult for Senate Democrats, facing stiff GOP opposition, to obtain the 60 votes needed to advance Obama’s $447 billion jobs bill.

It is almost certain, however, that the House and Senate will vote by Wednesday to approve free trade agreements with South Korea, Colombia and Panama that supporters say will foster tens of thousands of American jobs.

Cleavage Becomes a Big, Bouncy Issue in Canada’s Politics

_______________

- Canadian politician Christy Clark’s navy blue v-neck dress set off a debate about workplace attire. Credit: Hansard

- _______________

The Premier of British Columbia, Christy Clark, wasn’t criticized for her stances on taxes and education when she took questions from the legislature last Wednesday. Instead, the 45-year-old politician’s navy blue v-neck dress and khaki blazer was the subject of ire from one political pundit, which set off a fiery debate on Twitter that poured over into Canadian newspapers and news programs.

“Is Premier Clark’s cleavage revealing attire appropriate for the legislature?” David Schreck, a retired politician, tweeted.

Schreck’s controversial comment has drawn people on both sides of the issue to weigh in, with some agreeing and others branding the comments as sexist.

“Your comments about Premier Clark are sexist and inappropriate,” marketing consultant Lesli Boldt wrote to Schreck on Twitter.

Mary Polak, a liberal cabinet minister in Vancouver, who is from the same party as Clark, told the Vancouver Province that Schreck’s comments were “astonishing.”

“Her attire was quite appropriate. Everybody knows women are more likely than men to be judged on their appearance, so she takes great care about it, and I’ve heard nothing but compliments about the way she dresses,” Polak said.

Clark’s office did not respond to a message from ABCNews.com.

Despite calls for him to recant his comments, Schreck said he stands by them.

“I cannot apologize for my point of view, namely that Clark was inappropriately dressed for the legislature,” Schreck wrote on his blog.

There is, however, one thing that Schreck and his detractors can agree on: “It’s time to get back to the real issues of the day,” he wrote.

Comments »

Start of National Basketball Association Season Now in Grave Danger

Negotiations were expected to resume on Monday between National Basketball Association players and owners to discuss revenue splitting as a lockout continued to threaten the start of the basketball season.

Representatives from the two sides met for five hours on Sunday, but sources told Sports Illustrated the talks didn’t include the sharing of revenue, which is considered the biggest issue that divides the parties.

“We had another intense meeting,” player union president Derek Fisher said Sunday, according to The Associated Press. “We’re going to come back at it tomorrow afternoon and continue to try and put the time in and see if we can get closer to getting a deal done.”

NBA Commissioner David Stern has said that the first two weeks of the regular season would be cancelled if a deal wasn’t reached by Monday afternoon.

Comments »PIMCO pumps emerging markets

Comments »Emerging-market stocks are “cheap” and Pacific Investment Management Co. is buying in China after the nation’s shares tumbled this year, said Maria Gordon, an emerging-market equity-fund manager at Pimco.

“We are definitely fishing in the more cyclically distressed areas of the market where valuations are very, very cheap,” London-based Gordon said in an interview with Sara Eisen on Bloomberg Television today. “We’re selectively accumulating positions” in China, Gordon said, adding that shares of Hong Kong-based insurer AIA Group Ltd. (1299) are poised for “a lot of capital appreciation.”

The MSCI Emerging Markets Index has tumbled as much as 31 percent from this year’s high, sending its price-to-earnings ratio to 9.4 on Oct. 5, the lowest level since December 2008, according to data compiled by Bloomberg. The Hang Seng China Enterprises Index, a gauge of Chinese companies listed in Hong Kong, has slid 38 percent from a 30-month peak in November as tight monetary policy in the biggest emerging economy and Europe’s debt crisis spurred investors to sell riskier securities.

“Markets are cheap,” Gordon said. Still, “it’s very difficult to call the bottom” given concerns that the global economy is slowing, she said.

Emerging-market equity funds have posted 10 straight weeks of outflows, with investors withdrawing $3.3 billion in the seven days ended Oct. 5, according to data compiled by Cambridge, Massachusetts-based research firm EPFR Global. China funds had $167 million of outflows during the week.

Negative News: Horrible Anonymous attack on stock market doesn’t materialize

Sorry, but when these little bastards manage to hit some huge website with a denial of service attack or luck out by catching Sony with their pants down (no encryption) these fucks get unprecedented press time.

After issuing that idiotic video last week, I just figured it was well deserved that people remember the cyber attack that wasn’t

Comments »Eurobanks brace for calls to raise capital

Comments »BRUSSELS/PARIS (Reuters) – Europe’s banks expect to be told to raise more capital under a Franco-German effort to solve the euro zone debt crisis after the state rescue of Franco-Belgian lender Dexia SA.

Dexia agreed to the nationalization of its Belgian retail bank and secured 90 billion euros ($121 billion) in state guarantees, in a rescue that raises pressure on other euro zone countries to strengthen their banks.

German Chancellor Angela Merkel and French President Nicolas Sarkozy said on Sunday they would tackle Greece’s woes and agree how to recapitalize the regions’ banks by the end of the month, but they declined to reveal details of their plan.

“We expect the EU to come up with a minimum core Tier One (capital) level under certain stress scenarios and a higher one without any stress. Then banks will be asked to reach this level in a short period of time,” said a senior banker in Germany.

Banks were not involved in talks yet with governments on likely capital needs, several bankers said, although options were being considered in case they need to act quickly.

But they were concerned at just how much more capital they will be called on to find, after many urged Europe’s leaders to follow the “bazooka” approach of former U.S. Treasury Secretary Hank Paulson, who told banks they must raise capital.

British Prime Minister David Cameron told his euro zone peers to adopt a “big bazooka” solution.

Laugh of the Day: NFLX Completes Circle Jerk

The stock is now down, after surging at the open on news they are scrapping their idiotic “Qwickster” idea.

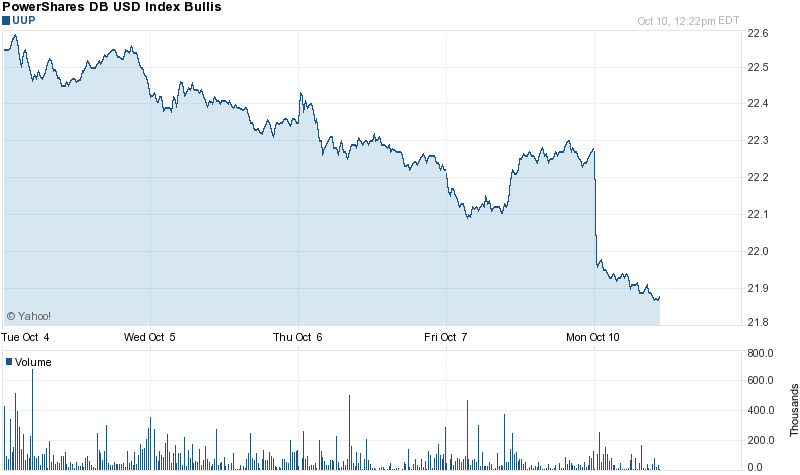

The Dollar Fell Off a Cliff Today

Beware of Deficiency Judgement; You Can’t Just Walk Away Anymore

Do not think you can just walk anymore. 30 states allow this type of lawsuit to be filed.

Comments »Equities Break Out Above the 50 Day Moving Average; Is it Time to Buy ?

I say froth for now until a clear picture emerges from Europe. Remember you do not have to catch the bottom, but rather rejoice in the fat middle.

Comments »