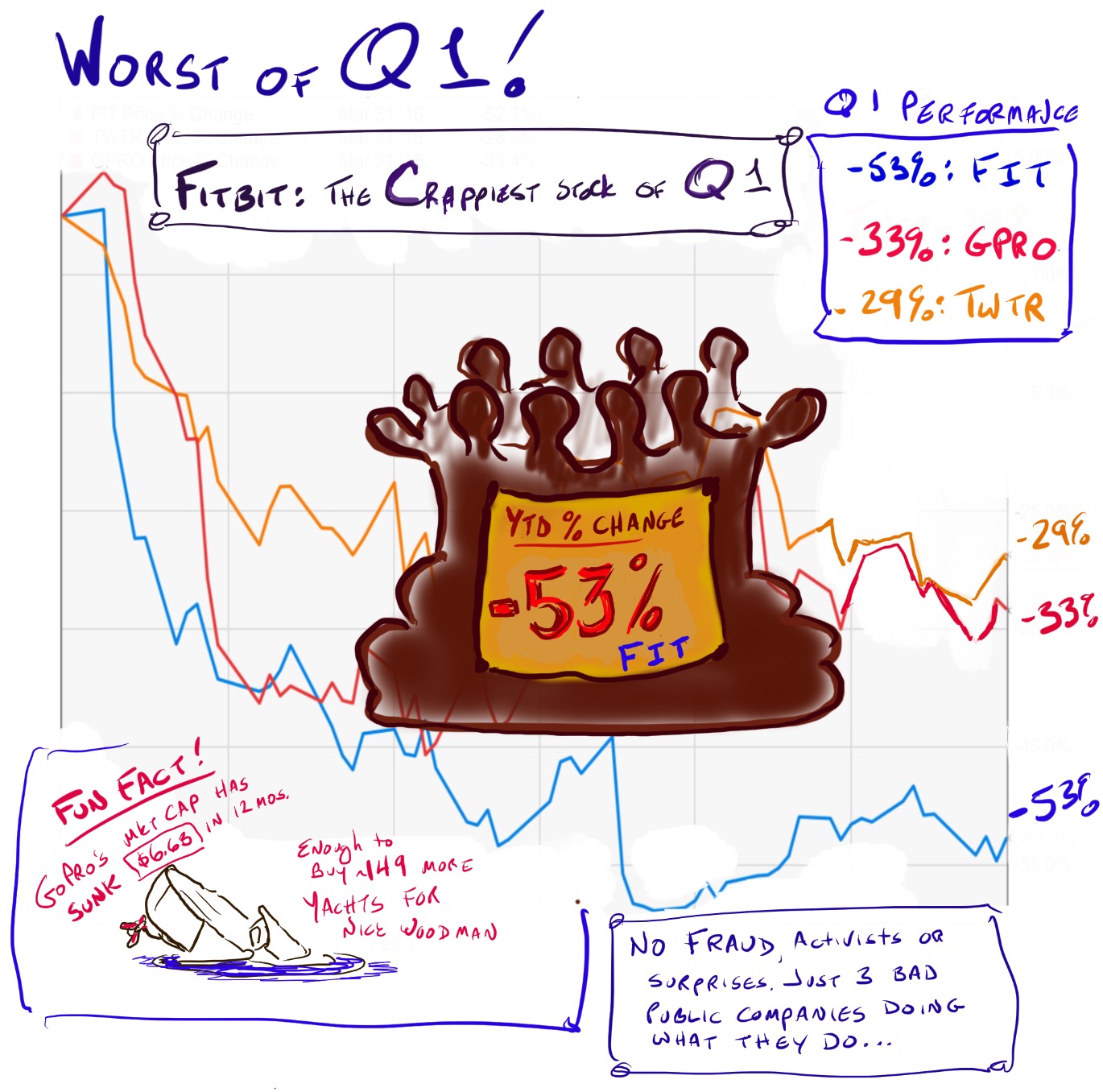

Avoid losers and the winners will take care of themselves.

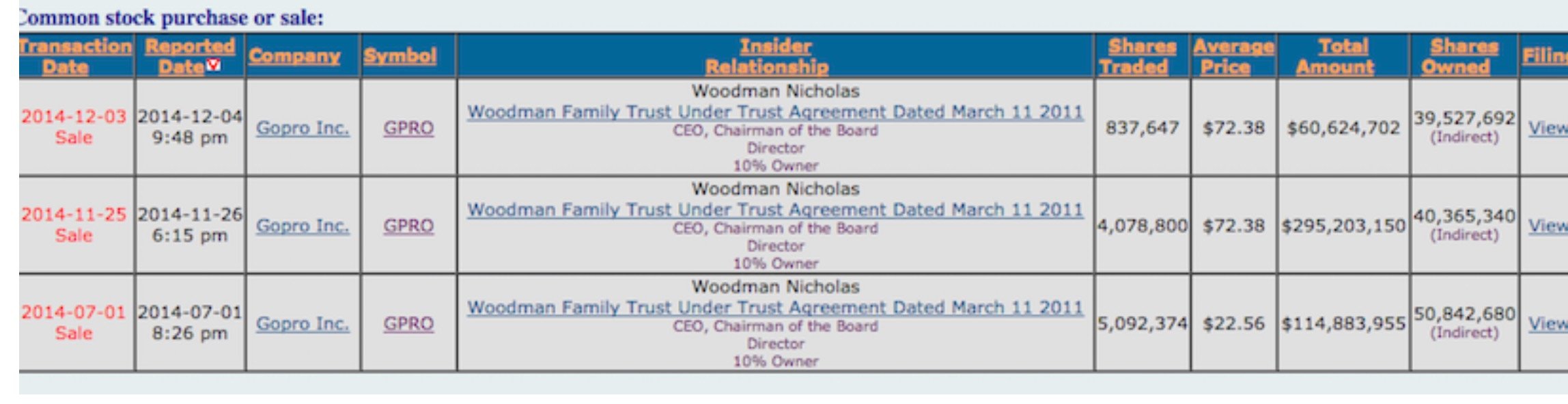

The point of the Triple Crown of Crap Index was pick the 3 worst public companies I could think of and make them into an index. The defining trait of a game of skill is whether or not it can be lost on purpose. Twitter, GoPro and FitBit were specifically chosen for to lose.

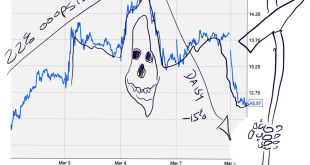

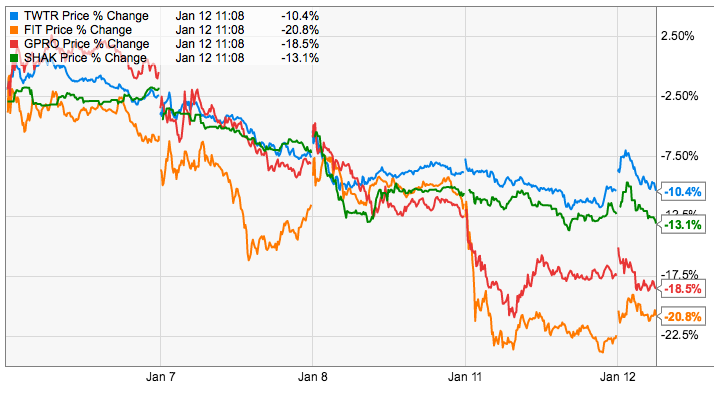

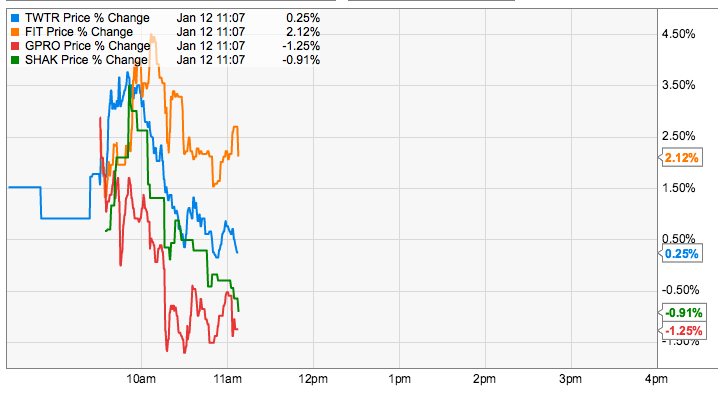

They didn’t disappoint. TWTR, GPRO and FIT have lost an average of 40% since the start of the year. All three stocks have been mercilessly beaten almost without interruption, and for very good reasons.

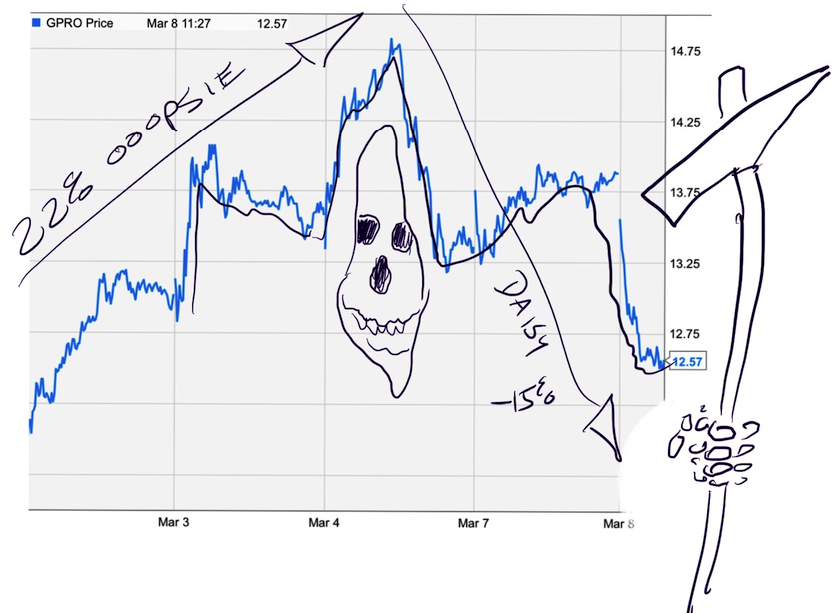

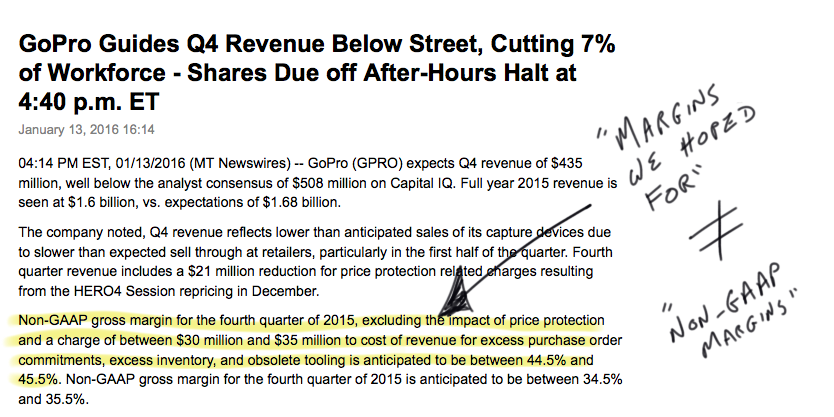

Some companies just shouldn’t be public and these are three of them. GoPro has dropped $6.6b in market cap over the last 52-weeks. That’s enough to buy 150 of at the party yachts CEO Nick Woodman bought for himself last Christmas.

FitBit is staggering to the wire and looks set to “win” Q1 with a 55% decline. Twitter and GoPro are both down about 30% with only one full day of trading left in the quarter. Whichever stock finishes closest to flat will be replaced in the Index starting April 1st.

You may make your case for the new entrant in Q2’s Triple Crown of Crap Index in the comment section below.

Comments »