One of you little trollops have been very, very busy indeud. As a matter of fact, one of you little scoundrels are in fact a MURDERER. I do not mean to make light of a horrible situation. However, your presence in these halls has attracted unwanted attention by the media, pointing out your hideous crimes.

I dare say, you should ask for protective custody, for the wrath of The Fly doesn’t know boundaries. I will hunt you down, like the dog that you are, and kick you off a skyscraper.

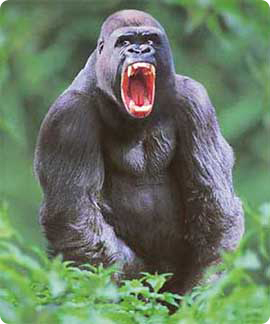

Who is this man?

The teen was reported missing the following day, but it was not until more than a year later that a hunter came across Hart’s remains, the Philadelphia Inquirer reported.

The cause of death had never been determined because officials said Hart’s remains had been decomposed.

Goff, who was 18 years old at the time of the murder, faces a weapons charge in addition to homicide.

At his initial court appearance Tuesday, Goff wanted to plead guilty but Judge Michael Donio prevented him from doing so without a lawyer present.

‘I did the crime and I’m prepared to do the time,’ said Goff, who wept during the hearing.

The 41-year-old is being held at Atlantic County justice Facility on $1million cash bail.

For the past several years, Goff has been very active online, blogging and tweeting about the stock market, economics and politics.

In a rambling profile on the site iBankCoin, the 41-year-old man has described himself as a ‘self educated genius’ and a ‘modern day Renaissance Man’ with a Master’s Degree from the school of hard knocks and a PhD from Google University.

Goff apparently has been dabbling in stock trading but was hoping to become a hedge fund manager. Speaking of his employment history, the New Jersey man wrote that he had tried his hand at half a dozen trades, including master electrician, baker, cook, teacher and semi-professional poker player.

But according to his online biography, Goff had a dark criminal past that included a five-year prison sentence on drug charges which he received when he was 18 years old – around the time of Hart’s slaying.

Speaking about his past bad decisions, the 41-year-old wrote that he was a ‘master safe cracker thief, liar, professional slot machine cheat,’ a bad father, bad brother and bad son who had been stabbed and shot at.

On another blog site, Goff lamented that his being a convicted felon has kept him from realizing his ‘BIG IDEAS for this world and our species on this planet.’

‘I am now hindered from ever sitting for a LAW BAR exam or a series 7 brokers [sic] exam. Or from ever becoming a teacher,’ he wrote.

‘I am MOST pissed that I can never be called upon to defend my nation in service if need be. They will never let me ever touch a firearm ever again.’

Following his arrest Monday, a friend posted on Goff’s Facebook page that she had seen him and he wanted to let everyone know that he is doing fine.

Another friend expressed hope that ‘this is the last of the skeletons’ in his closet.

Find this man. Feel free to kill him if you like.

UPDATE: Gap n Yap solved the mystery! Apparently, this fine gent was a denizen in the blogger network. Perhaps I need to keep a closer eye on the ongoings over there. Apparently, some of you are murderers, thieves and perhaps rapists.

Comments »