My presumption is lower rates will help highly indebted companies because those companies’ stock prices priced in HIGHER RATES. As their debt came due they’d have to finance at a more expensive rate; ergo, this would reduce their cash flow. But now since we’ve figured out inflation and we’re pricing in 5 rate cuts in 2024, we should refactor valuations for said companies.

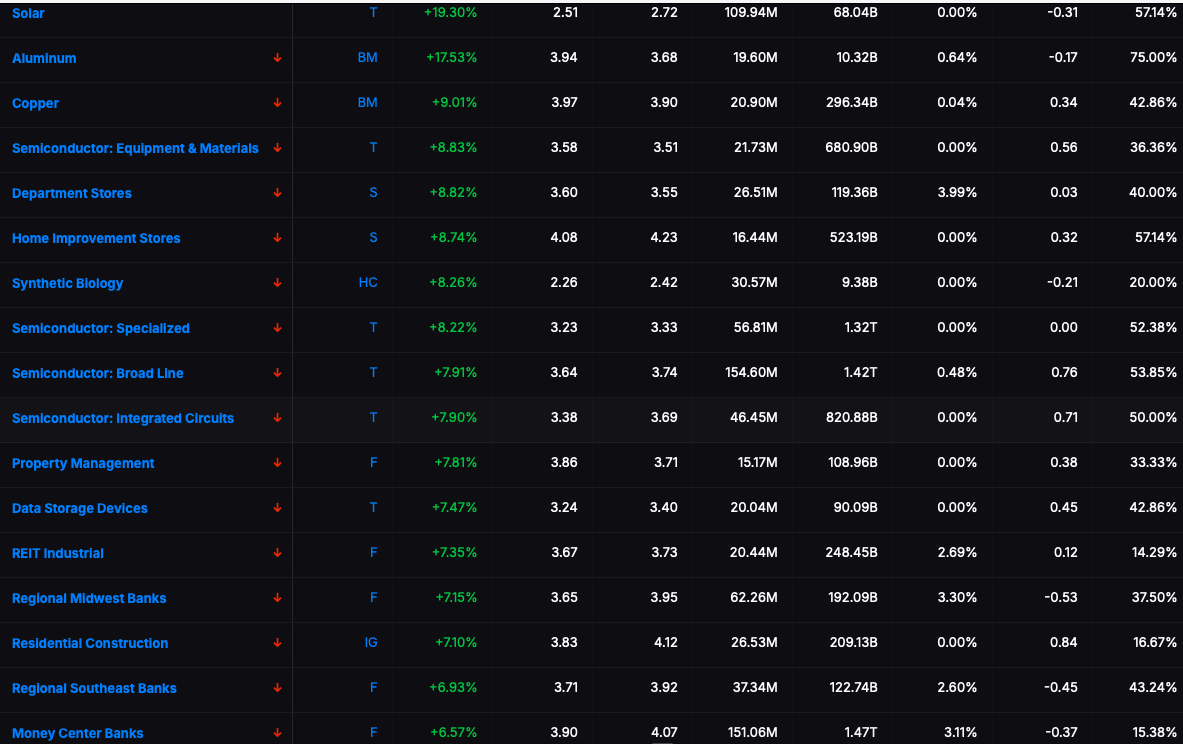

Here were the biggest winners, industry wise, last week.

Solar was the highlight with nearly a +20% return last week, reducing losses for 2023 to -40%.

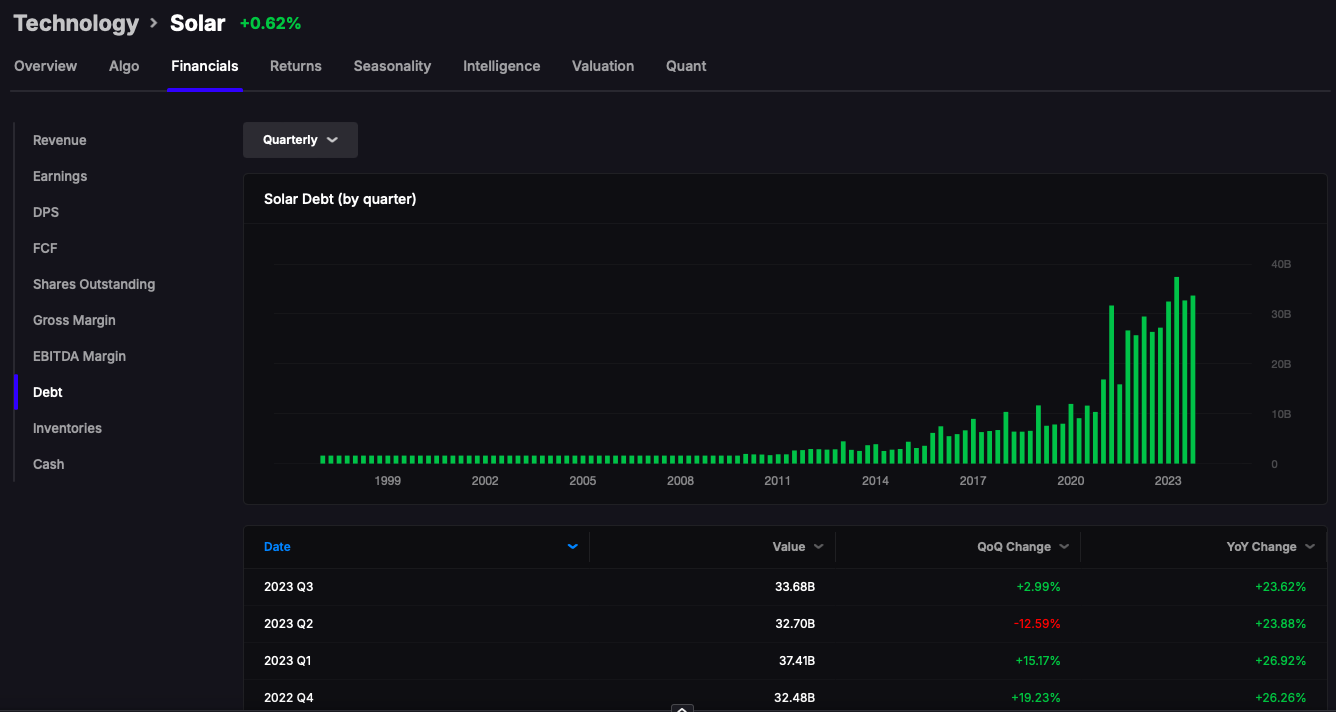

Debt-wise, the solar industry is extremely leveraged.

WTD the median return for ALL stocks was +4.2%

WTD the median return for stocks with debt/market cap over 2 was 5.64%

Debt growth (TTM) for all stocks is +1.93%

Let’s take a look at returns for companies who grew debt greater than 10% TTM.

+5.1%

+20% debt growth TTM

+5.8%

+30%

+6.03%

+50%

+6.22%

One thing to consider when looking at this data is the pool of stocks shrinks each time I constrict the data. So let’s look at the opposite, companies who reduced their debt and see if this exercise was a giant waste of time.

-10% debt growth TTM

+4.19%

-20%

+4.13%

I think it’s fair to say my assumption is correct. So now let’s take a look at some heavily indebted stocks that haven’t moved yet — for the sake of greed.

My criteria is debt/market cap (which is a real time assessment to company leverage unlike debt/equity) +0.75x, debt $1b+ with returns less than +15% YTD.

(SORTED BY DOWN MOST)

IEP, ACDC, DISH, HE, LUMN

(SORTED BY BEST TECHNICAL SCORE)

CMTG, TFSL, RUN, MS, CRBG

(SORTED BY TOP AGGREGATE TECH SCORES OVER 1 WEEK)

CMTG, DB, USB, BK, ARI

Conclusion: If rates continue to come in, we are likely to see these trends continue: rotation into capital intensive industries such as solar, mortgage, banks, biotechs etc.

One final note: which industries have been growing debt the most in the past 12 months?

Again, I’ll revert to data inside Stocklabs to search.

Debt Growth TTM

Biotech +3.47%

Gene Editing +4.97%

Alt Energy +14.97%

Electric Vehicles +24.2%

Autos (major) +4.8%

Financials as a general sector have universally grown debt by 8%

Industrials almost universally have negative debt growth, and have incidentally been the best area to invest the past year. There is one industry that is the exception: Defense, which is one of the worst performers YTD. Defense debt is +5.72% ttm

Restaurants +4.3%

Railroads +4.2%

CATV +3.04%

Lodging +5.8%

Trucking +5%

Auto parts stores +13%

SAAS we know is heavily dependent on private equity, which is driven by public markets valuations. It’s a bifurcated area — but you will see stocks like SNOW, WK, SPT and many others sports double digit debt growth while at the same time some like BOX, AMPL, ADBE and SHOP constrict debt — likely due to the environment. But I think it’s fair to assume lower rates will be a big net benefit for SAAS.

Semis +5%

Solar +16%

3d printing +26%

I think it’s fair to say, as a whole, lower rates help balance sheets and thus should propel share prices higher. As a stock picker I am more likely to pay attention to current trends in share prices much more than relying simply on the above data. However, it’s worth bearing in mind that some of the worst performers of 2023 might have motive to head higher into a much more accommodative refinancing environments in 2024.

If you enjoy the content at iBankCoin, please follow us on Twitter

i do like to speculate sometimes, so i bought 17,000 shares of NAIL. at 53 in Nov. Sold it all at 111 Fri. And that is how you make a fast Million. Just goes into the foundation anyway. I know our stations in life are not equal, but keep at it if that is all you aspire to. I have nine figure plus and nothing changes from day to day. Good luck sir.

I do like to speculate occasionally, i bought 17,000 shares of NAIL in Nov $53 a share, on interest rate spec of dropping. Sold it all Friday at 111. Make little over one million and it doesn’t change a thing. I know we are probably at different stations of monetary life. I have over nine figure plus, and day to day is the same, the money just goes to our foundation anyway. Make something of your life that is worthwhile. Don’t bank on well it’s for the kids. I think that might be a rude awaking possible. Well anyway good luck sir