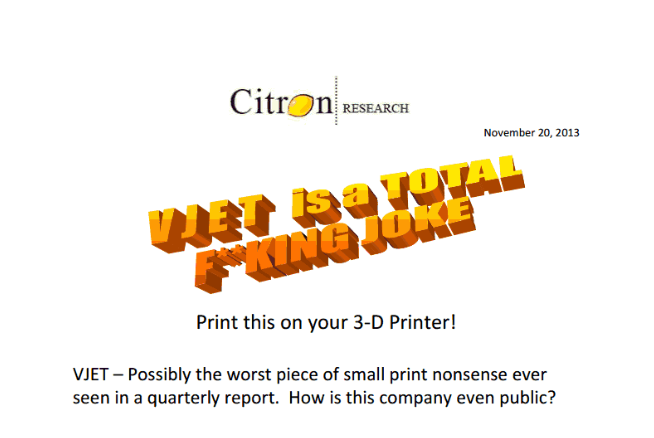

I’m still laughing at the ‘research report’ circulated by Citron yesterday, dragging VJET through the sticks and mud. Who wrote that report, Kenny Powers? These people are children.

I see the stock is down another $2.50, which is fascinating. You retards are just surfing the tide. You’re not swimming, which is why you have weak hands. “The Fly” has hands of stone and granite. He punches Citron in the face, then steals their lemons.

Retail numbers sucked today–because Obama is the devil. The economy is good–exclusively for those making more than 250k per annum. Stocks go up because Ben Bernanke is crazy and makes them go higher.

GMCR is ripping this morning, making a laughing stock of David Einhorn’s short position. Between GMCR and CMG, he’s been exactly wrong on the direction of two momentum stocks and should probably refrain from doing so in the future.

I like solar, dry bulk and sapphire on silicon. I also think Eddie LampBERT (sp?) is a goddamn idiot and should step away from SHLD.

Comments »