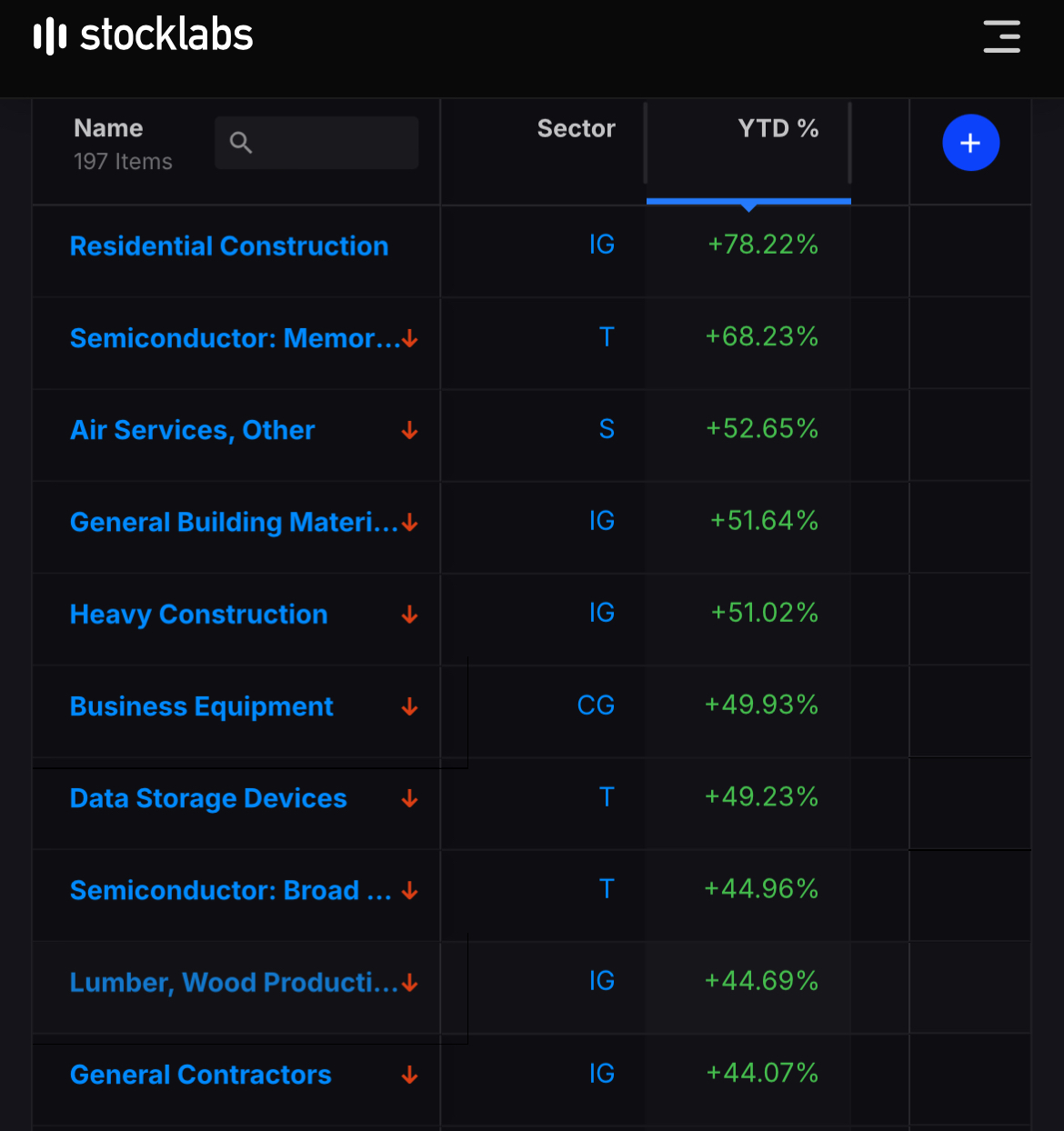

These aren’t the top 10 stocks based off technical scores now — but the aggregate scores year to date. I’d normally apply a volume filter for trading purposes but removed it for the sake of the exercise and it produced some names I was unfamiliar with. It was a great year for many stocks and specific sectors. If recalcitrant in the losing areas of the market, you were offered very few periods of respite, as the anointed places of bullish fervor constantly ebbed higher.

#1:M/I Homes Inc. ($MHO) +189% = M/I Homes, Inc., together with its subsidiaries, operates as a builder of single-family homes in Ohio, Indiana, Illinois, Michigan, Minnesota, North Carolina, Florida, and Texas, the United States. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments. It designs, constructs, markets, and sells single-family homes and attached townhomes to first-time, millennial, move-up, empty-nester, and luxury buyers under the M/I Homes brand name. The company also purchases undeveloped land to develop into developed lots for the construction of single-family homes, as well as for sale to others. In addition, it originates and sells mortgages; and serves as a title insurance agent by providing title insurance policies, examination, and closing services to purchasers of its homes. The company was formerly known as M/I Schottenstein Homes, Inc. and changed its name to M/I Homes, Inc. in January 2004. M/I Homes, Inc. was founded in 1976 and is based in Columbus, Ohio.

#2: Limbach Holdings Inc. ($LMB) +327% = Limbach Holdings, Inc. operates as an integrated building systems solutions company in the United States. It operates in two segments, Construction and Service. The company engages in the design, prefabrication, installation, management, and maintenance of mechanical, electrical, plumbing, and control systems, as well as heating, ventilation, air-conditioning (HVAC) system; and maintenance, and equipment upgradation, emergency service work, automatic temperature control, specialty contracting, and energy monitoring services. Its facility services comprise mechanical construction, HVAC service and maintenance, energy audits and retrofits, engineering and design build, constructability evaluation, equipment and materials selection, offsite/prefabrication construction, and sustainable building solutions and practices. The company serves research, acute care, and inpatient hospitals; public and private colleges, universities, research centers and K-12 facilities; sports arenas; entertainment facilities, and amusement rides; passenger terminals and maintenance facilities for rail and airports; government facilities comprising federal, state, and local agencies; hotels and resorts; office building and other commercial structures; multi-family apartments; data centers; and industrial manufacturing facilities. It operates in Florida, California, Massachusetts, New Jersey, Pennsylvania, Delaware, Maryland, Washington DC, Virginia, West Virginia, Ohio, and Michigan. The company was founded in 1901 and is headquartered in Pittsburgh, Pennsylvania.

#3: Fortress Transportation and Infrastructure Investors LLC ($FTAI) +174% = Fortress Transportation and Infrastructure Investors LLC owns and acquires infrastructure and related equipment for the transportation of goods and people in Africa, Asia, Europe, North America, and South America. It operates through three segments: Aviation Leasing, Jefferson Terminal, and Ports and Terminals. The Aviation Leasing segment leases aircraft and aircraft engines. As of December 31, 2020, this segment owned and managed 264 aviation assets, including 78 commercial aircraft and 186 engines. The Jefferson Terminal segment engages in the development of a multi-modal crude oil and refined products handling terminal in Beaumont, Texas; and ownership of various other assets for the transportation and processing of crude oil and related products. The Ports and Terminals segment operates Repauno, a 1,630 acre deep-water port located along the Delaware River; and Long Ridge, which is a 1,660 acre multi-modal port located along the Ohio River. The company also owns and leases offshore energy equipment and shipping containers. It serves operators of transportation and infrastructure networks comprising airlines, offshore energy service providers, energy providers, and shipping lines. The company is externally managed by FIG LLC, an affiliate of Fortress Investment Group LLC. Fortress Transportation and Infrastructure Investors LLC was founded in 2011 and is headquartered in New York, New York.

#4: NVIDIA Corporation ($NVDA) +234% = NVIDIA Corporation operates as a visual computing company worldwide. It operates in two segments, Graphics and Compute & Networking. The Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise design; GRID software for cloud-based visual and virtual computing; and automotive platforms for infotainment systems. The Compute & Networking segment offers Data Center platforms and systems for AI, HPC, and accelerated computing; Mellanox networking and interconnect solutions; automotive AI Cockpit, autonomous driving development agreements, and autonomous vehicle solutions; and Jetson for robotics and other embedded platforms. The company’s products are used in gaming, professional visualization, datacenter, and automotive markets. NVIDIA Corporation sells its products to original equipment manufacturers, original device manufacturers, system builders, add-in board manufacturers, retailers/distributors, Internet and cloud service providers, automotive manufacturers and tier-1 automotive suppliers, mapping companies, start-ups, and other ecosystem participants. NVIDIA has partnership with Google Cloud to create AI-on-5G Lab. NVIDIA Corporation was founded in 1993 and is headquartered in Santa Clara, California.

#5: Abercrombie & Fitch Company ($ANF) +305% = Abercrombie & Fitch Co., through its subsidiaries, operates as a specialty retailer in the United States, Europe, the Middle East, Asia, the Asia-Pacific, Canada, and internationally. The company operates through two segments, Hollister and Abercrombie. It offers an assortment of apparel, personal care products, and accessories for men, women, and kids under the Hollister, Gilly Hicks, Social Tourist, Abercrombie & Fitch, and abercrombie kids brands. The company sells products through its stores; various wholesale, franchise, and licensing arrangements; and e-commerce platforms. Abercrombie & Fitch Co. was founded in 1892 and is headquartered in New Albany, Ohio.

#6: Meta Platforms Inc ($META) +193% = Meta Platforms, Inc. develops products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, wearables, and in-home devices worldwide. It operates in two segments, Family of Apps and Reality Labs. The Family of Apps segment’s products include Facebook, which enables people to share, discover, and connect with interests; Instagram, a community for sharing photos, videos, and private messages, as well as feed, stories, reels, video, live, and shops; Messenger, a messaging application for people to connect with friends, family, groups, and businesses across platforms and devices through chat, audio and video calls, and rooms; and WhatsApp, a messaging application that is used by people and businesses to communicate and transact privately. The Reality Labs segment provides augmented and virtual reality related products comprising virtual reality hardware, software, and content that help people feel connected, anytime, and anywhere. The company was formerly known as Facebook, Inc. and changed its name to Meta Platforms, Inc. in October 2021. Meta Platforms, Inc. was incorporated in 2004 and is headquartered in Menlo Park, California.

#7: PulteGroup Inc. ($PHM) +125% = PulteGroup, Inc., through its subsidiaries, primarily engages in the homebuilding business in the United States. The company acquires and develops land primarily for residential purposes; and constructs housing on such land. It offers various home designs, including single-family detached, townhouses, condominiums, and duplexes under the Centex, Pulte Homes, Del Webb, DiVosta Homes, American West, and John Wieland Homes and Neighborhoods brand names. As of December 31, 2020, the company controlled 180,352 lots, of which 91,363 were owned and 88,989 were under land option agreements. It also arranges financing through the origination of mortgage loans primarily for homebuyers; sells the servicing rights for the originated loans; and provides title insurance policies, and examination and closing services to homebuyers. PulteGroup, Inc. has a strategic relationship with Invitation Homes Inc. The company was formerly known as Pulte Homes, Inc. and changed its name to PulteGroup, Inc. in March 2010. PulteGroup, Inc. was founded in 1950 and is headquartered in Atlanta, Georgia.

#8: Fair Isaac Corporation ($FICO) +96% = Fair Isaac Corporation develops analytic, software, and data management products and services that enable businesses to automate, enhance, and connect decisions in North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific. The company offers analytical solutions, credit scoring, and credit account management products and services to banks, credit reporting agencies, credit card processing agencies, insurers, retailers, healthcare organizations, and public agencies. It operates through three segments: Applications, Scores, and Decision Management Software. The Applications segment offers pre-configured decision management applications designed for various business problems or processes, such as marketing, account origination, customer management, fraud, financial crimes compliance, collection, and insurance claims management, as well as associated professional services. The Scores segment provides business-to-business scoring solutions and services, including myFICO solutions for consumers that give clients access to analytics to be integrated into their transaction streams and decision-making processes, as well as associated professional services. The Decision Management Software segment offers analytic and decision management software tools through FICO Decision Management Suite, as well as associated professional services. Fair Isaac Corporation markets its products and services primarily through its direct sales organization; indirect channels; subsidiary sales organizations; and resellers and independent distributors, as well as online. The company was formerly known as Fair Isaac & Company, Inc. and changed its name to Fair Isaac Corporation in July 1992. Fair Isaac Corporation was founded in 1956 and is headquartered in San Jose, California.

#9: BellRing Brands ($BRBR) +116% = BellRing Brands, Inc., together with its subsidiaries, provides various nutrition products in the United States and internationally. It offers ready-to-drink (RTD) protein shakes, other RTD beverages, powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. The company sells its products through club, food, drug, mass, eCommerce, specialty, and convenience channels. BellRing Brands, Inc. was incorporated in 2019 and is headquartered in Saint Louis, Missouri.

#10: Vertiv Holdings Co ($VRT) +257% = Vertiv Holdings Co, together with its subsidiaries, designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. It offers power management products, uninterruptible power systems, thermal management products, integrated rack systems, modular solutions, and management systems for monitoring and controlling digital infrastructure that are integral to the technologies used for various services, including e-commerce, online banking, file sharing, video on-demand, energy storage, wireless communications, Internet of Things, and online gaming. The company also provides lifecycle management services, predictive analytics, and professional services for deploying, maintaining, and optimizing these products and their related systems. It offers its products primarily under the Liebert, NetSure, Geist, and Avocent brands. The company serves social media, financial services, healthcare, transportation, retail, education, and government industries through a network of direct sales professionals, independent sales representatives, channel partners, and original equipment manufacturers. Vertiv Holdings Co is headquartered in Columbus, Ohio.

Bonus #11: CymaBay Therapeutics Inc. ($CBAY) +267% = CymaBay Therapeutics, Inc., a clinical-stage biopharmaceutical company, focuses on developing and providing therapies to treat liver and other chronic diseases. Its lead product candidate is seladelpar (MBX-8025), a selective agonist of peroxisome proliferator activated receptor delta for the treatments of autoimmune liver disease, primary biliary cholangitis (PBC). The company also develops MBX-2982 for the disease/condition of hypoglycemia in type 1 diabetics. It has a license agreement with ABW Cyclops SPV LP to support development of seladelpar for the treatment of PBC; and holds a worldwide license from Janssen Pharmaceuticals, Inc. to research, develop, and commercialize compounds with activity against an undisclosed metabolic disease target. The company was formerly known as Metabolex, Inc. CymaBay Therapeutics, Inc. was incorporated in 1988 and is headquartered in Newark, California.

Comments »