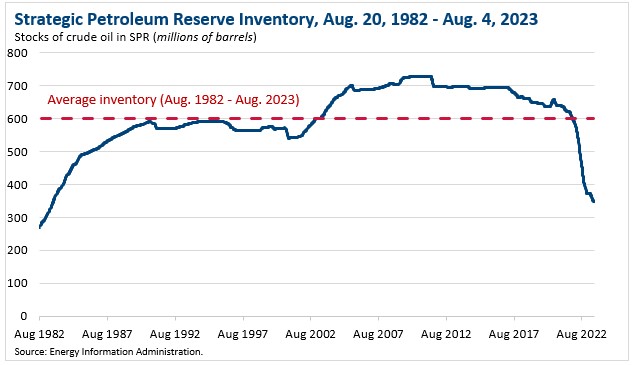

You should know I’ve traded well today after a brief collapse of my PNL. I am now just down 50bps, after being harangued to the tune of 1.5%. Part of my #success was to believe in the wanton incompetence of my government, depleting its strategic oil reserves to teach Putin a lesson. Meanwhile, oil is barreling henceforth towards $100 and the very cold winter chills awaits the dastardly bastards in the west.

The Biden bastards were supposed to fill up the SPR months and months ago — but balked at the prices of $70. They much prefer to contemplate buying here at $100. You have to understand something — these are not maniacal evil geniuses in control of everything, stemming from the weather to the way everyone prefers to be gay now. These are creatures, subhumans proles, who are neurotic and paranoid and weak. They use the laws and the special police to uphold their power, deploying MUHHHH constitution and democracy and liberty to ply those policemen, alongside lucrative pensions, to serve them.

Meanwhile, we can all see very plainly they’ve taken a great thing and ruined it — cast aside freedom for tyranny and use war to maintain their feeble grip on power.

America began the millennia in firm control of all parts of the world. That influence is waning rapidly, perhaps at the greatest speed since the collapse of the Mongol Empire. None of this is reflected in share prices, since profits are bountiful and the global markets are firm. But there are cracks and fissures in the bedrock and it won’t take much to collapse this piece of shit into dust — starting with rapidly pacing UPWARDS WTI/Brent prices.

If you enjoy the content at iBankCoin, please follow us on Twitter

Commodities are sensitive to inflation, a direct beneficiary of inflation actually. Oil being the largest and most important commodity, how could one realistically expect oil prices to drop before they do the energy shock treatment to the economy? Certain OPEC members might even hope for such an outcome. Once we enter energy shock, Wall St strategem requires oil to become extremely economically sensitive, which is of course nonsense as oil consumption is ineleastic. None the less, oil prices will plummet. No one will be interested and then we buy.

Friendly reminder that CPI comes out tomorrow!