I wonder if Walmart realizes how screwed it is.

I don’t mean that smugly. I want Walmart to win. I think it’s run by smart, generally good people. But even smart people can lose perspective if they don’t have outsiders getting in their face occasionally. Corporate cultures are like royal bloodlines; if you don’t freshen the breeding pool up every so often you start to go a little “Windsor”.

I love Walmart, though. It makes me sad to sincerely wonder if the company has any grip on the degree to which it’s getting murdered in what it still calls “the e-commerce space”. Because there’s a growing chasm between how Walmart should be viewing its online efforts and the spin the company is offering in public. Such disconnects are the calling card of a company losing it’s grip on reality.

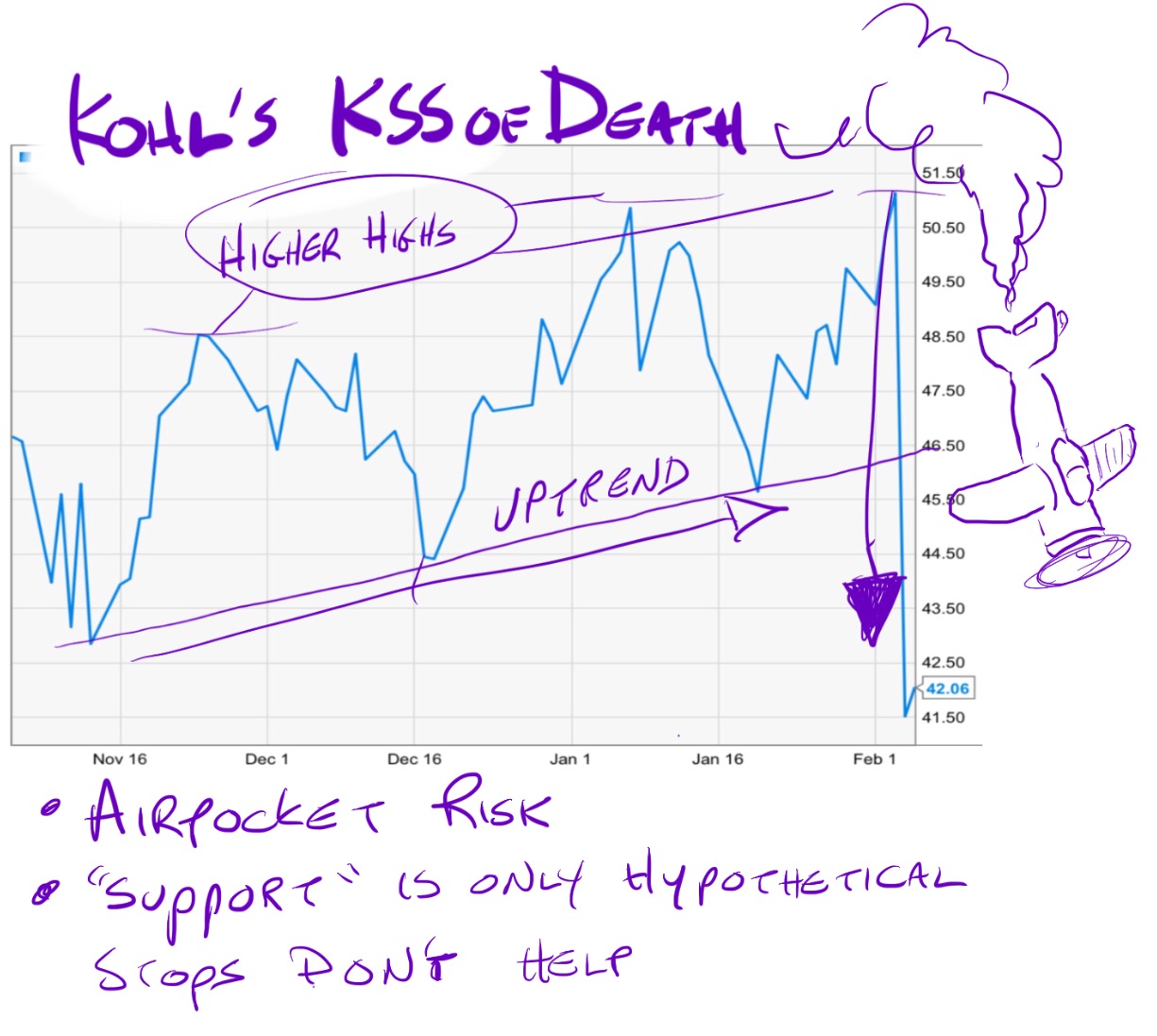

Corporate dementia is usually bearish. In this case it’s a matter of life and death.

This morning Walmart reported .6% comp store gains in the US for the 4th quarter. That includes 25-basis points of boost from e-commerce which sort of counts as one big store*. Walmart says online sales grew globally by 8% in Q4 and 12% for the full year, rising to $13.7b. Walmart is crowing about serving 20 US markets with online grocery already.

Some problems:

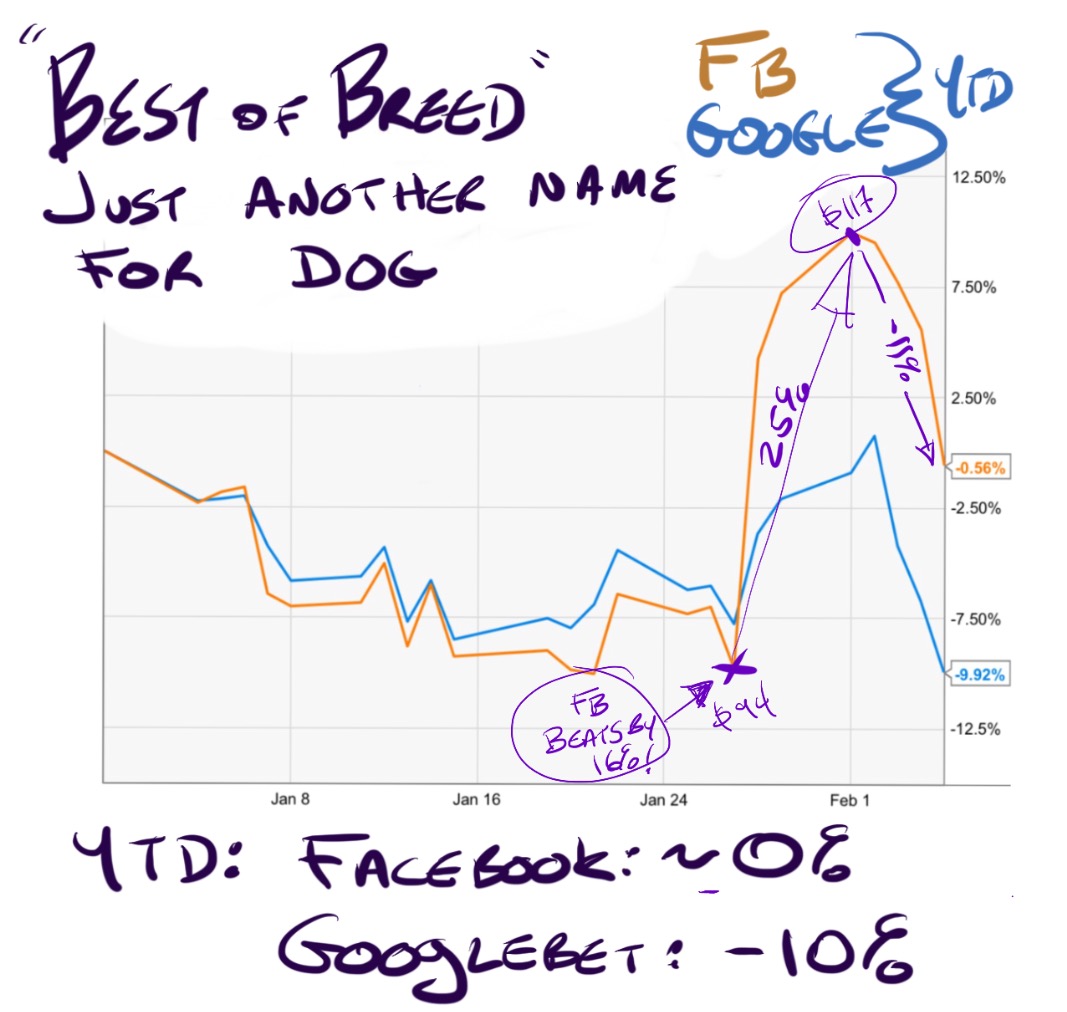

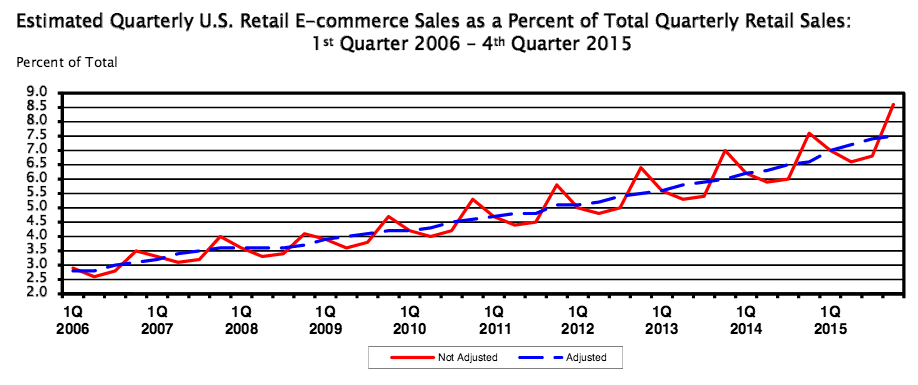

- Walmart’s growth online is lagging the growth rate of cyber-retail as a whole, which grew 14% last year according to the government.

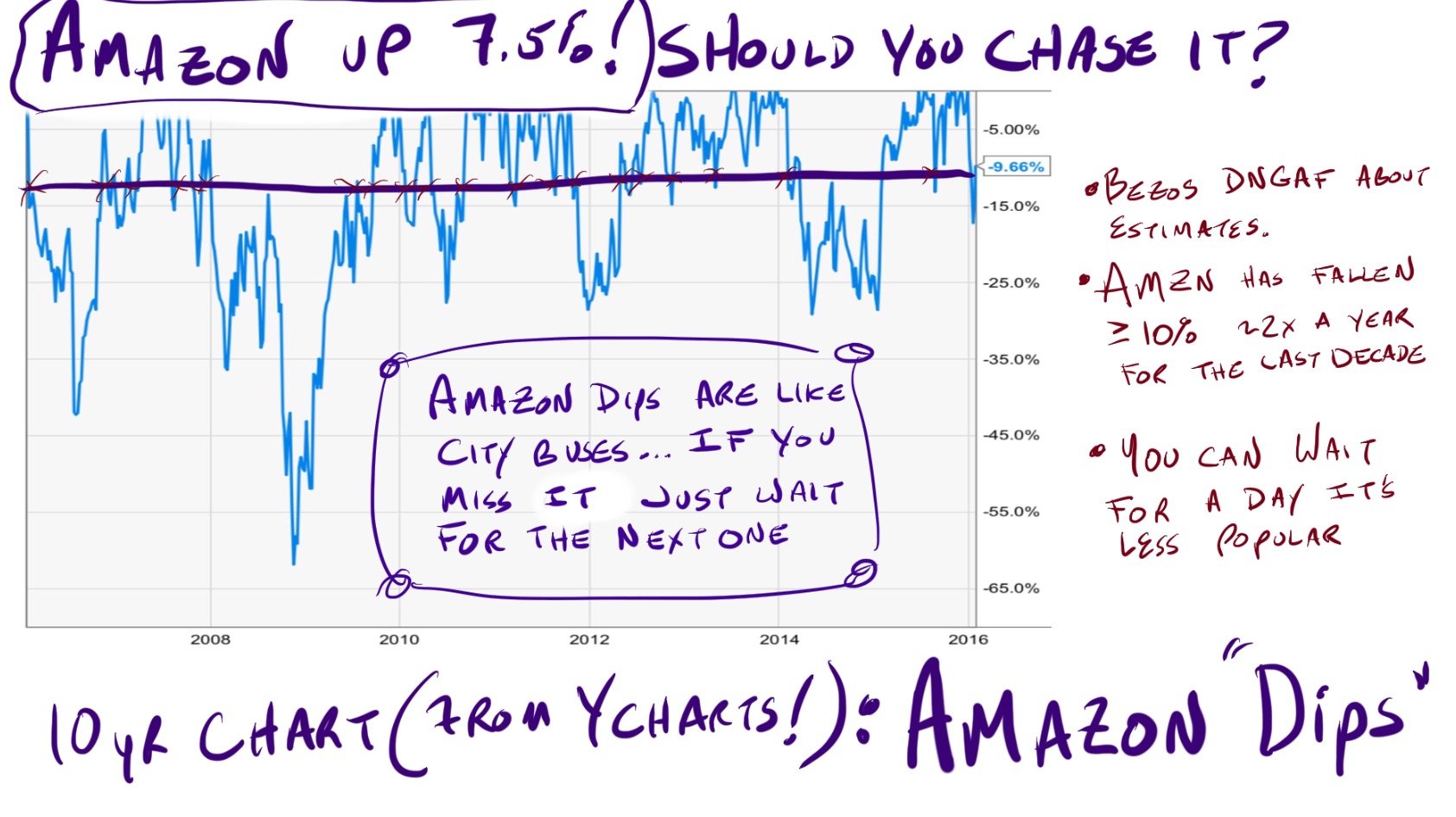

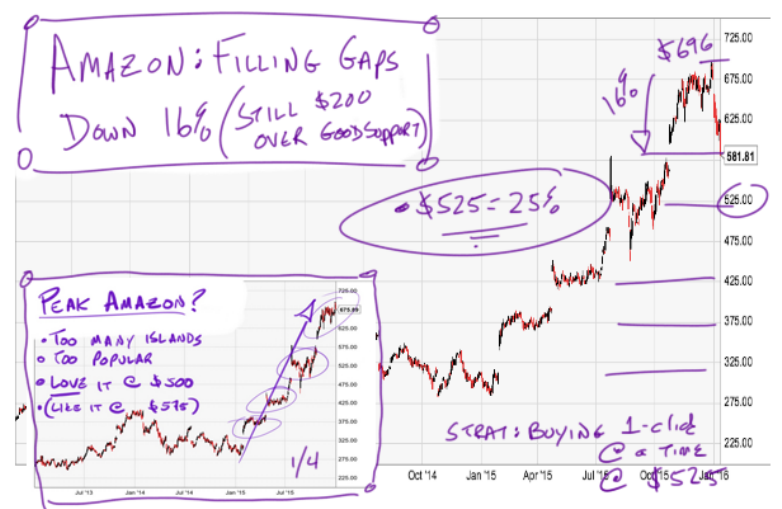

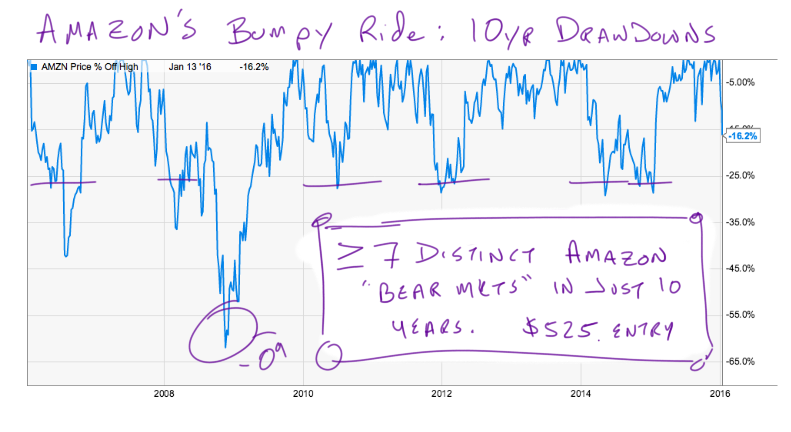

- Amazon grew US sales by more than 24% to $21.7b in Q4.

- This morning Amazon is leaking reports that it plans to hire more “Uber like” delivery employees. That’s not really “news” (as I’ve reported Amazon is already doing same day delivery in many markets… they’ll be same day, nationwide by next Christmas). It’s just a reminder of how far ahead of Walmart Amazon is. In fact, I’m pretty sure Amazon is hyping this just to screw with Walmart. I have no proof of that but I really want to believe it.

- Walmart should not be at all pleased about a below-average growth rate online. It has more resources than any other retailer on earth. Online is still up-for-grabs and Walmart is losing share to the field. Walmart is getting its ass kicked by Etsy. Saw Walton would not be pleased.

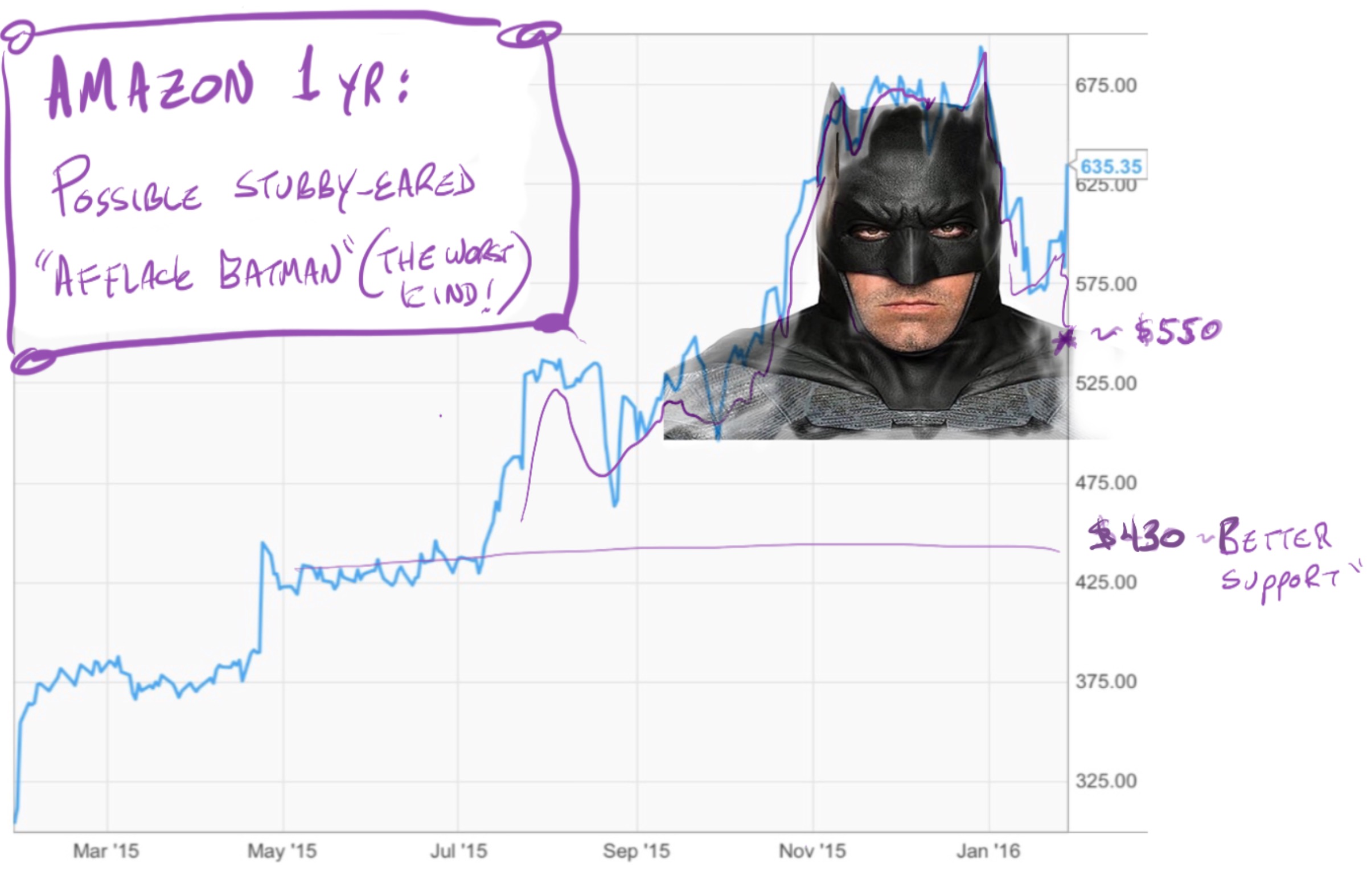

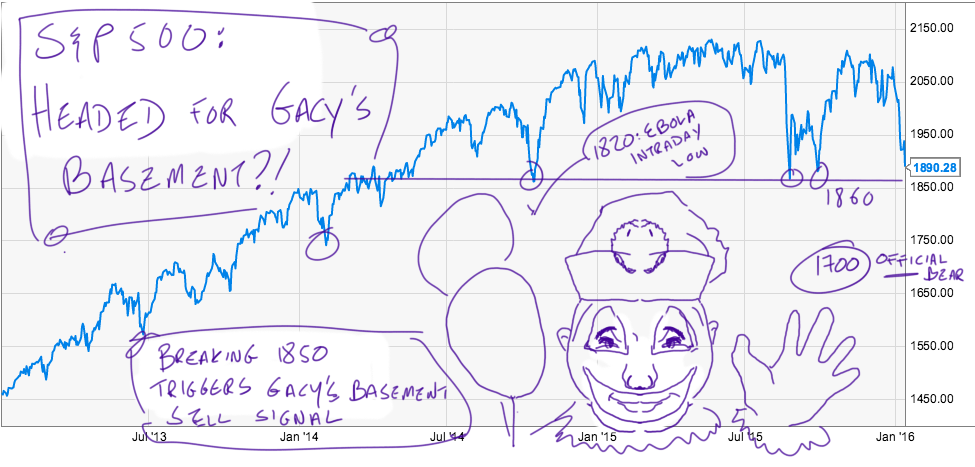

- Look at the growth rate of E-commerce as a percent of total US sales in the graph below. If there was a country with a market that was 10% the size of the US and growing in the teens Walmart would be throwing every available penny at the opportunity:

- I can forgive Walmart not growing abroad. Retail concepts seldom travel well. Merchants should assume every foreign country is Vietnam. I wouldn’t expect Walmart to grow any faster than US GDP at physical stores**. But Walmart has to grow online. Walmart can’t afford to be 1/8th the size of Amazon and fading fast.

- That being the case, the execs should actually be sheepish about these stats. Instead they are marveling at the shopping habits of online grocery buyers. That’s either an awesome job of spinning or evidence of a disturbing lack of urgency.

- Walmart is run by very smart people. It’s a legendarily tough company. That makes me wonder if they have any real friends in-house. A friend is someone who isn’t afraid to tell you when you’re screwing up. They tell you uncomfortable truths, over and over again. That’s how you can tell they’re you’re friend. I’m not sure Walmart execs have anyone with the wontons to tell them they’re 10 years from becoming Sears.

- I’ll be your friend, Walmart. Call me.

*Walmart doesn’t make it easy to put this data together, for obvious reasons.

** NOT the Law of Large Numbers.

Comments »