I interviewed Mike Jackson, CEO of AutoNation a few years ago for Yahoo Finance. One of the topics I wanted to address was the psychotically aggressive repurchase of its own shares.

I’m not a TV person by birth. I came at it backwards from investing. That being the case I liked to use the pre-interview time with subjects to get as much information as I could to facilitate an easier on-air chemistry. Jackson is a good CEO and a strong personality. As the crew set up our shots we chatted about business and shared our backgrounds. We spoke frankly, because that’s how business people speak to each other in private.

After a few minutes I asked about the repurchases. “With a huge expansion strategy and a cyclical business how come you don’t want to save up some cash for a downturn? You guys could kill it buying dealerships if you’re liquid in the next recession.”

Jackson looked at me as if I’d just keyed the best car in the showroom.

Finally he spoke. “Jeff… it was Jeff, right?… We’ve been buying back shares for years. The stock is higher. That makes me happy. My board is happy. Buybacks are great for this company.”

He was trying to go over the top like he was Johnny Chan and I was some tourist at the Taj. Not possible.

“Mike, I get it. Your people just survived the meltdown. Being bullish on your own company is the right message. But, man, $750 million is a lot of money. It’s, what, 10% of the whole market cap? And you’re buying other dealerships which means endless training and rebranding. That’ll be expensive. AutoNation is crushing. The stock is great. Why chase it?”

He stared at me. I tried to break the ice, chuckling, “Are you doing a stealth LBO?”.

During the awkward silence that followed I mentally checked my tone. I wasn’t trying to be a jerk. We were just two business guys talking. I’d say the same thing to a friend only with swear words. I wasn’t rude. I can’t stand being rude but I don’t do bowing deference. I literally can’t. It’s a professional liability.

I returned Mike’s blank look as the sound guy ran a cable down my back.

“Jeff” he said with flashy forbearance. “The stock is higher. I wish I could get paid based on the upside we would have made on our stock. Let’s not talk about this.”

And we didn’t. Because I wasn’t Mike Wallace staring down a terrorist. Buybacks are a wonky topic. My job was to get good video. The best way to do that was to talk about whatever Mike wanted. Make it an easy conversation. Just like 2 friends chatting, only with less awkward reality stuff.

Checking in…

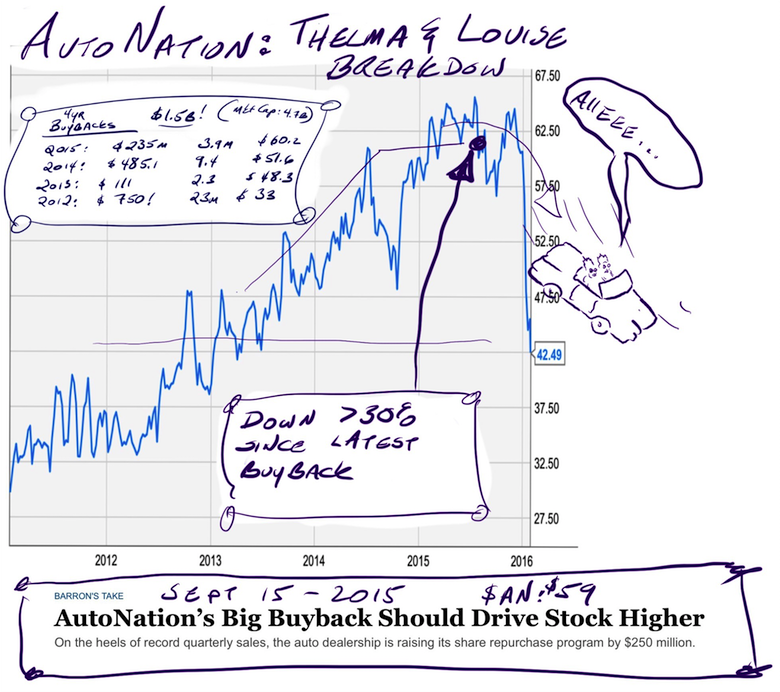

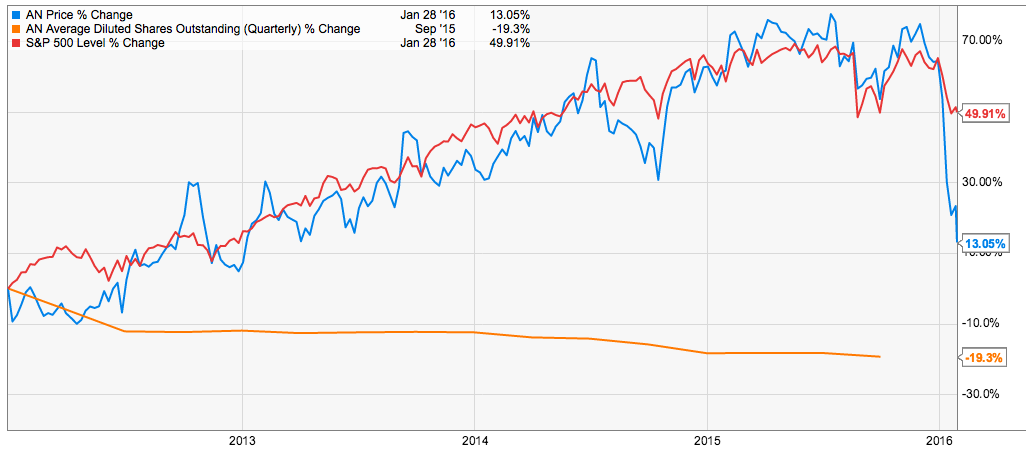

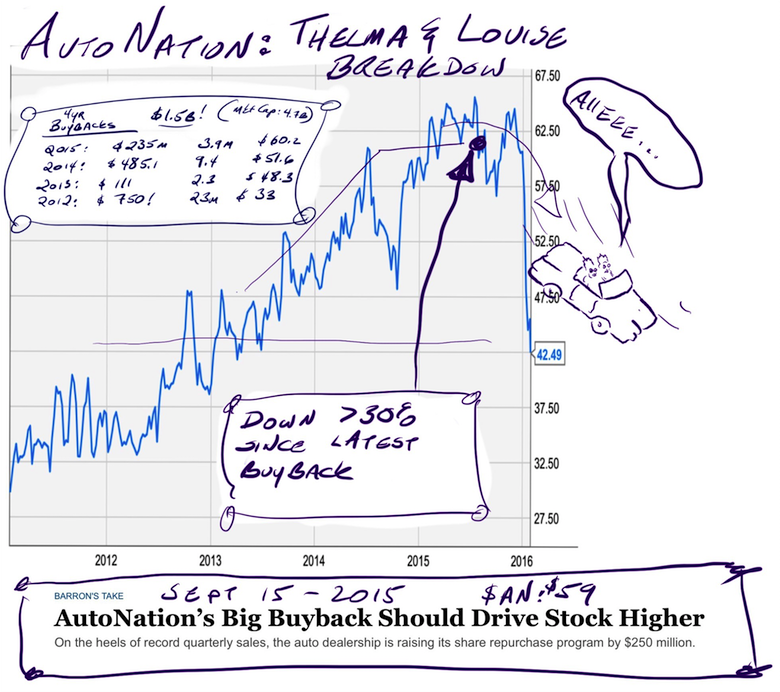

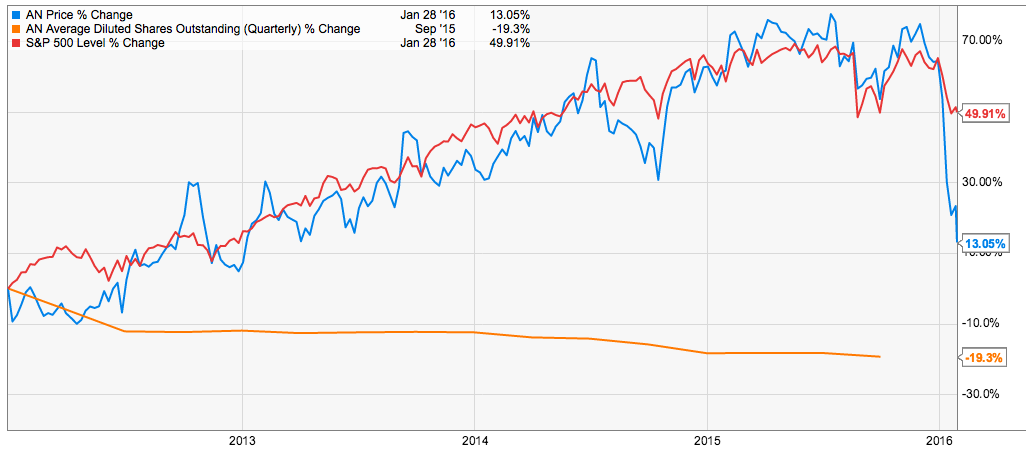

That was 2013. Since then AutoNation has spent more than $800 million on additional repurchases. The board has reduced the shares outstanding by more than 20% and the stock was doing great…

… right up until it wasn’t.

… right up until it wasn’t.

Debt is a cruel mistress, Mike Jackson. She’ll be super low-maintenance and chill for years then, right out of nowhere break into the house and boil your kid’s bunny.

AutoNation missed earnings today. This makes the second time the stock is getting punished for the same miss as Jackson effectively warned on a TV appearance earlier this month. Shares are down more than 30% year to date and only 13% higher since the start of 2012.

Margins were terrible in the 4th Q, despite Americans buying more cars than ever last year. Jackson says we’re buying SUVs, not the luxury rides AN was stocked up on all year. Now he’s got an inventory problem which means more margin issues. 3 years of stock gains have been wiped out in a month.

I’m not sure what the fix is for AutoNation but you know what I bet would come in handy for the company right now? About $1.6 billion in cash. It could fund the shares I’m confident AN is in the market buying as I type.

Be careful on this one.

Comments »

… right up until it wasn’t.

… right up until it wasn’t.