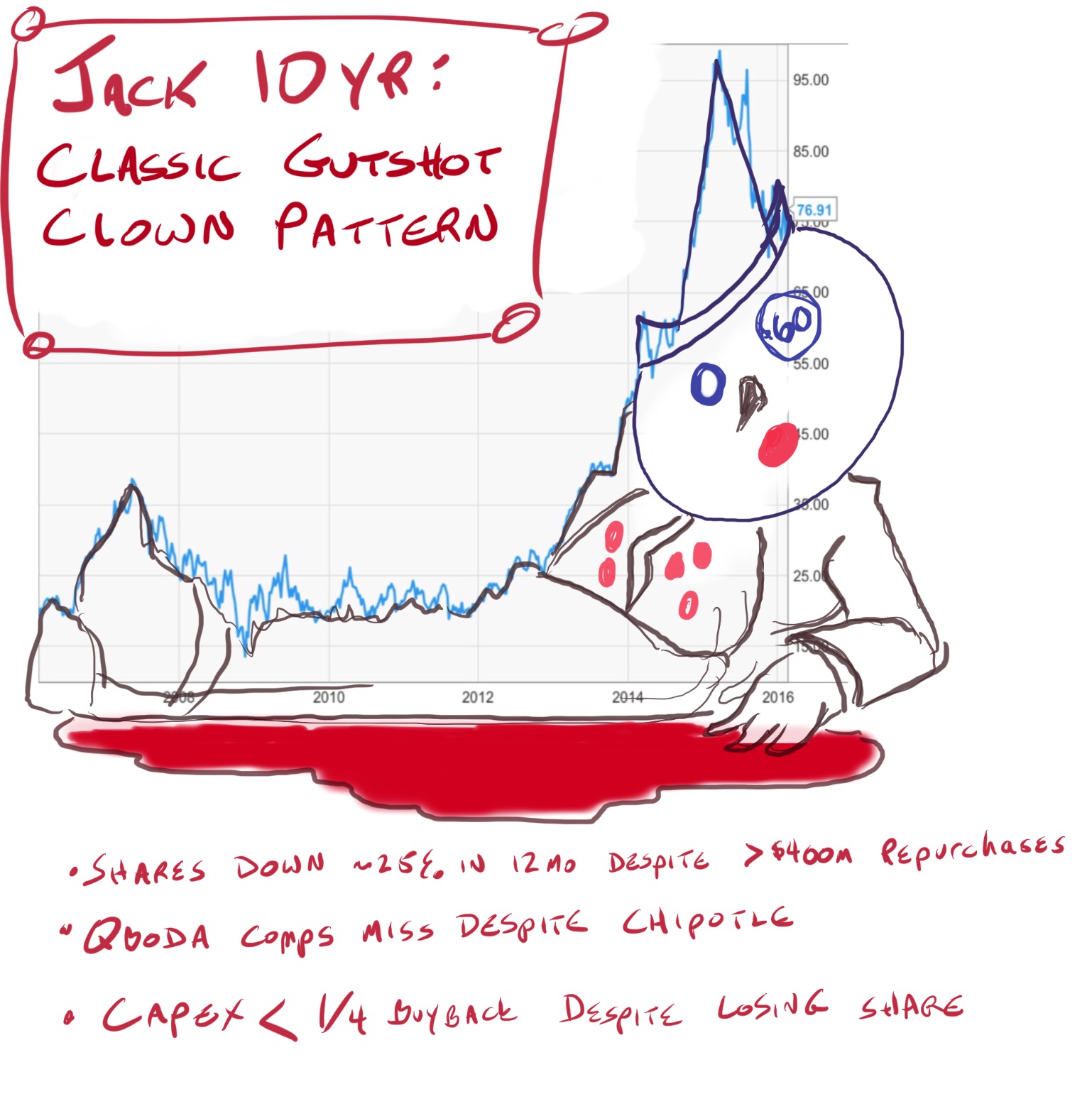

Shares of Jack in the Box are down some 20% after the former darling of last year’s “casual burger dining” bubble reported disappointing earnings and cut guidance last night.

In the short term the biggest concerns were the weak same store sales, both at the main Jack in the Box units and the once high-flying Qboda Mexican food unit. Qboda comps rose 1.8% despite the extreme tailwind provided by competitor Chipotle’s widely publicized E. Coli problems. Chipotle comps have down 30 and 36% in the last two months yet Qboda struggled to stay flat.

Red flags don’t come any bigger.

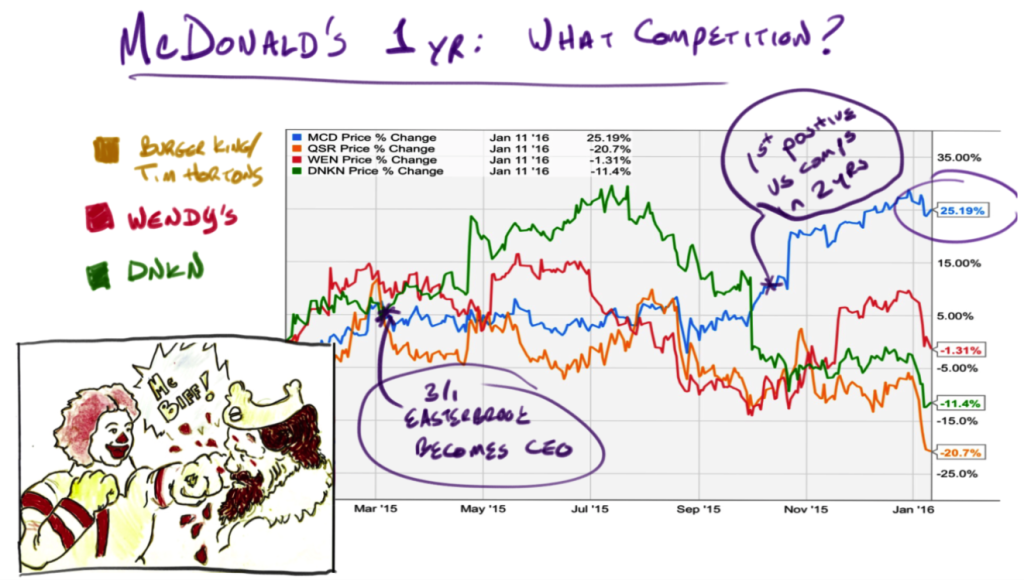

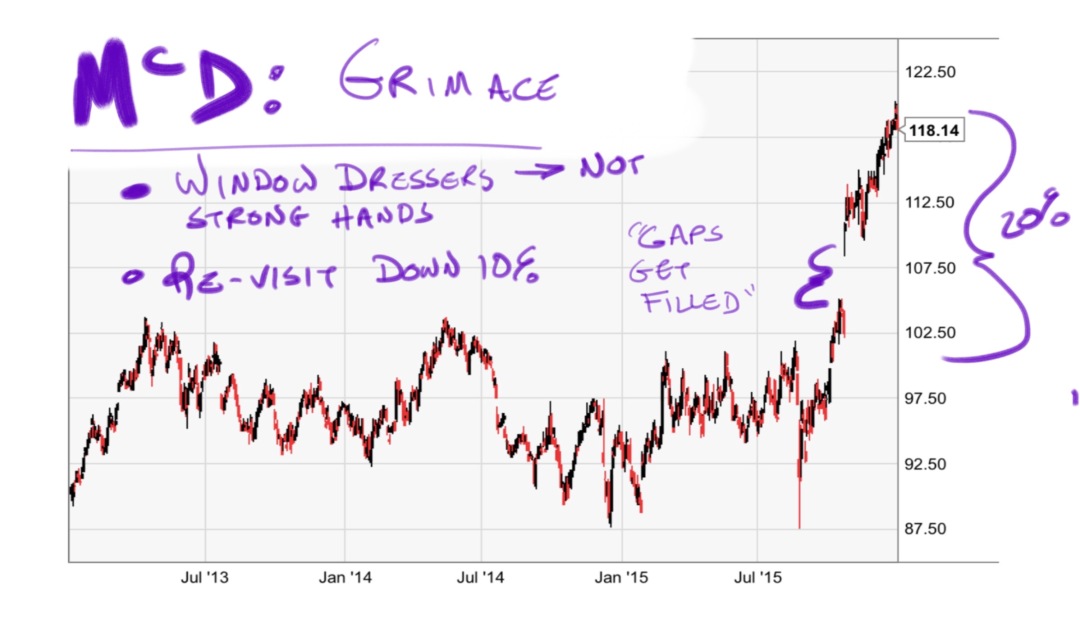

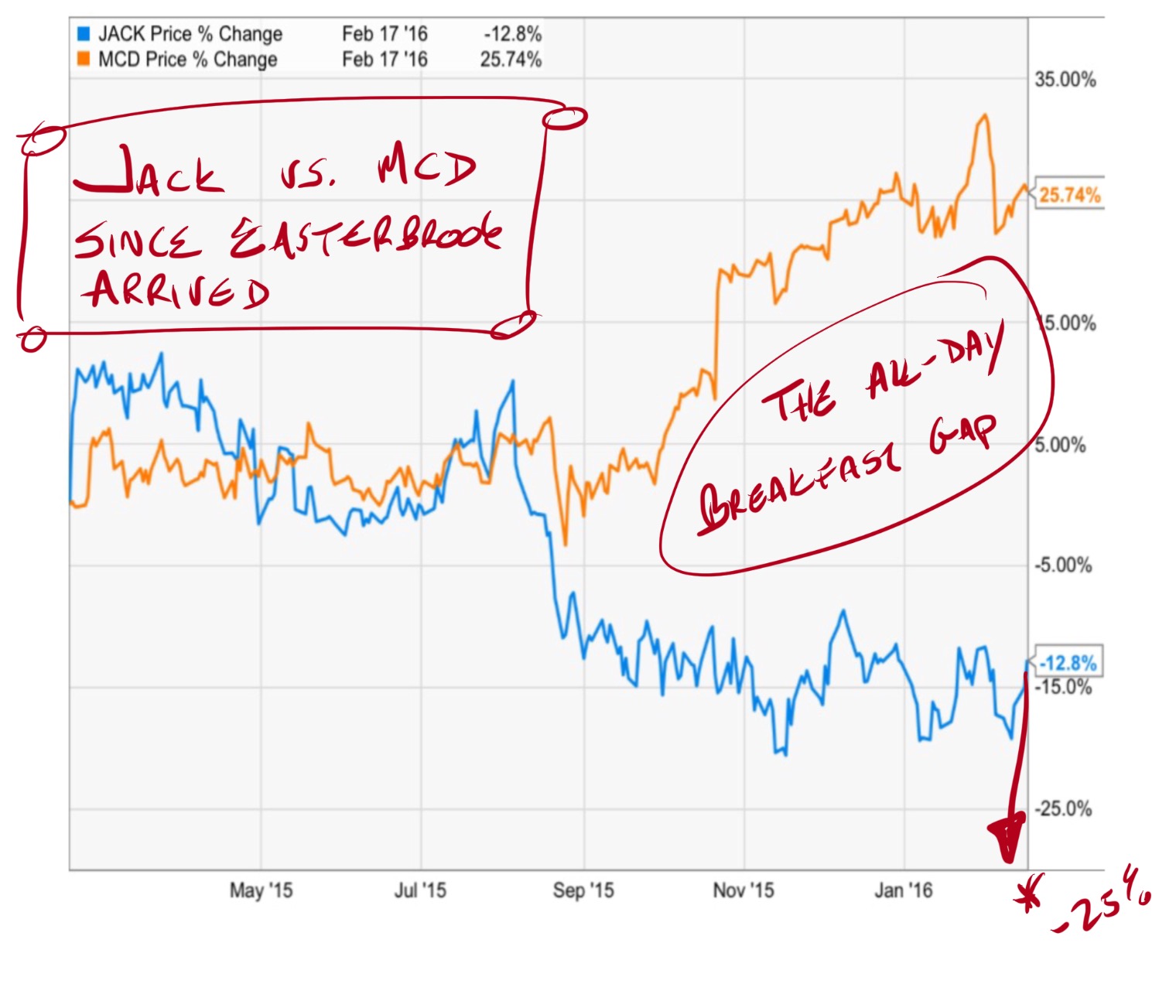

Jack said namesake units were hit by McDonald’s all-day-breakfast initiative. It would be more accurate to say Jack and its peers got stampeded by MCD simply waking up from a long slumber.

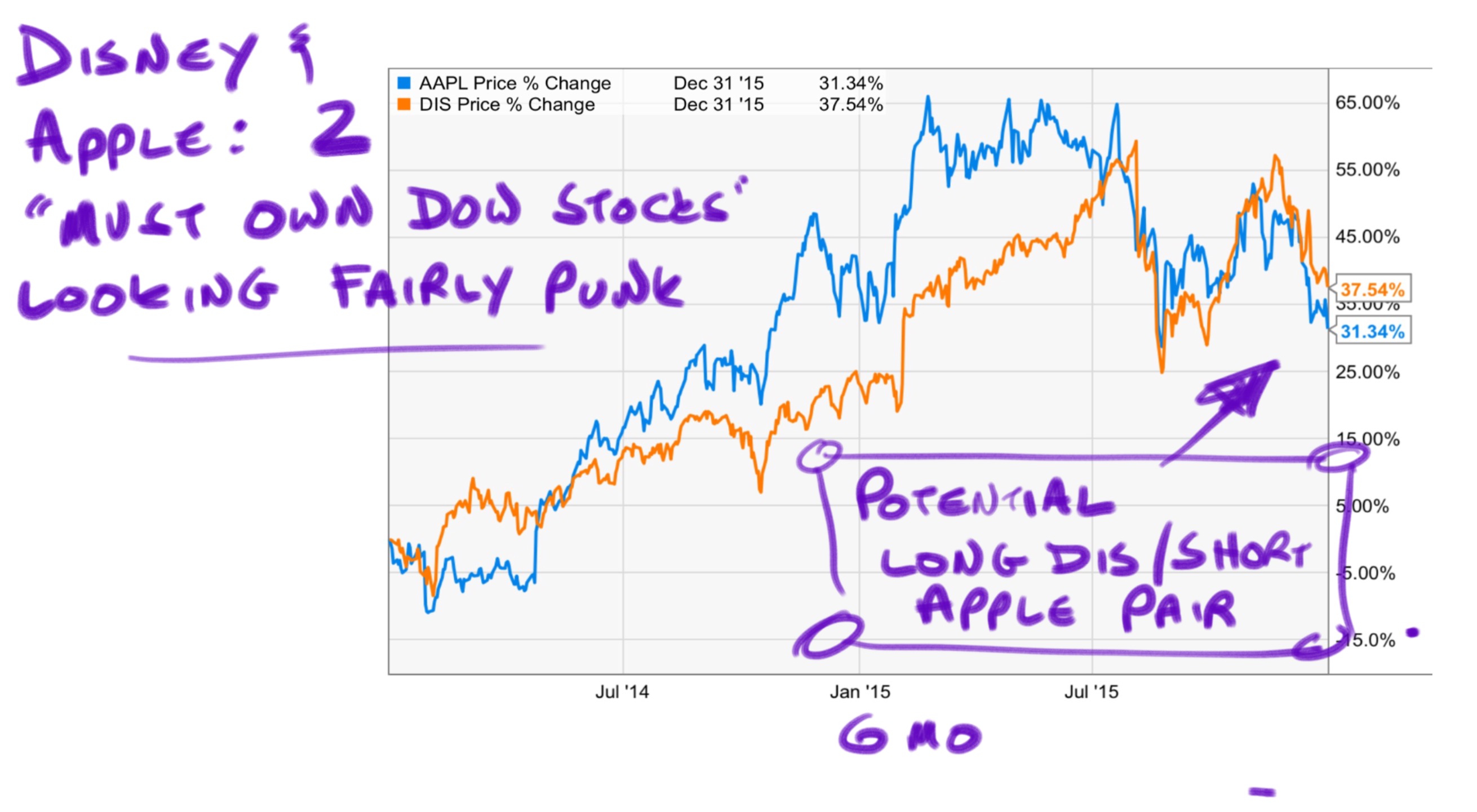

Here’s JACK vs MCD from 2012 when MCD posted negative comps for the first time in memory and last year when MCD named a new CEO:

It was an amazing run and Jack is to be credited for grabbing share from a sleeping giant. Of course it’s easy to win when the competition is unconscious. The trick is not getting stampeded once the giant awakes. On that front Jack isn’t so nimble:

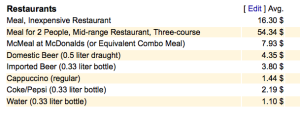

This is would an outstanding time for Jack to consolidate the gains it can save and dedicate resources to invigorating company concepts. Life in a world where MCD is posting 5.7% comps is much different than the situation 3 years ago when Japanese customers were finding bits of human beings in McDonald’s fries.

To its future shame, Jack is answering the threat of a rejuvenated McDonald’s with repurchases. In fiscal 2015 Jack spent $317m buying shares at an average cost of $84. In Q1 Jack spent another $100m buying stock at over $78. Last night the company said it was adding another $100m to the program.

That puts Jack on pace to spend 4x as much on buybacks as they do on Cap-ex. It’s the worst capital allocation since the French paid for our revolution rather than spending Parisian citizens. Look for a Franchisee revolt by the middle of this year if Jack puts up another quarter as bad as the one we just saw.

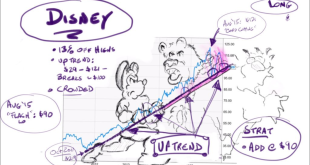

I’m playing by staying long McDonalds. No sense making this too complicated.

Comments »