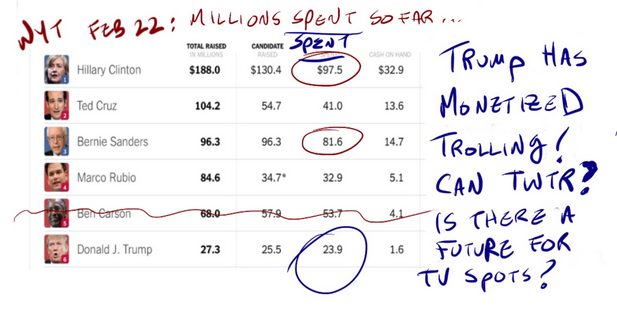

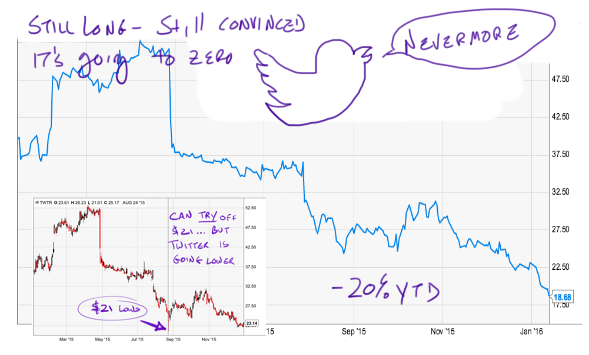

Twitter shares should be much higher. They aren’t and we need to figure out why.

To get up to speed, last night CEO Jack Dorsey confirmed the departure of 4 executives via midnight emo-Tweet. Dorsey’s note came hours after re/Code first reported the seed of the story, launching rampant speculation in the Twitter-spere itself.

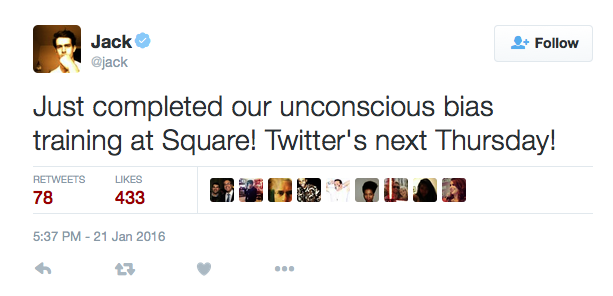

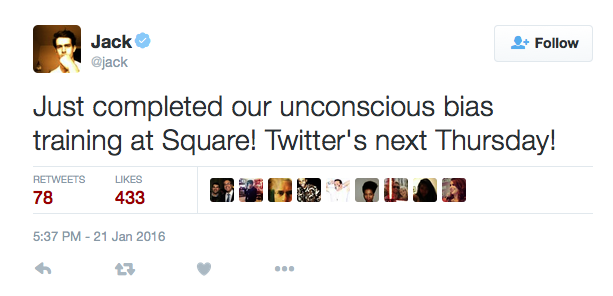

The lag is important. There’s skepticism in some circles regarding Dorsey’s sense of urgency and focus when it comes to Twitter. 4-days ago Jack was Tweeting about an “unconscious bias training” session he’d just completed at Square. “Twitter’s next Thursday!” he added.

To be gentle, it’s awkward to follow that with this news.

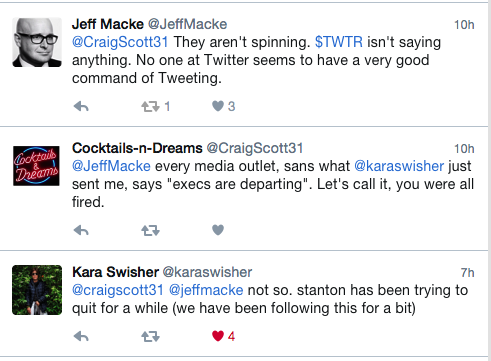

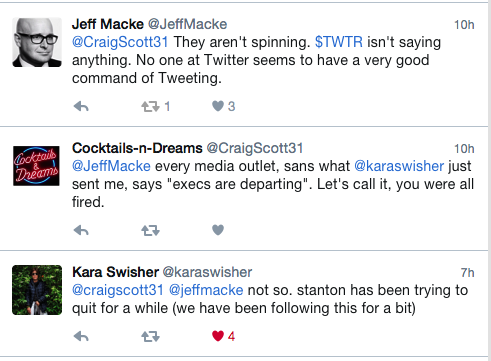

Maybe the prospect of taking unconscious bias training with Jack was just too much for the 4 execs (two senior VPs and two VPs). It’s still not clear if they quit or were forced out of Twitter for any number of obvious performance-based reasons (disastrous communications, the perplexing failure of Moments, the disappearance of Vine while SnapChat takes over the world etc ad nausea). At least one of the Departing had been “trying to quit” for while, per a Twitter exchange I had with Kara Swisher (@KaraSwisher) and @CraigScott31:

The exchange is everything great and maddening about Twitter. Kara Swisher has 1 million followers. Her company broke the story and she followed-up on it in real time, chatting with her massive audience about what may or may not be happening at Twitter.

Twitter gives anyone who wants one the ability to talk to the world. If you Tweet me (@JeffMacke), I’ll see it. I have 27,000 unread emails. I rarely answer my phone. I roam the earth like Caine by choice but I’ll see your Tweet. That’s kind of messed up. Twitter is insanely useful for investors. Kara Swisher is tied in to the Valley at the highest levels. She’s smart and she knows where all the bodies are buried. 5 years ago there’s almost no way I could have chatted with Kara Swisher about breaking Twitter rumors on a Sunday afternoon. Certainly not in pubic.

Kara is a smart source. She also generally defends Jack Dorsey against critics. That second part matters to me because, if we’re going totally honest here, I’m not sure Jack is up to the task of running two public companies.

.

Why Can’t Jack Tweet Good?

Executive turnover should be insanely positive for Twitter.

The company is bleeding share all over the place. It’s past time to get some fresh ideas at Twitter.

I’m willing to bet that had Jack Tweeted out a message remotely resembling the below shares would be pushing $20:

“I have a very specific vision of what [pick a failing product] needs to look like. Others have different views. A company can’t go in multiple directions at once. As CEO I have made the decision getting Twitter to the next level will require a more united view of our strategy. I thank these wonderful people for their contributions. My only regret is they didn’t have time to participate in our Unconscious Bias training. Using terms like ‘you guys’ can make others feel excluded.”

That last part was optional.

What mattered were speed and clarity. Twitter’s mass Exodus was either part of Jack consolidating the company behind his vision or rats leaving a sinking ship. The perception matters. It’s very hard to convince good executives to work for failing operations. Twitter is at a very fragile juncture. It doesn’t want to be seen as Yahoo.

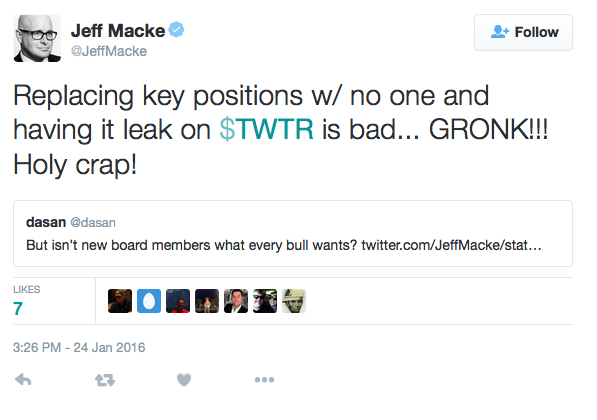

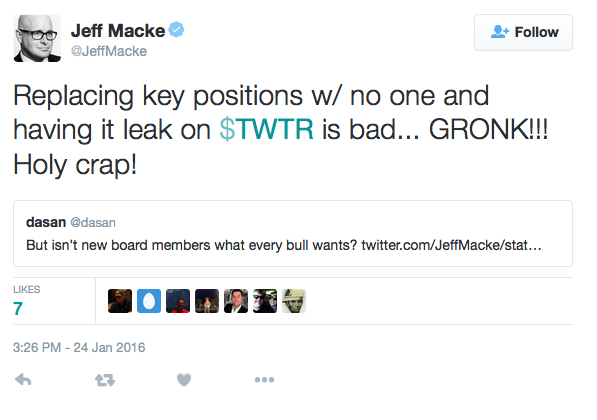

As the hours passed before Twitter released any official response, Finance Twitter chattered away while watching football.

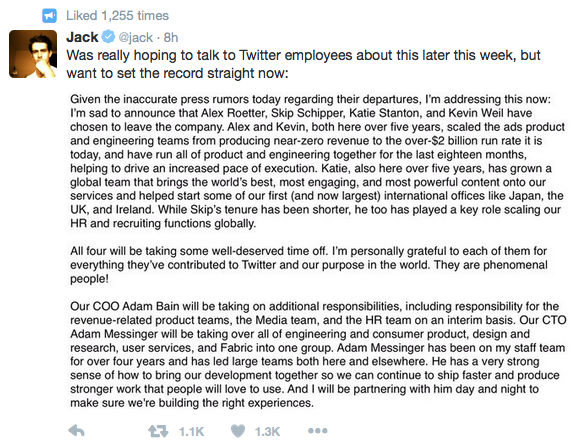

Finally @Jack released a sort of screenshot of an email linked to a Tweet:

Jack starts by blaming media inaccuracy for his having to address the flight of four top executives from his company. It’s a topic he was hoping to save for Twitter employees “later this week”. That’s a bad start. When you point fingers three point back at you, buddy. The media ran with what they had because Twitter didn’t give them anything else.

Jack never says if the execs quit, got fired or are leaving to spend more time with their collective families. “They have chosen to leave the company” implies they quit. But in the second paragraph Jack is gently stuffing all 4 in a pillowcase and throwing them under an oncoming bus. “All four will be taking some well-deserved time off” clearly implies they couldn’t keep up and were fired.

Per Swisher, Stanton has been trying to quit for months. Why couldn’t she just leave? Was Twitter thinking including the respected Stanton in a group Exodus would be more efficient?

Also, Jack didn’t mention the head of Vine who was reportedly overseeing 40 people. The exec, @JasonTorff announced via Twitter that he’s leaving to work for Google’s VR team. That’s a guy finding a better job. Seems worth mention.

Jack needs to hit the right notes. He needs to make it clear Twitter isn’t losing people it wants to keep. There is an underlying message sent when well-paid people leave low-stress jobs in favor of nothing. While execs move on for all sorts of different reasons be very sure of one thing: No one walks away from a huge pay-off. Twitter shares are down 75%. Employees wouldn’t leave unless they think on some level that drop makes sense.

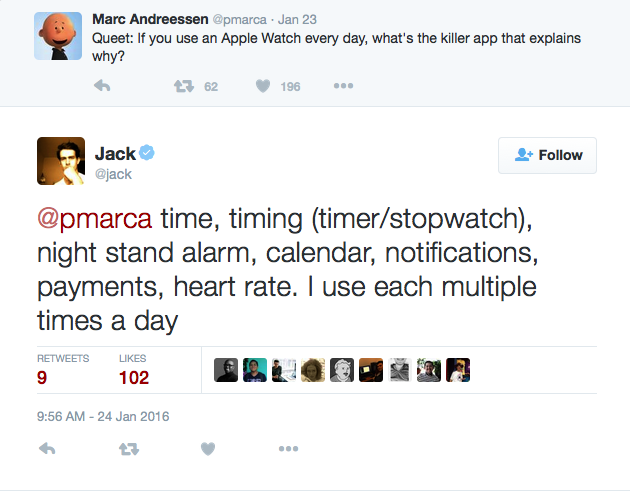

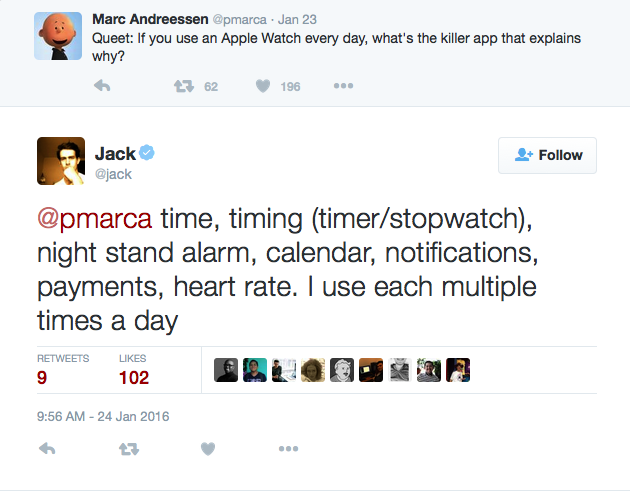

Which brings us to the awkward larger point raised by Jack’s indifferent Twitter feed. Mostly he re-Tweets banal basketball pictures. Occasionally he interacts with Twitter celebs like VC Capo Marc Andreessen. The nature of the conversations don’t inspire confidence. The last Tweet from @Jack prior to the executive emo missive was this exchange:

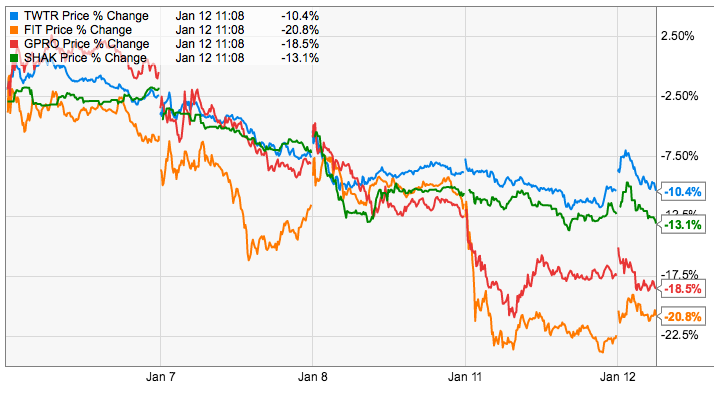

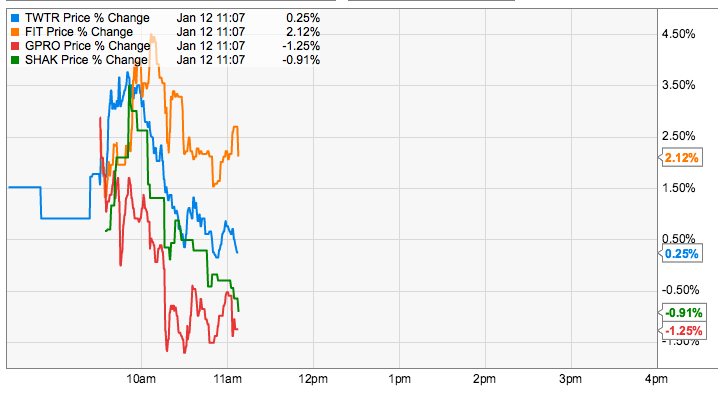

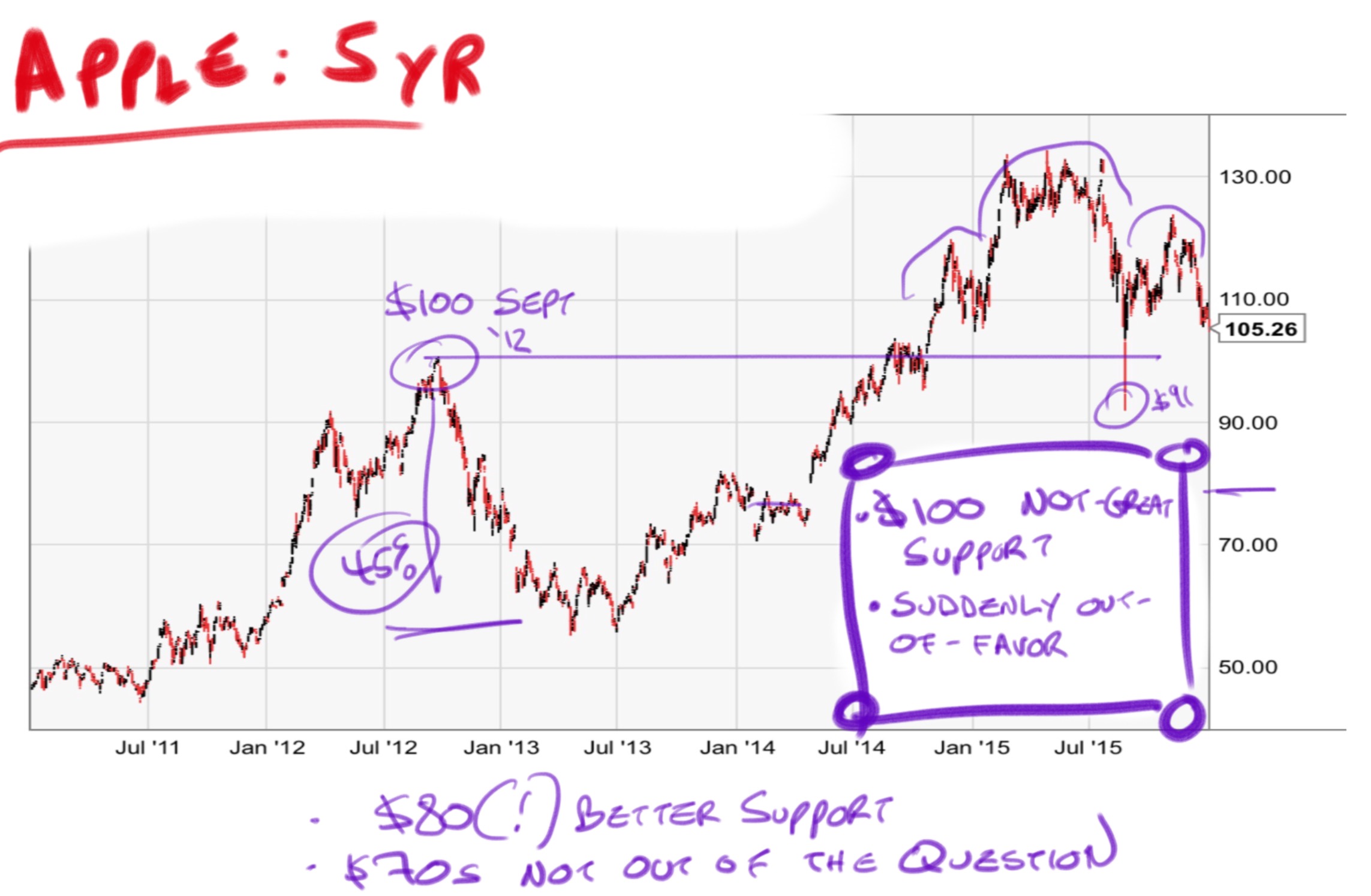

Twitter shares are down 50% in the last 6 months. It’s down more than 20% just in 2016. Jack’s tenure his given us the hype release of Moments, some lay-offs and now this debacle. These are all problems that speak to the core user experience. Shouldn’t the CEO of such a company be, if not expert, at least able to exhibit basic understanding of the appeal of his product?

Without the weird emotional disconnect from the top Twitter getting rid of this team would be good news. The stock would be higher. No offense but none of these products has been killing it. Clearing the deck makes some amount of sense. The stock should be higher. Instead Twitter is getting downgraded at Stifel and down 80-cents early.

I remain long only because flogging myself like an ancient monk draws stares. Later Twitter is going to announce a new celebrity board member and possibly a new product manager. Rumors are eveyone from Iger to Katie Couric. The world breathlessly awaits Jack’s next Tweet.

Comments »