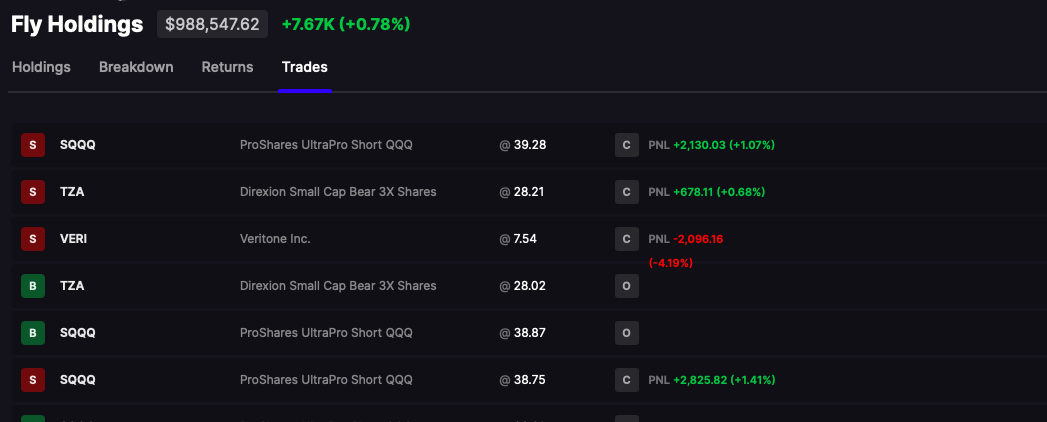

I gave it until 1pm, the crashing of the market and all. It didn’t happen, so I allocated back into my weekly quant and now have a market neutral position. The expectation for today is SOFT LANDING because housing starts went up around +8% vs the 1% expected. Because of this chicanery, amongst other things, we’re back to fucking dreamland where war is peace, down is up, and sharply higher interest rates is GOOD for housing.

How often can one person get upset over these things? Eventually the heart gives way and the agitant dies off only to be replaced with someone younger who will also die off after enough years have gone by in deepening purple anger.

I cannot fight it anymore. I acqueisce to the faggotry at large and might now perhaps support Ukraine and their fucking homosexual flag and all of the other cool things NATO is bringing forth around the world, including expanding the Atlantic Ocean into Asia.

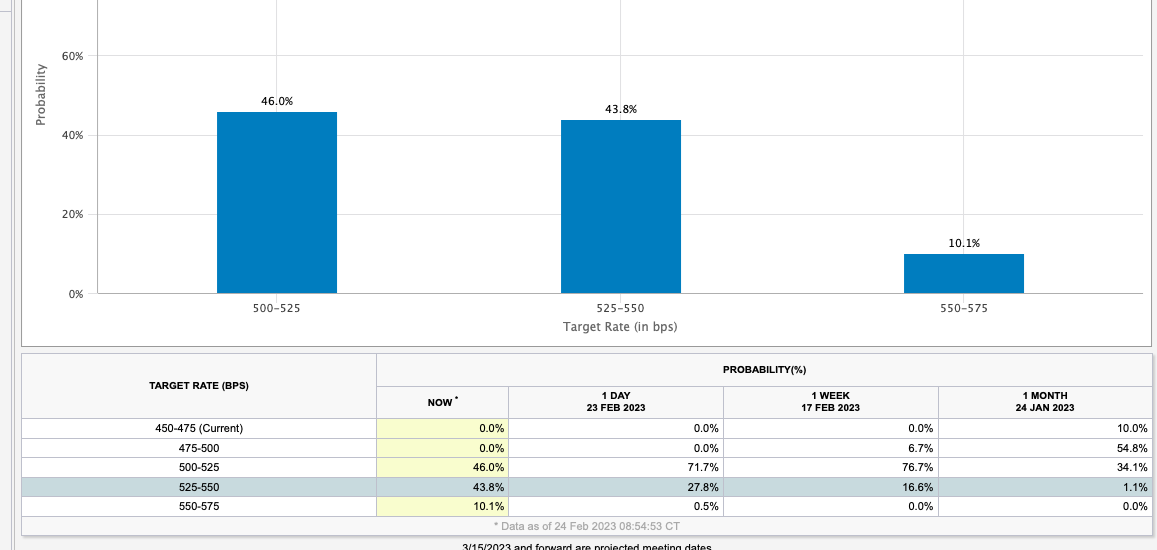

With regard to money supply and the Fed, they’re so awesome and amazing. I just can’t wait to pay my taxes.

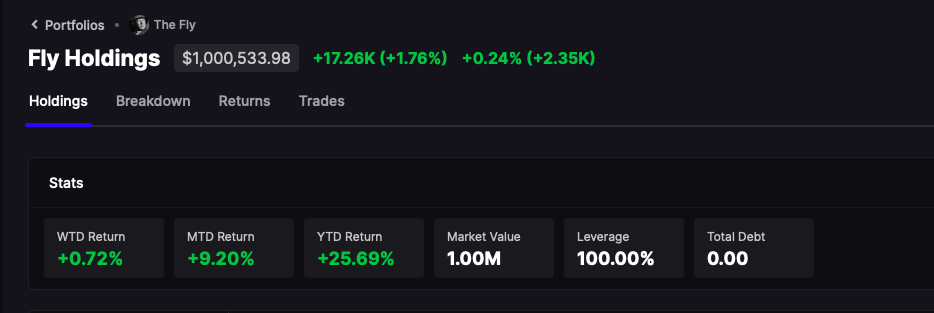

I am down 1.25% for the session and I am sure 90% of you assholes are up for the day, enjoying the market as you day drink like the fools you are.

Comments »