Some things to consider before you cast the market out a loser.

1. The SMH was +16.6% last month and is up 1% MTD.

That’s all I want you to consider, when thinking it’s 100% over. It might be over. God knows I want it over. But is it really that bad out there when the leading tech index is +1% following a +16% showing?

I think not.

Today was supposed to be an ebullient day spearheaded by NVDA. Well, as of now, that turned out to be a bust — as indices traded straight the fuck lower since the open.

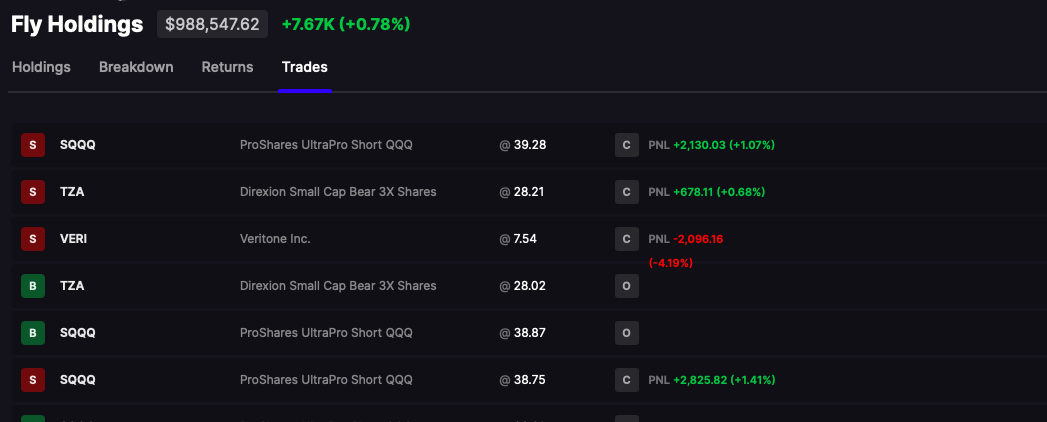

I managed a 100% long book into this decline by simply using leverage to sell short via inverse ETF’s and cover quickly. The trick is to take LARGE positions, 10-40% of overall assets and you need to be fast. I basically short into downside momo and over at the first sign of a robust green candle. It looks something like this.

These trades kept me green. The VERI trade was a carry over from yesterday.

I might need to step back in and bulk up short into the late afternoon hours. I am better that, at least for now, we’ll get some respite and resumption of the bull trade — although, admittedly, it looks rather glum out there.

If you enjoy the content at iBankCoin, please follow us on Twitter

In terms of the long wave we are at a secular inflection point. Four decades of disinflation and fighting deflation are ended. Now we return to fighting inflation as we did in the 70’s which will require the Fed to act on multiple flare-ups going forward. There will be many unpleasant ramifications. Right now the economy is behaving resilient considering the rate hikes, inflation is also behaving entrenched. Whether the Fed hikes or delays doesn’t matter; the bond market will determine where we’re headed. The only thing to like is this will make our excessive governments less spendy and more pragmatic. The disinflation drivers have run their course for the most part.