Dick’s Sporting Goods reports this morning.

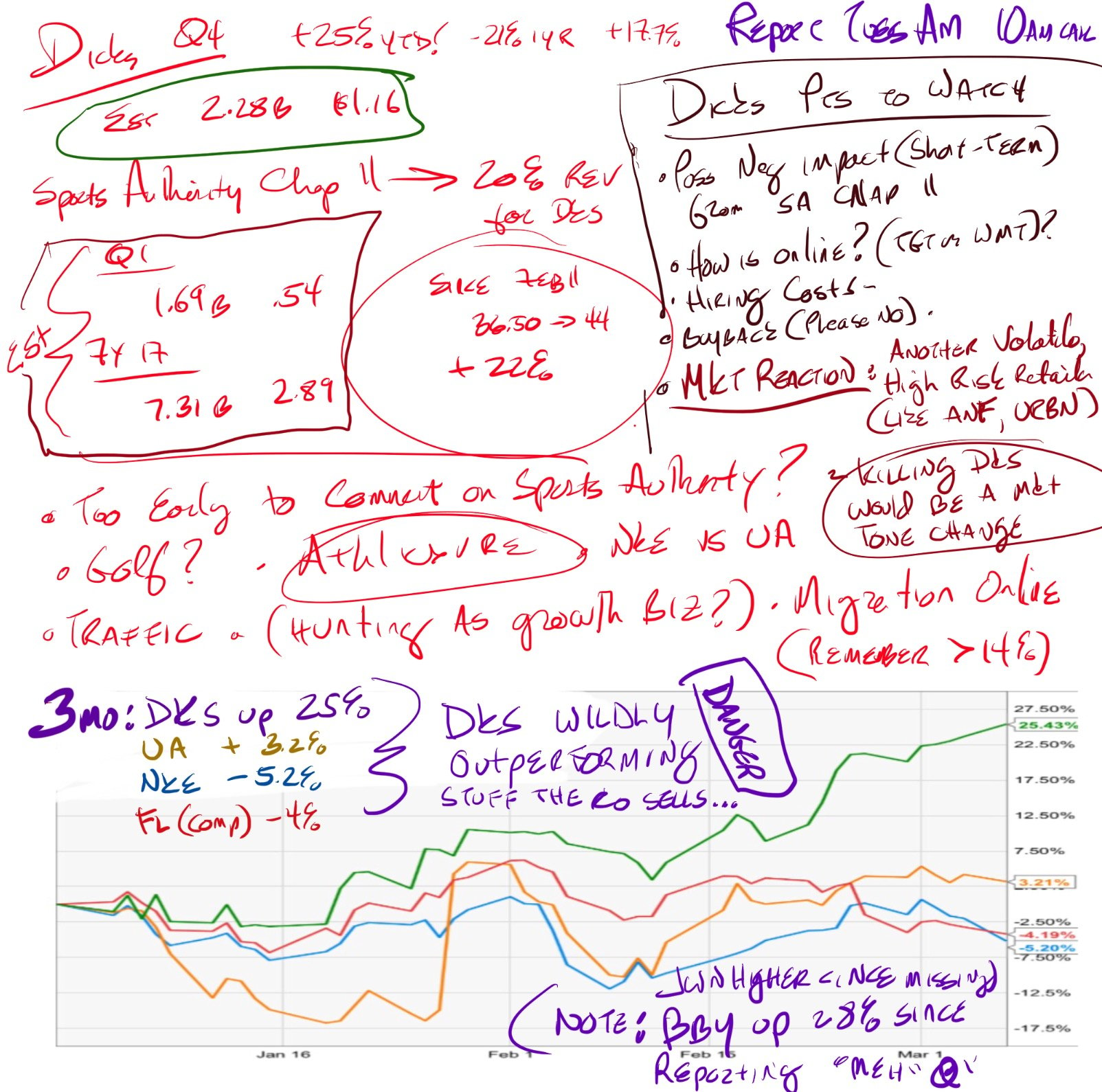

Estimates for Q1 stand at 54-cents on $2.28b. Full year is $2.89 on $7.31b. The co already warned for Q4.

Here’s my real-life pre-release cheat sheet*:

At this point you may be sick of retail coverage. You may prefer sexier stocks doing business in the cloud or selling $10 hamburgers. Or maybe you’re looking to scrape some goop off the bottom of the wreckage field that is energy.

Maybe you want to debate Apple some more or chase Tesla. Can Disney regain its downtrend?

I get it. Those are sexy stocks in the headlines. I was asked me about Palo Alto Networks as I was getting prepped for a routine colonoscopy last week. (The answer: “Too much risk just to get back to even. Go for ANF if you want the same danger seeking rush with more upside. Can I get the Michael Jackson drug now?”)

If you want cocktail party chatter stocks go play with Valeant. I hate cocktail parties in general and giving stock picks at said parties in particular. Professionally speaking I’m in it for winning, making money and scratching my creative itch, in no particular order.

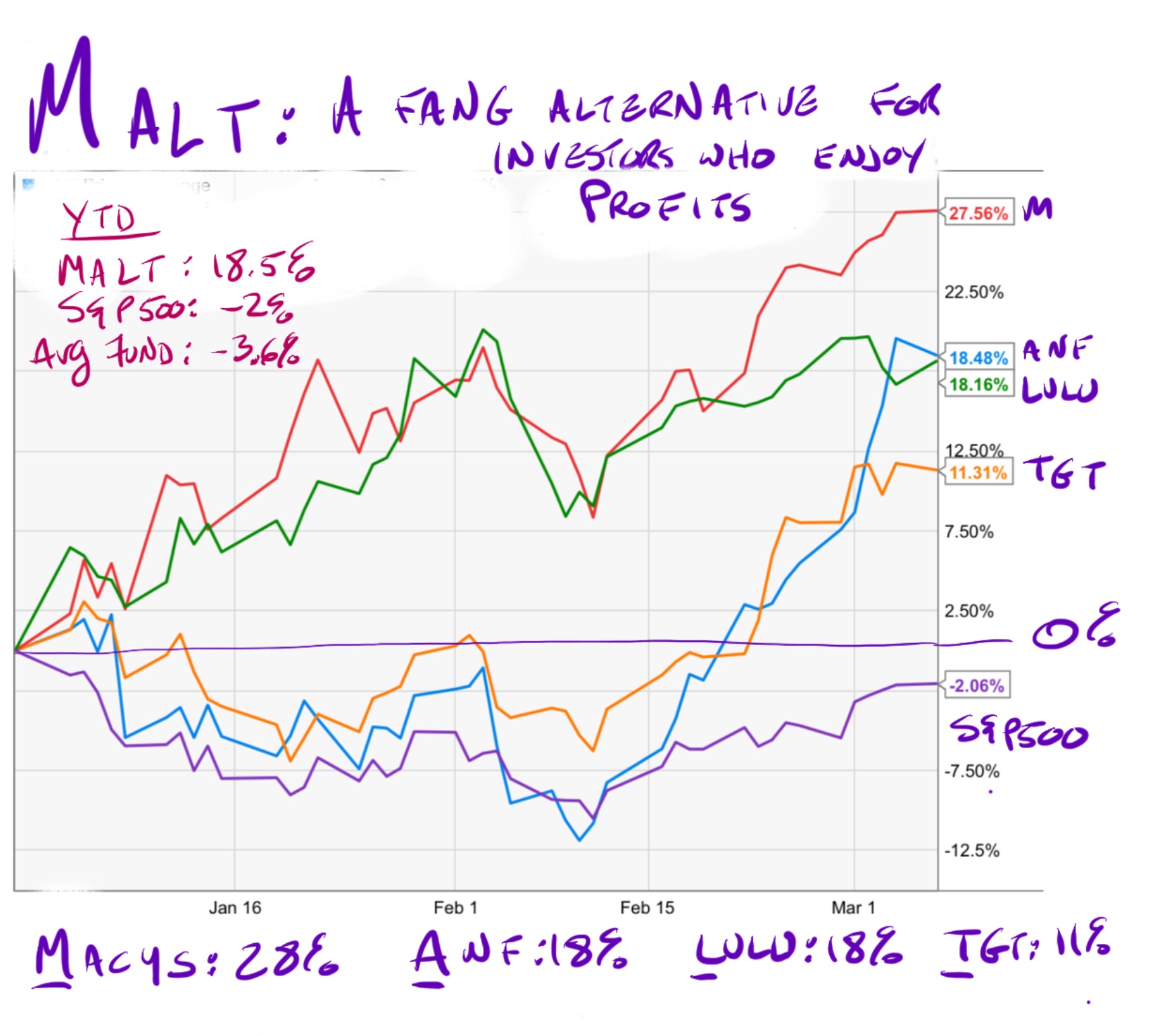

Retail is where the money is in stocks right now. That alone makes the sector sexy as far as I’m concerned but I’m sort of a hussy that way.

5 minutes ago I dubbed this basket of stocks-I-own MALT just because I wanted to respond to something I heard my friend (name drop!) Becky say on the TV. It stands for Mr Awesome Likes These. Later I realized MALT is also the first initial of these stocks in order of performance year to date (Macy’s, ANF, LULU and Target).

I prefer Mr Awesome Likes These but the company initials might make a better mnemonic strategy.

Dick’s

Retailers are shaking off horrendous earnings and exploding to the upside when they hurdle the lowest of bars. URBN thinks it’s a pizza chain and shares are up 10% after they avoided blowing up by more than expected last night. These stocks move big and have been reacting well. In part that’s because merchants started reporting near the market lows February 11th.

Something else is going on here. The retailers were sticky before the market cratered. Dicks is up 25% in 3 months, a period during which they guided lower! The stock is way outperforming shares of the companies whose product it sells. Nike and UA have been slumping while Dick’s keeps chugging along.

BBY shares are up 8% since the miss. They never really even dropped. JWN sounded like lost children on their call and the stock has already recovered. With futures lower this AM and Dick’s set to report any minute I think DKS shares are your market tell of the day.

There are a lot of moving parts to this story. If you do conference calls, tune in to DKS through the webcast at 10am. Management is a hoot (the quarter they chucked golf under bus is legendary) and the company has its finger on the pulse of things you wouldn’t expect like fashion via Athleisure.

Some stocks are for buying (like the MALT group!). Dick’s is just one to watch.

Rememeber: it’s about guidance, stock reaction and brands.

Enjoy! And… Just because I’m not mature and it must be said… I don’t know why the company has kept the name.

- I know the notes look chaotic. That was also true of yesterday’s Shake-Shack cheat sheet, which ended up mostly being a bubble shaped hamburger when I realized how insane SHAK’s valuation is. Do your best to make sense of what I’ve written. I promise there’s value in there somewhere.

Comments »